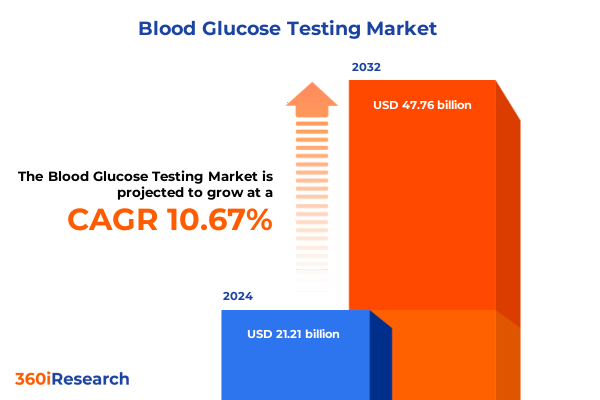

The Blood Glucose Testing Market size was estimated at USD 23.40 billion in 2025 and expected to reach USD 25.81 billion in 2026, at a CAGR of 10.73% to reach USD 47.76 billion by 2032.

Shifting the Foundation of Diabetes Management Through Advanced Blood Glucose Testing Innovations and Patient-Centric Approaches

Shifting demographics lifestyles and healthcare delivery models have placed blood glucose testing at the forefront of diabetes management strategies worldwide. Driven by rising prevalence of diabetes and heightened emphasis on personalized care blood glucose monitoring solutions are rapidly evolving to meet the complex needs of patients clinicians and payers. The imperative to balance accuracy convenience and cost effectiveness has sparked accelerated innovation across the product lifecycle from fingerstick meters to minimally invasive sensors. At the same time payers and providers are seeking integrated diagnostic platforms that deliver actionable analytics and support value based care initiatives. Against this backdrop the blood glucose testing ecosystem has become a critical convergence point for emerging sensor technologies digital health platforms and patient centric service models.

As advancements in continuous glucose monitoring have propelled market momentum and regulatory landscapes adapt to novel sensor modalities greater focus has fallen on interoperability data security and remote patient monitoring capabilities. Moreover as healthcare systems worldwide integrate telehealth services the significance of reliable point-of-care glucose testing has magnified. In this context understanding the interplay between technological breakthroughs shifting patient expectations and evolving reimbursement frameworks is essential for industry stakeholders aiming to drive adoption optimize resource allocation and engineer sustainable growth trajectories.

Emerging Disruptions and Technological Breakthroughs Redefining the Blood Glucose Testing Landscape for Enhanced Clinical and Consumer Outcomes

The blood glucose testing landscape is experiencing transformative shifts fueled by converging trends in digital health analytics artificial intelligence enhanced sensor platforms and evolving payer paradigms. Innovations in miniaturized electrochemical and optical biosensors have enabled continuous monitoring with unprecedented accuracy while smartphone integrations and cloud based data repositories facilitate real time insights for both patients and providers. In parallel regulatory bodies have established accelerated pathways for breakthrough devices encouraging a competitive environment that fosters rapid iteration and user experience enhancements.

Meanwhile the rise of value based care models has intensified collaboration between manufacturers and healthcare networks to develop bundled service offerings that include diagnostics wearable technology and telehealth support. This shift toward holistic diabetes management is accompanied by greater patient empowerment through user friendly interfaces intuitive mobile applications and decision support algorithms that can proactively flag glycemic excursions. As such the field is transitioning from reactive point sampling to proactive glycemic trend analysis ensuring that clinical interventions can be delivered with timeliness precision and scalability.

Unraveling the Ripple Effects of Recent United States Tariffs on Supply Chains Costs and Strategic Positioning Within the Blood Glucose Testing Sector

In 2025 the blood glucose testing sector faced significant headwinds from the cumulative impact of newly instituted tariffs by the United States government. Tariff adjustments on raw materials and finished glucose monitoring products resulted in cost pressures throughout the supply chain impacting manufacturers of test strips sensors and ancillary consumables. Manufacturers relying on global sourcing networks found themselves navigating higher import duties on semiconductors specialty polymers and biochemical reagents, which in turn placed upward pressure on unit costs and squeezed profit margins.

These economic headwinds prompted key industry players to reassess manufacturing footprints and logistics strategies. Close collaboration with customs authorities and negotiations for tariff exclusions emerged as critical tactics to mitigate cost escalations. Additionally a number of organizations accelerated diversification of supplier bases and explored regional manufacturing partnerships to circumvent tariff burdens and maintain product affordability. Although the short term impact saw inventory rationalization and price adjustments in certain markets, the sector’s emphasis on long term supply chain resilience promises to bolster stability and foster innovation beyond immediate tariff challenges.

