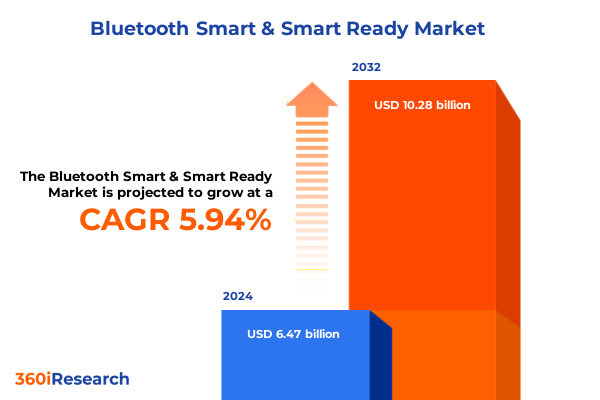

The Bluetooth Smart & Smart Ready Market size was estimated at USD 6.86 billion in 2025 and expected to reach USD 7.28 billion in 2026, at a CAGR of 8.66% to reach USD 12.28 billion by 2032.

Understanding the Evolution and Significance of Bluetooth Smart and Smart Ready Technologies in Modern Connected Ecosystems

The evolution of Bluetooth Smart and Smart Ready technology has reshaped how devices communicate in our increasingly connected world. From its early roots as a wireless alternative to cables, Bluetooth has matured into an indispensable protocol underpinning a vast array of consumer, industrial, and automotive applications. Today’s Smart Ready devices not only discover and connect to sensors and wearables but also serve as gateways to expansive Internet of Things deployments, bridging the gap between low-power endpoints and cloud-based analytics platforms. As connectivity demands intensify, the distinction between Smart and Smart Ready has become pivotal for developers and decision-makers striving to optimize power consumption without compromising on range, reliability, or interoperability.

In this context, our examination delves deeply into the latest iterations of Bluetooth Low Energy, the enduring relevance of Classic Bluetooth for audio and legacy systems, and the emergence of Dual Mode solutions that promise the best of both worlds. We explore the technical underpinnings-such as enhanced data throughput, extended packet lengths, and advanced channel selection algorithms-while also framing these advancements within strategic business considerations. By weaving together technological insights with real-world use cases, this introduction sets the stage for a thorough understanding of how Bluetooth Smart and Smart Ready are catalyzing a new wave of wireless innovation across industries.

Exploring the Key Technological Disruptions and Strategic Realignments Shaping the Bluetooth Connectivity Landscape Today

Recent years have witnessed transformative shifts in the Bluetooth connectivity landscape, driven by a convergence of technological breakthroughs and shifting market imperatives. With the rollout of Bluetooth 5.x versions, developers can leverage doubled data rates, quad-range capacity, and direction-finding capabilities that unlock novel use cases in asset tracking, indoor navigation, and secure access control. These enhancements have amplified the appeal of Bluetooth in scenarios once reserved for more complex wireless standards, enabling device makers to build lightweight, battery-efficient sensors while delivering robust performance.

Concurrently, the proliferation of edge computing and AI-enabled devices has redefined expectations for latency and data integrity. Enterprises are now integrating Bluetooth endpoints directly with edge processors, enabling real-time analytics, predictive maintenance, and adaptive user experiences without the need for constant cloud connectivity. Meanwhile, the automotive sector has embraced Bluetooth for in-vehicle infotainment, telematics, and emerging vehicle-to-vehicle communication, spurring new requirements around electromagnetic compatibility and cybersecurity. As a result, Bluetooth Smart and Smart Ready solutions are no longer siloed innovations but foundational elements of complex, multi-layered ecosystems that demand cohesive hardware-software co-design and rigorous validation protocols.

Examining the Cumulative Consequences of 2025 United States Tariff Policies on Bluetooth Device Supply Chains and End Market Dynamics

Since early 2025, the United States has implemented a series of tariff measures targeting imported wireless communication components and finished electronics that have had a profound cumulative impact on Bluetooth Smart and Smart Ready supply chains. A combination of increased duties on semiconductor chips, RF modules, and integrated circuits has compelled manufacturers to reassess production footprints and seek alternative sourcing strategies. Instead of relying solely on traditional offshore suppliers, many technology firms have accelerated near-shoring initiatives, establishing assembly lines in Mexico and Southeast Asia to mitigate cost pressures and reduce lead times.

