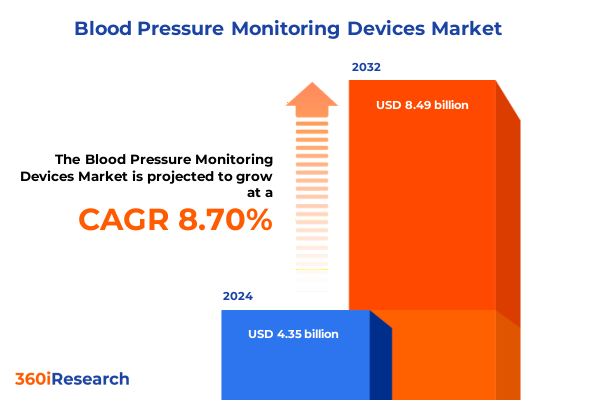

The Blood Pressure Monitoring Devices Market size was estimated at USD 4.73 billion in 2025 and expected to reach USD 5.14 billion in 2026, at a CAGR of 8.71% to reach USD 8.49 billion by 2032.

Navigating the Surge in Hypertension: How Blood Pressure Monitoring Devices Are Redefining Patient-Centric Cardiovascular Care Delivery

The rapid escalation of hypertension as a global public health concern underscores the critical importance of advanced monitoring solutions. An estimated 1.28 billion adults aged 30–79 live with elevated blood pressure worldwide, with nearly half unaware of their condition and fewer than one in five achieving adequate control; this sprawling burden amplifies demand for reliable, user-friendly monitoring devices that facilitate early detection and ongoing management. As cardiovascular disease remains the leading cause of mortality in both developed and emerging economies, healthcare systems and consumers alike seek technologies that deliver clinical-grade accuracy outside traditional settings.

Embracing Digital Transformation and Innovative Technologies That Are Revolutionizing Blood Pressure Monitoring for Enhanced Patient Outcomes

Breakthroughs in device design and data integration have propelled blood pressure monitoring into a new era of precision and accessibility. Noninvasive cuffless solutions, exemplified by nanotechnology-based continuous systems such as SimpleSense-BP-the first FDA 510(k) cleared device in its category-validate the industry’s pivot toward seamless patient experiences without sacrificing accuracy. Concurrently, patent filings by major technology firms signal imminent entry of liquid-filled sensor wearables into regulated cardiovascular care, promising closer alignment with consumer electronics trends and healthcare standards.

At the same time, connectivity has become a baseline expectation. Modern monitors embed Bluetooth and Wi-Fi capabilities to sync readings with smartphones and cloud platforms, enabling remote patient monitoring programs that integrate real-time analytics dashboards with clinician workflows. Leading manufacturers have secured FDA De Novo authorization for devices that screen for atrial fibrillation during each blood pressure measurement, underscoring the convergence of diagnostic and monitoring functions in a single form factor. As reimbursement codes evolve-Medicare’s 2025 schedule now pays providers for onboarding and management of remote monitoring services-health networks are scaling out home-based kits tied to outcome-driven care pathways, cementing RPM as a core element of chronic disease management.

In parallel, advanced analytics and artificial intelligence transform raw readings into actionable insights, enabling predictive trend analysis, personalized alerts, and decision support tools that enhance patient adherence and clinical interventions. Integration of AI-driven notifications helps providers identify early warning signs of uncontrolled hypertension, reinforcing care continuity and fostering proactive adjustments to treatment regimens.

Analyzing the Cumulative Impact of the 2025 United States Tariff Policies on Blood Pressure Monitoring Device Supply Chains and Cost Structures

The trade landscape of 2025 introduced renewed complexities for manufacturers and buyers of medical devices, with tariffs emerging as a pivotal cost driver. Executive orders implemented early in the year imposed 10% duties on imports from China-subsequently extended to Canada and Mexico before partial pauses-prompting industry groups to advocate for exemptions on critical care products, including single-use blood pressure cuffs. Cross-border discussions between the United States and the European Union have also explored mutual waivers for medical devices, signaling potential relief even as retaliatory measures loom.

Unlocking Deep Insights Through Strategic Segmentation That Illuminates Device Types, Technologies, End Users, Distribution Channels, and Applications

The market’s multifaceted nature becomes clear when viewed through strategic segmentation lenses. Device types span ambulatory systems-such as Holter and telemetric monitors that deliver 24-hour blood pressure profiles for nuanced diagnoses-to automatic units with upper-arm and wrist cuffs that balance clinical validation with ease of self-administration. Manual instruments, including aneroid and mercury sphygmomanometers, remain integral to resource-constrained settings due to their robustness and minimal power requirements.

Technological approaches further delineate the landscape. Auscultatory devices continue to uphold traditional standards for clinical sound-based measurements, while oscillometric monitors employ automated pressure detection and digital signal processing to facilitate widespread self-monitoring and integration with telehealth platforms. These dual modalities address distinct user preferences and regulatory pathways, shaping device development priorities.

