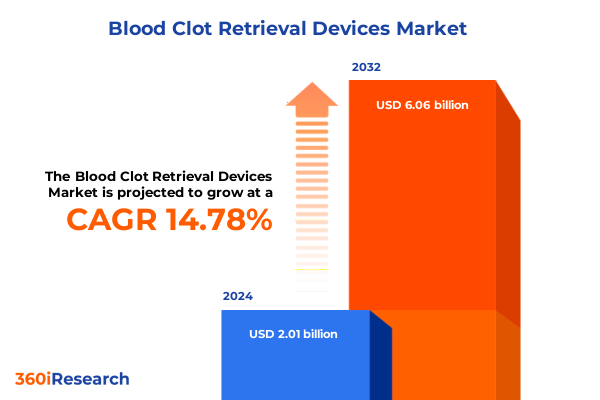

The Blood Clot Retrieval Devices Market size was estimated at USD 2.30 billion in 2025 and expected to reach USD 2.64 billion in 2026, at a CAGR of 14.80% to reach USD 6.06 billion by 2032.

Introduction to the Evolution, Challenges, and Clinical Significance Surrounding Blood Clot Retrieval Devices in Contemporary Healthcare Environments

Blood clot retrieval devices stand at the forefront of modern neurovascular and cardiovascular interventions, transforming patient outcomes and clinical protocols across multiple specialties. From the earliest mechanical aspiration catheters to next-generation stent retrievers, this technology has evolved into a cornerstone for emergent treatment of ischemic stroke, pulmonary embolism, and deep vein thrombosis. Clinicians are leveraging refined device profiles to navigate complex arterial anatomies, reduce procedural times, and mitigate the irreversible damage caused by large vessel occlusions.

As epidemiological trends show an increasing global incidence of acute thrombotic events, healthcare systems face mounting pressure to adopt interventions that maximize both efficacy and safety. This surge is accentuated by demographic shifts toward aging populations and expanded screening programs that identify high-risk individuals sooner. In response, manufacturers have prioritized ergonomic designs, hydrophilic coatings, and integrated visualization features that streamline catheter manipulation and clot engagement within tortuous vasculature.

Against this backdrop, reimbursement pathways and evolving clinical guidelines play an essential role in determining device uptake and procedural protocol standardization. Payer policies that reward faster door-to-reperfusion times and lower complication rates incentivize hospitals and specialized centers to incorporate the latest thrombectomy platforms. Stakeholders across the value chain continue to refine training modules and interdisciplinary care pathways, fostering multidisciplinary collaboration among neuroscientists, interventional radiologists, and vascular surgeons.

Examining the Pivotal Technological Breakthroughs, Regulatory Evolutions, and Clinical Practice Trends Reshaping the Blood Clot Retrieval Market Dynamics

In recent years, technological breakthroughs have redefined what is possible in endovascular clot removal, driving a paradigm shift from purely mechanical approaches toward integrated solutions that leverage advanced imaging and robotics. Innovations such as high-resolution fluoroscopic guidance systems, real-time hemodynamic feedback loops, and AI-assisted device navigation algorithms enhance procedural accuracy and reduce operator dependency. Alongside these advancements, regulatory agencies have adopted accelerated review pathways for devices demonstrating clear clinical benefit in acute stroke care, streamlining market entry for truly novel platforms.

Clinical practices have also evolved in parallel, with multidisciplinary stroke teams embracing telemedicine and mobile stroke units to administer thrombectomy within critical time windows. Hospitals are forging closer ties with ambulatory surgical centers and specialized vascular clinics to distribute procedural volumes, optimize resource allocation, and expand patient access. Training programs now incorporate simulation-based curricula that replicate challenging anatomies, reinforcing hands-on expertise under controlled conditions.

These transformative shifts in technology, regulation, and clinical practice converge to create an ecosystem where collaboration between device developers, care providers, and policymakers accelerates innovation. Looking ahead, the convergence of digital health tools with next-generation thrombectomy devices is set to redefine care standards, fostering continuous improvement through data-driven quality metrics and iterative design enhancements.

Assessing the Cumulative Effects of United States Tariff Adjustments in 2025 on Blood Clot Retrieval Device Production, Pricing, and Supply Chain Resilience

In 2025, newly implemented tariff measures in the United States have introduced an additional layer of complexity for manufacturers and distributors of thrombectomy devices. Equipment components sourced internationally now carry heightened import duties, which in turn elevate base production costs. This shift has prompted strategic realignment across supply chains, with firms negotiating alternative procurement agreements and exploring near-shore manufacturing partnerships to mitigate exposure to cross-border levies.

Consequently, device developers are reassessing vendor relationships for critical raw materials, such as high-grade nitinol and specialized polymer coatings. Procurement teams are diversifying their supplier portfolios, incorporating regional fabricators within the Americas to shield against future tariff escalations. Simultaneously, distributors have adjusted inventory strategies to leverage existing stockpiles while negotiating volume-based commitments that offset incremental duties over longer contract periods.

