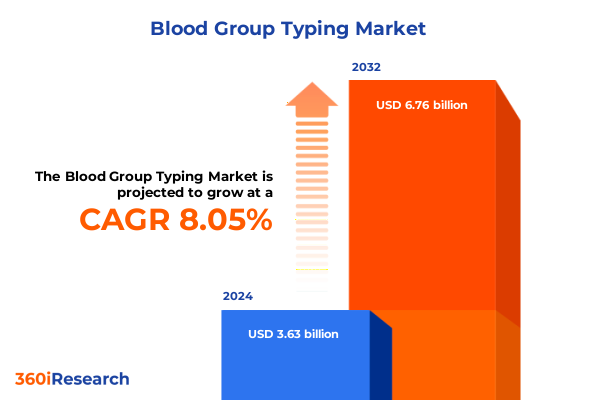

The Blood Group Typing Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.13 billion in 2026, at a CAGR of 8.26% to reach USD 6.76 billion by 2032.

Exploring the Critical Role of Blood Group Typing in Modern Healthcare Delivery and Ensuring Patient Safety Across Diverse Clinical Settings

Blood group typing is foundational to patient safety, clinical diagnostics, and transfusion medicine, forming the bedrock of modern healthcare delivery. As healthcare systems evolve to meet rising demands, the ability to accurately and efficiently determine blood groups remains critical to preventing adverse transfusion reactions and ensuring optimal therapeutic outcomes. Recent global health challenges have underscored the importance of robust blood typing capabilities, prompting laboratories and healthcare institutions to reassess workflows and invest in more reliable, automated solutions.

This renewed emphasis on precision and speed has driven collaboration among technology providers, reagent manufacturers, and clinical end users. These stakeholders share a common objective: to enhance the accuracy of blood group screening while minimizing turnaround times and operational costs. In this context, the blood group typing domain has emerged as a dynamic arena, characterized by rapid innovation, stringent regulatory requirements, and shifting procurement strategies. This introduction sets the stage for exploring how these converging forces are shaping the future of blood group typing worldwide.

Unveiling the Paradigm Shifts Redefining Blood Typing Practices Through Technological Innovation Regulatory Updates and Workflow Automation in Diagnostics

Technological innovation continues to transform blood group typing, creating new paradigms in laboratory diagnostics. High-throughput automated blood typers have reduced manual handling errors, while gel card analyzers offer improved sensitivity for weak antigen detection. These advancements are complemented by the integration of laboratory information systems, facilitating seamless data exchange and traceability throughout the testing process.

Simultaneously, digital PCR and real-time PCR platforms are widening the scope of molecular blood typing, enabling genotyping approaches that precisely identify rare and variant blood group alleles. Flow cytometry and microplate agglutination have gained traction in applications requiring multiplexed analysis, while gel centrifugation remains a trusted standard in many clinical laboratories. Each of these technologies brings unique strengths, which are being harnessed to accelerate workflows, bolster quality assurance, and support personalized medicine initiatives.

Regulatory evolution also exerts a powerful influence, as agencies implement more rigorous validation guidelines for blood typing instruments and reagents. These changes are driving manufacturers to invest heavily in compliance and quality management, with an emphasis on international harmonization. As a result, laboratories are increasingly adopting end-to-end solutions that combine hardware, software, and services into unified platforms, thereby streamlining implementation and ongoing maintenance.

Analyzing the Compound Effects of United States Tariff Measures Implemented in 2025 on Supply Chains Costs and Strategic Sourcing Decisions

In 2025, the United States implemented a series of tariff measures targeting imported diagnostic instruments, reagents, and related supplies, with the stated goal of strengthening domestic manufacturing. These levies have directly affected the cost structure of blood group typing laboratories, particularly those reliant on specialized equipment from overseas vendors. As a consequence, many organizations are reassessing procurement strategies to mitigate the financial impact and preserve budgetary priorities.

The cumulative effect has been a tangible shift in supply chain design, with some laboratories exploring alternative sourcing routes through regional distributors or domestic manufacturers. At the same time, pricing pressures have incentivized reagent producers to localize certain production processes, thereby enhancing supply continuity and reducing lead times. While these adjustments have introduced complexity in vendor negotiations, they have also stimulated investments in automation and digital integration, as laboratories seek to offset higher unit costs with efficiency gains.

Strategic sourcing decisions in response to tariffs have heightened collaboration among end users, technology providers, and service organizations. By pooling forecast data and aligning inventory management practices, stakeholders are negotiating more flexible terms and minimizing exposure to future trade disruptions. This cooperative approach demonstrates how industry resilience can be reinforced through coordinated action, even in the face of evolving trade policies.

