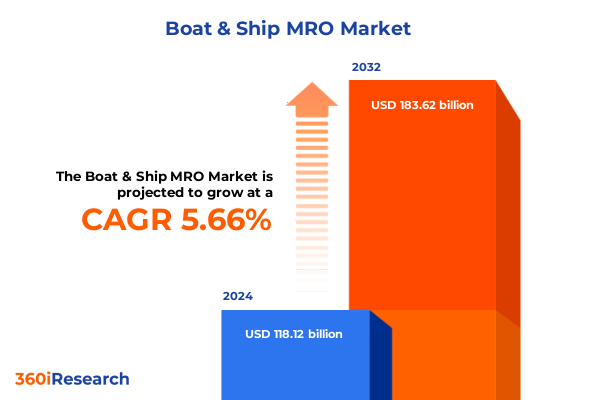

The Boat & Ship MRO Market size was estimated at USD 124.57 billion in 2025 and expected to reach USD 131.46 billion in 2026, at a CAGR of 5.69% to reach USD 183.62 billion by 2032.

A concise introduction that positions modern boat and ship MRO as a strategic imperative driven by safety, availability, and lifecycle optimization

The contemporary landscape for boat and ship maintenance, repair, and operations has shifted from routine upkeep to strategic asset management, driven by rising expectations for availability, safety, and regulatory compliance. Fleet operators now view MRO as a lever for competitive advantage rather than a purely transactional cost center. As a result, maintenance programs increasingly prioritize predictability of operations, lifecycle extension of critical components, and the integration of digital tools that provide situational awareness across distributed fleets.

This shift is accompanied by heightened stakeholder scrutiny-classification societies, port authorities, insurers, and flag states all demand demonstrable adherence to safety and environmental standards. Consequently, MRO strategies must reconcile short-term operational continuity with long-term capital stewardship. The introduction summarizes the core drivers reshaping MRO priorities, the intersection of technology and human expertise in maintenance execution, and the emergent expectations for agility in responding to supply chain disruptions, regulatory changes, and evolving vessel architectures.

An analysis of the transformative technological, workforce, regulatory, and supply chain shifts reshaping maintenance and repair strategies across maritime assets

The last five years have produced transformative shifts that are redefining how maintenance and repair services are conceived and delivered. Digitalization stands at the forefront: connected sensors, cloud-based analytics, and edge computing now enable continuous monitoring that transforms time-based maintenance into condition-based and predictive paradigms. This transition reduces unplanned downtime and redirects skilled labor toward higher-value diagnostic and repair tasks, while also demanding new capabilities in data governance, cybersecurity, and systems integration.

Concurrently, the workforce landscape has changed. Experienced technicians are aging out of the labor pool in many markets, prompting investments in training programs, augmented reality tools, and remote expert support to bridge skill gaps. Environmental imperatives are accelerating adoption of low-emission propulsion systems and novel materials, creating new MRO workflows and certification requirements. Finally, supply chain resilience has emerged as a strategic priority: redundant sourcing, nearshoring of critical spares, and digital visibility into supplier capacity are essential to maintain service levels. Together, these shifts compel owners, yards, and service providers to reconfigure operating models and partnerships to deliver faster, safer, and more sustainable maintenance outcomes.

A focused exploration of how cumulative tariff measures have reshaped procurement, supply networks, and maintenance decision-making in maritime MRO

Tariff actions enacted in recent years have introduced a layer of complexity that affects procurement, spare parts availability, and the economics of repair versus replace decisions. The cumulative effect to date alters sourcing strategies as operators reassess where to procure components and which repair activities to prioritize domestically versus internationally. Increased duties on certain categories of marine equipment have incentivized closer collaboration with local manufacturers and service providers to mitigate lead times and avoid tariff-related cost volatility.

Beyond immediate cost considerations, tariffs influence investment decisions in inventory policies and repair capacity. Organizations are responding by expanding in-situ maintenance capabilities to reduce reliance on overseas dry dock spells and by qualifying additional approved suppliers to maintain compliance while avoiding single-source risks. From a strategic perspective, tariff-driven changes underscore the importance of robust supplier performance management and contract flexibility, as well as scenario planning that integrates trade policy shifts into procurement and maintenance scheduling. This cumulative impact is prompting operators and service providers to redesign logistics networks and contractual frameworks to protect operational readiness and manage total cost of ownership under evolving trade conditions.

In-depth segmentation insights that connect service models, maintenance modalities, component specialization, and vessel classes to operational priorities and supply strategies

Segment-level dynamics reveal distinct operational priorities and service models across service type, maintenance type, component, and vessel categories. In terms of service type, organizations are moving beyond corrective maintenance toward predictive maintenance, leveraging condition monitoring, analytics, and condition-based interventions to preempt failures and optimize labor deployment. This creates demand for integrated diagnostic platforms and a shift in contracts toward outcome-based service agreements that reward reliability rather than transaction volume.

