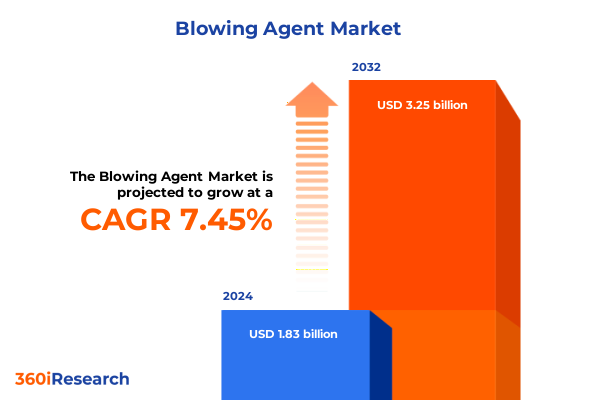

The Blowing Agent Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.08 billion in 2026, at a CAGR of 7.55% to reach USD 3.25 billion by 2032.

Understanding the Critical Role of Blowing Agents in Enhancing Performance Compliance and Efficiency in Foam Insulation Applications

Over recent years, blowing agents have emerged as indispensable components in the manufacturing of insulation and foam products across a wide range of industries. Originally developed to enhance the thermal performance of rigid and flexible foams, these chemical and physical agents have evolved to meet increasingly stringent environmental regulations while maintaining cost efficiencies. Today’s market environment demands that manufacturers balance compliance with Montreal Protocol amendments and the Kigali Amendment against the need for high-performing materials that support energy conservation and sustainability goals.

As global energy efficiency targets intensify, blowing agents are at the forefront of innovation, driving reductions in carbon footprint for end-use sectors such as building and construction, refrigeration, and automotive insulation. Industry leaders and new entrants alike are exploring a diverse palette of blowing solutions, from classic hydrocarbons and hydrofluorocarbons to emerging hydrofluoroolefins and water-based systems. This evolution reflects the pressing challenges of achieving low global warming potential without compromising on production scalability or product quality. The ensuing strategic landscape is defined by dynamic regulatory shifts, technological breakthroughs, and competitive imperatives, all of which underscore the critical role that blowing agents will play in shaping tomorrow’s sustainable infrastructure.

Navigating Environmental Regulations and Technological Innovations That Are Redefining the Blowing Agent Landscape Worldwide

The blowing agent market is undergoing a profound transformation driven by an unprecedented alignment of environmental policy, end-user demands, and technological breakthroughs. Governments worldwide have accelerated regulatory timelines, phasing out hydrofluorocarbons with high global warming potential and mandating the adoption of next-generation low-GWP alternatives. These policy interventions have compelled manufacturers to pivot toward innovative chemistries, such as hydrofluoroolefins and water-based blowing systems, which offer significantly lower emissions footprints while sustaining or improving thermal insulation properties.

Concurrently, rapid advancements in formulation science and chemical engineering are enabling the development of hybrid and next-generation blowing agents that can satisfy diverse application requirements. Digital design and simulation tools have streamlined R&D pipelines, allowing for faster optimization of cell structure, thermal conductivity, and mechanical resilience. As a result, the market is witnessing a surge in proprietary solutions tailored to specific end uses, from spray foam for complex building geometries to rigid board stock for industrial refrigeration. This confluence of regulation, innovation, and digitalization is reshaping competitive dynamics, elevating sustainability priorities, and driving the next wave of growth in the blowing agent sector.

Evaluating the Far-Reaching Consequences of Recent United States 2025 Tariff Measures on Blowing Agent Supply Chains and Pricing Dynamics

In 2025, the implementation of new United States import tariffs on select chemical precursors and finished blowing agent products has introduced significant ripple effects throughout the supply chain. By raising the cost of imported hydrofluorocarbons and certain physical blowing technologies, these tariff measures have intensified price volatility and prompted manufacturers to reassess sourcing strategies. Domestic producers have responded by expanding local capacity and forging strategic partnerships to mitigate reliance on foreign suppliers, thereby securing more stable supply streams and reducing exposure to future trade disruptions.

While elevated tariffs have increased operating costs for foam and refrigeration OEMs, they have also catalyzed investment in homegrown alternatives and accelerated the adoption of water-based and hydrocarbon blowing systems. Companies that can navigate shifting tariff landscapes by integrating flexible procurement models and hedging mechanisms gain a decisive competitive edge. As stakeholders recalibrate supply agreements and adjust pricing frameworks, the overall market is adapting to a new equilibrium where tariff-induced cost pressures coexist with innovation-driven efficiency gains, shaping a resilient and more regionally balanced blowing agent ecosystem.

Unveiling Critical Market Segmentation Insights by Type End Use Application Technology and Distribution Channels Shaping Growth Patterns

A nuanced examination of market segments reveals myriad pathways for tailored product strategies and revenue growth. When considering the types of blowing agents, differentiation emerges between classic hydrocarbons-including cyclopentane, isopentane, and pentane-versus more advanced hydrofluorocarbons such as HFC-134a, HFC-141b, and HFC-245fa, and cutting-edge hydrofluoroolefins including HFO-1233zd and HFO-1336mzz alongside evolving water-based systems. Each variant offers distinct performance characteristics and compliance profiles, enabling manufacturers to align formulation choices with regulatory mandates and application demands.

