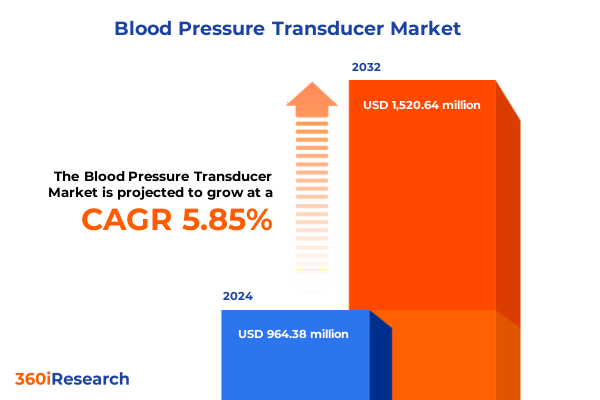

The Blood Pressure Transducer Market size was estimated at USD 1.00 billion in 2025 and expected to reach USD 1.05 billion in 2026, at a CAGR of 6.02% to reach USD 1.52 billion by 2032.

Revolutionizing Hemodynamic Monitoring Through Advanced Blood Pressure Transducers That Enhance Clinical Precision and Patient Comfort in Care Pathways

Blood pressure transducers serve as critical interfaces converting arterial or venous pressure signals into electrical outputs for bedside monitors, forming the backbone of modern hemodynamic monitoring. These devices vary from invasive sensors placed directly in the arterial system to non-invasive cuff-based and emerging cuffless formats deployed in ambulatory settings. In invasive monitoring, transducers attached to arterial and venous catheters deliver high-fidelity real-time data essential for patients in shock or undergoing major surgery, with minimal delay and high accuracy. Conversely, non-invasive solutions employ traditional auscultatory and oscillometric methods alongside novel optical and ultrasonic techniques to expand monitoring outside intensive care units, offering continuous and patient-friendly alternatives.

Over the past decade, the role of pressure transducers has expanded beyond hospital walls into home healthcare and wearable devices, driven by a rise in hypertension prevalence and digital health initiatives. Regulatory bodies globally are standardizing performance and safety, ensuring interoperability with patient monitoring systems. This evolution has positioned blood pressure transducers at the intersection of clinical precision and patient-centric care models, underpinning advances in telemedicine and remote monitoring that have gained traction since the COVID-19 pandemic.

Breakthrough Shifts in Blood Pressure Transducer Design Are Catalyzing a New Era of Wearable, Wireless, and Cuffless Monitoring Technologies

Rapid miniaturization and integration of flexible, wearable sensors have propelled blood pressure monitoring into continuous, beat-to-beat surveillance outside traditional clinical settings. New piezocapacitive, piezoresistive, piezoelectric and triboelectric flexible sensors now achieve laboratory-grade measurements while adhering to the skin, enabling ambulatory tracking that rivals invasive catheters. Simultaneously, ultrasonic wall-tracking techniques employing lightweight, conformable PVDF films promise deeper vascular assessments without external cuffs, leveraging intimate skin contact to detect arterial diameter changes with high resolution.

Integration with wireless protocols such as Bluetooth and Wi-Fi has ushered in the era of the Internet of Medical Things, facilitating real-time data transmission to electronic health records and mobile platforms. Advanced signal processing and machine learning algorithms are increasingly embedded within transducer modules to estimate continuous blood pressure waveforms using pulse transit time and optical signals, expanding cuffless measurement into mainstream telemonitoring applications.

The emergence of cable-lite, wireless disposable monitoring modules exemplifies the shift toward clinician mobility and streamlined workflows, as devices such as the MRV Pod transmit full-parameter vital signs wirelessly to bedside monitors, reducing clutter and enhancing patient comfort. These transformative shifts collectively redefine hemodynamic monitoring, enabling precision, convenience and broadened patient reach across care environments.

Comprehensive Assessment of How 2025 United States Tariffs on Medical Imports Are Reshaping Supply Chains and Device Costs

In 2024, the U.S. Trade Representative finalized significant amendments to Section 301 tariffs on China-origin imports, with escalations on medical products scheduled to take effect January 1, 2025. These modifications raise duties on medical consumables, including syringes, needles and related supplies, up to 100% for certain categories, directly affecting upstream components in blood pressure transducers. Although exemptions for blood pressure monitors were extended to May 31, 2025, reintroduction of tariffs post-extension is poised to increase procurement costs for hospitals and distributors, prompting concerns over potential supply disruptions.

Industry associations, including the American Hospital Association, have warned that renewed tariffs may exacerbate supply chain constraints and elevate operational expenditures. In February 2025, the AHA highlighted projected supply chain cost increases of 2% to 7% for hospitals, with medical device suppliers forecasting corresponding price hikes aligned with tariff rates.

Consequently, healthcare providers are diversifying sourcing strategies, evaluating domestic alternatives, and reassessing inventory models to mitigate cost pressures and maintain access to critical transducers. Meanwhile, device manufacturers are exploring localized production and strategic partnerships to circumvent tariffs, reshaping the competitive landscape in 2025.