Despite the upward pressure on unit costs, innovative value engineering and process optimization have enabled many stakeholders to maintain pricing structures that align with payer expectations. By adopting lean manufacturing principles and digitized production workflows, companies can ensure consistent quality control and uphold timelines for new device introductions. As a result, market accessibility remains intact even as the regulatory and economic environment evolves.

Deconstructing Critical Segmentation Insights by Device Type, End User, and Application to Illuminate Niche Drivers in the Thrombectomy Ecosystem

Device type differentiation drives much of the innovation strategy within the thrombectomy arena. Aspiration catheters have evolved with variable lumen profiles and advanced tip designs that enhance clot ingestion efficiency, while standalone stent retrievers offer optimized radial force for engaging fibrin-rich occlusions. Combined system approaches integrate both aspiration and stent-based retrieval in a single procedural sequence or through simultaneous dual-device deployment, each method calibrated to specific clot compositions and vascular geometries.

End-user settings play a defining role in procurement decisions and procedural workflow design. Ambulatory surgical centers emphasize streamlined device kits and rapid turnover processes to maximize throughput, whereas hospitals allocate resources across focused cardiac units or neurovascular centers based on patient volume and case complexity. Specialized vascular clinics offer dedicated thrombectomy suites configured for multidisciplinary collaboration, catering to high-acuity referrals and outpatient follow-up regimens.

Application specificity underscores the nuanced clinical routing for each device category. In deep vein thrombosis cases, distal and proximal segments demand distinct catheter flexibility and aspiration power to navigate deep venous networks. Acute ischemic stroke interventions prioritize rapid revascularization tactics aimed at core infarct salvage, while subacute and chronic occlusion treatments may employ adjunctive thrombolytic infusion and modified retriever geometries. Pulmonary embolism protocols differentiate massive from submassive presentations by balancing aspiration velocity, clot fragmentation risk, and hemodynamic support during device deployment.

This comprehensive research report categorizes the Blood Clot Retrieval Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- End User

- Application

Unveiling Diverse Regional Dynamics and Growth Catalysts across the Americas, EMEA, and Asia-Pacific Blood Clot Retrieval Markets in 2025

The Americas region benefits from a mature clinical infrastructure and well-established reimbursement frameworks that reward demonstrable procedural efficacy. North American healthcare networks have expedited credentialing pathways for novel thrombectomy platforms, driving widespread adoption among both urban stroke centers and community hospitals. Latin America presents a compelling growth corridor wherein government-led initiatives to expand stroke awareness and equip regional hospitals with foundational interventional capabilities are gaining momentum.

In Europe, Middle East, and Africa, divergent regulatory environments require device developers to navigate multiple approval regimes and national reimbursement policies. The European single market facilitates cross-border device registrations through centralized processes, yet individual countries maintain distinct procurement dynamics and price controls. Meanwhile, the Middle East’s strategic investments in advanced cancer and cardiovascular centers are enhancing the deployment of hybrid vascular suites capable of handling complex thrombectomy cases. Sub-Saharan Africa remains in the early phases of capability building, with public-private partnerships driving investments in training and equipment procurement.

Asia-Pacific markets span highly advanced healthcare systems with robust stroke networks to rapidly developing economies that prioritize infrastructure expansion. Japan and Australia showcase integrated emergency response models and high patient volumes that support iterative clinical trials, while China’s emphasis on domestic innovation is fostering new entrants in the clot extraction device segment. In Southeast Asia, targeted government funding for high-acuity centers is laying the groundwork for more widespread procedural adoption.

This comprehensive research report examines key regions that drive the evolution of the Blood Clot Retrieval Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Competitive Positioning, and Collaborative Trends among Leading Blood Clot Retrieval Device Innovators

Leading device manufacturers are pursuing multifaceted strategies to fortify their positions in the thrombectomy landscape. Global medtech companies are expanding their product portfolios through targeted acquisitions of niche innovators, thereby integrating specialty catheters and hybrid retrieval systems under single brand umbrellas. R&D investments focus on enhancing device deliverability, reducing profile diameters, and incorporating radiopaque markers for superior visualization.

Strategic partnerships between established firms and startup ventures have accelerated the transition from prototype to commercialization. By embedding clinical engineers within stroke centers, these collaborations enable real-world performance feedback that informs next-generation design iterations. Additionally, joint ventures with software developers have produced analytics platforms that track procedural metrics and patient outcomes, aligning value-based care models with product roadmaps.

Concurrent with organic innovation, selected players are forging alliances with hospital networks and specialized clinics to establish center-of-excellence programs. These initiatives combine educational outreach, standardized training modules, and real-time procedural support via remote platforms. Such collaborative frameworks not only enhance device proficiency among new adopters but also generate longitudinal clinical data that underpin future regulatory filings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Clot Retrieval Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Matrix Medical Technologies

- Abbott Laboratories

- Acandis GmbH

- AngioDynamics, Inc.

- Asahi Intecc Co., Ltd.

- Balt USA, LLC

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Insera Therapeutics, Inc.