Maintenance type also dictates resource allocation: dry dock maintenance remains essential for hull fabrication, major structural repairs, and comprehensive system overhauls, while in-situ maintenance expands the range of tasks that can be performed without removing a vessel from service, reducing operational disruption. Component-level segmentation highlights differentiated technical competencies and supply challenges. Electrical systems encompass communication systems and navigation equipment that require rapid software updates, cybersecurity oversight, and certified calibration. Engine-related work covers diesel engines, electric propulsion, and gas turbine engines, each with unique tooling, diagnostics, and spares ecosystems. Hull work centers on fabrication and structural repair, which necessitate skilled welders, non-destructive testing capabilities, and dry dock planning.

Vessel-type segmentation further nuances market behavior: commercial vessels-which include bulk carriers, container ships, and tankers-prioritize turnaround time, predictable availability, and standardized component supply chains. Leisure boats-encompassing fishing boats, sailboats, and yachts-demand bespoke service, rapid access to specialized parts, and high-touch customer experience. Military vessels require heightened security, classified spares handling, and lifecycle support under strict regulatory frameworks. Understanding these segment distinctions allows operators and suppliers to design targeted service offerings, align inventory strategies with failure modes, and invest in the specific skills and certifications required by each segment.

This comprehensive research report categorizes the Boat & Ship MRO market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Maintenance Type

- Component

- Maintenance Strategy

- Vessel Type

- Service Provider

- End User

Key regional insights that illuminate how labor pools, regulatory rigor, infrastructure, and trade patterns shape MRO strategies across all major maritime regions

Regional dynamics shape both capacity and service delivery approaches across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting different regulatory, labor, and infrastructure profiles that influence MRO planning. In the Americas, fleet diversity and port infrastructure drive demand for scalable in-situ services and flexible dry dock capacity, while regulatory regimes emphasize safety and emissions compliance that shape maintenance priorities. This region often balances domestic repair capability with reliance on international supply networks for specialized components.

Europe, Middle East & Africa presents a mosaic of markets where stringent environmental and safety standards in some jurisdictions accelerate adoption of advanced propulsion and emissions-control systems, thereby increasing demand for specialized diagnostic and retrofit services. At the same time, ports in this region serve as hubs for global logistics, enabling rapid movement of spare parts and repair materials. Asia-Pacific combines dense shipbuilding activity with expansive repair yards, creating competitive service markets that emphasize cost efficiency, high throughput dry dock operations, and rapid parts manufacturing. Labor availability, local supplier ecosystems, and regional trade policies further modulate how operators prioritize stocking, repair scheduling, and partnerships with local yards and OEM service networks across these regions.

This comprehensive research report examines key regions that drive the evolution of the Boat & Ship MRO market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company-level insights showing how OEMs, yards, and independent specialists compete and collaborate through digital services, partnerships, and specialized capabilities

Corporate strategies among leading equipment manufacturers, specialized service providers, and yard operators have converged on a few clear priorities: digital service platforms, partnerships for extended lifecycle support, and vertical integration of critical spares. Major OEMs have invested in predictive analytics and remote monitoring capabilities to create recurring revenue streams from aftermarket services and to maintain tighter control over quality and certification. Service providers, in turn, are differentiating through fast-response teams, modular service packages, and training programs that certify technicians on proprietary systems.

At the same time, collaboration between yards, OEMs, and third-party logistics firms has increased to shorten lead times for critical repairs and to provide seamless handoffs for complex dry dock projects. Independent MRO specialists have found opportunity in niche services-such as advanced composites repair, hybrid propulsion retrofits, and cybersecurity for navigation systems-where technical barriers create premium pricing. Across the ecosystem, the competitive advantage lies in combining deep technical competence with digital capabilities to deliver transparent, auditable maintenance outcomes and measurable reliability improvements for fleet operators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boat & Ship MRO market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3GA Marine Ltd.

- ABB Ltd.

- Abu Dhabi Ship Building Pjsc

- Atlas Marine Shipping LLC

- Austal Ltd.

- Babcock International Group PLC

- BAE Systems PLC

- Bender CCP, Inc.

- Bollinger Shipyards LLC

- Chantier Naval de Marseille

- Chantiers de l'Atlantique

- China Shipbuilding Trading Co., Ltd.

- COSCO Shipping Heavy Industry Co., Ltd.

- Damen Shipyards Group

- Dynatron Services Pvt. Ltd.

- Everllence

- Fincantieri S.p.A.

- General Dynamics Corporation

- Goltens

- HD Hyundai Heavy Industries Co., Ltd.

- HPI, LLC

- Huntington Ingalls Industries, Inc.

- Hydrex NV

- International Maritime Industries

- Keppel Offshore & Marine

- Kongsberg Gruppen ASA

- Larsen & Toubro Limited

- Lockheed Martin Corporation

- Lürssen Werft GmbH & Co. KG

- Mitsubishi Heavy Industries, Ltd.

- Mitsui E&S Co., Ltd.

- NAVANTIA, S.A.

- Neptune Marine Services Private Limited

- Rhoads Industries Inc.

- Saab AB

- Seaspan Group of Companies

- Singapore Technologies Engineering Ltd.

- Subsea Global Solutions

- Sumitomo Heavy Industries, Ltd.

- Wärtsilä Corporation

- Zamakona Yards Canarias, S.L.