In-Depth Exploration of Market Segmentation Dynamics Illuminating Product Technology End User and Application Drivers Shaping Blood Group Typing Evolution

The blood group typing market exhibits intricate segmentation that underscores the diverse needs of laboratories and healthcare facilities. Within product type, instruments such as automated blood typers and gel card analyzers deliver high-throughput processing alongside robust quality controls, while reagents-including antisera reagents, reagent red blood cells, and screening cells-provide the biochemical specificity required to identify blood antigens and antibodies. In parallel, software and services cover laboratory information system integration as well as support and maintenance offerings, ensuring that hardware and reagent performance is sustained over time.

Technology segmentation reflects distinct methodological preferences, with flow cytometry and gel centrifugation serving high-volume reference centers, microplate agglutination offering flexible throughput for mid-sized laboratories, and polymerase chain reaction techniques-particularly digital PCR and real-time PCR-enabling precise genotyping workflows. This technological diversity allows laboratories to align platform selection with case mix and throughput demands, whether addressing routine transfusion requirements or complex alloantibody investigations.

End-user segmentation spans government and private blood banks, hospital-based and independent clinical laboratories, and private as well as public hospitals and diagnostic centers. Each end-user cohort operates under unique regulatory frameworks, budget constraints, and operational priorities. For example, government blood banks often manage large inventories for national programs, whereas private hospitals seek rapid turnaround for emergent transfusion cases. Diagnostic centers balance cost-effectiveness with specialized service offerings, driving demand for modular testing systems.

Application segmentation includes donor screening, newborn screening, and pretransfusion testing. Donor screening encompasses both blood typing and infectious disease screening protocols to safeguard the blood supply, whereas newborn screening prioritizes early detection of hemolytic diseases through sensitive antibody identification. Pretransfusion testing remains the final verification step before blood administration, reinforcing the critical role of consolidated testing strategies across clinical scenarios.

This comprehensive research report categorizes the Blood Group Typing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Comprehensive Regional Overview Highlighting Growth Trends Market Drivers and Adoption Patterns in Americas EMEA and Asia-Pacific Blood Typing Sectors

Regional dynamics in blood group typing reflect variations in healthcare infrastructure, regulatory environments, and market maturity. In the Americas, established diagnostic networks and favorable reimbursement frameworks have supported widespread adoption of automated platforms and advanced molecular assays. Laboratories across North America are optimizing workflows through consolidation and digitalization, while Latin American centers increasingly prioritize modernization to meet growing demand for reliable transfusion services.

Europe, Middle East & Africa presents a heterogeneous landscape where economically advanced markets in Western Europe drive adoption of high-end technologies, and cost-sensitive regions in parts of the Middle East and Africa prioritize value-based procurement. Regulatory harmonization initiatives within the European Union have elevated quality standards, whereas public-private collaborations in the Gulf and North Africa are accelerating infrastructure investment. Across these geographies, decentralized healthcare systems necessitate flexible, scalable solutions that can be tailored to local needs.

Asia-Pacific demonstrates the fastest adoption rates, underpinned by governmental initiatives to enhance blood safety and expand diagnostic capabilities. In East Asia, large national reference labs integrate digital PCR and high-throughput gel centrifugation systems, while South and Southeast Asian markets are investing in mid-tier automated typers and reagent kits optimized for local antigen profiles. This regional fervor for innovation is further propelled by partnerships between global technology providers and regional distributors, aiming to bridge gaps in training and logistical support.

This comprehensive research report examines key regions that drive the evolution of the Blood Group Typing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful Analysis of Leading Industry Participants’ Strategic Approaches Innovations and Collaborative Efforts Advancing Blood Group Typing Solutions Worldwide

Leading companies in the blood group typing market are distinguished by their strategic investments in research and development, global distribution networks, and comprehensive service portfolios. Major diagnostics manufacturers have introduced next-generation automated typers that integrate real-time data analytics, while reagent suppliers are expanding antigen-specific portfolios to address rare blood group variants. Software developers are forging partnerships with hospital systems to deliver laboratory information system integration that streamlines pre- and post-analytical workflows.

Collaborative efforts between technology providers and reference laboratories are advancing validation studies and clinical trials, reinforcing product credibility and facilitating regulatory approvals. Some organizations have launched service-model agreements that include proactive maintenance and performance monitoring, reducing downtime and ensuring consistent analytical performance. Joint ventures have emerged to localize production of key reagents, mitigate supply chain risks, and optimize cost structures.

Moreover, several companies are actively pursuing mergers and acquisitions to broaden their technological capabilities and geographic reach. By aligning complementary product lines and consolidating manufacturing expertise, these strategic transactions aim to create integrated solution providers capable of delivering end-to-end blood typing services. This consolidation trend is reshaping competitive dynamics, encouraging both incumbents and challengers to enhance their value propositions through continuous innovation and customer-centric offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Group Typing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agena Bioscience, Inc.

- B. Braun Melsungen AG

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- BioMérieux SA

- CareDx, Inc.

- DIAGAST

- Fujirebio Holdings, Inc.

- Grifols, S.A.

