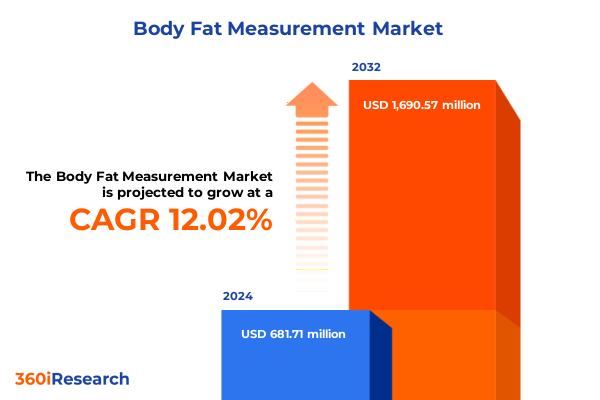

The Body Fat Measurement Market size was estimated at USD 763.87 million in 2025 and expected to reach USD 849.63 million in 2026, at a CAGR of 12.01% to reach USD 1,690.57 million by 2032.

Setting the Stage for Precision in Health Management with Advanced Body Composition Analysis Poised to Revolutionize Clinical and Consumer Practices

The global body fat measurement landscape has reached an inflection point as rising awareness of metabolic health and personalized wellness accelerates demand for precise evaluation tools. With obesity rates continuing to escalate worldwide, stakeholders across healthcare, fitness, and research sectors are recognizing that traditional weight scales offer limited actionable data. In response, advanced measurement modalities are gaining traction, driven by a collective desire to move beyond simple weight metrics toward deeper insights into body composition. This shift underscores the urgent need for integrated solutions that can deliver reliable assessments to support clinical diagnosis, athletic performance optimization, and at-home health management.

Amid this transformation, technological innovation has become the cornerstone of progress. Developments in imaging, sensor technology, and data analytics are converging to create instruments that offer unparalleled accuracy and convenience. The maturation of air displacement plethysmography titans alongside improvements in handheld bioelectrical impedance devices illustrates the diverse approaches reshaping the industry. Meanwhile, clinicians and researchers are increasingly adopting dual-energy X-ray absorptiometry for its gold-standard precision, while fitness enthusiasts embrace portable ultrasound and skinfold calipers for their affordability and ease of use.

This executive summary aims to present a cohesive overview of the key factors propelling market evolution, highlight the influence of recent policy and regulatory changes, and offer segmentation and regional insights. Drawing on primary research, expert interviews, and secondary data sources, this analysis will guide decision-makers in identifying growth opportunities and formulating strategies to capitalize on emerging trends.

Navigating Disruptive Forces Driving the Body Fat Measurement Market through Digital Transformation and Next Generation Analytical Technologies

Recent years have witnessed transformative shifts that are rewriting the rules of body fat measurement and composition analysis. The integration of digital health ecosystems has become a driving force, with connected devices streaming real-time biometric data into centralized platforms. This seamless data flow empowers healthcare providers to monitor patient progress remotely and allows individuals to track trends over time, reinforcing engagement and adherence to lifestyle interventions.

Simultaneously, artificial intelligence and machine learning algorithms are enhancing the interpretive power of raw measurement data. By analyzing patterns across large datasets, these technologies can predict risk factors, tailor personalized recommendations, and refine measurement accuracy. As a consequence, companies that successfully embed AI-driven insights in their devices are outpacing traditional manufacturers and cultivating new revenue streams through software subscriptions and value-added analytics.

Furthermore, the upswing in wearable technology adoption is blurring the lines between continuous monitoring and periodic assessment. Smart devices now integrate optical sensors and impedance measurement capabilities, offering users a holistic view of body composition alongside heart rate, activity levels, and sleep metrics. This convergence is redefining consumer expectations and pressuring established players to innovate rapidly or risk obsolescence.