- InspireMD, Inc.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Medtronic plc

- MicroPort Scientific Corporation

- Penumbra, Inc.

- Phenox GmbH

- Stryker Corporation

- Terumo Corporation

Definitive Actionable Strategies for Industry Leaders to Navigate Regulatory, Technological, and Market Access Challenges in Thrombectomy

To navigate the evolving regulatory conditions and competitive pressures, industry leaders should pursue supply chain diversification by identifying alternative component suppliers within domestic and near-shore jurisdictions. This approach mitigates risks associated with import levies and geopolitical disruptions, while ensuring continuity of critical raw material availability. Complementary investments in agile manufacturing technologies, such as additive and precision microfabrication, will reduce lead times and enable rapid response to clinical demand shifts.

Fostering value-added partnerships with payers and healthcare providers is another pivotal strategy. By co-developing outcome-based reimbursement models that link device performance to patient recovery metrics, manufacturers can substantiate premium positioning and strengthen market access negotiations. In parallel, embedding digital health solutions-ranging from procedural documentation portals to post-procedure monitoring applications-will reinforce the long-term value proposition of advanced clot retrieval platforms.

Finally, maintaining a robust pipeline of clinical evidence through investigator-initiated studies and post-market registries is essential for sustaining competitive advantage. Aligning with key opinion leaders across neurology, interventional radiology, and vascular surgery disciplines enables continuous improvement feedback loops. Collectively, these measures empower organizations to anticipate emerging practice patterns, adapt product roadmaps, and capitalize on novel application opportunities.

Transparent Overview of Research Methodology Employing Mixed Qualitative and Quantitative Approaches to Ensure Robust Insights into Thrombectomy Device Markets

This research integrates both qualitative and quantitative methodologies to deliver a granular understanding of the blood clot retrieval device market. Secondary data collection encompassed peer-reviewed clinical studies, regulatory filings, and professional society guidelines to establish a robust foundational context. Complementing this desk research, primary insights were obtained through structured interviews with interventional neurologists, procurement directors, and biomedical engineers across key regions.

The segmentation framework was derived via cross-validation of device usage patterns, end-user preferences, and therapeutic applications observed during expert workshops. Data from hospital case logs and procedural registries provided real-world performance metrics, which were harmonized with anonymized billing and reimbursement records to clarify economic considerations. These intersecting data sources were subjected to triangulation methods to ensure consistency and mitigate bias.

To enhance analytical rigor, scenario-based modeling was conducted, incorporating tariff scenarios and policy shifts. Findings were peer reviewed by an advisory panel of industry veterans and academic researchers, guaranteeing that the final report reflects both strategic relevance and clinical authenticity. The outcome is a comprehensive, validated perspective that equips stakeholders with actionable knowledge for decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Clot Retrieval Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Clot Retrieval Devices Market, by Device Type

- Blood Clot Retrieval Devices Market, by End User

- Blood Clot Retrieval Devices Market, by Application

- Blood Clot Retrieval Devices Market, by Region

- Blood Clot Retrieval Devices Market, by Group

- Blood Clot Retrieval Devices Market, by Country

- United States Blood Clot Retrieval Devices Market

- China Blood Clot Retrieval Devices Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights on Innovation, Market Dynamics, and Strategic Imperatives Shaping the Future of Blood Clot Retrieval Devices

Blood clot retrieval devices are poised to redefine vascular intervention protocols through a confluence of technological, economic, and clinical forces. Breakthroughs in device design and procedural workflow optimization are elevating therapeutic benchmarks, while evolving regulatory and reimbursement environments shape adoption strategies. Tariff-related cost pressures and regional market variances underscore the importance of supply chain agility and localized engagement models.

Segmentation analysis reveals that differentiated device types, end-user settings, and targeted applications drive nuanced decision-making criteria, requiring tailored product development and marketing approaches. Leading companies harness strategic partnerships and digital health integrations to reinforce value propositions, whereas emerging markets present both opportunities and operational challenges for market entrants.

Taken together, these insights form a cohesive narrative that empowers stakeholders to anticipate shifting dynamics and capitalize on new areas of clinical need. As the field continues to evolve, stakeholders who combine evidence-based innovation with strategic collaboration will shape the next chapter of thrombectomy practice standards and patient care outcomes.

Drive Strategic Growth and Secure Competitive Advantage by Accessing Our Comprehensive Blood Clot Retrieval Device Market Analysis with Expert Guidance

To explore the full breadth of insights into evolving clinical applications, regulatory landscapes, and competitive strategies within the blood clot retrieval device arena, connect with Ketan Rohom, Associate Director, Sales & Marketing. His comprehensive understanding of stakeholder priorities and market drivers will guide you through the detailed report tailored to strategic decision making. Secure your access today to transform your approach to planning, product positioning, and partnership development by leveraging our rigorous analysis and expert perspectives. Reach out to engage in a dialogue that aligns your organizational goals with the trends defining the next wave of innovation in thrombectomy.

- How big is the Blood Clot Retrieval Devices Market?

- What is the Blood Clot Retrieval Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?