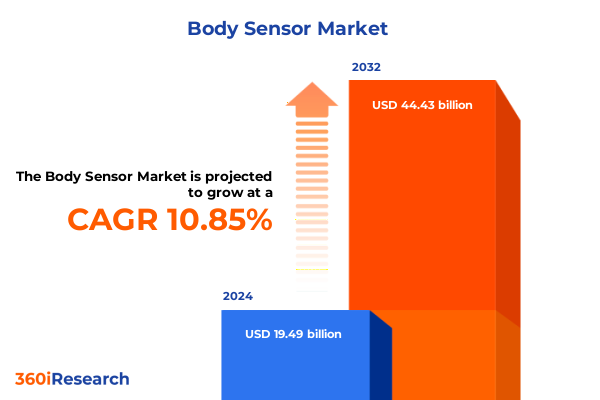

The Body Sensor Market size was estimated at USD 21.21 billion in 2025 and expected to reach USD 23.08 billion in 2026, at a CAGR of 11.14% to reach USD 44.43 billion by 2032.

Innovative Body Sensor Technologies Are Unlocking New Frontiers in Health Monitoring and Personalized Patient Care Across Clinical and Consumer Environments

Body sensor technologies have rapidly emerged as a foundational pillar in modern healthcare and consumer wellness ecosystems, enabling unprecedented real-time monitoring and data-driven decision making. From implantable cardiac defibrillators and cochlear implants to ingestible capsule sensors and wearable multi-lead ECG patches, the convergence of miniaturization, connectivity, and advanced signal processing has transformed the way clinicians diagnose conditions, manage chronic diseases, and support preventive health programs. This surge in adoption is underpinned by growing patient demand for personalized and remote care services, as well as the imperative for healthcare providers to enhance operational efficiency and clinical outcomes.

Moreover, the body sensor domain has expanded beyond traditional medical environments into sports performance enhancement, telemedicine platforms, and wellness applications, reflecting an ecosystem that bridges clinical-grade functionality with consumer accessibility. The integration of artificial intelligence (AI) and cloud analytics into sensor networks has accelerated the transition from isolated measurements to holistic insights, facilitating early warning systems and predictive health models. As a result, this technology landscape is poised to redefine patient engagement, care coordination, and research methodologies across ambulatory care centers, home healthcare settings, hospitals, and academic institutions.

Given these dynamics, an executive summary that contextualizes the transformative shifts, trade impacts, segmentation nuances, regional contrasts, and competitive forces is essential for industry stakeholders. By distilling key trends, recognizing tariff-driven cost challenges, and identifying strategic imperatives, this document aims to equip decision-makers with the clarity and foresight required to navigate and lead in the rapidly evolving body sensor market.

Rapid Integration of Digital Connectivity Artificial Intelligence and Advanced Materials Has Transformed the Body Sensor Landscape With Unprecedented Data Insights

Over the past several years, the body sensor industry has undergone transformative shifts fueled by technological convergence and evolving healthcare paradigms. The proliferation of IoT infrastructure and low-power wireless protocols has enabled body sensors to reliably transmit high-frequency physiological data over extended periods, supporting applications ranging from chronic care management to performance monitoring in elite sports. Consequently, the integration of advanced materials such as biocompatible substrates and flexible electronics has enhanced device wearability, patient comfort, and long-term adherence, marking a shift from rigid form factors to seamless skin interfaces.

In parallel, breakthroughs in signal processing algorithms and machine learning techniques have elevated sensor intelligence, allowing devices to discern complex biomarkers and subtle physiological changes with greater accuracy. For instance, electrochemical glucose sensors have evolved from enzyme-based detection to non-enzymatic modalities, reducing calibration demands and extending sensor lifespans. Additionally, the advent of acoustic emission and ultrasound sensors has opened new pathways for non-invasive organ and soft tissue monitoring, accelerating diagnostic confidence and enabling continuous patient supervision outside hospital walls.

Furthermore, regulatory bodies and reimbursement frameworks are increasingly recognizing the clinical value of remote monitoring solutions, streamlining pathways for sensor integration into standard care protocols. This regulatory momentum, coupled with heightened consumer health awareness and growing investments in telehealth infrastructure, underscores a pivotal era in which body sensor technologies are no longer niche innovations but core components of interconnected healthcare ecosystems.

Escalating Tariffs and Trade Tensions in 2025 Have Reshaped Supply Chains for Body Sensor Components and Altered Cost Structures for US Manufacturers

The cumulative impact of United States tariff measures enacted through 2025 has exerted pronounced pressure on the cost structure and supply chain resilience of body sensor manufacturers. As import duties on electronic components-including MEMS accelerometers, gyroscopes, and pressure sensors-rose incrementally throughout 2023 and 2024, OEMs faced escalating input expenses that translated into compressed margins. In response, many players sought to diversify their sourcing strategies, shifting procurement to alternative regions such as Southeast Asia and Latin America, while also exploring nearshoring opportunities in Mexico to mitigate exposure to additional duties.