In parallel, component vendors have responded by diversifying their product portfolios to include domestically produced or tariff-exempt alternatives, while contract manufacturers have increased buffer inventories to hedge against unpredictable duty fluctuations. These strategic shifts have not only affected bill-of-materials cost structures but have also influenced product launch timelines and the cadence of firmware updates. As a result, organizations that embraced early supplier diversification and modular design frameworks have gained a competitive edge, while those reliant on rigid, single-source models have encountered production bottlenecks and margin erosion.

Uncovering Critical End Use, Technology, Component, and Application Segmentation Patterns Driving Strategic Decision Making in Bluetooth Markets

A nuanced understanding of segmentation yields actionable insights for stakeholders across the Bluetooth Smart and Smart Ready market. By end-use industry, automotive applications-such as in-vehicle infotainment systems, telematics units, and emerging vehicle-to-vehicle communication modules-remain prime drivers of adoption, reflecting automakers’ emphasis on seamless, low-latency connectivity within increasingly digital cockpits. In parallel, consumer electronics segments, spanning gaming peripherals, personal computers, smart home hubs, smartphones, tablets, and a variety of wearables, demand standards that balance interoperability and power efficiency to support vibrant ecosystem play.

Turning to healthcare, fitness trackers, advanced medical imaging equipment, and continuous patient monitoring devices illustrate how Bluetooth enables both patient engagement and clinical data acquisition, necessitating stringent security and compliance measures. In industrial automation, Bluetooth-based asset tracking, sensor networks for predictive maintenance, and smart metering solutions are expanding operational visibility, driving productivity gains and cost reductions. From a technology perspective, Bluetooth Low Energy-particularly versions 4.x and 5-dominates new deployments, while Classic Bluetooth maintains relevance in audio-centric applications and legacy support. Dual Mode offerings allow developers to target diverse user experiences by blending ultra-low-power signaling with robust audio streaming capabilities.

Component segmentation further refines strategic planning: chip vendors are increasingly offering single-chip systems alongside multi-chip solutions to cater to space-constrained devices; module manufacturers differentiate with fully certified and pre-certified options to accelerate time to market; and software tool providers integrate advanced stack features and development frameworks to reduce integration complexity. Finally, application segmentation-ranging from automotive audio, conferencing systems, headphones and earbuds, speakers, to beacon implementations in healthcare, hospitality, retail, transportation, home energy management, HVAC and lighting control, security systems, inventory tracking, supply chain management, demand response, and smart metering-highlights the breadth of Bluetooth’s versatility across end-use scenarios.

This comprehensive research report categorizes the Bluetooth Smart & Smart Ready market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- End Use Industry

- Application

Assessing How the Americas, EMEA, and Asia-Pacific Regions Are Shaping the Global Bluetooth Ecosystem with Region-Differentiated Adoption Pathways

Regional dynamics shape Bluetooth adoption in ways that reflect unique commercial, regulatory, and infrastructural conditions. In the Americas, a robust ecosystem of chipset manufacturers, module providers, and system integrators has fostered rapid deployment of Bluetooth solutions across automotive telematics, consumer wearable devices, and industrial automation. Recent policy initiatives supporting domestic semiconductor production have reinforced supply chain resilience, while a culture of venture-backed innovation continues to spur disruptive applications in smart cities and connected retail.

Across EMEA, stringent wireless regulation and harmonized spectrum allocations underpin consistent product certification processes, enabling cross-border interoperability. European manufacturers are placing growing emphasis on environmental sustainability and circular economy principles, integrating Bluetooth into energy-saving HVAC systems, building security platforms, and healthcare monitoring tools. Meanwhile, the Middle Eastern and African markets are witnessing accelerated urbanization projects and digital transformation programs that rely on Bluetooth-enabled infrastructure for asset tracking, transport logistics, and consumer engagement.

In the Asia-Pacific region, dynamic manufacturing hubs in China, Taiwan, South Korea, and Southeast Asia maintain their status as global supply chain anchors while driving local consumption of Bluetooth Smart Ready devices. Government incentives for Industry 4.0 adoption have energized smart factory deployments, and high smartphone penetration rates facilitate rapid uptake of home automation, audio accessories, and wearable healthcare devices. Collectively, these regional strengths underscore why global players must tailor product roadmaps and partner ecosystems to each market’s regulatory frameworks, end-user preferences, and technological maturity.

