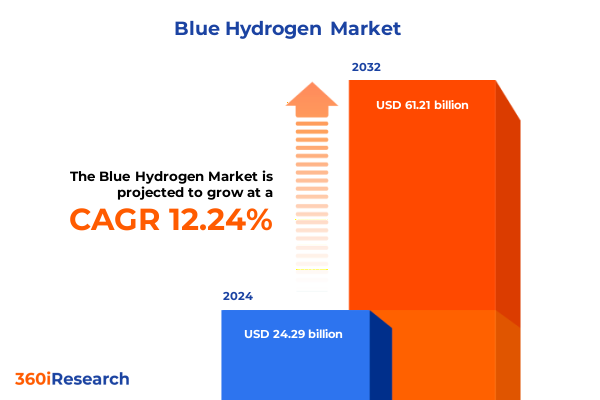

The Blue Hydrogen Market size was estimated at USD 27.21 billion in 2025 and expected to reach USD 30.23 billion in 2026, at a CAGR of 12.27% to reach USD 61.21 billion by 2032.

Establishing the Foundational Role of Blue Hydrogen in Accelerating Decarbonization Efforts and Empowering Industry Transition Toward Sustainable Energy Paradigms

Blue hydrogen has emerged as a pivotal component in the global pursuit of decarbonization, bridging the gap between traditional fossil fuel dependencies and the broader adoption of renewable energy sources. Derived primarily from natural gas with integrated carbon capture and storage technologies, this low-carbon energy vector offers industries a pragmatic pathway to reduce greenhouse gas emissions without compromising on energy reliability or supply chain continuity.

As governments and corporations worldwide intensify commitments to net-zero targets, blue hydrogen occupies a unique position by combining existing infrastructure capabilities with advanced emissions mitigation techniques. This hybrid nature positions it not only as a transitional solution but also as a long-term pillar of a diversified energy mix. With scaling production technologies and strengthening policy support, blue hydrogen is rapidly evolving from pilot-scale demonstrations to commercially viable operations, setting the stage for widespread industrial deployment.

In this context, understanding the foundational principles, market drivers, and emerging barriers to adoption is essential for stakeholders seeking to harness the full potential of blue hydrogen. By framing this comprehensive overview, executives and decision-makers can appreciate both the strategic imperatives and the operational considerations that will shape the trajectory of this transformative energy sector.

Unveiling the Recent Transformative Shifts Reshaping the Blue Hydrogen Landscape Through Technological, Regulatory, and Market Dynamics

The landscape of blue hydrogen is undergoing a series of profound shifts that extend beyond technological improvements to encompass regulatory evolution, supply chain maturation, and stakeholder collaboration. On the technological front, advancements in steam methane reforming with carbon capture are driving down the cost and complexity of production, while breakthroughs in coal gasification and gas partial oxidation, when coupled with sophisticated capture systems, are positioning these processes as viable alternatives in regions with abundant coal or natural gas reserves.

Regulatory frameworks have similarly adapted, with new incentives, carbon pricing mechanisms, and policy mandates emerging in key markets. These measures are stimulating investment flows and underwriting project viability by reducing investor risk and enhancing revenue certainty. Simultaneously, offtake agreements and joint ventures between utilities, industrial end users, and technology providers are becoming more prevalent, reflecting a growing recognition of blue hydrogen’s role in comprehensive decarbonization roadmaps.

Market dynamics are also evolving as supply chains mature to support large-scale distribution. From liquid hydrogen carriers facilitating international trade to dedicated pipeline networks enabling regional transport, the infrastructure underpinning blue hydrogen is transitioning from concept to reality. These interdependent shifts collectively underscore the maturation of blue hydrogen from experimental niche to strategic cornerstone in the energy transition.

Examining the Cumulative Impact of 2025 United States Tariffs on Critical Blue Hydrogen Value Chains and Competitive Market Positioning

In 2025, the United States implemented targeted tariffs aimed at domestic and imported equipment integral to blue hydrogen production and distribution. These measures, designed to protect nascent domestic manufacturing capabilities, have reverberated across the supply chain, influencing project timelines, cost structures, and competitive positioning. Providers of steam methane reformers, carbon capture units, and pipeline components have adjusted their sourcing strategies, emphasizing local content compliance to mitigate tariff exposure.

Consequently, project developers are navigating a recalibrated procurement landscape, weighing the trade-offs between higher domestic equipment costs and the long-term benefits of tariff exemptions or reduced levies on compliant goods. Strategic alliances have emerged as a mechanism to share manufacturing capacity, transfer technology, and secure favorable terms with OEMs and EPC contractors operating within the United States.

Beyond the immediate procurement impacts, these tariffs have prompted a reexamination of global supply routes, with some stakeholders looking to diversify import origins or pivot toward regional clusters. While this reorientation entails logistical complexities and potential cost increases, it also presents opportunities to cultivate new supplier relationships and enhance supply chain resilience. Ultimately, the cumulative effect of the 2025 tariffs is reshaping competitive dynamics by reinforcing the value of strategic local partnerships and proactive supply chain planning.

