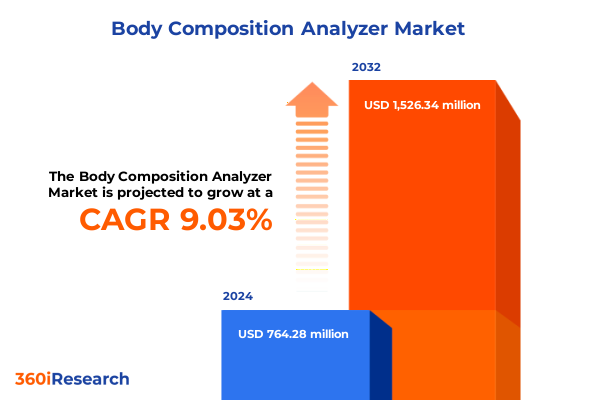

The Body Composition Analyzer Market size was estimated at USD 829.48 million in 2025 and expected to reach USD 901.73 million in 2026, at a CAGR of 9.10% to reach USD 1,526.34 million by 2032.

Unveiling the Rising Significance and Evolving Applications of Body Composition Analysis Across Healthcare and Fitness Domains to Empower Personalized Wellness Strategies

Body composition analysis has evolved from a clinical curiosity into a foundational pillar for precision health management and performance optimization. Modern analyzers leverage advances in bioelectrical impedance, dual-energy X-ray absorptiometry, and air displacement plethysmography to deliver rapid, noninvasive metrics that inform everything from nutritional plans to clinical diagnostics. As consumers and healthcare professionals increasingly demand personalized data, the ability to accurately partition fat, lean mass, and bone density has become indispensable for monitoring chronic disease risk, guiding rehabilitation, and maximizing athletic performance.

Against this backdrop, the market for body composition analyzers is being propelled by rising global health concerns including obesity, diabetes, and cardiovascular disease. Technological democratization has ushered in a wave of portable and smartphone-compatible devices, enabling at-home assessments that were once confined to research labs. Simultaneously, the emphasis on preventive care and wellness programs within corporate and sports settings reinforces the value of continuous body composition tracking. Consequently, stakeholders across healthcare, research, and fitness sectors are converging on solutions that deliver both clinical accuracy and user-centric convenience.

Embracing Technological Evolution and Data-Driven Innovations That Are Redefining the Body Composition Analysis Landscape Globally

In recent years, the body composition analyzer landscape has undergone transformative shifts driven by breakthroughs in sensor miniaturization, data analytics, and connectivity. For example, next-generation bioelectrical impedance devices now integrate multi-frequency assessments with machine learning algorithms to enhance accuracy across diverse populations. Moreover, smartphone-compatible analyzers leverage onboard processors and cloud platforms to deliver real-time insights directly through mobile applications, effectively turning everyone’s pocket into a personalized health monitoring station.

Furthermore, the proliferation of telehealth services and remote patient monitoring has elevated the importance of interoperable devices that conform to digital health standards. As a result, vendors are forging partnerships with electronic health record platforms and fitness ecosystems to embed body composition metrics into broader care pathways. These developments are complemented by regulatory agencies streamlining approvals for innovative measurement technologies, which in turn accelerates product launches and broadens market access.

Assessing How the United States’ 2025 Tariff Measures Are Shaping Supply Chains Pricing and Competitive Dynamics in Body Composition Devices

The United States government’s tariff adjustments implemented throughout 2025 have exerted a multifaceted impact on the body composition analyzer industry. Import duties introduced on select medical device components have driven raw material and subassembly costs upward, compelling manufacturers to reevaluate pricing strategies. Consequently, end-product prices have experienced incremental increases, influencing purchasing decisions within cost-sensitive segments such as fitness centers and home users.

Supply chain dynamics have also shifted, as companies navigate elevated lead times and logistical complexities. Some organizations have responded by near-shoring component production or forging alliances with domestic suppliers to mitigate exposure to import tariffs. Meanwhile, regional distributors are reassessing margin structures and expanding value-added services to preserve competitiveness. Looking ahead, market participants that invest in vertically integrated operations or strategic procurement alliances will be best positioned to absorb tariff-related cost pressures while maintaining customer loyalty.