Insightful Analysis of Market Segmentation Reveals Diverse Product, Technology, Distribution, Application, and End User Profiles Shaping Growth

A nuanced view of market segmentation reveals that product diversity spans invasive sensors for arterial and venous catheterization alongside non-invasive formats differentiated by auscultatory, oscillometric, cuffless optical and ultrasonic mechanisms. Each product segment serves distinct clinical needs, from high-acuity hemodynamic assessment in operating rooms and intensive care units to portable and wearable solutions for ambulatory monitoring.

Technological segmentation highlights a clear bifurcation between wired interfaces-supporting serial and USB connections for bedside equipment-and wireless modules leveraging Bluetooth and Wi-Fi protocols. Wireless transducers facilitate patient mobility and flexible workflow integration, while wired options remain essential for uninterrupted, high-fidelity signal transmission in critical care.

Distribution channels encompass direct sales relationships with hospitals, partnerships with medical device distributors and burgeoning e-commerce platforms, which include both manufacturer websites and third-party marketplaces. This multi-channel approach ensures broad market reach and accommodates shifting procurement preferences driven by digital transformation.

Applications stretch across ambulatory monitoring, emergency departments, operating rooms and intensive care units. Within ambulatory monitoring, both portable and wearable configurations serve outpatient clinics and home healthcare, promoting preventive care and hypertension management.

Finally, end users range from ambulatory care centers and specialty cardiology clinics to general clinics, home healthcare services and both private and public hospitals. This end-user diversity underscores the requirement for tailored transducer solutions that balance cost, accuracy and ease of use to address the unique operational and patient care priorities of each setting.

This comprehensive research report categorizes the Blood Pressure Transducer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Distribution Channel

- Application

- End User

Regional Dynamics in the Blood Pressure Transducer Market Highlight Varied Adoption, Manufacturing, and Regulatory Trends Across Key Geographies

The Americas remain at the forefront of transducer adoption, bolstered by robust reimbursement frameworks, well-established hospital networks and a high prevalence of advanced critical care monitoring. Leading manufacturers maintain regional headquarters and R&D centers in North America, facilitating close collaboration with clinical end users and regulatory bodies.

In Europe, the Middle East and Africa, stringent regulatory standards such as the EU’s Medical Device Regulation drive product quality and safety enhancements. Regional research institutions and healthcare providers actively collaborate on pilot studies of wearable and wireless transducers, while emerging healthcare markets in the Middle East are prioritizing infrastructure investments to upgrade ICU and operating room monitoring capabilities.

Asia-Pacific represents one of the fastest-growing markets, fueled by rising cardiovascular disease prevalence, expanding hospital infrastructure and government initiatives to promote domestic medical device manufacturing. China, India and Southeast Asian nations are witnessing increased local production of both invasive and non-invasive transducers, leveraging cost advantages and government-backed innovation programs to meet surging regional demand.

This comprehensive research report examines key regions that drive the evolution of the Blood Pressure Transducer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Driving Innovation Through Strategic Technologies, Partnerships, and Product Launches in Blood Pressure Transducers

Edwards Lifesciences has long commanded the invasive hemodynamic monitoring segment through its TruWave disposable pressure transducers, which feature a straight fluid path and gold-plated connectors for signal fidelity. These transducers integrate seamlessly with VAMP closed blood sampling systems and support minimal waveform distortion, catering to high-acuity clinical environments such as operating rooms and intensive care units.

In June 2024, Becton, Dickinson and Company completed the acquisition of Edwards’ Critical Care division for $4.2 billion, rebranding it as BD Advanced Patient Monitoring. This strategic move amalgamated TruWave technology with BD’s Alaris infusion systems, laying the groundwork for closed-loop hemodynamic monitoring platforms equipped with AI-enabled clinical decision tools.

Mindray has accelerated innovation in cable-lite patient monitoring with its MRV Pod, a wireless vital signs module launched in 2025 that transmits full-parameter data to the BeneVision V Series bedside monitor. By integrating portable ultrasound imaging through HemoSight™, Mindray is forging multi-modal hemodynamic assessment tools that empower clinicians to visualize ultrasound-derived parameters alongside traditional pressure waveforms.

Tensys Medical continues to pioneer non-invasive, continuous blood pressure monitoring with its TL-400 and TL-300 systems, recently securing CE marks for both in Europe. These devices employ radial artery applanation tonometry within a disposable sensor and bracelet assembly, delivering beat-to-beat pressure waveforms without calibration and offering clinicians a comprehensive hemodynamic snapshot via touch-screen interfaces.