Additionally, higher levies on semiconductor and optical component imports triggered a reassessment of vertical integration strategies, prompting several leading developers to bring critical manufacturing processes in-house or form strategic joint ventures with domestic foundries. These adjustments have begun to stabilize supply chain risks; however, they also necessitated significant capital investments in tooling, certification, and compliance. Consequently, some smaller emerging sensor enterprises experienced project delays as they recalibrated supply networks and negotiated new distribution agreements to offset tariff-induced cost increases.

Despite these headwinds, the tariff environment has spurred innovation in design efficiencies and component optimization. Manufacturers have intensified efforts to reduce the bill of materials through multi-sensor integration and shared substrate technologies, thereby offsetting duty hikes with greater functionality per unit. Moreover, collaborative consortia between industry players and academic institutions have accelerated research into alternative sensor chemistries and manufacturing processes that may be less vulnerable to trade distortions, laying the groundwork for a more resilient and cost-effective body sensor supply chain in the years ahead.

In-Depth Segmentation Analysis Reveals Distinct Body Sensor Market Niches by Product Type Application Technology End User and Distribution Channel Dynamics

A granular examination of the body sensor landscape reveals distinct growth drivers and innovation pathways across multiple segmentation dimensions. When assessed by product type, the market comprises both implantable sensors-anchored by cardiac rhythm devices such as implantable defibrillators and pacemakers, as well as cochlear implants and neurostimulators including deep brain and spinal cord stimulators-and ingestible variants like capsule endoscopy sensors and pill sensors that traverse the gastrointestinal tract to deliver internal diagnostic data. Complementing these are patch sensors exemplified by ECG patches and glucose monitoring patches that offer non-invasive continuous tracking, alongside an array of wearable sensors encompassing multi-lead and single-lead ECG sensors, enzymatic and non-enzymatic glucose sensors, motion detectors based on accelerometer, gyroscope, and magnetometer technologies, and temperature sensors utilizing both infrared and RTD methods.

Transitioning to application segmentation, animal monitoring solutions inform veterinary diagnostics for livestock and pet health, while healthcare monitoring addresses chronic disease management and disease diagnosis within cardiovascular, diabetes, and respiratory domains. Remote patient monitoring systems have carved out dedicated niches in chronic care management and post-operative surveillance, enabling clinicians to track vital parameters from afar and intervene proactively. In addition, the sports fitness sector leverages fitness tracking and performance monitoring tools to optimize athlete conditioning and injury prevention through granular biomechanical and physiological metrics.

From a technology perspective, sensor platforms employ acoustic methods-ranging from acoustic emission sensors that detect structural anomalies to ultrasonic devices for deep tissue imaging-alongside electrochemical modalities designed around amperometric and potentiometric principles. Micro-electromechanical systems (MEMS) form the cornerstone of many wearable and implantable sensors, integrating accelerometers, gyroscopes, and pressure sensors into compact form factors. Optical technologies, including fluorescence, near-infrared spectroscopy, and photoplethysmography, further expand the portfolio of non-invasive monitoring tools capable of capturing vascular and biochemical signals with high temporal resolution.

End user segmentation underscores the diverse environments in which body sensors are deployed, spanning ambulatory care centers outfitted for rapid diagnostics, home healthcare settings that emphasize patient comfort and autonomy, hospital infrastructures seeking advanced monitoring capabilities, and research institutes conducting longitudinal studies and clinical trials. Finally, distribution channel analysis highlights the dual pathways of offline procurement-through direct sales teams and retail outlets-and online avenues facilitated by company websites and e-commerce platforms, enabling a broad spectrum of stakeholders to access sensor solutions through both traditional and digital marketplaces.

This comprehensive research report categorizes the Body Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- Application

- End User

Regional Dynamics in the Body Sensor Ecosystem Highlight Varied Adoption Patterns Regulatory Environments and Growth Drivers Across Americas EMEA and Asia-Pacific

Regional insights into the body sensor market illustrate diverse trajectories shaped by regulatory frameworks, healthcare infrastructure maturity, and investment climates. In the Americas, the United States serves as a technology hub, driven by robust R&D ecosystems, established reimbursement mechanisms for remote monitoring, and a strong emphasis on digital health adoption among providers and consumers. Canada complements this landscape with targeted funding for telehealth initiatives and a growing venture capital presence supporting sensor startups, while Latin American markets are beginning to pilot remote care programs to address accessibility challenges in rural areas.

