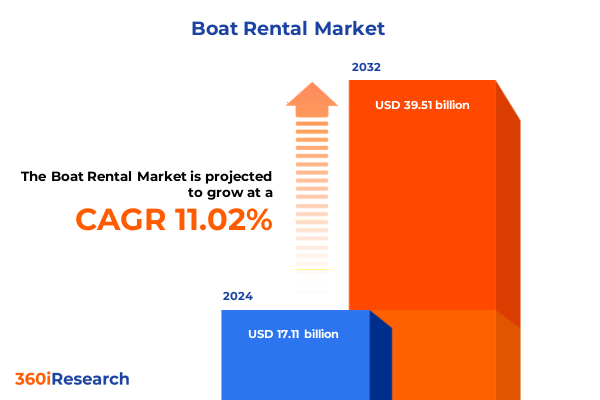

The Boat Rental Market size was estimated at USD 18.98 billion in 2025 and expected to reach USD 21.06 billion in 2026, at a CAGR of 11.04% to reach USD 39.51 billion by 2032.

Navigating the Changing Tides of Boat Rental: An Informed Introduction to Industry Dynamics, Consumer Shifts, and Emerging Opportunities

The boat rental industry has entered a period of unprecedented change, driven by evolving consumer behaviors, technological advancements, and shifting economic conditions. Beginning with a broad examination of market drivers and end-user preferences, this introduction sets the stage for understanding how operators can navigate emerging challenges and capitalize on growth prospects. Developments in on-demand digital platforms have already redefined how customers discover, compare, and book vessels, while sustainability imperatives and enhanced safety regulations are reshaping operational practices.

Furthermore, consumer expectations have diversified substantially, with a rising emphasis on personalized experiences that range from intimate leisure outings to grand corporate events. At the same time, market participants face pressure from cost fluctuations tied to regulatory interventions, including the latest tariff measures. Against this backdrop, the value of granular segmentation, regional differentiation, and competitive benchmarking becomes clear. This foundational overview highlights the necessity of an integrated approach that balances technological innovation, operational excellence, and strategic agility. As you progress through this executive summary, each section will build upon this contextual framework, equipping you with critical insights to inform data-driven decision-making and sustained marketplace relevance.

Examining the Revolutionary Transformations in Boat Rental Technology, Consumer Preferences, Sustainability Efforts, and Regulatory Framework

The boat rental landscape is undergoing a series of transformative shifts that are rewriting traditional business paradigms. Technology-led disruption has proliferated across the value chain, from AI-based dynamic pricing engines to immersive virtual tours that allow potential renters to preview vessels remotely before committing. Moreover, the integration of IoT sensors and telematics solutions is enabling real-time tracking of vessel performance, predictive maintenance alerts, and enhanced safety oversight-key differentiators in a competitive marketplace.

In parallel, consumer preferences are evolving beyond simple functionality toward experiential richness and sustainability. A growing segment of renters seeks eco-friendly options such as electric or hybrid boats, prompting operators to invest in green propulsion systems and carbon-offset programs. Regulatory frameworks are also becoming more stringent, with enhanced safety certifications and environmental compliance requirements influencing both fleet composition and operational protocols.

Consequently, incumbent operators and new entrants alike must adapt their business models to embrace these shifts. Strategic partnerships with technology providers, investments in sustainable assets, and proactive compliance initiatives are essential to stay ahead of regulatory developments. Furthermore, the rise of peer-to-peer rental platforms is reshaping supply-side dynamics by democratizing vessel ownership and access. As these revolutionary transformations continue to unfold, the imperative for agility and innovation has never been more pronounced.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Boat Imports, Supply Chains, Operational Costs, and Market Adaptation

The implementation of new United States tariffs in 2025 has introduced both challenges and strategic inflection points for boat rental operators. By targeting imported marine vessels and related equipment, these measures have elevated landed costs across a broad spectrum of assets, especially those manufactured overseas. As a result, operators with heavy reliance on imported yachts and motor boats have encountered margin pressures, while those with domestically produced fleets have experienced relative cost advantages.

In addition, the ripple effects of increased tariffs on raw materials such as aluminum, stainless steel, and composite components have manifested in higher maintenance and refurbishment expenses. Consequently, service providers are re-evaluating maintenance schedules and sourcing strategies to mitigate the impact, with many exploring localized supply partners or in-house repair capabilities to maintain cost efficiency. New procurement frameworks are also emerging, as operators negotiate longer-term contracts with domestic suppliers to hedge against further tariff volatility.

Furthermore, these tariff adjustments have accelerated supply chain diversification efforts. Forward-thinking companies are forging relationships with alternative manufacturing hubs and investing in modular fleet designs that can be adapted or upgraded more easily. While short-term cost pressures remain, the strategic reorientation triggered by 2025 tariffs is laying the groundwork for a more resilient and geographically balanced supply chain over the medium term. This cumulative impact underscores the importance of proactive tariff management and flexible operational planning.

