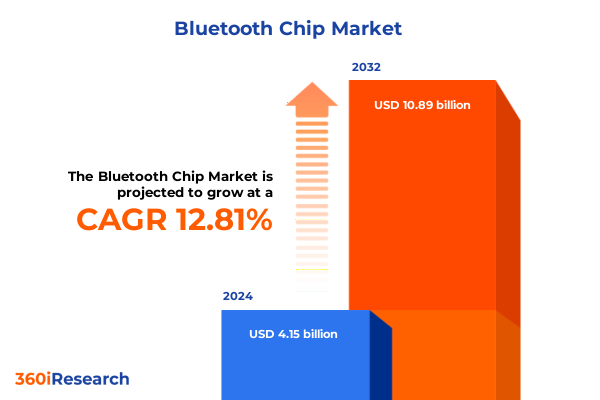

The Bluetooth Chip Market size was estimated at USD 4.69 billion in 2025 and expected to reach USD 5.23 billion in 2026, at a CAGR of 12.77% to reach USD 10.89 billion by 2032.

Understanding the Evolution and Strategic Significance of Bluetooth Chips Across Industry Verticals in Today’s Connected Ecosystem

The Bluetooth chip has undergone a remarkable transformation from its origins as a simple short-range radio module into a sophisticated integrated circuit that underpins the wireless connectivity of billions of devices. Early implementations prioritized basic data exchange and device pairing, but today’s solutions support complex audio streaming, precise location tracking, and robust mesh networking, all while balancing power efficiency. Innovations in protocol design and silicon process technology have played a crucial role in enabling this evolution. As of 2025, dual-mode Bluetooth chipsets-combining Classic and Low Energy functionality-remain the standard in platform devices such as smartphones, tablets, and laptops, accounting for approximately 60 percent of unit shipments globally. At the same time, single-mode Bluetooth Low Energy chips have emerged as a dynamic growth segment, reflecting a sustained compound annual growth rate of more than 20 percent over the past five years, driven by expanding IoT use cases.

Against this backdrop, Bluetooth chips now serve as foundational enablers in diverse industry verticals. From wearable health monitors to industrial automation sensors, the ability to maintain reliable connections with minimal power draw has unlocked new possibilities in healthcare, manufacturing, and smart infrastructure. Automotive applications have evolved beyond infotainment to encompass advanced safety systems and telematics, while smart home devices leverage Bluetooth Low Energy for responsive control and secure access. As connectivity demands escalate in volume and complexity, the strategic importance of Bluetooth chip technology continues to grow, compelling businesses to closely monitor technological advancements, interoperability standards, and ecosystem partnerships that will shape the next generation of connected experiences.

How Emerging Wireless Protocols and Advancements in Bluetooth Technology Are Redefining Connectivity and Use Cases in Key Markets

A confluence of technological breakthroughs in wireless protocols and chip design is reshaping the Bluetooth landscape, driving both performance gains and novel applications. One of the most significant advancements is Bluetooth Low Energy Audio, which delivers high-quality sound at lower power consumption and supports multi-device streaming. Despite its promise, broader ecosystem support remains a hurdle; while Windows 11 and Android 13 have embraced LE Audio, full adoption across major operating systems is still in progress, prompting chipset vendors to maintain dual-mode solutions that ensure backward compatibility during this transitional phase.

Moreover, the introduction of Bluetooth Channel Sounding in the Core Specification marks a major leap forward in device intelligence, enabling accurate distance estimation between radios. This feature promises to enhance user experiences in applications ranging from precise "find my" tracking to secure digital key systems, and it opens new opportunities for proximity-based industrial controls and automated safety interlocks. Early demonstrations of Channel Sounding on production hardware have underscored its potential to drive innovation in both consumer and enterprise settings, setting the stage for widespread adoption as silicon vendors integrate the capability into next-generation chipsets.

Simultaneously, the IoT ecosystem is witnessing a shift toward unified connectivity frameworks. The emergence of protocols like Matter and Thread threatens to reduce reliance on standalone Bluetooth radios in smart home devices, yet Bluetooth’s ubiquity and flexibility remain vital. Leading standards bodies are collaborating to embed Thread radios in home routers to streamline device onboarding, even as Bluetooth continues to deliver low-latency, low-power links for health and wellness devices that transmit periodic, small data packets. These collective efforts reflect a broader industry pivot toward seamless interoperability, where Bluetooth chipmakers play an instrumental role in bridging protocols and ensuring reliable connectivity across varied use cases.

