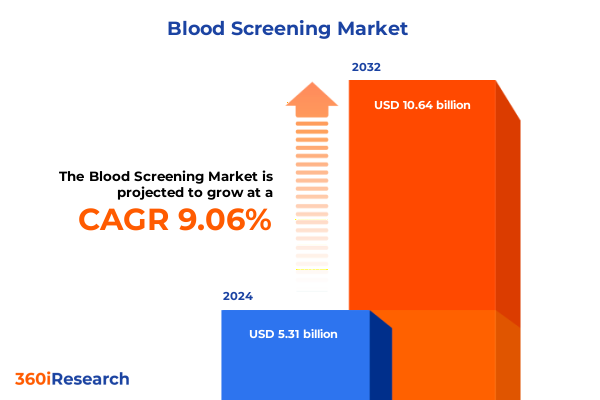

The Blood Screening Market size was estimated at USD 5.79 billion in 2025 and expected to reach USD 6.31 billion in 2026, at a CAGR of 9.07% to reach USD 10.64 billion by 2032.

Exploring the Critical Role of Advanced Blood Screening Technologies in Safeguarding Public Health and Enhancing Clinical Decision Making

Blood screening stands as a cornerstone of preventive healthcare, offering critical insights into disease detection and management that drive both clinical decision making and public health strategies. As we navigate an era marked by rising prevalence of blood-borne infections and increasing regulatory scrutiny, the demand for reliable, rapid, and accurate testing has never been more pronounced. Innovations such as point-of-care diagnostics and high-throughput laboratory platforms have expanded access and enhanced the precision of screening, ensuring that healthcare providers can identify and address conditions like hepatitis, HIV, and syphilis with greater confidence. In this complex environment, stakeholders across the value chain-from instrument manufacturers to diagnostic laboratories-must remain cognizant of shifting epidemiological patterns and technological breakthroughs. By contextualizing these dynamics within the broader healthcare ecosystem, this summary illuminates the factors shaping the blood screening market today and underscores the critical role of continued innovation.

Transitioning from foundational context to practical implications, it becomes evident that blood screening does far more than detect disease; it informs treatment pathways, reduces transmission risks, and optimizes resource utilization. This interdependency between technology and clinical outcomes drives the strategic priorities of leading organizations and regulatory bodies alike. By understanding these linkages, readers can gain a holistic view of the market’s trajectory, identify key pivot points, and anticipate how emerging trends will redefine operational benchmarks. The following sections unravel transformative shifts, policy impacts, and segmentation insights that collectively map the future of blood screening, equipping decision-makers with the clarity needed to foster impactful investments and partnerships.

How Innovative Diagnostic Platforms and Data-Driven Solutions Are Reshaping the Blood Screening Landscape for Better Patient Outcomes

The blood screening landscape is undergoing a profound metamorphosis, powered by advancements in diagnostic platforms, data analytics, and patient-centric test delivery models. Diagnostic innovation has accelerated the integration of microfluidic chips and multiplex assays, enabling simultaneous detection of multiple pathogens with minimal sample volumes. Coupled with the advent of next generation sequencing capabilities, these tools are reshaping how laboratories approach complex screening protocols, particularly in high-prevalence settings where rapid turnaround is crucial. Beyond instrumentation, the rise of digital pathology and cloud-based reporting systems is enhancing the interoperability of test results, allowing clinicians to track trends, benchmark performance, and streamline workflows across geographically dispersed sites.

In parallel, the expansion of decentralized testing has redefined patient access, with point-of-care devices extending critical diagnostic services to community clinics and mobile health units. This shift not only mitigates the logistical barriers associated with centralized laboratories but also accelerates the window from sample collection to clinical intervention. Furthermore, artificial intelligence algorithms are increasingly applied to screening data, offering predictive insights that can flag high-risk profiles and prioritize cases for confirmatory testing. As these transformative forces converge, the blood screening sector is poised to deliver more personalized, efficient, and scalable solutions that align with evolving standards of precision medicine, ultimately paving the way for a more resilient diagnostic infrastructure.