Unveiling Critical Segmentation Perspectives Across Rental Type, Boat Classifications, Booking Channels, User Profiles, Durations, and Pricing Strategies

Understanding the nuances of the boat rental market requires a multifaceted segmentation approach that illuminates distinct customer needs and operational imperatives. Based on rental type, the industry bifurcates into exclusive charters that cater to private or high-end clientele seeking bespoke experiences, and shared arrangements where cost-sharing and social interaction create value. This segmentation underscores how pricing strategies and service packages must align with the level of personalization demanded by each cohort.

Delving deeper into vessel categories, the market is studied across motor boats, sailboats, and yachts. The motor boat segment is further analyzed through the lens of inboard and outboard engine configurations, each presenting unique performance, maintenance, and fuel cost considerations. By distinguishing between motor propulsion systems, operators can tailor maintenance schedules and pricing models that reflect operational complexity and fuel efficiency expectations.

Booking modes introduce another layer of differentiation, as the market is split between offline channels-such as direct marina reservations and travel agencies-and online platforms. Within the digital sphere, the customer journey unfolds through mobile apps and websites, each offering tailored user interfaces, loyalty programs, and integrated payment options designed to maximize convenience and conversion rates.

From an end-user perspective, the market is studied across corporate clients seeking brand-activating events, event organizers coordinating weddings or festivals, and leisure renters focused on recreational outings. This tripartite breakdown informs marketing messaging and ancillary service bundles. Furthermore, rental duration impacts utilization patterns, as daily, hourly, and weekly terms each generate distinct revenue streams and inventory turnover rates. Finally, pricing models vary by distance-based fees, packaged bundles that include add-ons, and purely time-based tariffs, allowing operators to optimize yield management and customer satisfaction simultaneously.

By weaving these segmentation lenses into strategic planning, decision-makers gain a holistic view of operational levers and market opportunities that transcend one-size-fits-all models.

This comprehensive research report categorizes the Boat Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Rental Type

- Boat Type

- Booking Mode

- Rental Duration

- End User

Decoding Key Regional Variations Shaping Boat Rental Demand and Service Innovations Across the Americas, EMEA, and Asia-Pacific Markets

Geographic diversity plays a pivotal role in shaping boat rental dynamics, as regional market characteristics reflect local regulatory requirements, consumer behaviors, and competitive landscapes. In the Americas, mature markets such as the United States and Canada benefit from sophisticated marina infrastructure and well-established leisure cultures, while emerging tourism hotspots in the Caribbean are witnessing rapid growth fueled by cruise-ship spillover and experiential travel trends. Consequently, operators across North and South America must balance premium service expectations with aggressive differentiation tactics to stand out in both mature and nascent segments.

Within Europe, Middle East, and Africa, the Mediterranean basin remains a perennial stronghold, driven by high-net-worth travelers and seasonal influxes. Regulatory variations across EU member states and Gulf Cooperation Council countries add complexity, particularly around environmental standards and harbor fees. Meanwhile, Africa’s coastal markets are in a nascent stage, presenting high-growth potential but requiring significant infrastructure investments and localized expertise.

In the Asia-Pacific region, the trajectory varies from highly regulated and technologically advanced hubs like Australia and Japan to rapidly developing markets across Southeast Asia. Consumer appetite for premium experiences is growing, with rising disposable incomes and domestic tourism initiatives driving demand. However, inconsistent regulatory frameworks and limited marina networks in emerging markets necessitate tailored entry strategies. By recognizing the distinct drivers and barriers in each geography, industry participants can calibrate fleet composition, service offerings, and marketing investments to align with local market realities.

This comprehensive research report examines key regions that drive the evolution of the Boat Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Boat Rental Companies: Strategic Positioning, Competitive Advantages, Technological Innovations, and Partnership Approaches

The competitive landscape in boat rental is characterized by a mix of global platforms, regional specialists, and boutique operators, each leveraging unique strategic assets to capture market share. Leading global platforms have harnessed network effects and brand recognition to deliver scale advantages, investing heavily in user experience enhancements and strategic partnerships with marinas worldwide. Their success hinges on the ability to aggregate extensive vessel inventories and offer seamless cross-border rental solutions.

Regional specialists, by contrast, differentiate through localized expertise, curated fleets that reflect regional sailing conditions, and deep relationships with coastal tourism boards. These operators excel at crafting destination-specific experiences and navigating regulatory intricacies that can be prohibitive for global entrants. Boutique operators focus on niche segments-such as luxury yacht charters or eco-conscious electric boat experiences-capitalizing on premium pricing and tailored service models.

Across the board, leading companies are deploying technology to optimize fleet utilization, implement dynamic pricing algorithms, and deliver personalized communications at scale. Strategic alliances with insurance providers, equipment suppliers, and waterfront venues enhance end-to-end customer journeys. Many are also piloting subscription-based models to secure recurring revenue streams and foster long-term customer loyalty. By analyzing these competitive strategies, industry participants can identify best practices and partnership prospects to bolster their own positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boat Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Boatsetter, Inc.