Evaluating the Comprehensive Repercussions of 2025 United States Tariffs on Bluetooth Chip Supply Chains, Costs, and Market Dynamics

In 2025, the United States government moved to impose broad tariffs on semiconductor products, creating significant ripple effects across the Bluetooth chip supply chain and beyond. Although raw, discrete semiconductor components were initially exempted, finished goods containing embedded chips-such as mobile devices, wearables, and automotive modules-became subject to a 25 percent levy. This policy has introduced substantial cost pressures for manufacturers, compelling them to reevaluate sourcing strategies and capitalize on tariff-free alternatives where possible.

Economic analyses project that a sustained 25 percent tariff could reduce U.S. gross domestic product growth by 0.18 percent in the first year and up to 0.76 percent by the tenth year, while also triggering an average annual loss in consumer living standards of roughly $122 per household. The Semiconductor Industry Association warns that these tariffs effectively act as a “tax on non-substitutable goods,” potentially increasing the final sale price of electronics by a factor of three times the incremental chip cost to maintain industry-standard profit margins. Furthermore, the Government Accountability Office has highlighted the risk of diminished U.S. technological leadership if downstream industries face chip shortages or inflated costs that slow product development and adoption in critical sectors like healthcare and defense.

Market reactions have been swift: shares of key chip suppliers such as Texas Instruments declined nearly 12 percent following a cautious profit outlook that cited tariff uncertainty as a primary headwind for analog and connectivity device shipments. Industry associations, including the Consumer Technology Association, have termed the policy move “Zombie Liberation Day,” reflecting widespread concern that the looming tariffs could deter investment, disrupt established multi-tier supply chains, and lead to production delays. As a result, companies are accelerating diversification efforts, exploring nearshoring to Canada and Mexico, and expanding domestic fabrication capacity under recently enacted incentives like the CHIPS and Science Act.

Dissecting Bluetooth Chip Market Segmentation Through Application, Technology, Range, and Component Lenses to Uncover Targeted Insights

Bluetooth chip market segmentation offers a multifaceted lens through which industry leaders can identify emerging opportunities and address evolving customer needs. When analyzed by application, the market spans five principal domains: automotive systems that include infotainment, safety electronics, and telematics; consumer electronics encompassing audio peripherals, computing devices, smartphones, tablets, and wearables; healthcare equipment such as diagnostic instruments, patient monitoring systems, and therapeutic devices; industrial solutions for asset tracking, automation equipment, and environmental monitoring; and smart home technologies covering automation controllers, security apparatus, and connected appliances. Each vertical imposes unique requirements on latency, power consumption, and integration complexity, which in turn influence chipset feature sets and roadmap priorities.

A second vantage point considers the underlying Bluetooth technology variants: Classic implementations divided into Basic Rate and Enhanced Data Rate profiles, dual-mode solutions that blend legacy support with Version 5.0 capabilities, and Low Energy configurations iterating through Versions 4.0, 4.2, and 5.0. The progression toward Bluetooth 5.x standards has prioritized extended range, higher throughput, and improved coexistence, providing new avenues for high-bandwidth audio applications and robust mesh networks.

Range-based classification further segments the landscape into Class 1, Class 2, and Class 3 devices, reflecting varying transmit power levels and maximum operational distances that inform use in outdoor asset tracking versus indoor personal area networks. Lastly, a component-centric perspective distinguishes between discrete integrated circuits and fully integrated system-on-chip offerings, the latter combining radio, controller, and application processor elements to streamline development cycles and reduce bill-of-materials costs. By synthesizing these interlocking segmentation frameworks, stakeholders can align product portfolios with target use cases, optimize feature sets, and tailor go-to-market strategies to specific market niches.

This comprehensive research report categorizes the Bluetooth Chip market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Range

- Component

- Application

Unveiling Regional Dynamics Shaping Bluetooth Chip Adoption, Production, and Innovation Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the production, adoption, and innovation trajectories of Bluetooth chip technology. In the Americas, advanced semiconductor fabrication capacity and sizable homegrown consumer electronics OEMs drive a robust demand for high-performance Bluetooth solutions. Domestic policy initiatives, including the CHIPS and Science Act, have incentivized the expansion of local silicon processing capabilities, which in turn reduces exposure to tariff-related cost fluctuations and shortens lead times for prototype and volume production.