Nihon Kohden’s inflation-based iNIBP technology has redefined non-invasive cuff measurements by detecting systolic and diastolic pressures during cuff inflation rather than deflation. This approach reduces measurement time by up to 60% and minimizes patient discomfort, aligning with clinician demand for rapid, gentle readings in perioperative and critical care settings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Pressure Transducer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Microelectronics GmbH

- B. L. Lifesciences

- Becton, Dickinson and Company

- CODAN AG

- Drägerwerk AG & Co. KGaA

- Edwards Lifesciences Corporation

- GE HealthCare Technologies Inc.

- Haisheng Medical Shanghai Co., Ltd.

- Honeywell International Inc.

- ICU Medical, Inc.

- Koninklijke Philips N.V.

- Lepu Medical Technology Co., Ltd.

- Medtronic plc

- Millar, Inc.

- Mindray Medical International Limited

- Nihon Kohden Corporation

- Smiths Group plc

- Suntech Medical, Inc.

- TE Connectivity Ltd.

- Teleflex Incorporated

Actionable Strategies to Optimize Innovation, Supply Resilience, and Market Penetration in the Evolving Blood Pressure Transducer Landscape

Industry leaders should accelerate investment in wireless and cuffless sensor technologies, prioritizing integration with medical IoT platforms to offer comprehensive, multi-modal monitoring solutions. Collaborations between device manufacturers and software providers can yield advanced analytics and AI-driven decision support, elevating clinical value while differentiating offerings in a competitive landscape.

To mitigate supply chain risks, companies must diversify sourcing strategies by establishing dual-sourcing agreements and exploring regional production hubs. Developing manufacturing partnerships in high-growth markets, such as Asia-Pacific, can safeguard against tariff fluctuations and reduce lead times, ensuring uninterrupted device availability for critical care settings.

Regulatory engagement remains paramount; early dialogue with agencies in target regions can streamline approvals for novel transducer designs and digital health integrations. Investing in robust clinical validation studies will not only support regulatory submissions but also strengthen value propositions with payers and healthcare providers.

Finally, firms should tailor training and education programs for end users, emphasizing proper sensor placement, calibration techniques and data interpretation to maximize clinical outcomes. Establishing comprehensive post-market surveillance and user support services will reinforce product reliability and build long-term customer loyalty.

Robust Multi-Method Research Approach Combining Primary Expert Interviews and Extensive Secondary Analysis Underpins Report Validity

This research leverages a hybrid methodology combining secondary desk analysis of academic literature, patent filings, regulatory databases and industry publications with primary interviews of more than 15 key opinion leaders, including biomedical engineers, ICU physicians and procurement specialists. Data triangulation ensures robustness by cross-verifying insights across multiple sources and methodologies.

Market segmentation analysis was conducted using a bottom-up approach, mapping product portfolios against clinical applications and technology platforms. Regional dynamics were assessed through country-level regulatory reviews and trade data analysis, while tariff impact evaluation incorporated official USTR notices and industry commentaries.

All quantitative and qualitative findings underwent rigorous validation via expert review panels, and methodological limitations were transparently documented. This multi-method framework underpins the report’s credibility, delivering a holistic view of the blood pressure transducer market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Pressure Transducer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Pressure Transducer Market, by Product

- Blood Pressure Transducer Market, by Technology

- Blood Pressure Transducer Market, by Distribution Channel

- Blood Pressure Transducer Market, by Application

- Blood Pressure Transducer Market, by End User

- Blood Pressure Transducer Market, by Region

- Blood Pressure Transducer Market, by Group

- Blood Pressure Transducer Market, by Country

- United States Blood Pressure Transducer Market

- China Blood Pressure Transducer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Insights to Conclude on Emerging Opportunities and Challenges in Blood Pressure Transducers for Critical and Ambulatory Care

Blood pressure transducers occupy a pivotal role in both critical and ambulatory care, with innovation accelerating across invasive and non-invasive platforms. Emerging wearable, wireless and cuffless technologies are expanding monitoring beyond hospital environments, while advanced analytics and IoT integration are enhancing real-time decision support.

Tariff landscapes and supply chain disruptions underscore the importance of strategic sourcing and regional manufacturing partnerships. Leading companies are responding with M&A, product diversification and regulatory collaborations, shaping a competitive market poised for growth amid rising cardiovascular disease prevalence.

As healthcare systems evolve toward value-based care, transducer solutions that balance accuracy, comfort and connectivity will define market winners. The convergence of miniaturized sensors, AI-driven analytics and patient-centric design heralds a new era in hemodynamic monitoring, offering significant opportunities for manufacturers and care providers alike.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Insights with Our Detailed Blood Pressure Transducer Market Research Report

To secure an in-depth understanding of blood pressure transducer market dynamics, pricing structures and technology roadmaps, please reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive research report can support your strategic objectives and investment decisions.

Ketan will guide you through customized options, exclusive add-ons and expert advisory packages designed to deliver actionable intelligence and competitive advantage. Engage today to access the full suite of market insights and take your organization’s hemodynamic monitoring strategies to the next level.

- How big is the Blood Pressure Transducer Market?

- What is the Blood Pressure Transducer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?