Assessing the Ripple Effects of 2025 United States Tariffs on Critical Blood Screening Equipment Supply Chains and Cost Structures

In 2025, the imposition of new United States tariffs on imported diagnostic reagents and instrumentation has introduced a complex set of challenges and opportunities for the blood screening industry. The immediate effect has been heightened cost pressure on laboratories and manufacturers that rely on global supply chains for critical components, prompting many to reassess supplier relationships and negotiate revised contracts. Concurrently, domestic producers of assay kits and analytical devices have seen an uptick in demand, leveraging local manufacturing capabilities to fill gaps created by increased import duties. This shift underscores a broader trend toward supply chain resilience, as organizations seek to diversify sources and mitigate dependencies on high-tariff markets.

Over time, the cumulative impact of these tariff measures is catalyzing investment in regional production hubs and onshore capacity expansion. Funding initiatives and public–private partnerships have emerged to support the scaling of reagent synthesis and the validation of novel diagnostic platforms within the United States. At the same time, cost-containment strategies-such as reagent concentration optimization and consolidation of testing panels-are being deployed to offset tariff-induced margin erosion. While the short-term landscape reflects elevated unit costs and renegotiated supplier terms, the longer-term outlook suggests a more self-sufficient ecosystem, with increased domestic throughput, accelerated regulatory pathways for locally produced devices, and strengthened logistical networks to underpin the next generation of blood screening solutions.

Unraveling Comprehensive Segmentation Dynamics Revealing Insights across Test Types Technologies End Users Sample Types and Testing Modes

A nuanced understanding of market segmentation offers invaluable clarity for decision makers seeking to tailor blood screening strategies to specific use cases and settings. When tests are categorized by type, it becomes apparent that hepatitis B and C screening continue to be foundational pillars, addressing both endemic and emergent infection risks. In parallel, HIV screening maintains its crucial role in public health surveillance and personalized therapy initiation, while syphilis screening underscores the importance of maternal health programs and prenatal care. By aligning test development priorities with prevailing disease burdens, manufacturers and laboratories can optimize resource allocation and ensure that high-impact assays receive the necessary investments for continual refinement.

Delving deeper into technology segmentation reveals divergent trajectories across assay modalities. Chemiluminescence platforms offer high-throughput capabilities and robust sensitivity, whereas flow cytometry delivers precise cell-based analyses valued in research and specialized laboratory settings. Within the immunoassay domain, chemiluminescence immunoassays, enzyme-linked immunosorbent assays, and radioimmunoassays each exhibit distinct performance profiles that cater to varying throughput and specificity requirements. Meanwhile, molecular diagnostics is experiencing rapid diversification, with isothermal amplification techniques enabling point-of-care virus detection, next generation sequencing facilitating comprehensive pathogen typing, and polymerase chain reaction retaining its status as the gold standard for confirmatory testing. The interplay between these technological vectors informs both product development roadmaps and capital investment decisions.

Considering the end-user perspective, blood banks prioritize high-volume screening and donor safety, clinics focus on ease of use and rapid result delivery, diagnostic laboratories balance throughput with multi-analyte capabilities, and hospitals demand integrated systems that interface seamlessly with electronic health records. Sample type further differentiates assay design, as plasma-based tests often necessitate high-sensitivity chemistries, serum assays require stringent controls to minimize matrix effects, and whole blood diagnostics emphasize minimal processing steps for point-of-care applicability. Finally, the testing mode distinction between lab-based platforms and point-of-care devices illustrates the ongoing tension between centralized efficiency and decentralized convenience. Together, these segmentation lenses illuminate pathways for strategic portfolio optimization and targeted market entry, equipping stakeholders with the granularity needed to compete effectively across diverse clinical environments.

This comprehensive research report categorizes the Blood Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Sample Type

- Testing Mode

- End User

Region-by-Region Comparative Analysis Highlighting Distinct Blood Screening Trends Infrastructure and Regulatory Environments Globally

Regional dynamics in blood screening reflect a tapestry of healthcare infrastructure capabilities, epidemiological profiles, and regulatory frameworks that shape adoption patterns and investment priorities. In the Americas, established laboratory networks in North America drive widespread use of high-throughput chemiluminescence and molecular platforms, while emerging economies in Latin America emphasize affordable, point-of-care solutions to bridge gaps in access and mitigate the burden of endemic infections. As a result, industry players targeting this region often pursue tiered pricing strategies and localized partnerships to balance cost-effectiveness with technological sophistication.