Across Europe, the Middle East, and Africa, automotive and industrial automation serve as primary growth engines for Bluetooth chip utilization. European Tier 1 automotive suppliers have integrated low-latency Bluetooth links for vehicle diagnostics and cabin entertainment, while EMEA’s diverse regulatory environment has spurred the development of secure, GDPR-compliant device pairing and data encryption features. Simultaneously, Middle Eastern smart city initiatives leverage mesh-enabled Bluetooth networks for real-time monitoring of infrastructure assets, reflecting a growing appetite for distributed IoT architectures.

Asia-Pacific stands out as both the largest production hub and the fastest-growing consumption market for Bluetooth chips. China’s dominant position-accounting for nearly half of global BLE chip demand-reflects its extensive consumer electronics ecosystem and rapidly expanding industrial IoT adoption. Meanwhile, South Korea and Taiwan remain vital centers for advanced packaging, foundry services, and chipset design, supplying world-class components to OEMs worldwide. In combination, Asia-Pacific’s scale, manufacturing agility, and innovation clusters continue to exert an outsized influence on the global Bluetooth technology roadmap.

This comprehensive research report examines key regions that drive the evolution of the Bluetooth Chip market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Bluetooth Chip Manufacturers and Innovators Driving Technological Breakthroughs and Competitive Differentiation

A cohort of established semiconductor leaders and emerging specialists competes fiercely in the Bluetooth chip arena. Nordic Semiconductor, recognized for its low-power SoC innovations, consistently secures a position among the top three vendors, collectively holding over 36 percent of the BLE chip segment. The company’s focus on versatile development kits and robust software stacks has accelerated product launches in wearables, smart lighting, and healthcare niches.

Texas Instruments has similarly leveraged its analog and mixed-signal expertise to address the automotive, industrial, and consumer electronics sectors. Despite recent stock fluctuations tied to tariff concerns, TI’s investments in U.S. manufacturing capacity underscore its commitment to supply chain resilience and tailored chip customization for high-reliability applications.

Broadcom and Qualcomm dominate the dual-mode chipset market, embedding both Classic and Low Energy protocols into flagship mobile platforms. Industry data indicates that virtually 100 percent of new smartphones, tablets, and laptops support dual-mode Bluetooth, highlighting the critical role these suppliers play in maintaining seamless interoperability across billions of connected devices.

Other noteworthy participants include NXP Semiconductors and STMicroelectronics, whose automotive-grade Bluetooth controllers integrate advanced security frameworks and functional safety features. Meanwhile, Realtek and Silicon Labs cater to high-volume consumer segments with cost-effective modules, and Infineon contributes specialized chips for secure element integration and medical device certifications. This competitive landscape continues to drive downward pricing pressure while elevating feature innovation, as each vendor strives to differentiate through performance, power optimization, and ecosystem support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bluetooth Chip market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actions Semiconductor Co Ltd

- Apple Inc

- Beken Corporation

- Bestechnic Shanghai Co Ltd

- Broadcom Inc

- Dialog Semiconductor Plc

- Infineon Technologies AG

- Intel Corporation

- MediaTek Inc

- Microchip Technology Inc

- Murata Manufacturing Co Ltd

- Nordic Semiconductor ASA

- NXP Semiconductors N.V.

- Panasonic Corporation

- Qualcomm Incorporated

- Realtek Semiconductor Corp

- Renesas Electronics Corporation

- Samsung Semiconductor Inc

- Silicon Laboratories Inc

- Skyworks Solutions Inc

- STMicroelectronics N.V.

- Telink Semiconductor

- Texas Instruments Incorporated

- Toshiba Corporation

- Zhuhai Jieli Technology Co Ltd

Implementing Strategic Initiatives to Navigate Technological Shifts, Supply Chain Disruptions, and Tariff Challenges in the Bluetooth Chip Sector

Industry leaders must adopt a multi-pronged strategy to capitalize on technological shifts and mitigate supply chain disruptions. Prioritizing silicon platforms with built-in support for emerging Bluetooth features-such as Low Energy Audio and Channel Sounding-will provide a competitive edge, enabling rapid deployment of next-generation products. At the same time, forging strategic partnerships with standards bodies and software vendors can streamline certification processes and ensure compatibility across diverse operating environments.

