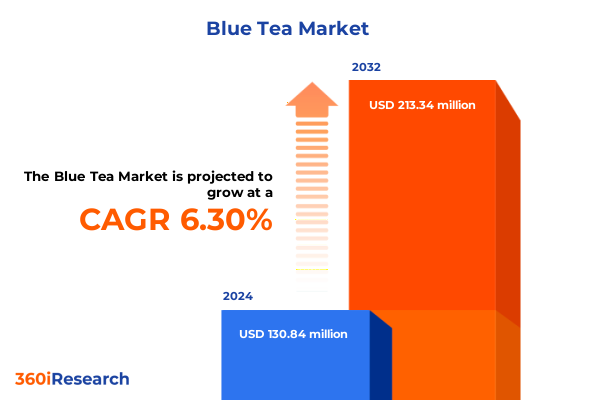

The Blue Tea Market size was estimated at USD 138.20 million in 2025 and expected to reach USD 152.29 million in 2026, at a CAGR of 6.39% to reach USD 213.34 million by 2032.

Understanding the Emergence of Blue Tea as a Revolutionary Botanical Beverage Shaping Health and Lifestyle Trends in Modern Consumer Markets

In recent years, Blue Tea has emerged from the niche herbal beverage arena to claim a prominent position in global wellness portfolios. Derived primarily from the vibrant butterfly pea flower, this distinctive infusion captivates health-conscious consumers with its natural striking hue and functional benefits. Rich in anthocyanins, Blue Tea offers antioxidant and cognitive support properties that resonate with modern demands for holistic nourishment and cognitive vitality. Simultaneously, its visual appeal has become a powerful tool for product differentiation across digital and retail channels.

As consumers increasingly pursue clean-label and naturally sourced ingredients, Blue Tea’s profile aligns seamlessly with broader lifestyle trends. Social media platforms have further amplified its allure, with influencers showcasing visually captivating recipes and functional blends that incorporate citrus, ginger, and mixed-berry infusions. This social amplification has propelled Blue Tea beyond traditional tea-drinking communities into mainstream awareness, inspiring innovation among beverage developers and fortifying its growth trajectory.

By examining the confluence of nutritional science, consumer engagement, and artisanal heritage, this report illuminates the foundational drivers shaping the Blue Tea market. A comprehensive understanding of product innovation pathways, regulatory influences, and evolving consumer behaviors sets the stage for informed strategic decision-making. The following sections provide an integrated view of market dynamics, enabling stakeholders to navigate opportunities and mitigate challenges within this rapidly evolving sector.

Identifying the Key Transformative Forces Reshaping the Blue Tea Landscape Through Innovation Consumer Behavior and Sustainability Imperatives

The Blue Tea landscape has undergone multiple transformative shifts, driven by a confluence of innovation, consumer expectations, and sustainability concerns. Technological advancements in extraction and stabilization techniques have enabled producers to develop liquid extracts and powdered concentrates that deliver consistent potency, facilitating incorporation into beverages, cosmetics, and dietary supplements. These improvements have expanded the application scope beyond loose-leaf and tea bag formats into ready-to-drink products packaged in bottles, cans, and pouches.

Consumer behavior has likewise evolved, with an escalating appetite for functional beverages that offer tangible health benefits. This trend has prompted brands to introduce novel flavor variants-such as citrus infusion for an antioxidant boost, ginger infusion for digestive support, and mixed-berry blends for enhanced nutrient diversity-while preserving the signature indigo coloration. Parallel to taste-driven innovation, the emphasis on organic certification has intensified as buyers seek provenance and purity assurances, motivating industry players to secure organic credentials and enhance supply chain transparency.

Sustainability imperatives have also reshaped production and distribution strategies. Brands are adopting eco-friendly packaging solutions-favoring recyclable sachets over traditional boxes-and forging partnerships with specialty stores and online retailers to minimize carbon footprints. These strategic shifts underscore a market that values both environmental stewardship and product efficacy, laying the groundwork for sustained Blue Tea adoption across diverse consumer segments.

Analyzing the Multifaceted Impacts of 2025 United States Tariff Measures on Blue Tea Supply Chains and Industry Cost Structures

In 2025, the United States enacted a series of tariff adjustments impacting botanical imports, including butterfly pea flower derivatives. These measures introduced heightened duties on shipments originating from key production hubs in Southeast Asia, namely Thailand and Vietnam, which have historically supplied the majority of raw material for Blue Tea extract and tea bag manufacturing. As a result, procurement costs have risen, compelling manufacturers to reassess sourcing strategies and absorb part of the increment to maintain competitive retail pricing.

The tariff escalation has also disrupted supply chain continuity. Longer lead times and increased documentation requirements have led to intermittent stock shortages for extract and powder suppliers, compelling brands to diversify vendor portfolios and explore alternate cultivation regions in India and Latin America. Concurrently, financial pressures have driven some private-label producers to renegotiate contracts with co-packers, leveraging long-term commitments to secure tariff rebates and optimize freight consolidation.