Across Europe, the Middle East, and Africa, heterogeneous regulatory environments coexist alongside varying levels of healthcare funding. Western European markets exhibit stringent conformity assessments, prompting manufacturers to invest in robust clinical validations and ISO certifications. In contrast, Middle Eastern and African markets present opportunities for rapid deployment of modular diagnostic systems, particularly in areas with evolving laboratory networks and mobile screening initiatives. These divergent contexts necessitate flexible go-to-market approaches that account for regional regulatory timelines, reimbursement policies, and public–private funding mechanisms.

In the Asia-Pacific region, a combination of population density, rising healthcare expenditure, and proactive government screening programs has fueled demand for both centralized and decentralized testing solutions. Markets such as China and India are experiencing accelerated local innovation in molecular diagnostics and point-of-care devices, supported by regulatory reforms that expedite approval pathways for novel assays. Meanwhile, Southeast Asian nations often rely on imported platforms supplemented by technology transfer agreements to bolster regional capacity. Taken together, these regional insights underscore the importance of adaptive business models that can respond to localized needs while leveraging global best practices in blood screening.

This comprehensive research report examines key regions that drive the evolution of the Blood Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Inside the Strategic Moves of Leading Blood Screening Companies Driving Innovation Partnerships and Market Positioning in 2025

Leading companies in the blood screening arena are leveraging strategic partnerships, targeted R&D investments, and diversified product portfolios to cement their market positions and drive next-generation diagnostic innovation. A prominent player has expanded its footprint through acquisitions of specialized molecular diagnostic firms, integrating isothermal amplification and next generation sequencing technologies into its core platform suite. Another industry leader has focused on enhancing its immunoassay line by developing proprietary chemiluminescent substrates and introducing new reagents with improved stability at ambient temperatures, addressing logistical challenges in resource-limited settings.

Collaborations between equipment manufacturers and reagent suppliers are becoming increasingly common, enabling co-development of turnkey solutions that reduce the complexity of laboratory workflows. At the same time, several established firms are investing in digital health capabilities, deploying cloud-enabled data management systems that link screening devices to analytics dashboards for real-time quality assurance and epidemiological monitoring. Emerging companies are entering the space with disruptive point-of-care offerings, targeting niche segments such as mobile testing units for outreach in rural populations.

Competitive differentiation is also shaped by service models, with organizations offering extended warranties, remote troubleshooting, and training programs to enhance customer retention and maximize instrument uptime. Meanwhile, strategic alliances with academic institutions and public health agencies are fostering joint validation studies and pilot programs that accelerate the adoption of novel assays. This confluence of product innovation, service excellence, and collaborative research underscores the multifaceted strategies companies deploy to navigate the evolving blood screening landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Grifols, S.A.

- Hologic, Inc.

- Merck KGaA

- Ortho Clinical Diagnostics, Inc.

- QIAGEN N.V.

- Siemens Healthineers AG

- Terumo BCT, Inc.

- Thermo Fisher Scientific Inc.

Actionable Strategies for Industry Leaders to Navigate Supply Challenges Technology Adoption and Regulatory Complexities in Blood Screening

To thrive amid supply chain uncertainties and regulatory complexities, industry leaders should prioritize the diversification of sourcing strategies by forging partnerships with multiple reagent and component manufacturers. This will mitigate the risk of single-source dependencies and enable more agile responses to tariff fluctuations or logistical bottlenecks. Additionally, organizations should accelerate investment in modular diagnostic platforms that can be reconfigured for both centralized laboratories and point-of-care environments, allowing for efficient scaling of operations in response to shifting public health demands.

Embracing digital transformation will be critical; integrating artificial intelligence and machine learning tools into screening workflows can enhance the predictive power of test results and streamline quality control processes. Companies should also pursue collaborative research agreements with clinical networks and academic centers to validate new assays swiftly and expand the evidence base for regulatory submissions. In parallel, adopting a value-based pricing framework that aligns product costs with demonstrated clinical outcomes will foster stronger payer relationships and support greater market uptake.

