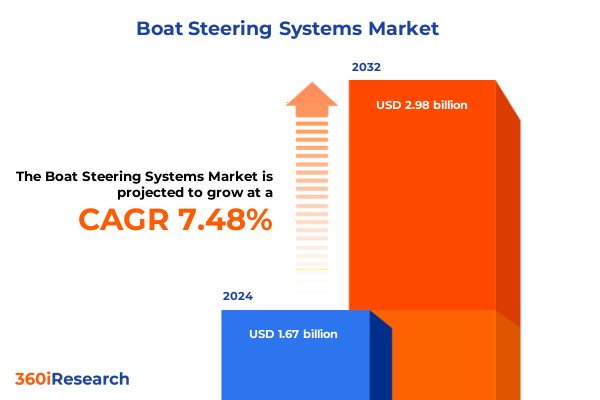

The Boat Steering Systems Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 1.92 billion in 2026, at a CAGR of 7.55% to reach USD 2.98 billion by 2032.

Navigating the Waters of Innovation and Safety: An In-Depth Exploration of Contemporary Boat Steering Systems Shaping the Maritime Industry’s Future

The maritime industry is experiencing a pivotal evolution, with boat steering systems at the heart of advancements in vessel performance, safety, and operator experience. Modern steering mechanisms now extend far beyond traditional tiller or wheel configurations, incorporating digital controls, smart interfaces, and integrated sensor networks that enhance real-time navigation precision. As vessels traverse increasingly crowded and regulated waterways, operators demand systems that respond instantly, reduce fatigue, and seamlessly interface with broader vessel management platforms. This report illuminates the critical role that steering technology plays in optimizing fuel efficiency, enhancing maneuverability in confined environments, and mitigating safety risks associated with mechanical failure or human error.

Transitioning from legacy architectures to advanced steering solutions requires a clear understanding of technological drivers, regulatory mandates, and market forces that shape investment decisions. Our approach delves into the evolutionary trends shaping steering mechanisms, from the emergence of electric actuation to the integration of predictive maintenance analytics. By examining the interplay between innovation and market adoption, this introduction sets the stage for a holistic analysis of segmentation dynamics, regional variations, and competitive strategies. Stakeholders across the value chain-spanning OEMs, component suppliers, system integrators, and end-users-will gain a comprehensive foundation for navigating the complex landscape of modern marine steerage.

Charting Oceanic Evolution: Identifying Key Technological, Regulatory, and Market Shifts Disrupting Steerage Mechanisms in Modern Vessels

Over the past decade, boat steering systems have undergone transformative shifts driven by rapid technological advancement and evolving operator requirements. Digitalization has ushered in the era of smart interfaces, enabling wireless connectivity, touchscreen controls, and remote diagnostics that redefine human-machine interactions on deck. Concurrently, the rise of electric actuation has challenged the dominance of hydraulic mechanisms, offering quieter operation, reduced maintenance cycles, and improved energy efficiency. These technological inflections are complemented by increasing demand for autonomy, where rudimentary autopilot and route optimization algorithms lay the groundwork for fully unmanned maritime missions.

Regulatory frameworks and customer expectations are also contributing to landscape shifts. Emission standards for marine engines and noise regulations in protected waters necessitate steering solutions that minimize hydraulic leaks and acoustic disturbances. Meanwhile, operators in commercial, recreational, and defense sectors are seeking modular designs that support rapid retrofits and future upgrades without extensive refitting. The convergence of these factors has prompted OEMs and system integrators to adopt agile development methodologies, emphasizing iterative prototyping and co-development partnerships with end-users to accelerate time-to-market and ensure compliance across jurisdictions.

Analyzing the Comprehensive Impact of 2025 United States Tariffs on Component Costs, Supply Chains, and Competitive Dynamics in Boat Steering Systems

In 2025, the United States implemented a new tranche of tariffs on imported maritime hardware, impacting key steering system components such as cylinders, cables, and helm assemblies. These measures, aimed at protecting domestic manufacturing, have led to a tangible uptick in landed costs for hydraulic pumps and precision-machined steering gears sourced from international suppliers. The immediate aftermath saw OEMs reassessing vendor agreements and passing incremental cost increases through to end-users, particularly in aftermarket channels where price sensitivity remains acute.