End use analysis further segments the market across key verticals like automotive, building and construction, household appliances, and packaging, with building and construction itself branching into floor, roofing, and wall insulation applications that each require optimized thermal and structural properties. This segmentation underscores the importance of customizing blowing agent solutions to sub-industry requirements, whether enhancing vehicle weight reduction or ensuring consistent insulation density in complex architectural assemblies.

Application-based categorization highlights the divergent needs of flexible foam, rigid foam, and spray foam systems, each necessitating precise control of cell morphology and cure kinetics. Technological segmentation distinguishes chemical approaches-centered around azodicarbonamide and sodium bicarbonate-from physical methods reliant on pressure and expansion dynamics. Finally, distribution channel segmentation clarifies the differing demands of the aftermarket versus original equipment manufacturing, revealing opportunities for tailored support services and supply security models that reinforce customer loyalty and drive long-term partnerships.

This comprehensive research report categorizes the Blowing Agent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Blowing Agent Type

- Technology

- End Use

- Application

- Distribution Channel

Exploring Regional Dynamics and Opportunities in the Americas Europe Middle East & Africa and Asia-Pacific Blowing Agent Markets

Regional dynamics in the blowing agent market diverge significantly as stakeholders navigate distinct regulatory regimes, feedstock availability, and end-user demands. In the Americas, a robust push toward domestic content and tariff resilience has stimulated investment in hydrocarbon and water-based development, supported by incentive programs that promote energy-efficient building codes and sustainable manufacturing practices. This region’s mature infrastructure and well-established supply chains facilitate rapid scale-up of innovative blowing agent formulations.

Conversely, Europe, the Middle East & Africa presents a regulatory environment characterized by some of the world’s most aggressive decarbonization targets and exacting chemical standards. Here, low-GWP hydrofluoroolefins and emerging bio-based blowing agents have gained substantial traction as manufacturers align with the European Green Deal and regional refrigerant phase-down schedules. The Middle East’s growing industrial and construction sectors provide additional impetus for high-performance insulation solutions that can withstand extreme climatic conditions.

In the Asia-Pacific region, dynamic economic expansion and surging demand for household appliances and commercial refrigeration systems drive rapid market growth. Many countries within this zone are accelerating regulatory implementation, spurring adoption of next-generation blowing agents. Local chemical producers are expanding capacity to meet both domestic and export needs, while governmental partnerships foster technology transfers that enhance regional self-sufficiency. These convergent trends position Asia-Pacific as a key battleground for innovation, production scale, and competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Blowing Agent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Strategies and Innovation Portfolios of Leading Blowing Agent Manufacturers Driving Market Advancement

The competitive landscape of the blowing agent sector is marked by strategic investments in innovation, capacity expansion, and sustainability-oriented partnerships. Leading chemical manufacturers differentiate themselves through proprietary low-GWP formulations, extensive patent portfolios, and integrated service offerings that support end-use customization. For instance, some global leaders have pioneered hydrofluoroolefin variants with optimized thermal performance, while others have focused on water-based systems that eliminate fluorinated components altogether.

Strategic alliances between blowing agent producers and appliance or insulation OEMs further underscore the importance of co-development agreements and joint research initiatives. These collaborations accelerate time-to-market for next-generation solutions and foster deeper technical exchange, ensuring that end-use requirements are met with precision. Additionally, mergers and acquisitions remain a prevalent strategy for bolstering geographic reach and consolidating production assets, enabling companies to navigate tariff-induced cost pressures and regional regulatory complexities more effectively.

A clear competitive advantage also stems from digital and analytical capabilities, where data-driven process optimization and supply chain transparency tools enhance operational resilience. Enterprises that leverage advanced analytics to forecast demand and monitor regulatory shifts demonstrate superior agility, positioning them to capture emerging opportunities and outpace rivals in delivering high-value, compliant blowing agent technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blowing Agent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajanta Group

- Arkema SA

- Asahi Kasei Corporation

- BASF SE

- Daikin Industries, Ltd.

- HCS Group

- Honeywell International Inc.

- J B Industries

- KibbeChem, Inc

- Kumyang Co., Ltd.

- Lanxess AG

- Linde PLC

- Milliken & Company

- Orbia Advance Corporation, S.A.B. de C.V.

- Shandong Dongyue Group Co., Ltd.

- SHANDONG REPOLYFINE ADDITIVES CO.,LTD

- Sinochem Group Co. Ltd

- Solvay SA

- The Chemours Company

- Zhejiang Juhua Co., Ltd.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Regulatory Economic and Technological Challenges

Industry leaders must adopt a proactive stance to harness the full potential of blowing agent innovations while mitigating regulatory and trade-related risks. Prioritizing research and development investments that focus on scalable low-GWP chemistries and water-based technologies can deliver both sustainability credentials and performance excellence. Simultaneously, diversifying the supply base through regional partnerships and dual-sourcing strategies reduces exposure to import tariffs and geopolitical disruptions.