This comprehensive research report examines key regions that drive the evolution of the Bluetooth Smart & Smart Ready market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Approaches and Innovation Drivers of Leading Firms Reinforcing Their Positions in the Bluetooth Smart and Smart Ready Market Sphere

Leading companies in the Bluetooth Smart and Smart Ready arena are deploying differentiated strategies to secure long-term growth. Semiconductor innovators are integrating advanced radio and microcontroller functionalities onto single die solutions, reducing power consumption and footprint for next-generation wearable and IoT devices. Module specialists are combining hardware certification with embedded firmware updates, offering customers turnkey solutions that streamline regulatory compliance and shorten development cycles. Software vendors, meanwhile, are expanding their protocol stacks with security enhancements, mesh networking capabilities, and cloud connectivity interfaces to support scalable IoT architectures.

Strategic partnerships are also shaping the competitive landscape. Chip manufacturers are collaborating with platform providers to optimize radio performance in constrained environments and co-developing reference designs that expedite integration into consumer electronics and industrial equipment. Similarly, alliances between automotive OEMs and Bluetooth solution vendors have accelerated the rollout of in-vehicle connectivity modules that meet rigorous safety and reliability standards. In the healthcare domain, cross-industry consortia are working to harmonize data encryption frameworks, helping to ensure that patient monitoring and medical device applications comply with evolving privacy regulations.

Moreover, bespoke innovation centers and co-creation labs established by leading firms are fostering deeper engagement with ecosystem partners. By offering joint testing facilities, interoperability events, and developer outreach programs, these companies reinforce their market leadership while incubating the next wave of Bluetooth-based applications. Such initiatives highlight a shared recognition: In an ecosystem characterized by rapid standard evolution and diverse end-use requirements, strategic collaboration and differentiated technical roadmaps are essential to driving sustainable advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bluetooth Smart & Smart Ready market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Broadcom Inc.

- Infineon Technologies AG

- Intel Corporation

- MediaTek Inc.

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Corporation

- Vention Electronic Technology Group Co., LTD

Empowering Decision Makers with Targeted Strategies to Navigate Emerging Bluetooth Connectivity Challenges and Seize Growth Opportunities

To thrive amid intensifying competition and evolving technical standards, industry leaders should prioritize a series of targeted strategies. First, investing in advanced Bluetooth Low Energy features-such as enhanced attribute protocol (EATT), LE Audio support, and channel selection algorithms-will position product portfolios to meet emerging demands for high-fidelity audio and precision location services. Concurrently, organizations must embed security by design, employing robust encryption, secure key management, and continuous vulnerability testing to uphold data integrity across healthcare, industrial, and consumer applications.

Next, companies should cultivate agile supply chain frameworks that adapt to tariff fluctuations and component shortages. Establishing multi-tiered sourcing agreements, nurturing relationships with domestic and international contract manufacturers, and leveraging modular design concepts will bolster resilience and shorten time to market. At the same time, forging strategic alliances with cloud and edge computing platforms can unlock integrated solutions that combine local data processing with scalable analytics, reinforcing value propositions in smart cities, manufacturing, and connected vehicle deployments.

Finally, executive teams must champion cross-functional innovation cultures that bridge hardware, firmware, and software domains. By integrating user experience research, regulatory compliance expertise, and longstanding standardization bodies’ input into the product development cycle, organizations can accelerate proof-of-concept iterations and reduce adoption barriers. This holistic approach ensures that Bluetooth Smart and Smart Ready solutions not only deliver technical performance but also align with customer expectations, regulatory mandates, and evolving industry ecosystems.

Detailing the Rigorous Research Techniques and Data Validation Protocols Underpinning the Comprehensive Analysis of Bluetooth Smart and Smart Ready Markets

Our research approach combines rigorous primary outreach with comprehensive secondary analysis to ensure both depth and accuracy. Initially, in-depth interviews were conducted with key stakeholders across chipset vendors, module manufacturers, software providers, and end-use system integrators. These conversations provided real-world perspectives on technology adoption, design challenges, and strategic priorities. Simultaneously, a structured survey captured quantitative insights on deployment timelines, preferred feature sets, and anticipated barriers across multiple industry verticals.