Assessing the Cumulative Impact of Newly Implemented United States Tariffs in 2025 on the Global Supply Chain and Cost Dynamics for Measurement Devices

In 2025, the imposition of new United States tariffs on imported measurement devices has introduced both challenges and opportunities across the global supply chain. Equipment manufacturers relying on components sourced from overseas are encountering increased production costs, leading to price adjustments that reverberate throughout distribution and end-user pricing structures. These developments compel organizations to reevaluate sourcing strategies and explore near-shoring options to mitigate tariff implications.

At the same time, domestic producers are positioned to capture a larger share of the marketplace as imported alternatives become comparatively more expensive. This protective effect has spurred investment in local manufacturing capabilities, encouraging innovation hubs to refine production processes and scale output. However, increased costs may slow adoption rates among price-sensitive segments, particularly in home-use devices and mid-range fitness centers.

Regulatory bodies have signaled intent to review tariff schedules and consider exemptions for critical healthcare equipment, highlighting the strategic importance of ensuring continued access to high-precision measurement tools. Under this evolving policy environment, industry stakeholders must remain vigilant, engaging with policymakers to advocate for balanced trade measures that preserve affordability without undermining supply chain resilience.

Unveiling Crucial Insights from Diverse Segmentation Perspectives Including Product Modalities End Users Distribution Channels and Application Contexts

An in-depth examination of market segmentation reveals differentiated growth drivers and adoption patterns across product types, end users, distribution methods, and application contexts. Air displacement plethysmography remains a cornerstone in clinical and research settings, appreciated for its rigorous accuracy and noninvasive nature. This contrasts with the rising ubiquity of handheld bioelectrical impedance analysis devices, which appeal to consumers seeking quick at-home assessments without specialist supervision. Dual-energy X-ray absorptiometry continues to serve as the reference standard in hospital and academic research environments, while hydrostatic weighing, despite its logistical complexity, retains a niche following among elite sports institutions and university laboratories.

Turning to end-user categories, hospitals and clinical practices are prioritizing systems that integrate seamlessly into existing electronic health record infrastructures, whereas fitness centers show a preference for scalable, network-enabled devices that can accommodate high throughput and member engagement. Home users gravitate toward cost-effective solutions with intuitive interfaces, offering limited but practical insight into personal health metrics. Research institutes demand the highest precision and data export capabilities to support longitudinal studies and protocol-driven inquiry.

Distribution channels further illustrate market nuances. Brick-and-mortar channels, including dedicated fitness equipment stores and specialty medical outlets, maintain relevance for buyers requiring hands-on demonstrations and expert guidance. Meanwhile, online platforms have surged as indispensable routes for both direct-to-consumer and institutional procurement, driven by streamlined purchasing workflows and competitive pricing models. Offline retail outlets still cater to value-conscious buyers who prefer immediate access and tangible proofs of performance.

Finally, the application spectrum ranges from formal clinical diagnosis of metabolic disorders to general health and wellness monitoring, from controlled research protocols to performance tracking in sports and fitness. Each use case imposes distinct technical and regulatory requirements, underscoring the necessity for manufacturers to align product design and certification pathways with targeted application segments.

This comprehensive research report categorizes the Body Fat Measurement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

- End User

Examining Key Regional Dynamics Shaping Demand Growth in the Americas Europe Middle East Africa and Asia Pacific for Body Fat Analysis Solutions

Regional dynamics underscore how economic maturity, healthcare infrastructure, and consumer preferences shape the adoption of body fat measurement solutions. In the Americas, robust healthcare spending and proactive wellness culture drive strong uptake of premium systems in hospitals and specialized fitness centers. North American market growth is fueled by insurance reimbursement policies expanding coverage for body composition analysis, whereas Latin American markets benefit from public health initiatives targeting obesity management, even as price sensitivity tempers demand for high-end devices.

In Europe, Middle East, and Africa, regulatory harmonization within the European Union facilitates cross-border distribution of devices meeting CE certification standards, bolstering vendor confidence in expansion plans. Gulf Cooperation Council countries exhibit rising investment in fitness infrastructure, creating opportunities for portable and automated systems to enter these emerging market niches. Conversely, in parts of Africa, constrained healthcare budgets and limited technical expertise heighten demand for simplified, low-maintenance measurement equipment.