Finally, proactive engagement with regulatory bodies and public health authorities is essential to anticipate policy changes and shape guidelines that facilitate faster approval of innovative diagnostics. By pairing these regulatory insights with robust training programs for end users, organizations can maximize the impact of new technologies and ensure smooth implementation across diverse healthcare settings. Collectively, these strategies will position companies to convert challenges into opportunities, drive sustainable growth, and elevate the standard of care in blood screening.

Transparent Research Methodology Integrating Primary Interviews Secondary Data and Expert Validation to Ensure Analytical Rigor and Accuracy

This analysis draws upon a rigorous research methodology combining primary and secondary data sources to ensure comprehensive coverage and analytical integrity. Primary research encompassed in-depth interviews with key stakeholders, including laboratory directors, procurement officers, clinical affairs specialists, and technology innovators, providing nuanced perspectives on operational challenges and emerging priorities. Complementing these qualitative insights, secondary research involved systematic reviews of scientific literature, regulatory filings, patent databases, and technical whitepapers to map technological advancements and approval timelines.

Data triangulation was employed to validate findings across multiple sources, reconciling discrepancies and enhancing the robustness of the analysis. Quantitative datasets from public health agencies and industry associations were integrated to contextualize test utilization trends and supply chain dynamics. An expert panel comprising diagnostic scientists, healthcare strategists, and policy advisors reviewed interim findings, offering critical feedback that refined the interpretive framework and ensured alignment with real-world practice environments. This comprehensive methodology underpins the strategic recommendations and insights presented, guaranteeing that conclusions are both evidence-based and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Screening Market, by Test Type

- Blood Screening Market, by Technology

- Blood Screening Market, by Sample Type

- Blood Screening Market, by Testing Mode

- Blood Screening Market, by End User

- Blood Screening Market, by Region

- Blood Screening Market, by Group

- Blood Screening Market, by Country

- United States Blood Screening Market

- China Blood Screening Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Takeaways from Evolving Blood Screening Trends Technological Advances Regulatory Shifts and Market Segmentation Dynamics

In synthesizing the key themes across technological innovation, policy shifts, and market segmentation, it becomes clear that blood screening is at a pivotal juncture. The convergence of advanced diagnostic platforms, digital analytics, and decentralized testing paradigms is redefining how healthcare systems detect and manage blood-borne diseases. Concurrently, tariff-driven supply chain recalibrations are accelerating efforts to bolster domestic manufacturing and foster resilient logistics networks, thereby reshaping competitive dynamics.

A deep dive into segmentation reveals the critical importance of aligning assay development with disease prevalence, user needs, and operational contexts-from high-throughput hospital laboratories to mobile screening units. Regional variations further underscore the necessity for adaptive strategies that respond to local regulatory environments, infrastructure capabilities, and public health imperatives. Together, the strategic initiatives of leading companies-characterized by R&D collaborations, portfolio expansion, and digital integration-offer a blueprint for navigating complexity and capturing emerging opportunities.

By acting on the actionable recommendations outlined-diversifying supply chains, investing in modular platforms, and fostering regulatory partnerships-industry participants can not only mitigate current challenges but also drive sustainable growth. Ultimately, the future of blood screening rests on the seamless integration of technological prowess, operational agility, and collaborative innovation, setting the stage for enhanced patient outcomes and public health resilience.

Connect with Ketan Rohom to Acquire In-Depth Market Insights and Empower Decision Making with the Comprehensive Blood Screening Report

To delve deeper into the evolving landscape of blood screening and secure the insights you need to stay ahead of the curve, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will provide you direct access to the full comprehensive report, tailored data sets, and expert advisory services that can inform strategic planning and decision making. Whether you are seeking granular analysis of tariff impacts, detailed breakdowns of technology adoption, or forward-looking recommendations, Ketan can guide you through the process of acquiring the intelligence that will drive measurable business outcomes. Initiating a conversation now will enable your organization to capitalize on emerging opportunities, mitigate risks associated with supply chain disruptions, and refine your approach to regulatory compliance. Contact Ketan today to unlock the insights that will empower your team to transform challenges into competitive advantages and drive sustainable growth in the blood screening sector.

- How big is the Blood Screening Market?

- What is the Blood Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?