Actionable recommendations for industry leaders to strengthen resilience, elevate technician capability, and align procurement with long-term reliability goals

Industry leaders should treat maintenance strategy as an integral component of fleet competitiveness and allocate capital toward initiatives that deliver measurable improvements in uptime, safety, and cost efficiency. First, prioritize investments in condition monitoring and analytics platforms that integrate across propulsion, electrical, and hull systems to enable predictive maintenance and to optimize spare parts inventory. Coupled with this, develop workforce programs that blend hands-on apprenticeship, remote expert support, and augmented reality tooling to accelerate technician proficiency and reduce dependency on scarce specialists.

Second, redesign supplier and logistics arrangements for resilience to trade disruptions. This includes qualifying multiple suppliers for critical components, negotiating flexible contracts that accommodate tariff variability, and exploring nearshore manufacturing options for high-priority spares. Third, standardize inspection, certification, and repair documentation through digital records to improve audit readiness and to streamline interactions with classification societies and regulatory bodies. Lastly, pursue collaborative partnerships between OEMs, yards, and service providers that align incentives for reliability and lifecycle performance, enabling outcome-based contracts that share risk and reward while ensuring long-term access to technical expertise.

A transparent research methodology combining expert interviews, regulatory analysis, technical validation, and scenario-based triangulation to ensure actionable insights

The research underpinning these insights combined primary engagement with industry practitioners and secondary analysis of technical standards, regulatory developments, and publicly available operational data. Primary methods included structured interviews with fleet operators, yard managers, OEM service leads, and procurement specialists to capture real-world constraints and decision criteria. These qualitative inputs were triangulated with secondary sources such as classification guidance, regulatory updates, and technical white papers to validate observed trends and to contextualize region-specific regulatory influences.

Analytical approaches emphasized scenario analysis rather than projection, focusing on mapping the operational consequences of technology adoption, tariff changes, and supply chain reconfiguration. Segmentation logic aligned service offerings, maintenance modalities, components, and vessel categories to ensure recommendations are actionable at the program level. Throughout the process, findings were stress-tested with domain experts to verify technical plausibility and to refine practical recommendations for implementation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boat & Ship MRO market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boat & Ship MRO Market, by Service Type

- Boat & Ship MRO Market, by Maintenance Type

- Boat & Ship MRO Market, by Component

- Boat & Ship MRO Market, by Maintenance Strategy

- Boat & Ship MRO Market, by Vessel Type

- Boat & Ship MRO Market, by Service Provider

- Boat & Ship MRO Market, by End User

- Boat & Ship MRO Market, by Region

- Boat & Ship MRO Market, by Group

- Boat & Ship MRO Market, by Country

- United States Boat & Ship MRO Market

- China Boat & Ship MRO Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

A concise conclusion that emphasizes strategic alignment, digital adoption, and workforce development as the pillars of resilient maritime maintenance

In summary, the boat and ship MRO environment is in the midst of a structural transition driven by digital capabilities, workforce evolution, environmental mandates, and shifting trade dynamics. Operators that embrace condition-based and predictive maintenance models, invest in workforce enablement, and redesign supply and logistics arrangements for resilience will sustain higher operational availability and reduce lifecycle risk. Service providers that pair technical specialization with digital delivery platforms will capture a growing share of aftermarket value by offering auditable, outcome-oriented services.

Looking forward, the most successful organizations will be those that make strategic, cross-functional investments-aligning procurement, engineering, and operations-while maintaining agility to respond to regulatory and trade policy shifts. By focusing on interoperability, workforce development, and supplier diversification, stakeholders can navigate the complexity of modern MRO and secure both immediate operational improvements and durable performance advantages.

A decisive purchasing path that connects senior leaders to tailored briefings, licensing options, and expedited delivery coordinated by the sales lead

For decision-makers ready to convert insight into action, engaging directly with our sales lead will fast-track access to the full market research report, tailored briefings, and enterprise licensing options. Ketan Rohom, Associate Director, Sales & Marketing, can coordinate a customized demonstration that highlights the sections most relevant to procurement, fleet operations, and strategic planning, and can outline available deliverables such as executive summaries, technical appendices, and regional deep dives.

To initiate a purchase or to request a tailored briefing, prospective buyers should outline their primary areas of interest-whether that is technology adoption pathways, tariff impact scenarios, or component-level service strategies-and Ketan Rohom will arrange next steps including a capability presentation, proposal of licensing terms, and expedited delivery timelines for executive teams. This direct engagement ensures buyers receive precisely the insights, templates, and strategic recommendations required to integrate findings into capital planning, supplier negotiations, and maintenance program redesigns.

Engage now to secure immediate access to authoritative analysis and practical roadmaps that support resilient operations and cost-efficient maintenance strategies across commercial, leisure, and defense fleets. Reach out to schedule a briefing and finalize purchase details with Ketan Rohom, Associate Director, Sales & Marketing, who will ensure an efficient onboarding process and answer any questions about report scope, customization, or ancillary advisory services.

- How big is the Boat & Ship MRO Market?

- What is the Boat & Ship MRO Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?