End users drive targeted innovation, with hospitals leveraging integrated suites that unify blood pressure modules with multi-parameter monitoring platforms, and home healthcare programs capitalizing on reimbursement structures to supply pre-configured kits directly to patients. Ambulatory care centers and clinics adopt portable digital units for community outreach and preventive screening, broadening access beyond acute care environments.

Distribution channels play a defining role in market reach. Hospital procurement follows tender-based acquisitions that emphasize reliability and supplier accreditation, while online marketplaces attract tech-savvy consumers seeking at-a-glance trend reports and app-driven insights. Retail pharmacies offer over-the-counter availability, enabling impulse trials and fueling adoption among first-time users.

Application areas-from disease management programs that demand rigorous validation and regulatory compliance to fitness and wellness monitoring that emphasize convenience and continuous feedback-underscore the breadth of use cases. Research initiatives rely on high-fidelity data capture for clinical trials and epidemiological studies, further diversifying the market’s growth drivers.

This comprehensive research report categorizes the Blood Pressure Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Application

- Distribution Channel

- End User

Examining Regional Dynamics in the Blood Pressure Monitoring Device Market Across the Americas, Europe Middle East Africa, and Asia Pacific

In the Americas, North America leads the adoption curve, supported by mature reimbursement frameworks and strong e-health infrastructures. The United States remains a critical battleground for innovation, with cross-border regulatory harmonization efforts involving Canada and Mexico enhancing market entry pathways and supply resilience. Bulk procurement models coexist with direct-to-consumer digital offerings, creating a dual-track environment that accelerates technology diffusion among both institutional and retail segments.

Europe, the Middle East, and Africa present a mosaic of regulatory regimes and healthcare financing models. European markets benefit from universal coverage systems that prioritize validated accuracy and data security, driving demand for devices that meet stringent notified-body standards. Meanwhile, emerging economies in the Middle East and Africa are investing in telehealth hubs and chronic disease management programs, combining donor-funded initiatives with local procurement strategies to support widespread monitoring access.

Asia-Pacific represents the fastest-growing region, propelled by demographic aging, increasing hypertension prevalence, and policy initiatives that expedite device approvals. China’s streamlined pathways for high-impact medical technologies have accelerated local innovation and regulatory clearances, while production-linked incentive programs in India foster domestic manufacturing capacity and cost efficiencies. Regional convergence around validation standards is enabling broader distribution across Southeast Asia and Oceania.

This comprehensive research report examines key regions that drive the evolution of the Blood Pressure Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Innovation, Expanding Market Reach, and Shaping the Competitive Landscape of Blood Pressure Monitoring Devices

Omron Healthcare maintains its leadership role through an extensive portfolio of upper-arm and ambulatory monitors, leveraging a combination of clinical accuracy and consumer-friendly features. The company’s strategic expansion in India-where hypertension rates outpace device penetration-coupled with its first Chennai manufacturing facility, exemplifies proactive market development and e-commerce integration that boost accessibility.

Philips and GE HealthCare compete closely in hospital-grade systems, embedding blood pressure modules within multi-parameter platforms and predictive analytics suites. Both firms are mitigating tariff pressures by localizing production footprints in key markets, thereby stabilizing costs and preserving margin structures amid shifting trade policies.

Withings has carved out a niche in the consumer wellness segment by introducing FDA-cleared devices such as the color-display BPM Vision, which pairs clinical performance with intuitive mobile app integration. This approach resonates with health-conscious consumers seeking a seamless bridge between lifestyle tracking and medical monitoring.

Innovators like Nanowear and Aktiia are accelerating the transition to cuffless continuous monitoring, securing regulatory milestones for AI-driven wearables that promise unobtrusive long-term data capture. Their focus on calibration-free technologies and seamless integration with digital health ecosystems positions them as formidable challengers to legacy cuff manufacturers.

Strategic acquisitions and collaborations are also reshaping the competitive field. SunTech Medical’s alliance with Masimo expands its optical monitoring expertise, while BD’s acquisition of Edwards Lifesciences’ critical care portfolio enhances its access to advanced pressure-sensor technologies, deepening its institutional presence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Pressure Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&D Company, Limited

- Aktiia SA

- American Diagnostic Corporation

- B. Braun Melsungen AG

- Baxter International Inc.

- Beijing Choice Electronic Technology Co., Ltd.

- Biobeat Technologies Ltd.

- Briggs Healthcare, Inc. by Briggs Medical Service Company

- Contec Medical Systems Co., Ltd.

- GE HealthCare Technologies Inc.

- Halma PLC

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Microchip Technology Inc.

- Microlife Corporation

- Nihon Kohden Corporation

- Omron Corporation

- Pyle Audio

- Rossmax International Ltd.

- Spacelabs Healthcare Inc.