Deriving Strategic Insights from End User Technology Type Distribution Channel and Application Segmentation to Guide Market Positioning Decisions

Insights drawn from end-user segmentation reveal that clinical environments and hospitals continue to rely on high-precision analyzers for diagnostic and therapeutic purposes, whereas fitness centers and home users are gravitating toward portable and smartphone-compatible models that emphasize convenience over absolute accuracy. Within technology segmentation, bioelectrical impedance analysis commands a large share of unit sales due to its affordability and ease of use, while dual-energy X-ray absorptiometry remains the gold standard for research institutions prioritizing bone mass and detailed tissue analysis. Air displacement plethysmography sustains a niche role for specialized applications that require comprehensive volume measurements.

Type segmentation further highlights rapid uptake of portable analyzers in consumer markets, driven by compact form factors and mobile integration, with standalone devices maintaining relevance in clinical settings that demand integrated software packages. Distribution channels illustrate a robust interplay between traditional offline networks, including medical device distributors and sporting goods specialists, and burgeoning online platforms that offer direct-to-consumer models with subscription-based software updates. Application segmentation underscores healthcare providers’ reliance on body composition tools for patient risk stratification, researchers’ utilization of high-precision systems for longitudinal studies, and sports and fitness professionals’ preference for devices that deliver actionable performance metrics in real time.

This comprehensive research report categorizes the Body Composition Analyzer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Analyzer Type

- Modality

- Measurement Type

- Parameter Measured

- Connectivity

- Distribution Channel

- Application

- End User

Comparing Regional Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia Pacific for Body Composition Solutions

Regional analysis demonstrates that the Americas account for the largest installed base of body composition analyzers, underpinned by substantial healthcare expenditure and widespread adoption within fitness franchises. Transitioning eastward, Europe, the Middle East, and Africa exhibit heterogeneous demand; Western European nations report high penetration rates driven by preventive health initiatives, whereas emerging Middle Eastern and African markets are witnessing incremental investments as public health infrastructure expands.

Asia-Pacific is emerging as the fastest-growing region, propelled by rising disposable incomes, increasing awareness of lifestyle-related diseases, and government programs promoting digital health. Moreover, local manufacturers in key markets are introducing cost-competitive models tailored to regional preferences, reinforcing adoption among home users and community clinics. As market leaders evaluate global expansion, it will be critical to adapt distribution strategies, comply with diverse regulatory frameworks, and localize device calibration algorithms to serve varied demographic profiles effectively.

This comprehensive research report examines key regions that drive the evolution of the Body Composition Analyzer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Participants’ Strategic Initiatives Partnerships and Product Innovations Driving Competitiveness in Body Composition Analytics

Leading participants in the body composition analyzer ecosystem are differentiating their offerings through a combination of technological innovation, strategic partnerships, and targeted acquisitions. Prominent medical device manufacturers are integrating advanced analytics modules and cloud-based reporting functionalities to meet the growing demand for comprehensive health insights. Simultaneously, specialized technology firms are collaborating with academic institutions to validate novel measurement methodologies, thereby strengthening their clinical credibility.

At the same time, consumer electronics players are exploring synergies with fitness platforms and wearable brands to embed body composition features within broader wellness ecosystems. These collaborations often include co-development agreements that accelerate time-to-market and enhance user engagement through seamless app interoperability. Furthermore, mergers and acquisitions continue to reshape the competitive landscape, as stakeholders seek to acquire niche capabilities in hardware miniaturization, artificial intelligence, and remote monitoring services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Body Composition Analyzer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&D Company, Limited

- AccuFitness, LLC

- ACCUNIQ by SELVAS Healthcare, Inc.

- AKERN SRL

- anovator

- Beurer GmbH

- BioTekna Limited.

- Biowave Healthcare

- Bodivis by Tongyong Tizhi Health Technology Co.,Ltd

- Bodystat Limited

- Charder Electronic Co. Ltd

- COSMED Srl

- GE Healthcare, Inc.

- Hologic, Inc.

- Hume Health LLC

- iHealth Labs Inc.

- ImpediMed Limited

- Inbody Co. Ltd.

- Jawon Medical Co., Ltd.

- Joicom Corporation d/b/a Renpho

- medisana GmbH

- Omron Corporation

- RJL Systems, Inc.

- Seca GmbH & Co. KG

- Shenzhen Sonka Medical Technology Co., Limited

- Tanita Corporation

- Terraillon S.A.