To navigate tariff uncertainties, organizations should diversify sourcing by establishing nearshore and onshore relationships with foundries and assembly houses. Implementing dual-sourcing agreements and validating alternative HTS classifications for product components can also reduce the risk of sudden cost escalations. Concurrently, investing in domestic capacity through joint ventures or technology licensing agreements aligns with government incentives and fosters supply chain agility.

Finally, embedding market intelligence into product roadmaps is essential. Continuous monitoring of end-market trends-such as the integration of Matter in smart homes or the rise of wireless medical monitoring-enables companies to allocate R&D resources effectively. By maintaining a flexible product architecture and leveraging modular hardware designs, chipmakers and OEMs can respond to evolving customer requirements without incurring prohibitive redesign costs.

Employing Rigorous Research Methodologies Integrating Primary Insights and Secondary Data to Ensure Robust Bluetooth Chip Market Analysis

Our research methodology integrates extensive secondary data collection with targeted primary interviews to deliver a comprehensive perspective on the Bluetooth chip market. The secondary phase involved scrutinizing publicly available sources, including industry reports, corporate filings, regulatory publications, and technology white papers, to establish foundational insights into market structure, technological standards, and competitive dynamics.

Subsequently, we conducted in-depth interviews with more than twenty senior executives and technical experts from chipset vendors, OEMs, and trade associations. These conversations provided qualitative context around strategic priorities, R&D roadmaps, and supply chain strategies, enabling us to validate and enrich the secondary research findings.

Data triangulation techniques were applied to reconcile quantitative metrics-such as shipment trends and patent filings-with qualitative inputs, ensuring that our conclusions reflect both empirical evidence and real-world industry perspectives. Finally, all insights were peer-reviewed by an advisory panel comprising former Bluetooth SIG contributors and seasoned semiconductor analysts to maintain the highest standards of accuracy and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bluetooth Chip market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bluetooth Chip Market, by Technology

- Bluetooth Chip Market, by Range

- Bluetooth Chip Market, by Component

- Bluetooth Chip Market, by Application

- Bluetooth Chip Market, by Region

- Bluetooth Chip Market, by Group

- Bluetooth Chip Market, by Country

- United States Bluetooth Chip Market

- China Bluetooth Chip Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings to Illuminate the Future Trajectory and Strategic Priorities in the Bluetooth Chip Industry

The analysis presented herein underscores the transformative journey of Bluetooth chip technology and highlights the complex interplay of innovation, market segmentation, regional dynamics, and policy influences that define the current landscape. Advances in Bluetooth Low Energy Audio, distance-aware features, and mesh networking are expanding the realm of possibility for connected devices, while tariff pressures and supply chain realignments inject fresh challenges that require agile strategic responses.

Segmentation frameworks reveal distinct growth pockets across automotive, consumer electronics, healthcare, industrial, and smart home use cases, each demanding tailored silicon solutions and certification pathways. Regional insights illustrate how government incentives, manufacturing ecosystems, and end-market appetites shape regional priorities, from domestic fabrication initiatives in the Americas to industrial automation in EMEA and high-volume adoption in Asia-Pacific.

Against this backdrop, leading chipmakers and emerging specialists must continuously innovate, diversify supply chains, and align product roadmaps with evolving connectivity standards. By embracing a holistic, data-driven approach-grounded in rigorous research and cross-functional collaboration-industry stakeholders can navigate uncertainty, seize emerging opportunities, and chart a sustainable growth trajectory in the dynamic Bluetooth chip market.

Engage with Ketan Rohom to Unlock Comprehensive Bluetooth Chip Market Intelligence and Accelerate Informed Decision-Making

We invite decision-makers seeking in-depth insights to engage with Ketan Rohom, whose expertise in market analysis and industry trends can guide your strategic investment in Bluetooth chip technology. Ketan’s deep understanding of wireless connectivity dynamics ensures that your organization will gain tailored intelligence aligned with your business objectives. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to explore how this comprehensive report can support your product development, partnership negotiations, and competitive positioning.

- How big is the Bluetooth Chip Market?

- What is the Bluetooth Chip Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?