- SunTech Medical, Inc.

- Withings SA

Implementing Actionable Strategies to Optimize Innovation, Supply Chain Resilience, and Collaboration for Sustained Leadership in Blood Pressure Monitoring

Industry leaders should prioritize investments in next-generation cuffless and AI-enhanced monitoring technologies, aligning product roadmaps with regulatory frameworks that favor noninvasive continuous measurement. By securing early FDA and international approvals through De Novo and accelerated pathways, companies can establish first-mover advantages in emerging subcategories.

Simultaneously, strengthening supply chain resilience is imperative. Dual sourcing strategies, local manufacturing partnerships, and tariff mitigation measures can stabilize input costs and reduce exposure to geopolitical disruptions. Collaboration with government stakeholders to extend exemptions for vital medical devices, as advocated by healthcare associations, can further alleviate procurement uncertainties.

Forging deeper partnerships with payers and health systems to expand remote patient monitoring reimbursement will accelerate adoption. Leveraging Medicare’s RPM codes and demonstrating clear value through return-on-investment analyses can facilitate broader inclusion of home-based blood pressure monitoring within value-based care contracts.

Optimizing distribution requires a balanced omnichannel approach. Providers should refine online platforms, enhance retail pharmacy collaborations for over-the-counter availability, and tailor institutional tender submissions to emphasize lifecycle support and data analytics integration. This diversified strategy ensures market access across consumer and professional segments.

Finally, a customer-centric focus on segment-specific needs will drive product differentiation. Rigorous primary research into device usability across various end users and applications-ranging from community health screenings to high-acuity hospital settings-will inform feature sets that harmonize accuracy, ease of use, and cost-efficiency.

Ensuring Robust and Transparent Research Methodology Through Comprehensive Primary and Secondary Data Collection and Rigorous Validation Processes

Our research methodology integrates comprehensive secondary analysis with targeted primary engagements to ensure data reliability and depth. We conducted a systematic review of public domain literature, regulatory filings, and policy documents, mapping global trends across device approvals, reimbursement codes, and trade regulations.

Primary research included interviews with senior executives at leading device manufacturers, healthcare providers, and industry associations. These qualitative insights were triangulated with quantitative data drawn from customs databases, market intelligence platforms, and peer-reviewed studies.

Data validation followed a multi-stage review process, encompassing cross-referencing of key metrics, network consultations with subject-matter experts, and iterative feedback loops. All findings were subject to editorial scrutiny by our in-house senior analysts, ensuring adherence to rigorous standards of accuracy and contextual relevance.

This layered approach-blending desk research, stakeholder interviews, and iterative validation-underpins our confidence in the thematic and strategic conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Pressure Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Pressure Monitoring Devices Market, by Device Type

- Blood Pressure Monitoring Devices Market, by Technology

- Blood Pressure Monitoring Devices Market, by Application

- Blood Pressure Monitoring Devices Market, by Distribution Channel

- Blood Pressure Monitoring Devices Market, by End User

- Blood Pressure Monitoring Devices Market, by Region

- Blood Pressure Monitoring Devices Market, by Group

- Blood Pressure Monitoring Devices Market, by Country

- United States Blood Pressure Monitoring Devices Market

- China Blood Pressure Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings and Strategic Imperatives to Guide Stakeholders Toward Future Developments in Blood Pressure Monitoring Technology

The converging trends of technological innovation, shifting reimbursement landscapes, and evolving trade policies underscore a dynamic blood pressure monitoring devices market. Breakthroughs in cuffless continuous monitoring and AI-driven analytics are redefining patient experiences, while connectivity and remote care models continue to reshape delivery paradigms.

Tariff fluctuations and supply chain realignments are prompting industry stakeholders to adopt agile manufacturing strategies and engage proactively with policy makers to secure favorable trade terms. Regional diversities-in regulatory rigor, reimbursement frameworks, and healthcare infrastructure-present both challenges and opportunities for tailored market entry and expansion.

Market leadership will be determined by the ability to harmonize product innovation with cost structures, to build resilient supply networks, and to forge partnerships that expand access through both professional and consumer channels. Companies that effectively integrate segment-specific insights into their strategic roadmaps will be best positioned to capture sustainable growth and deliver improved cardiovascular outcomes at scale.

Connect With Ketan Rohom to Acquire In-Depth Market Research Insights and Empower Your Strategic Decisions in the Blood Pressure Monitoring Devices Arena

To discuss how our comprehensive analysis can empower your strategic decisions and unlock new growth opportunities in the blood pressure monitoring devices market, simply reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep industry expertise and can guide you through tailored insights, custom data requests, and exclusive briefings that align with your unique priorities. Connect directly with Ketan to secure your copy of the full market research report and gain early access to proprietary data that will sharpen your competitive edge in this dynamic sector.

- How big is the Blood Pressure Monitoring Devices Market?

- What is the Blood Pressure Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?