Unlocking Market Dynamics Through Insights on Product Types Technologies End Users and Distribution Channels Shaping Testing Strategies

Analyzing the market through the lens of product type reveals a multifaceted ecosystem that encompasses blood glucose meters control solutions lancets sensors and test strips. Blood glucose meters continue to serve as foundational tools for point monitoring while control solutions ensure ongoing calibration accuracy. Lancets are evolving to prioritize patient comfort and safety in daily sampling routines. Sensors represent the vanguard of innovation with continuous glucose monitoring sensors and flash glucose monitoring sensors delivering real time glycemic trends and reducing the frequency of invasive fingersticks. Test strips remain the workhorse of affordability and accessibility, preserving their role in both clinical settings and home testing environments.

Turning to technology segmentation, electrochemical sensors stand out for their widespread adoption given proven reliability and cost effective manufacturing. Optical techniques leveraging near infrared spectroscopy and photonic sensing are gaining traction as they promise no blood sample modalities. Thermal techniques are also under exploration for non invasive detection, offering potential expansions into wearable formats. This diversification of technological approaches underscores the relentless pursuit of improved sensitivity specificity and user convenience.

End user analysis highlights diagnostic laboratories, home care environments and hospitals and clinics as key adoption corridors. Diagnostic laboratories integrate high throughput analyzers for batch testing while home care markets benefit from remote monitoring devices that empower patient self management. Hospitals and clinics increasingly deploy integrated glucose management systems that tie into electronic health records and support multidisciplinary care teams.

Distribution channel insights emphasize hospital pharmacies as critical nodes for acute care supply, online pharmacies as enablers of convenience and subscription models, and retail pharmacies as universally accessible touchpoints. Together these channels ensure that patients receive the right testing modality at the right time regardless of care setting.

This comprehensive research report categorizes the Blood Glucose Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Distribution Channel

Analyzing Regional Nuances and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific in Blood Glucose Testing Operations

Regional dynamics in the Americas are shaped predominantly by advanced healthcare infrastructures in the United States and Canada that support expansive reimbursement frameworks for both traditional and continuous glucose monitoring devices. This environment encourages private payers and public programs to evaluate integrated diabetes management solutions that combine diagnostic hardware software and patient analytics. Across Latin America emerging economies exhibit growing demand for affordable strip based testing as screening programs expand to underserved populations.

In Europe Middle East and Africa a tapestry of regulatory requirements and pricing controls drives market behavior. The European Union’s harmonized medical device regulations enforce stringent safety and performance standards while health technology assessment bodies in individual nations scrutinize cost effectiveness and long term outcomes. In the Middle East and Africa centralized tenders and government sponsored healthcare modernization initiatives are accelerating the adoption of point-of-care testing in both urban hospitals and remote clinics.

Asia-Pacific markets demonstrate diverse growth trajectories. In mature markets such as Japan and Australia uptake of flash and continuous monitoring sensors is high due to supportive regulatory pathways and established distribution networks. Conversely emerging markets in Southeast Asia India and China prioritize cost efficient test strips and basic meters, even as home care adoption gradually rises. Government led screening programs and partnerships with local manufacturers are instrumental in driving access in these regions.

This comprehensive research report examines key regions that drive the evolution of the Blood Glucose Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Driving Competitive Advantage in the Global Blood Glucose Testing Ecosystem

Leading companies in the blood glucose testing domain are focused on strengthening portfolios through technological differentiation strategic alliances and geographic expansion. Prominent market participants are engaging in collaborations with digital health firms to integrate artificial intelligence powered analytics into sensor ecosystems, enhancing predictive capabilities and personalized therapy recommendations. Partnerships between device manufacturers and pharmaceutical companies are also increasing as stakeholders aim to offer bundled solutions that align diagnostics with tailored treatment regimens.

In parallel, several firms are channeling resources into next generation sensor development to improve wearability battery life and data transmission reliability. The competitive landscape is further shaped by targeted acquisitions of startups specializing in non invasive measurement techniques and telehealth platforms. Regional players are forging joint ventures to establish localized manufacturing and distribution facilities, thereby optimizing cost structures and ensuring regulatory compliance.

Innovations in subscription based service models and remote patient monitoring programs underscore the growing emphasis on software as a service in diabetes management. By offering value added services such as digital coaching and automated report generation, leading companies are cementing relationships with healthcare providers and payers while creating sustainable recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Glucose Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACON Laboratories, Inc

- AgaMatrix, Inc.

- ARKRAY, Inc.

- Ascensia Diabetes Care Holdings AG

- B. Braun Medical Ltd.

- Becton Dickinson and Company

- Beurer Belgium

- Dexcom, Inc.