Strengthening collaborations with key end users-including construction firms, appliance OEMs, and automotive manufacturers-enables co-creation of tailored solutions that address specific thermal, mechanical, and environmental criteria. Establishing integrated support services, such as onsite technical assistance and formulation optimization workshops, fosters deeper customer engagement and long-term loyalty. Moreover, leveraging digital supply chain tools to enhance transparency and demand forecasting can streamline inventory management and ensure continuity of supply during market fluctuations.

Finally, maintaining active engagement with regulatory bodies and participating in industry consortia can help shape forthcoming policy frameworks, providing early visibility into compliance pathways and emerging standards. By aligning advocacy efforts with sustainability objectives and demonstrating technical leadership, companies can influence market trajectories and secure a competitive advantage in a rapidly evolving blowing agent ecosystem.

Outlining a Robust Mixed Methodology Approach Featuring Primary Data Collection Secondary Research and Expert Validation Techniques

This analysis was developed through a rigorous, multi-step approach that integrates both qualitative and quantitative research techniques. Primary data collection involved in-depth interviews with key stakeholders across the value chain, including chemical engineers, formulation scientists, regulatory experts, and supply chain managers. These discussions provided granular insights into product performance requirements, adoption barriers, and evolving customer priorities.

Secondary research complemented primary findings by encompassing a comprehensive review of industry publications, patent filings, environmental legislation, and company disclosures. Trade association reports and government databases were systematically analyzed to validate trends in tariff policies, regional capacity growth, and sustainability mandates. Data triangulation ensured that conflicting sources were reconciled, yielding a robust and objective market narrative.

Expert validation was conducted via a panel of third-party industry veterans, whose feedback refined analytical assumptions and enhanced the credibility of strategic recommendations. Finally, a structured segmentation framework was applied to categorize market dynamics by type, end use, application, technology, and distribution channel, ensuring that insights remain relevant to targeted decision-making. This methodical process underpins the reliability and depth of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blowing Agent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blowing Agent Market, by Blowing Agent Type

- Blowing Agent Market, by Technology

- Blowing Agent Market, by End Use

- Blowing Agent Market, by Application

- Blowing Agent Market, by Distribution Channel

- Blowing Agent Market, by Region

- Blowing Agent Market, by Group

- Blowing Agent Market, by Country

- United States Blowing Agent Market

- China Blowing Agent Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Strategic Imperatives to Highlight the Transformative Potential of Blowing Agents Across End User Verticals

In synthesizing the multifaceted insights gathered, it becomes evident that the blowing agent industry stands at a pivotal juncture where sustainability imperatives and performance demands converge. Regulatory pressures continue to accelerate the transition toward lower global warming potential solutions, catalyzing innovation in both chemical and physical blowing technologies. Coupled with evolving tariff landscapes and regional policy frameworks, these drivers are reshaping supply chain configurations and competitive dynamics.

Segment-specific analysis underscores that success hinges on the ability to tailor solutions for varied end uses-whether optimizing cell structure for flexible foam in automotive applications or ensuring consistent density in rigid building insulation. Regional variations further highlight the necessity of strategic localization, as each geography presents its own regulatory timelines and feedstock considerations. Leading companies are those that seamlessly integrate R&D advancements with agile supply chain strategies and collaborative partnerships.

Ultimately, organizations that can anticipate regulatory shifts, invest in next-generation chemistries, and engage proactively with stakeholders will emerge as market leaders. The transformative potential of advanced blowing agents offers not only environmental benefits but also distinct commercial opportunities for companies willing to navigate complexity and drive strategic execution.

Drive Growth and Gain Competitive Advantage by Securing Premium Blowing Agent Market Intelligence with a Tailored Purchase Offering

For decision-makers seeking to leverage advanced insights and secure a competitive edge in the dynamic blowing agent arena, engaging directly with an experienced associate director of sales and marketing can catalyze success. By reaching out to Ketan Rohom, stakeholders gain personalized guidance on how the detailed findings and strategic recommendations within the comprehensive report align with their specific priorities. This tailored approach ensures that procurement aligns with organizational objectives while expediting access to vital data on tariff impacts, segmentation nuances, technology advances, and regional growth vectors.

From small innovators to leading chemical corporations, aligning purchasing decisions with expert support transforms raw market intelligence into actionable strategies. Collaboration with Ketan Rohom unlocks additional resources, including customizable data breakdowns, targeted workshops, and ongoing advisory services. By taking this next step, companies position themselves to capitalize on emerging trends, navigate regulatory complexities, and optimize R&D investments.

Seize the opportunity to translate research findings into measurable outcomes by connecting directly with an authority who understands both the technical intricacies and commercial imperatives of the blowing agent market. Secure your pathway to informed decision-making and sustained growth by initiating the procurement process today.

- How big is the Blowing Agent Market?

- What is the Blowing Agent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?