- Borrow A Boat Ltd

- Click&Boat SAS

- Dream Yacht Charter S.A.

- GetMyBoat, Inc.

- MarineMax, Inc.

- Nautal, S.L.

- SamBoat SAS

- Sunsail International Limited

- The Moorings Yacht Charter & Sales Ltd

- Yachtico Inc.

Delivering Strategic, Actionable Recommendations to Empower Industry Leaders in Adapting to Market Evolution and Enhancing Competitive Resilience

To thrive in a rapidly evolving market, industry leaders must act decisively to integrate cutting-edge technologies, strengthen ecosystem partnerships, and refine service offerings. Investing in robust digital platforms that seamlessly bridge mobile and web experiences will enhance customer acquisition and foster brand loyalty. Furthermore, incorporating AI-driven analytics into pricing strategies and customer engagement efforts will unlock deeper behavioral insights and maximize revenue potential.

Operators should also explore collaborative ventures with electric boat manufacturers and renewable energy providers to introduce sustainable fleet options that resonate with eco-conscious renters. Implementing modular maintenance frameworks and leveraging predictive telematics will reduce downtime and maintenance costs, ensuring vessels remain mission-ready during peak periods. Equally important is the cultivation of strategic alliances with marinas, hospitality brands, and event planners to create integrated end-to-end experiences that differentiate offerings beyond vessel rental alone.

From a geographical standpoint, tailoring market entry strategies to local regulations and cultural preferences will be essential. In mature Western markets, focus on value-added services and luxury segments, while in emerging economies, prioritize infrastructure partnerships and flexible pricing models. Finally, embedding continuous feedback mechanisms-such as post-rental surveys and loyalty incentives-will enable rapid iterations and sustained improvements. By executing these actionable recommendations, industry leaders can secure a competitive edge and drive long-term growth.

Detailing Rigorous Research Methodology Combining Primary Insights, Secondary Data, Quantitative Analysis, and Qualitative Validation Techniques

This research is underpinned by a rigorous methodology that combines both primary and secondary data sources to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with senior executives from leading rental platforms, marina operators, boat manufacturers, and regulatory bodies, complemented by structured surveys of end-users across key regions. These insights were triangulated with secondary research derived from industry publications, technical whitepapers, government trade and tariff databases, and financial filings of public companies.

Quantitative analysis encompassed the evaluation of historical fleet utilization patterns, booking channel performance metrics, and cost structures under varying tariff scenarios. Advanced statistical techniques were applied to discern correlations and project operational impacts of regulatory changes. Qualitative validation was achieved through expert panels and peer reviews, ensuring that findings reflect current industry sentiment and emerging best practices.

Geographic segmentation frameworks were developed by analyzing regional macroeconomic indicators, tourism flows, and maritime infrastructure capacities. Competitive profiling leveraged proprietary databases to assess market share drivers, partnership networks, and innovation pipelines. Finally, all data inputs and analytical models underwent multiple rounds of validation to guarantee accuracy and relevance, providing stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boat Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boat Rental Market, by Rental Type

- Boat Rental Market, by Boat Type

- Boat Rental Market, by Booking Mode

- Boat Rental Market, by Rental Duration

- Boat Rental Market, by End User

- Boat Rental Market, by Region

- Boat Rental Market, by Group

- Boat Rental Market, by Country

- United States Boat Rental Market

- China Boat Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Insights and Strategic Outlook to Guide Stakeholders in Maximizing Value Across the Transforming Boat Rental Landscape

This executive summary has unveiled the complex interplay of technological innovation, consumer evolution, tariff impacts, and competitive dynamics that define today’s boat rental industry. By dissecting critical segmentation lenses and decoding regional variations, it has illuminated pathways for tailored growth strategies and operational efficiency improvements. The cumulative impact of the 2025 United States tariffs underscores the necessity for agile supply chain reconfiguration and proactive cost management, while the spotlight on industry leaders reveals the potency of strategic partnerships and technology integration.

Collectively, these insights serve as a strategic compass, guiding stakeholders toward informed investment decisions and differentiated service offerings. As the industry continues to navigate volatile economic conditions and heightened sustainability imperatives, the ability to adapt swiftly and innovate boldly will distinguish market leaders from followers. By synthesizing these findings, decision-makers are equipped to chart a course that capitalizes on emerging opportunities and mitigates evolving risks, ensuring long-term viability in a dynamic global marketplace.

Seize the Opportunity to Access Exclusive Boat Rental Market Intelligence by Connecting with Ketan Rohom for the Full Comprehensive Report

Take decisive action today by engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing. His expertise offers an unparalleled gateway to the boat rental market’s richest intelligence and nuanced data. By securing this report, you will instantly enhance your strategic planning, identify untapped opportunities, and gain actionable tactics to outpace competitors. Reach out now to transform insights into high-impact strategies and position your organization for sustained growth in an evolving industry landscape.

- How big is the Boat Rental Market?

- What is the Boat Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?