Amid these challenges, industry leaders are innovating pricing structures and value propositions. By introducing premium formulations with enhanced functional claims-such as cognitive support and beauty-from-within benefits-companies have justified modest price adjustments while fostering consumer loyalty. This strategic recalibration ensures resilience against tariff-induced cost inflation and underscores the capacity of agile enterprises to sustain growth under shifting trade policies.

Deriving Actionable Segmentation Perspectives to Navigate the Complex Blue Tea Market Across Product Formats Channels Packaging Flavors and Applications

A nuanced understanding of Blue Tea segmentation reveals critical pathways for product development and market penetration. The product type dimension encompasses extract and powder formats-subdivided into liquid extracts and powders-alongside loose-leaf, ready-to-drink in bottles, cans, and pouches, and traditional tea bags. Extracts and powders enable high-concentration functional blends suited for dietary supplements and cosmetics, while ready-to-drink offerings cater to on-the-go wellness consumers demanding convenience and flavor variety.

Distribution channels also shape market accessibility. Convenience stores and supermarket & hypermarket outlets provide widespread physical reach, whereas online retail platforms facilitate direct-to-consumer engagement and subscription models. Specialty stores serve as hubs for artisanal and premium Blue Tea experiences, offering personalized sampling and educational touchpoints that reinforce brand authenticity.

Packaging type influences both shelf impact and sustainability credentials. Bottles and cans offer robust protection and portability, whereas boxes and sachets optimize shelf merchandising and portion control. The choice of packaging directly correlates with consumer preferences for ease of use and environmental considerations.

Flavor variants such as citrus-infused, ginger-infused, mixed-berry, and plain appeal to differentiated taste profiles and functional needs. Citrus-infused blends highlight antioxidant potency, ginger-infused formulations emphasize digestive support, and mixed-berry combinations offer a balanced nutrient spectrum. Application segmentation underscores Blue Tea’s versatility, spanning beverage consumption, topical cosmetics, and inclusion in dietary supplements. Finally, organic certification has emerged as a decisive attribute, with conventional and organic variants addressing divergent consumer priorities for affordability and purity.

This comprehensive research report categorizes the Blue Tea market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Flavor Variant

- Application

- Distribution Channel

Unlocking Regional Nuances Revealing How Americas Europe Middle East Africa and Asia Pacific Drive Blue Tea Market Dynamics Differently

Regional dynamics reveal distinct market drivers and consumer attitudes toward Blue Tea across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, elevated health awareness and the growing functional beverage sector have accelerated adoption, with supermarkets and online platforms championing both conventional and organic formulations. The United States leads demand for ready-to-drink offerings, leveraging its mature e-commerce infrastructure and robust cold-chain logistics.

Within Europe Middle East & Africa, premiumization has taken center stage. Consumers in Western Europe favor artisanal loose-leaf and tea bag varieties endorsed by sustainability certifications and ethical sourcing standards. The Middle East presents a burgeoning market for flavored Blue Tea, particularly in hospitality and upscale café settings, while African producers are increasingly integrating butterfly pea cultivation into diversified agroeconomic models.

Asia-Pacific remains the epicenter of both production and consumption. Southeast Asian countries continue to expand butterfly pea flower cultivation, driven by favorable agronomic conditions and established export agreements. Simultaneously, domestic markets in China, Japan, and Australia exhibit strong demand for ready-to-drink and extract-based formats, fueled by urbanization and rising disposable incomes. This region’s synergy of supply robustness and consumer enthusiasm ensures its status as a strategic priority for market entrants.

This comprehensive research report examines key regions that drive the evolution of the Blue Tea market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Established Players Dominating the Blue Tea Industry Through Strategic Partnerships and Product Advancements

The competitive landscape features a blend of established tea conglomerates and emerging botanical specialists. Legacy brands have leveraged their extensive distribution networks and brand equity to launch Blue Tea extensions, often partnering with niche producers to ensure authenticity and product quality. In parallel, dedicated butterfly pea flower innovators have emerged, focusing on proprietary extraction processes and unique flavor formulations that emphasize functional benefits.

Strategic collaborations between ingredient suppliers and beverage manufacturers have accelerated product diversification. Partnerships with cosmetic companies have introduced topical Blue Tea-infused skincare lines, while alliances with supplement formulators have facilitated the creation of powdered blends targeted at cognitive and beauty-from-within segments. These cross-industry synergies underscore the adaptability of Blue Tea as a multipurpose ingredient and strengthen the market position of participating companies.

Additionally, the rise of private-label offerings in both retail and online channels has intensified competition. Retailers have structured exclusive agreements with co-packers to develop bespoke Blue Tea products, enabling them to differentiate assortments and capture margin opportunities. Against this backdrop, innovation in packaging design and digital marketing has become paramount, with leading players deploying interactive e-commerce experiences and eco-conscious materials to engage consumers and reinforce brand distinction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blue Tea market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adagio Teas

- Bird & Blend Tea Co.