Beyond direct cost implications, the tariff regime has catalyzed broader supply chain realignment. Leading integrators have expedited near-shoring initiatives, expanding partnerships with North American foundries and machining centers to mitigate exposure to tariff volatility. This strategic pivot has enhanced lead-time predictability but introduced new challenges around capacity constraints and capital expenditure in domestic facilities. In parallel, smaller retrofit specialists and independent distributors have explored alternative sourcing from low-tariff regions within Asia-Pacific, balancing savings against added logistical complexity. Collectively, these adjustments underscore the multifaceted impact of the 2025 U.S. tariffs, shaping both short-term procurement tactics and long-term manufacturing footprints within the boat steering ecosystem.

Unveiling Critical Segmentation Perspectives Across Types, Components, Technologies, Vessel Classes, Control Methods, and End-Use Applications in Maritime Steerage Markets

The boat steering systems market exhibits nuanced behavior across multiple segmentation lenses, revealing opportunities for targeted strategy and product differentiation. Within the type dimension, electric steering systems are rapidly gaining acceptance in recreational and small commercial vessels due to their plug-and-play installation and seamless integration with digital bridge consoles. Hydraulic systems continue to dominate larger craft and industrial applications, valued for their robust force multiplication and familiar maintenance protocols. Meanwhile, mechanical steering remains prevalent in nimble watercraft, with rack-and-pinion setups offering direct feedback and rotary systems prized for compact installations.

Evaluation by component exposes distinct performance and cost trade-offs. Steering cables serve as the simplest and most economical solution for manual control in smaller vessels, whereas advanced steering helms and precision-machined cylinders underpin hydraulic configurations in larger yachts and patrol boats. Pumps with variable displacement functionality are increasingly specified to optimize power draw under fluctuating load conditions, and ergonomic steering wheels featuring integrated throttle and joystick controls enhance operator comfort and situational awareness.

Assessing technological segmentation, manual systems still anchor entry-level and price-sensitive applications, providing proven reliability with minimal electronic dependency. In contrast, smart interfaces that incorporate touchscreen navigation overlays, haptic feedback, and predictive maintenance alerts are carving out a premium niche among forward-looking fleet operators. Steering control type further differentiates user experience: tiller systems retain loyalty among traditionalists and small-craft enthusiasts, while wheel steering asserts itself as the standard for larger vessels demanding finer input resolution and multi-axis integration.

Boat size segmentation underscores that craft under 16 feet favor lightweight mechanical or electric tug-and-go setups for ease of trailering. Mid-sized vessels spanning 16 to 40 feet represent the largest addressable segment, with diverse steering requirements spanning all system types and installation modalities. In the 40 to 65 foot class, hydraulic and hybrid-electric solutions prevail, supporting heavier loads and integrated bridge systems. Yacht and commercial fleets place a premium on aftermarket versus OEM installation flexibility, making original equipment manufacturers’ modular retrofit kits a competitive differentiator. Finally, application segmentation reveals that recreational vessels drive innovative interface development, military and research vessels adopt fail-safe redundancy protocols, and commercial fleets prioritize total cost of ownership through durable component selection.

This comprehensive research report categorizes the Boat Steering Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Technology

- Steering Control Type

- Boat Size

- Boat Type

- Installation Type

- Application

Delineating Strategic Regional Dynamics and Growth Drivers in Boat Steering Systems Across Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics for boat steering systems diverge significantly across the Americas, EMEA, and Asia-Pacific, each shaped by distinct operational requirements and regulatory landscapes. In the Americas, strong leisure boating cultures and well-developed inland waterways underpin robust demand for electric and mechanical steering solutions across recreational craft. OEM dealers leverage established distribution networks to bundle digital upgrades with engine offerings, while aftermarket providers cater to retrofit opportunities in aging coastal fleets. Additionally, government incentives for domestic manufacturing have stimulated investment in local pump and helm assembly capacities.

Within Europe, Middle East & Africa, stringent environmental directives and noise ordinances drive adoption of leak-free hydraulic actuation and low-emission electric systems. Vessel certification processes demand comprehensive compliance testing, pushing manufacturers to collaborate with regional conformity assessment bodies. Recreational yachting hubs in the Mediterranean accelerate uptake of smart bridge consoles integrated with steering controls, while defense procurement in the Gulf region favors redundant hydraulic steering systems with proven battlefield reliability. Africa, in contrast, exhibits growing interest in cost-effective mechanical and manual systems to support expanding offshore wind and research vessel fleets.