Asia-Pacific presents a dichotomy between developed markets like Japan and Australia, where advanced imaging and high-precision instrumentation are well-entrenched, and rapidly developing economies in Southeast Asia and India, where price-competitive handheld devices dominate. Public sector wellness campaigns in China and India are catalyzing large-scale deployment of community-level assessment programs, leveraging portable bioelectrical impedance devices to screen millions of individuals in preventive health drives. These diverse regional landscapes necessitate tailored go-to-market strategies that account for regulatory environments, channel preferences, and pricing expectations.

This comprehensive research report examines key regions that drive the evolution of the Body Fat Measurement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Market Movements from Global Manufacturers to Emerging Disruptors Redefining Standards in Body Composition Technology

The competitive arena features a blend of established multinational corporations, specialized device manufacturers, and agile startups driving innovation. Leading players have solidified positions through strategic partnerships with healthcare providers and fitness chains, offering integrated hardware-software ecosystems that deliver recurring revenue through subscription models. These companies are aggressively investing in R&D to enhance signal processing algorithms and miniaturize components, aiming to capture market share in both clinical and consumer domains.

Niche innovators are seizing opportunities by targeting underserved segments with disruptive pricing or novel measurement approaches. Collaborative ventures between technology firms and academic institutions have accelerated the development of portable ultrasound and wearable impedance sensors that promise lower cost of ownership and increased convenience. Meanwhile, traditional medical device companies are expanding their portfolios by acquiring smaller specialists to fill capability gaps and broaden distribution footprints.

Strategic alliances with digital health platforms have emerged as a key differentiator, as manufacturers integrate body composition data into telehealth services and wellness applications. By enabling frictionless data exchange and actionable insights, these collaborations enhance patient engagement and open new monetization pathways through data analytics services. Looking ahead, success will hinge on blending robust device performance with comprehensive digital experiences that resonate with both professional and end-user audiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Body Fat Measurement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AccuFitness LLC

- Apple Inc.

- Beurer GmbH

- Biospace Co., Ltd.

- Bodystat Ltd.

- Charder Electronic Co., Ltd.

- COSMED S.r.l.

- EchoMRI LLC

- FitTrack, Inc.

- Garmin Ltd.

- Hologic, Inc.

- InBody Co., Ltd.

- Jawon Medical Co., Ltd.

- LUXSCAN Technologies

- Marsden Weighing Machine Group Ltd.

- Omron Healthcare, Inc.

- RJL Systems, Inc.

- seca GmbH & Co. KG

- Siemens Healthineers AG

- Tanita Corporation

- Withings SA

Delivering Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities Enhance Competitive Positioning and Drive Sustainable Growth

To maintain momentum and capitalize on emerging trends, industry leaders should prioritize a multi-pronged strategy. First, intensify investment in R&D focused on enhancing measurement accuracy and reducing form factor size. Collaborative research partnerships with universities and clinical centers can accelerate validation studies, strengthening product credibility and regulatory approval pathways. Simultaneously, expanding digital service offerings-such as predictive analytics, remote monitoring platforms, and personalized coaching interfaces-will foster deeper customer engagement and create recurring revenue streams.

Second, cultivate strategic alliances throughout the value chain to optimize cost structures and secure supply resilience. Engaging with component suppliers and contract manufacturers in near-shore regions can mitigate tariff impacts and shorten lead times. At the same time, co-marketing agreements with fitness chains, telehealth providers, and wellness influencers can amplify market reach and reinforce brand positioning.

Third, tailor go-to-market strategies for distinct regional and segment-specific requirements. In price-sensitive emerging markets, consider launching entry-level devices coupled with subscription-based software to lower capital expenditure barriers. In mature healthcare environments, pursue reimbursement approvals and focus on interoperability with clinical information systems. Finally, invest in comprehensive training and support programs to ensure optimal device utilization and client satisfaction, thereby reducing churn and bolstering reputation among professional users.