Revealing Key Segmentation Insights Highlighting Diverse End Use Industries Production Technologies Applications and Delivery Modes in Blue Hydrogen Markets

Insights into market segmentation reveal nuanced demand patterns driven by end use industries that range from chemical manufacturing to refining, oil and gas operations, power generation, and transportation. Within chemical applications, blue hydrogen serves as a feedstock for producing high-purity ammonia and methanol, enabling a transition toward low-carbon fertilizers and chemical intermediates. In refining, the incorporation of blue hydrogen into hydrotreating and hydrocracking processes accelerates the removal of sulfur compounds and supports cleaner fuel standards.

By examining production technologies, it becomes evident that steam methane reforming with carbon capture has established itself as the predominant pathway due to its compatibility with existing natural gas infrastructure and proven performance metrics. Auto thermal reforming and coal gasification, while less prevalent, offer strategic alternatives in regions rich in coal or with specialized thermal processing capabilities, and gas partial oxidation provides flexibility where oxygen supply and process integration are prioritized.

Applications further highlight the versatility of blue hydrogen, spanning distributed and grid connected power generation that delivers firm, low-carbon electricity alongside large-scale production of ammonia and methanol. Moreover, the rapid electrification of transportation is underpinned by fuel cell vehicles, where buses, heavy duty trucks, material handling equipment, and passenger vehicles benefit from refueling flexibility and extended range. Each application segment underscores distinct operational requirements, catalyzing tailored delivery modes such as on site production, pipeline networks, tube trailers, and liquid hydrogen carriers to address logistical, safety, and cost considerations.

This comprehensive research report categorizes the Blue Hydrogen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Technology

- Delivery Mode

- Application

- End Use Industry

Exploring Regional Dynamics of Blue Hydrogen Adoption Across the Americas EMEA and Asia Pacific to Illuminate Growth Drivers and Barriers

Regional analysis underscores differentiated adoption trajectories across the Americas, Europe Middle East & Africa, and Asia Pacific as governments and industries pursue carbon reduction strategies aligned with local resource endowments. In the Americas, abundant natural gas reserves and established petrochemical complexes anchor blue hydrogen deployment within refining and chemical sectors, while pilot projects in power generation and heavy transport are scaling steadily.

Across Europe, the Middle East, and Africa, policy incentives, carbon pricing frameworks, and strategic partnerships have catalyzed investments in carbon capture-equipped steam reforming facilities. In Europe, robust emissions regulations drive integration with power utilities, whereas Middle Eastern economies leverage blue hydrogen for both domestic energy diversification and potential export in liquid carrier form. In Africa, nascent initiatives focus on capacity building, technology transfer, and smaller scale demonstration projects to validate models for future expansion.

In the Asia Pacific, the convergence of energy security concerns and net-zero commitments has led to substantial commitments from government-backed entities and private consortia. Countries with limited domestic gas supplies are exploring coal gasification routes with integrated capture, while pipeline and shipping corridors are being designed to facilitate cross-border trade. This threefold regional mosaic reveals how local policy ecosystems, resource availability, and infrastructure capabilities collectively inform strategic blue hydrogen roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Blue Hydrogen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants in Blue Hydrogen Value Chain to Highlight Strategic Initiatives Partnerships and Technological Advancements

Industry participants across the blue hydrogen value chain are advancing strategic initiatives and forging alliances to secure competitive advantage. Major energy corporations are integrating carbon capture with existing reforming assets, leveraging their upstream gas portfolios to streamline project development. Equipment manufacturers are enhancing modular designs for reformers and capture systems, aiming to reduce lead times and adapt to varying feedstock characteristics.

Partnerships between technology providers and engineering contractors are evolving into joint development programs that blend intellectual property with on site engineering capabilities, expediting project execution and risk sharing. Financial institutions and infrastructure funds are structuring innovative financing models, including green bonds and project finance facilities tied to emissions performance, thereby unlocking new capital pools for large scale deployments.

In parallel, collaborative research initiatives involving academic institutions and consortia are focused on next generation catalysts and membranes to boost capture efficiency and lower operational expenditures. Through these strategic alignments and ongoing R&D efforts, the industry is bolstering its collective capacity to meet escalating demand while driving down the unit costs of blue hydrogen production.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blue Hydrogen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- BASF SE

- BP plc

- CF Industries Holdings, Inc.

- Chevron Corporation

- Enbridge Inc.

- ENGIE S.A.

- Equinor ASA

- Exxon Mobil Corporation

- Hyundai Engineering Co., Ltd.

- Intermountain Power Agency

- Linde plc

- Lotte Chemical Corporation

- Mitsubishi Heavy Industries, Ltd.

- OCI N.V.

- Phillips 66 Company

- Saudi Basic Industries Corporation (SABIC)

- Shell plc

- Siemens Energy AG

- Snam S.p.A.