- Illumina, Inc.

- Immucor, Inc.

- Lorne Laboratories

- Merck KGaA

- Novacyt Group

- Ortho Clinical Diagnostics, Inc.

- QuidelOrtho Corporation

- Quotient Limited

- Rapid Labs Ltd.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities Mitigate Risks and Enhance Competitive Positioning in Blood Group Typing Market

To capitalize on emerging opportunities in blood group typing, industry leaders should prioritize investments in workflow automation and data integration. Adopting comprehensive laboratory information systems that interface seamlessly with automated typers and reagent management modules can unlock efficiencies and enhance traceability. Embracing digital PCR platforms alongside traditional agglutination methods will enable differentiated service offerings, particularly in complex genotyping cases.

Mitigating supply chain risks requires diversifying vendor portfolios and strengthening partnerships with domestic manufacturers for critical reagents and consumables. Establishing flexible sourcing agreements and demand forecasting collaborations can reduce the impact of potential tariff changes or logistical disruptions. Furthermore, expanding presence in high-growth regions through localized distribution models and training initiatives will ensure that technology adoption aligns with regional regulatory and operational requirements.

Enhancing competitive positioning demands a customer-centric approach that includes proactive service agreements and outcome-based pricing models. By offering performance guarantees and bundled solutions encompassing hardware, reagents, and services, organizations can demonstrate value and foster long-term client relationships. Strategic alliances with clinical research organizations and blood banks will further facilitate co-development opportunities and support new application areas such as point-of-care typing and personalized transfusion protocols.

Robust and Transparent Research Methodology Detailing Data Collection Validation and Analytical Processes Underpinning the Insights Presented

The insights presented in this report are grounded in a rigorous and transparent research methodology. Secondary research involved comprehensive analysis of scientific literature, regulatory filings, and manufacturer white papers, complemented by evaluation of public procurement records and healthcare policy documents. These sources provided a thorough understanding of technological trends, regulatory frameworks, and regional market dynamics.

Primary research comprised in-depth interviews with key stakeholders, including laboratory directors, procurement managers, technology innovators, and clinical pathologists. These conversations yielded qualitative perspectives on adoption barriers, workflow requirements, and future investment priorities. A structured questionnaire was utilized to ensure consistency across interviews and facilitate comparative analysis of end-user preferences and purchasing criteria.

Data synthesis involved cross-validation of quantitative and qualitative findings, supported by triangulation techniques. Analytical processes included segmentation analysis, benchmarking of technology performance characteristics, and assessment of regulatory pathways. Quality assurance measures encompassed peer review of draft findings and iterative validation discussions with subject-matter experts to ensure the highest level of accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Group Typing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Group Typing Market, by Product Type

- Blood Group Typing Market, by Technology

- Blood Group Typing Market, by Application

- Blood Group Typing Market, by End User

- Blood Group Typing Market, by Region

- Blood Group Typing Market, by Group

- Blood Group Typing Market, by Country

- United States Blood Group Typing Market

- China Blood Group Typing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesis of Key Findings Emphasizing Strategic Imperatives Technological Advances and Market Dynamics Shaping the Future of Blood Typing Services

Throughout this executive summary, key findings have underscored the pivotal interplay between technological innovation, regulatory evolution, and supply chain resilience in shaping the blood group typing landscape. Advanced automation platforms and molecular methods are redefining diagnostic workflows, while tariff measures and geopolitical factors are prompting strategic realignments in sourcing and manufacturing. The market’s multifaceted segmentation highlights the importance of tailored solutions across product types, technologies, end-user categories, and applications.

Regional dynamics reveal differentiated adoption patterns, driven by healthcare infrastructure maturity, policy initiatives, and logistical considerations. Leading industry participants are leveraging collaborative models, service-oriented agreements, and M&A activity to broaden their competitive reach and deliver integrated offerings. For industry leaders, actionable recommendations emphasize the need for investment in data integration, diversified supply chains, and customer-focused service models.

The convergence of these trends foreshadows a future in which blood group typing will become increasingly automated, digitally interconnected, and responsive to personalized care requirements. By understanding these dynamics and implementing strategic imperatives, stakeholders can ensure that their organizations remain at the forefront of this critical healthcare domain.

Accelerate Decision-Making and Propel Growth by Securing Your Customized Blood Group Typing Market Research Report Through Direct Engagement

I invite industry leaders and decision-makers to secure a tailored market research report that addresses specific strategic objectives and operational challenges in blood group typing. By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, organizations will gain access to personalized insights and support designed to accelerate decision-making processes. This partnership ensures that critical intelligence on technological innovations, regulatory shifts, and competitive strategies is delivered promptly and aligned with unique business requirements. Taking this step not only positions your organization at the forefront of market developments but also enables you to capitalize on emerging opportunities with confidence and clarity.

- How big is the Blood Group Typing Market?

- What is the Blood Group Typing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?