By executing these strategic imperatives, companies will be well-placed to navigate competitive pressures, address shifting policy landscapes, and deliver differentiated value across the evolving body fat measurement ecosystem.

Outlining Rigorous Multi Stage Research Methodology Employed to Ensure Accuracy Reliability and Depth in Comprehensive Body Fat Measurement Analysis

This analysis is underpinned by a rigorous multi-stage research methodology designed to ensure comprehensiveness, accuracy, and relevance. Initially, an exhaustive review of secondary data sources was conducted, covering peer-reviewed journals, industry white papers, regulatory filings, and corporate disclosures. These insights were augmented by consultation of public health databases and trade publications to map regulatory frameworks and trade policies affecting body composition measurement.

Building on this foundation, primary research comprised in-depth interviews with clinicians, laboratory directors, fitness facility operators, and procurement specialists across key regions. These structured dialogues provided qualitative perspectives on unmet needs, technology preferences, and procurement challenges. In parallel, an online survey targeting home users and individual fitness enthusiasts yielded quantitative data on purchase drivers, usage patterns, and device satisfaction levels.

Data triangulation techniques were employed to reconcile findings from diverse inputs, ensuring robust validation of trends and forecasts. Key data points were cross-verified against financial reports of leading market players and aggregated shipment figures provided by industry associations. Finally, expert panels, including biomedical engineers and policy analysts, reviewed draft conclusions to affirm methodological soundness and practical applicability. This comprehensive approach ensures that the insights presented are grounded in empirical evidence and reflective of real-world dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Body Fat Measurement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Body Fat Measurement Market, by Product Type

- Body Fat Measurement Market, by Distribution Channel

- Body Fat Measurement Market, by Application

- Body Fat Measurement Market, by End User

- Body Fat Measurement Market, by Region

- Body Fat Measurement Market, by Group

- Body Fat Measurement Market, by Country

- United States Body Fat Measurement Market

- China Body Fat Measurement Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Conclusive Perspectives on the Evolution of Body Composition Assessment to Inform Decision Making and Foster Innovation Across Stakeholder Segments

The evolution of body fat measurement from rudimentary caliper techniques to sophisticated digital platforms marks a significant advance in health management. Throughout this report, we have examined how technological breakthroughs, regulatory shifts, and regional market dynamics intersect to shape the trajectory of this domain. Industry stakeholders must remain agile, embracing innovation in both hardware design and software integration to meet escalating demands for precision and user engagement.

Collaboration across the ecosystem will be essential to navigate evolving trade policies and accelerate the adoption of high-value solutions. Manufacturers, distributors, and end users must work together to streamline certification processes, optimize cost structures, and foster trust in new measurement modalities. In doing so, the industry can unlock the full potential of body composition analysis as a cornerstone of preventive health, performance optimization, and scientific research.

As the market continues to diversify, aligning product strategies with distinct segment requirements and regional nuances will be critical. Companies that prioritize data-driven decision making and champion interoperable platforms will lead the way, enabling seamless information flow and actionable insights. The insights presented herein are intended to guide stakeholders in making informed choices that drive sustainable growth and enhance health outcomes worldwide.

Encouraging Engagement with Associate Leadership to Secure Comprehensive Market Insights and Empower Strategic Decisions through Customized Research Solutions

We invite you to take the next step in equipping your organization with a thorough understanding of the body fat measurement market’s evolving landscape. Engaging with Ketan Rohom, Associate Director of Sales & Marketing, will enable you to access tailored insights, leverage custom data analysis, and gain competitive advantages rooted in precise market intelligence. By partnering to secure this comprehensive report, you’ll benefit from in-depth segmentation breakdowns, regulatory impact assessments, and actionable recommendations designed specifically for your strategic objectives. Reach out to arrange a personalized consultation, explore sample findings, and explore flexible purchasing options that align with your budgetary and operational requirements. This collaboration will empower you to make informed decisions, accelerate innovation, and optimize your market positioning within the expanding domain of body composition analysis solutions

- How big is the Body Fat Measurement Market?

- What is the Body Fat Measurement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?