- ForaCare Suisse AG

- Johnson & Johnson

- LifeScan IP Holdings, LLC

- Medisana AG

- Medtronic PLC

- Merck KGaA

- Microlife AG

- Neogen Corporation

- Nipro Corporation

- Nova Biomedical

- Omron Healthcare, Inc.

- Roche Diagnostics Nederland BV

- Rossmax International Ltd.

- Sanofi S.A.

- Sinocare Inc.

- Terumo Corporation

- Trividia Health, Inc.

- VivaChek Laboratories Inc.

Empowering Industry Leaders With Actionable Strategies to Navigate Technological Advances Regulatory Shifts and Supply Chain Challenges in Diabetes Testing

Industry leaders should prioritize accelerated investment in advanced sensor platforms that deliver continuous glucose monitoring capabilities, ensuring devices meet evolving regulatory standards and patient expectations for minimal invasiveness. Establishing robust digital ecosystems through partnerships or in-house development can enhance patient engagement by offering integrated mobile applications remote monitoring dashboards and AI driven alerts. Embracing flexible supply chain strategies such as dual sourcing and regional manufacturing partnerships will mitigate risks associated with trade policy shifts and tariffs.

Additionally aligning value proposition with payer and provider objectives is critical. Manufacturers can collaborate with health systems to demonstrate long term cost savings through reduced hospital admissions and improved clinical outcomes. Embedding patient support services into product offerings-such as virtual coaching and adherence reminders-will further differentiate solutions in a competitive marketplace. Finally adopting a proactive regulatory engagement approach can expedite product approvals and shape emerging guidelines around novel sensor modalities ensuring seamless market access.

Establishing Robust Research Frameworks Leveraging Primary and Secondary Insights for Accurate and Reliable Analysis of Glucose Testing Market Dynamics

This analysis is grounded in a rigorous research framework combining both secondary and primary methodologies. Secondary research involved systematic review of regulatory filings peer reviewed journals industry white papers and publicly disclosed corporate presentations. This provided an extensive foundation of insights into device technologies market dynamics and policy impacts.

Primary research comprised comprehensive interviews with key opinion leaders including endocrinologists diabetes educators payers and supply chain executives. These qualitative discussions yielded nuanced perspectives on device adoption barriers clinical workflow integration and emerging reimbursement models. Collected data underwent triangulation across multiple sources to validate consistency and ensure robust credibility.

Analytical techniques included thematic coding of qualitative inputs statistical cross tabulation of device attributes versus user preferences and scenario mapping of potential tariff and regulatory outcomes. This multifaceted approach guarantees that findings reflect both strategic market intelligence and operational realities faced by stakeholders in the blood glucose testing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Glucose Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Glucose Testing Market, by Product Type

- Blood Glucose Testing Market, by Technology

- Blood Glucose Testing Market, by End User

- Blood Glucose Testing Market, by Distribution Channel

- Blood Glucose Testing Market, by Region

- Blood Glucose Testing Market, by Group

- Blood Glucose Testing Market, by Country

- United States Blood Glucose Testing Market

- China Blood Glucose Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Insights Into a Comprehensive Narrative Guiding Decision Makers Toward Strategic Investments in Blood Glucose Monitoring Solutions

Drawing together the salient insights from market disruptions regulatory evolutions technological advancements and regional dynamics creates a cohesive narrative that informs strategic decision making. The convergence of continuous monitoring sensors with sophisticated data platforms underscores a paradigm shift toward proactive diabetes management and personalized care. Simultaneously the challenges posed by tariff impositions and supply chain complexities emphasize the need for resilient manufacturing and sourcing strategies.

By understanding segmentation nuances from product type technologies end user channels and distribution pathways, stakeholders can craft targeted approaches that optimize market penetration and patient outcomes. Regional variations further highlight the importance of adaptable business models tailored to specific reimbursement environments and local regulatory landscapes. As leading companies refine their competitive positioning through alliances acquisitions and service innovations, the stage is set for an era of integrated diagnostic and therapeutic solutions that can drive improved clinical efficacy and operational efficiency across healthcare systems worldwide.

Connect With Associate Director Ketan Rohom to Secure Exclusive Insights and Drive Growth With the Definitive Blood Glucose Testing Market Research Report

To secure the comprehensive blood glucose testing market research report and unlock unparalleled strategic insights tailored to your organizational objectives, please connect with Ketan Rohom Associate Director Sales & Marketing at 360iResearch He will guide you through the report’s scope answer any questions you may have and facilitate a seamless purchasing experience Your partnership will empower your organization with data driven analysis and expert recommendations that can drive growth optimize operations and deliver competitive advantage in the dynamic blood glucose testing landscape Reach out today and transform your market intelligence approach with this definitive resource

- How big is the Blood Glucose Testing Market?

- What is the Blood Glucose Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?