The Asia-Pacific region represents a dynamic amalgamation of high-growth shipbuilding corridors and emerging recreational boating markets. Nations with mature marine manufacturing bases, such as Japan and South Korea, continue to refine hydraulic and integrated steering systems for large commercial vessels. Meanwhile, Southeast Asian markets display rising preference for affordable electric steering kits in smaller fishing boats and passenger ferries. China’s rapidly expanding yacht market is beginning to embrace premium smart interface solutions, supported by local tech startups that customize user experiences for domestic consumers.

This comprehensive research report examines key regions that drive the evolution of the Boat Steering Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Pioneering Strategic Alliances, Technological Integrations, and Business Models Driving Leading Boat Steering System Suppliers

Leading companies in the boat steering systems space are advancing differentiated strategies to capture emerging opportunities and defend core market positions. Major OEMs have pursued targeted acquisitions of electronic interface providers to enhance their product portfolios, integrating proprietary touchscreen navigation overlays directly into helm units. These alliances accelerate time-to-market for next-generation smart steering platforms and capitalize on growing demand for turnkey solutions among high-end yacht builders.

Concurrently, specialized component manufacturers are expanding their global footprints through joint ventures in key shipbuilding hubs. By establishing regional fabrication and calibration centers, they reduce lead times and localize after-sales support, a critical factor in markets with stringent service-level requirements. Investments in additive manufacturing for custom cylinder and pump components have enabled rapid prototyping of bespoke designs, positioning these firms as agile partners for both military and research vessel projects.

Innovative entrants focusing on software-driven steering algorithms and predictive maintenance have attracted strategic funding from maritime investors. Their modular control modules, which can be retrofitted onto existing mechanical or hydraulic systems, offer incremental upgrade paths that appeal to budget-conscious operators. Moreover, partnerships between system integrators and telematics providers are forging new service models, bundling subscription-based monitoring services with traditional hardware sales to create recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boat Steering Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- China Deyuan Marine Fitting Company Limited

- CMP Group Ltd.

- Custom Hydraulic Components, Inc.

- Damen Marine Components

- Dometic Group AB

- Excel Controlinkage Private Limited by Greaves Cotton Limited

- Garmin Ltd.

- Honda Motor Co., Ltd.

- HyDrive Engineering Pty Ltd.

- Hypro Marine

- Jastram Engineering Ltd.

- JEFA STEERING A/S by BSI A/S

- Kawasaki Heavy Industries, Ltd.

- Kobelt Manufacturing Co. Ltd.

- Latham Marine Inc.

- Lecomble & Schmitt by Artzainak Industrial Group

- Lippert Components, Inc.

- Mac N Hom Marine Equipments (P) Ltd.

- Marathon Leisure, Ltd.

- Mercury Marine by Brunswick Corporation

- MJR Corporations

- Multisteer

- Parikh Power

- Parvalux Electric Motors by maxon Group

- Sleipner Group

- Sperry Marine B.V. by Northrop Grumman Corporation

- Suzuki Motor Corporation

- Techno Italia Kft.

- Twin Disc, Incorporated

- Ultraflex S.p.A.

- Yamaha Motor Co., Ltd.

- Yanmar Marine International B.V.

- ZF Friedrichshafen AG

Implementing Strategic Initiatives to Advance Modular Innovations, Supply Chain Resilience, and Value-Added Services in Marine Steering Solutions

Industry leaders should prioritize the development of modular, smart steering ecosystems that accommodate rapid retrofits and future technology upgrades. By decoupling hardware from interface layers and adopting open-architecture software frameworks, manufacturers can reduce time-to-market for new features and create scalable product lines that address both entry-level and premium segments. Early engagement with end-users in prototyping phases will ensure that solutions align with real-world operational demands and regulatory requirements.

To mitigate tariff-driven cost volatility, companies must diversify their supplier base across multiple geographies and invest in strategic near-shoring initiatives. Establishing flexible manufacturing cells in regions with favorable trade agreements reduces exposure to abrupt policy changes, while fostering stronger collaborative ties with regional partners accelerates joint innovation. Additionally, implementing dynamic pricing models that reflect component cost fluctuations can help preserve margins without compromising competitive positioning.