On the secondary front, an extensive review of technical specifications, white papers, regulatory filings, and patent databases underpinned our understanding of the evolving Bluetooth standards landscape. We triangulated these findings with publicly available product roadmaps, company disclosures, and industry consortium publications to validate feature adoption rates and strategic partnerships. A dedicated data validation protocol cross-checked inputs from primary interviews against documented performance benchmarks and certification records, ensuring consistency and eliminating outliers.

Finally, all synthesized insights underwent rigorous peer review by a panel of wireless connectivity experts and industry veterans. This iterative process refined our analysis, highlighted emerging undercurrents, and identified potential blind spots. By blending qualitative expertise with quantitative rigor and robust validation steps, our methodology delivers a comprehensive, unbiased perspective on the Bluetooth Smart and Smart Ready ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bluetooth Smart & Smart Ready market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bluetooth Smart & Smart Ready Market, by Technology

- Bluetooth Smart & Smart Ready Market, by Component

- Bluetooth Smart & Smart Ready Market, by End Use Industry

- Bluetooth Smart & Smart Ready Market, by Application

- Bluetooth Smart & Smart Ready Market, by Region

- Bluetooth Smart & Smart Ready Market, by Group

- Bluetooth Smart & Smart Ready Market, by Country

- United States Bluetooth Smart & Smart Ready Market

- China Bluetooth Smart & Smart Ready Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Key Insights to Illuminate the Future Trajectory and Strategic Imperatives of Bluetooth Connectivity Technologies

In synthesizing the myriad insights from technological advancements, policy developments, segmentation analyses, and regional dynamics, a clear strategic imperative emerges: organizations must adopt a multifaceted approach to harness the full potential of Bluetooth Smart and Smart Ready technologies. Embracing cutting-edge protocol enhancements, while simultaneously reinforcing security and supply chain resilience, will differentiate market leaders from fast-followers. Additionally, tailoring solutions to the nuanced requirements of automotive, consumer electronics, healthcare, and industrial automation verticals ensures that offerings remain relevant and value-driven.

Regional strategies must also reflect local regulatory landscapes and ecosystem maturity, whether cultivating partnerships in the Americas’ innovation clusters, navigating EMEA’s harmonized certification processes, or aligning with Industry 4.0 initiatives across the Asia-Pacific manufacturing belt. Collaborative models-spanning chipset alliances, co-creation labs, and consortium-led interoperability events-will further accelerate time to market and foster shared innovation.

Ultimately, the future trajectory of Bluetooth connectivity rests on the ability of industry stakeholders to integrate forward-looking roadmaps with agile operational frameworks. By leveraging the insights presented throughout this analysis, decision-makers can chart a clear path forward, optimize resource allocation, and confidently navigate the evolving landscape of wireless communication.

Connect with Ketan Rohom to Access the Definitive Bluetooth Smart and Smart Ready Market Research Report and Drive Your Strategic Decisions Forward

To explore how Bluetooth Smart and Smart Ready innovations can elevate your product strategy and competitive positioning, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He brings a deep understanding of connectivity trends, technical nuances, and business insights to guide you through the complexities of Bluetooth integration. By leveraging his expertise, you can secure tailored advice on selecting the right technology, optimizing development timelines, and navigating regulatory considerations to keep your initiatives on track.

Engaging with Ketan offers you a strategic partnership that extends beyond a simple transaction. He will walk you through the key findings from our comprehensive analysis, highlighting areas where you can gain a first-mover advantage, anticipate supply chain shifts, and capitalize on emerging application segments. His guidance is designed to accelerate your innovation cycle, reduce integration risks, and foster stronger relationships with chipset vendors, module manufacturers, and software platform providers.

Whether you are seeking in-depth technical briefings, custom benchmarking, or hands-on workshops for your product teams, Ketan is poised to provide the support you need. Reach out today to arrange a consultation and secure immediate access to the full market research report. With his assistance, you can transform insights into actionable strategies and position your organization for lasting success in the rapidly evolving Bluetooth Smart and Smart Ready ecosystem.

- How big is the Bluetooth Smart & Smart Ready Market?

- What is the Bluetooth Smart & Smart Ready Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?