- Toshiba Energy Systems & Solutions Corporation

- TotalEnergies SE

- Uniper SE

- Yara International ASA

Presenting Actionable Recommendations for Industry Leaders to Capitalize on Blue Hydrogen Opportunities Through Strategic Investments and Collaborative Innovation

To capitalize on the momentum behind blue hydrogen, industry leaders should prioritize robust partnerships that align upstream gas suppliers with carbon capture technology providers and distribution network operators. By structuring offtake agreements with downstream users in refining, chemicals, and power generation, stakeholders can secure stable revenue streams and de-risk project financing.

Investments in modular, scalable production units enable rapid deployment and adaptation to shifting demand profiles, thereby reducing time to market and mitigating exposure to tariff volatility. Concurrently, integrating digital monitoring and control systems enhances operational flexibility and predictive maintenance, driving performance optimization and ensuring compliance with evolving regulatory standards.

Engaging proactively with policymakers to shape supportive frameworks will be critical to sustaining incentives for clean hydrogen. Through industry associations and strategic coalitions, companies can influence carbon pricing mechanisms, streamline permitting processes, and advocate for infrastructure development. Equally, investing in workforce upskilling and safety protocols will underpin long term project success by fostering robust human capital and ensuring operational excellence.

Detailing a Rigorous Research Methodology Emphasizing Mixed Methods Qualitative and Quantitative Analyses to Ensure Comprehensive Insights

This report synthesizes secondary research from industry journals, policy white papers, and technology patents with primary insights gathered through interviews with project developers, technology licensors, and regulatory authorities. Quantitative data was validated against public disclosures, trade publications, and financial filings to ensure reliability and relevance. The analytical framework integrates value chain mapping, competitive landscaping, and scenario based impact assessments to elucidate market dynamics.

Qualitative inputs were captured through structured discussions with end users across chemicals, refining, power generation, and transport sectors, enabling the triangulation of supply chain challenges and demand drivers. Production technology benchmarks were evaluated against performance criteria such as capture efficiency, feedstock flexibility, and capital intensity. Regional regulatory landscapes were mapped to highlight permitting timelines, incentive structures, and carbon pricing regimes.

Through this rigorous methodology, the report delivers a nuanced understanding of blue hydrogen’s evolving landscape, offering stakeholders a robust foundation for strategic decision making and project development.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blue Hydrogen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blue Hydrogen Market, by Production Technology

- Blue Hydrogen Market, by Delivery Mode

- Blue Hydrogen Market, by Application

- Blue Hydrogen Market, by End Use Industry

- Blue Hydrogen Market, by Region

- Blue Hydrogen Market, by Group

- Blue Hydrogen Market, by Country

- United States Blue Hydrogen Market

- China Blue Hydrogen Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding on the Strategic Imperatives of Blue Hydrogen for Decarbonization Pathways and the Imperative of Collaborative Stakeholder Engagement

The evolution of blue hydrogen underscores its critical role in bridging the gap between conventional energy systems and a low carbon future. By harnessing existing gas infrastructure, integrating advanced carbon capture technologies, and aligning policy incentives, blue hydrogen offers a pragmatic yet transformative solution to decarbonize hard to abate sectors. Its versatility as a feedstock, fuel, and energy carrier makes it indispensable for stakeholders across the chemicals, refining, power, and transportation industries.

Moving forward, the strategic imperative lies in fostering collaboration among technology innovators, project developers, and regulatory bodies to streamline commercialization pathways. As cost structures continue to improve and policy frameworks mature, blue hydrogen is poised to transition from transitional remedy to foundational pillar in the energy ecosystem. Embracing this shift will require concerted efforts in infrastructure development, supply chain resilience, and workforce readiness.

Ultimately, blue hydrogen’s success will be defined by the ability of industry participants to translate technical feasibility into scalable, economically viable deployments that align with global net-zero ambitions. The insights presented herein provide a clear roadmap for navigating this dynamic landscape and unlocking the full potential of blue hydrogen.

Driving Strategic Engagement with Associate Director Sales and Marketing to Secure Comprehensive Blue Hydrogen Market Research Insights for Informed Decision Making

Engaging directly with Ketan Rohom offers a strategic opportunity to delve deeper into the complexities and opportunities of the blue hydrogen market. As Associate Director of Sales and Marketing, he can provide tailored guidance on how the insights within this report align with specific investment priorities and operational goals. By scheduling a consultation, stakeholders can explore bespoke scenarios, discuss integration strategies, and identify collaborative pathways to accelerate project timelines and optimize returns.

Beyond the high-level overview, acquiring the full report will equip decision-makers with a complete toolkit for navigating the evolving blue hydrogen landscape. Detailed analyses, proprietary data sets, and decision frameworks are designed to empower executive teams to make informed choices with confidence. To unlock comprehensive market intelligence, connect with Ketan Rohom and gain the clarity necessary to shape resilient strategies that capitalize on emerging trends and policy shifts.

For immediate access to customized recommendations and the complete suite of analyses, reach out to Ketan Rohom to request your copy of the blue hydrogen market research report.

- How big is the Blue Hydrogen Market?

- What is the Blue Hydrogen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?