- Zimed Healthcare LLC

Proposing Actionable Strategic Recommendations to Enhance Market Reach Operational Resilience and Technological Leadership in Body Composition Devices

Industry leaders should prioritize investments in product portfolios that balance accuracy with mobility, ensuring that offerings resonate across clinical, research, and consumer markets. In parallel, diversifying procurement strategies by cultivating relationships with regional component manufacturers will buffer the impact of trade policy fluctuations. Organizations can also differentiate through the development of integrated digital platforms, which unite body composition data with broader health and fitness ecosystems to enhance user retention and generate recurring revenue streams.

Additionally, forging cross-industry alliances with fitness app developers, telemedicine providers, and academic research centers will accelerate innovation cycles and open new channels for market penetration. Tailoring go-to-market approaches by collaborating with distribution partners that possess deep local market expertise will further bolster adoption rates. Finally, structuring flexible pricing models and service bundles-such as leasing options or software-as-a-service offerings-will allow companies to address the diverse budgetary constraints of end users while fostering long-term engagements.

Explaining the Comprehensive Mixed Method Research Approach Leveraging Primary Interviews and Secondary Data Triangulation for Market Accuracy

This analysis employs a mixed-method research framework combining primary interviews, secondary data synthesis, and expert validation to ensure robust and credible insights. Primary research involved structured conversations with key opinion leaders spanning hospital administrators, fitness center operators, and home users, complemented by in-depth discussions with device manufacturers and distributors. Secondary research drew upon academic publications, public regulatory filings, and reputable health organization reports to contextualize technological developments and market trends.

Quantitative data were triangulated through multiple sources to mitigate bias and validate findings. Sales performance indicators, import/export statistics, and clinical adoption rates were cross-referenced with technology patent filings and end-user survey results. An expert panel comprising clinicians, biomechanical engineers, and market analysts reviewed preliminary conclusions to refine strategic interpretations and identify emerging opportunities. This comprehensive approach ensures that the conclusions and recommendations presented herein are grounded in empirical evidence and aligned with industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Body Composition Analyzer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Body Composition Analyzer Market, by Analyzer Type

- Body Composition Analyzer Market, by Modality

- Body Composition Analyzer Market, by Measurement Type

- Body Composition Analyzer Market, by Parameter Measured

- Body Composition Analyzer Market, by Connectivity

- Body Composition Analyzer Market, by Distribution Channel

- Body Composition Analyzer Market, by Application

- Body Composition Analyzer Market, by End User

- Body Composition Analyzer Market, by Region

- Body Composition Analyzer Market, by Group

- Body Composition Analyzer Market, by Country

- United States Body Composition Analyzer Market

- China Body Composition Analyzer Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Strategic Imperatives from the Executive Summary to Guide Future Investments in Body Composition Analysis

In summary, the body composition analyzer market is poised for continued expansion, driven by escalating health awareness, technological innovation, and evolving consumer expectations. Accurate segmentation analysis reveals distinct growth vectors among clinical, research, and consumer user groups, while regional dynamics highlight both mature and emerging markets. Companies that navigate tariff-induced cost pressures and capitalize on digital integration will secure competitive advantages.

Strategic imperatives include diversifying supply chains, embracing platform-based business models, and aligning product development with end-user needs across diverse applications. As the ecosystem continues to converge around data-driven health management, stakeholders equipped with actionable insights and a clear understanding of segmentation, regional nuances, and competitive dynamics will be best positioned to lead the next wave of innovation in body composition analysis.

Inviting Direct Engagement with Associate Director Ketan Rohom to Secure the Full Market Research Report and Unlock Growth Opportunities

To explore the detailed findings, proprietary data tables, and in-depth strategic frameworks that underpin this analysis, reach out directly to Associate Director, Sales & Marketing, Ketan Rohom. His expertise in guiding organizations through complex market dynamics ensures you receive tailored insights aligned to your strategic priorities. Engage today to access exclusive executive briefings, customizable slide decks, and consultation sessions that will empower your decision-making and accelerate your competitive positioning. Begin your journey to unlocking growth opportunities with a partner who understands the nuances of the body composition ecosystem and is committed to delivering actionable intelligence.

- How big is the Body Composition Analyzer Market?

- What is the Body Composition Analyzer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?