- Chai Craft

- Chymey Teas

- Danta Herbs Pvt. Ltd

- Gopaldhara Tea Co Private Limited

- Harney & Sons Fine Teas

- Hawaii Bay Company

- Himalayan Brew

- Hyleys Tea

- Karma Kettle Teas

- Mittal Teas

- Noble Roots Urban Garden LLC

- Revival Tea Company

- Sancha Tea

- Secret Leaves by Bioscope India

- Teapro Limited

- TEASENZ

- TegaOrganicTea

- Tucson Tea Company

- Urban Platter

- Ésah Tea

Implementable Strategic Guidance for Industry Decision Makers to Capitalize on Emerging Opportunities in the Blue Tea Market Landscape

Industry leaders should adopt a multi-pronged approach to harness growth potential in the Blue Tea sector. First, accelerating product innovation through continuous research into bioactive compounds will unlock differentiated health claims, supporting premium positioning and justifying higher price points. Concurrently, securing organic and other relevant certifications will cater to discerning consumers and bolster brand credibility.

Expanding distribution footprints is equally crucial. Companies must strengthen direct-to-consumer channels by optimizing e-commerce platforms, implementing subscription models, and leveraging social media engagement. At the same time, cultivating relationships with specialty retailers and upscale hospitality partners will provide educational touchpoints, enhancing consumer trust and fostering loyalty.

Supply chain diversification stands as a vital risk mitigation strategy. By developing alternative sourcing regions and forging strategic alliances with local cultivators, businesses can safeguard against geopolitical disruptions and tariff volatility. Lastly, embracing sustainable packaging solutions and transparent reporting on environmental impact will resonate with eco-conscious buyers and align with global sustainability mandates, driving long-term brand equity.

Detailing Rigorous Research Methods Employed to Generate Reliable Blue Tea Market Insights Combining Qualitative and Quantitative Techniques

This research methodology combined rigorous primary and secondary data collection to ensure robust insights into the Blue Tea market. Primary research involved structured interviews with executive stakeholders across production, distribution, and retail sectors, complemented by on-site supply chain audits in key cultivation regions. Stakeholders provided firsthand perspectives on sourcing challenges, consumer trends, and innovation pipelines.

Secondary research integrated industry reports, trade association data, and peer-reviewed studies to contextualize primary findings and validate market patterns. Analysis of import-export databases and regulatory filings was conducted to assess tariff impacts and identify emerging trade routes. Proprietary frameworks were applied to segment the market by product type, distribution channel, packaging, flavor variant, application, and certification, ensuring comprehensive coverage of industry dynamics.

Quantitative techniques, including frequency analysis of consumer surveys and cross-sectional examination of sales channel performance, provided empirical support for segmentation and regional insights. Qualitative synthesis of expert opinions and case studies enriched the narrative, highlighting actionable strategies and best practices. This multi-method approach delivered a balanced perspective on Blue Tea market opportunities and risks, guiding strategic decision-making with evidence-based clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blue Tea market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blue Tea Market, by Product Type

- Blue Tea Market, by Packaging Type

- Blue Tea Market, by Flavor Variant

- Blue Tea Market, by Application

- Blue Tea Market, by Distribution Channel

- Blue Tea Market, by Region

- Blue Tea Market, by Group

- Blue Tea Market, by Country

- United States Blue Tea Market

- China Blue Tea Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Conclusions Emphasizing the Strategic Significance and Future Potential of Blue Tea in Health Wellness and Lifestyle Sectors

The convergence of health-driven consumer demand, aesthetic appeal, and functional versatility positions Blue Tea as a pivotal category within the broader botanical beverage landscape. Its unique composition and striking visual attributes have enabled industry participants to differentiate offerings and capture emerging wellness segments. At the same time, regulatory shifts-particularly the 2025 U.S. tariff adjustments-underscore the need for agile sourcing and pricing strategies that maintain market momentum.

Segmentation analysis reveals that tailored approaches across product type, distribution channel, packaging, flavor variant, application, and certification drive targeted growth opportunities. Regional dynamics further emphasize the importance of locally attuned strategies, as consumer preferences and supply chain capabilities vary markedly between the Americas, Europe Middle East & Africa, and Asia-Pacific.

Collectively, these insights highlight the strategic significance of continuous innovation, sustainable practices, and collaborative partnerships. Stakeholders who navigate these multifaceted dynamics with foresight and adaptability will be best positioned to capitalize on Blue Tea’s future potential, reinforcing its status as a transformative botanical ingredient in health, wellness, and lifestyle sectors.

Driving Strategic Engagement with Our Associate Director to Unlock Exclusive Blue Tea Market Insights and Propel Your Growth Trajectory Today

Elevate your strategic positioning in the rapidly evolving Blue Tea market by connecting directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His deep industry expertise and keen market insights will empower you to make data-driven decisions that unlock new growth avenues and enhance competitive advantage. Engage in a tailored discussion to explore premiere research offerings, receive exclusive content previews, and secure the actionable intelligence needed to outpace competitors. Reach out today to transform market insights into impactful business outcomes and seize the opportunities within the flourishing Blue Tea sector.

- How big is the Blue Tea Market?

- What is the Blue Tea Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?