Finally, service innovation will become a defining differentiator for market share gains. Operators increasingly value end-to-end solutions that incorporate predictive maintenance analytics, digital training modules, and subscription-based performance monitoring. By offering tiered service packages-ranging from basic warranty coverage to fully managed fleet-wide monitoring-suppliers can generate recurring revenue and foster deeper customer relationships, enhancing lifetime value and brand loyalty.

Outlining Rigorous Multi-Stage Research Methodology Incorporating Secondary Data, Expert Interviews, and Triangulation for Robust Market Analysis

This analysis draws on a rigorous, multi-stage research approach designed to ensure comprehensive coverage and analytical integrity. The secondary research phase involved an extensive review of industry publications, technical whitepapers, maritime regulations, and patent filings to map the evolution of steering system technologies and regulatory shifts. Proprietary databases and manufacturer datasheets were examined to verify component specifications, material trends, and integration capabilities across the competitive landscape.

In parallel, primary research included in-depth interviews with over fifty stakeholders, encompassing vessel OEMs, component suppliers, system integrators, and end-operators spanning commercial, recreational, military, and research segments. These dialogues provided firsthand insights into procurement criteria, performance expectations, and regional market nuances. Data triangulation was achieved by cross-referencing quantitative shipment data with qualitative feedback from subject-matter experts, ensuring that conclusions reflect both market realities and future growth catalysts.

Analytical methodologies employed include value chain mapping, SWOT analysis for key segments, and scenario planning to evaluate tariff impacts and technology adoption rates. Geographic and segmentation break-downs were validated through regional case studies and supplier capability assessments. Throughout the process, a stringent data validation protocol was maintained, incorporating peer reviews and expert panel consultations to confirm objectivity and reliability of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boat Steering Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boat Steering Systems Market, by Type

- Boat Steering Systems Market, by Component

- Boat Steering Systems Market, by Technology

- Boat Steering Systems Market, by Steering Control Type

- Boat Steering Systems Market, by Boat Size

- Boat Steering Systems Market, by Boat Type

- Boat Steering Systems Market, by Installation Type

- Boat Steering Systems Market, by Application

- Boat Steering Systems Market, by Region

- Boat Steering Systems Market, by Group

- Boat Steering Systems Market, by Country

- United States Boat Steering Systems Market

- China Boat Steering Systems Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Summarizing Core Trends, Strategic Imperatives, and Competitive Landscapes Shaping the Evolution of Boat Steering Systems in a Rapidly Changing Maritime Sector

The dynamic boat steering systems landscape is defined by the convergence of electrification, digitalization, and regulatory imperatives shaping maritime operations worldwide. As operators demand smarter, more efficient, and safer steering solutions, suppliers and integrators must navigate an increasingly complex matrix of technology choices, cost pressures, and regional regulations. Understanding the intricate interplay of segment-specific requirements-from high-precision hydraulic systems in naval vessels to compact electric steering kits in recreational craft-is essential for effective product development and market positioning.

Looking ahead, the imperative for modularization and service-based offerings will intensify, driven by the need for agile technology adoption and lifecycle revenue generation. Companies that proactively diversify supply chains and cultivate collaborative innovation ecosystems will secure competitive advantage, while those reliant on legacy architectures risk obsolescence in the face of tariff volatility and rising customer expectations. By synthesizing segmentation insights, regional dynamics, and competitor strategies, this analysis equips decision-makers with the strategic perspective required to steer confidently through the next wave of maritime industry transformation.

Secure Your Definitive Boat Steering Systems Insights with a Personalized Consultation to Drive Strategic Growth Across Maritime Operations

To secure a comprehensive understanding of the Boat Steering Systems market and gain tailored insights for your strategic planning, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By partnering directly, you will receive a personalized briefing that addresses your organization’s unique challenges and priorities, ensuring that the data and analysis provided align precisely with your operational objectives and decision-making timeframes.

Engaging with Ketan Rohom not only grants you early access to the full market research report but also offers the opportunity to discuss bespoke add-on services such as custom forecasting scenarios, deep-dive workshops, and executive presentations. He can guide you through licensing options, volume discounts, and corporate site-wide access agreements that maximize your return on investment. Take the next step toward informed leadership in the maritime industry by contacting Ketan today to obtain your copy of the definitive Boat Steering Systems market report and empower your organization to navigate upcoming market shifts with confidence and clarity.

- How big is the Boat Steering Systems Market?

- What is the Boat Steering Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?