The Europe, Middle East & Africa region demonstrates a multifaceted adoption pattern. Western Europe leads with sophisticated regulatory pathways and comprehensive public health coverage, creating favorable conditions for implantable and wearable sensors to integrate into chronic disease management programs. Middle Eastern nations are rapidly expanding telemedicine and smart hospital initiatives, often leveraging public-private partnerships to accelerate deployment. In contrast, certain African markets are focusing on low-cost sensor platforms and mobile health integrations to deliver basic telemonitoring services in under-resourced clinical settings, reflecting a strategic focus on scalability and affordability.

Across the Asia-Pacific corridor, growth momentum is among the highest globally, fueled by expansive digital health policies in China, India, Japan, and South Korea. High smartphone penetration rates and government incentives for domestic manufacturing have catalyzed local innovation clusters in MEMS and photonic sensors. Additionally, partnerships between technology conglomerates and healthcare institutions are advancing pilot programs for ingestible sensors and AI-driven analytics, underscoring the region’s role as both a production center and early adopter of emerging body sensor use cases.

This comprehensive research report examines key regions that drive the evolution of the Body Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape in Body Sensor Industry Spotlighting Market Leaders Innovative Startups and Strategic Partnerships That Drive Technological Advancements

Examining the competitive landscape within the body sensor market reveals a mix of established medical device titans and agile technology innovators vying for leadership. Major corporations have leveraged their deep regulatory experience and global distribution networks to introduce clinically validated solutions, often integrating sensor capabilities into broader patient monitoring platforms. Simultaneously, specialized medtech firms and startups are carving out niches by focusing on novel sensor modalities, streamlined form factors, and tailored software ecosystems that differentiate them in specific therapeutic or consumer segments.

Strategic partnerships and collaborations have become a hallmark of the industry’s competitive dynamics. Leading sensor developers frequently partner with academic research centers to co-develop next-generation materials and sensing techniques, while alliances with cloud service providers and AI specialists enable the creation of end-to-end digital health platforms. This convergence has accelerated time-to-market for advanced sensors and fostered an environment where intellectual property pooling and co-innovation consortia are now critical for maintaining technology leadership.

In addition, mergers and acquisitions have been instrumental in reshaping market standings. Larger entities have acquired sensor startups to integrate disruptive technologies and expand their product portfolios, whereas mid-market players have sought minority investments to scale manufacturing capabilities and enter new geographic markets. As a result, competitive positioning is increasingly defined by both product breadth and the ability to deliver comprehensive solution suites encompassing hardware, software, and service layers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Body Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Analog Devices, Inc.

- Apple Inc.

- Bio-Rad Laboratories, Inc.

- Biosensors International Group, Ltd.

- Bosch Sensortec GmbH

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd.

- Garmin Ltd.

- General Electric Company

- Huawei Technologies Co., Ltd.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Nova Biomedical

- OMRON Corporation

- OPPO Guangdong Mobile Telecommunications Corp., Ltd.

- Polar Electro Oy

- Samsung Electronics Co., Ltd.

- Senseonics Holdings, Inc.

- STMicroelectronics N.V.

- VitalConnect, Inc.

- Xiaomi Corporation

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends Enhance Supply Chain Resilience and Foster Sustainable Innovation Initiatives

To capitalize on emerging opportunities and mitigate sector-specific challenges, industry leaders should prioritize strategic investments and operational enhancements. First, accelerating R&D efforts around multi-modal sensor platforms that consolidate electrical, optical, and electrochemical detection can reduce device proliferation and simplify integration for end users. By focusing on inter-sensor data fusion and standardized interfaces, manufacturers can deliver unified solutions that cater to both clinical and consumer markets.

In parallel, diversifying supply chains through a balanced mix of regional manufacturing hubs and strategic partnerships with semiconductor foundries will bolster resilience against future tariff fluctuations and geopolitical disruptions. Executives should evaluate potential nearshoring options and long-term vendor collaborations to optimize cost structures without compromising component quality or regulatory compliance.

Furthermore, forging alliances with software developers and AI specialists will enhance the value proposition of body sensor systems. Embedding advanced analytics capabilities directly within sensor ecosystems will enable predictive maintenance, personalized health recommendations, and seamless EMR integration. Equally important, companies should engage proactively with regulatory authorities to shape standards around data privacy, interoperability, and reimbursement, ensuring swift market access and sustainable revenue models.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Collection and Rigorous Analytical Frameworks to Ensure Reliable Body Sensor Market Insights

Our research combined a rigorous methodological framework to ensure robust and reliable insights. Primary research involved in-depth interviews with C-level executives, clinical specialists, regulatory experts, and technology innovators across North America, EMEA, and Asia-Pacific, capturing firsthand perspectives on market dynamics, unmet needs, and innovation roadmaps. These qualitative inputs were triangulated with secondary data sourced from peer-reviewed journals, industry whitepapers, patent filings, and public financial disclosures, providing a comprehensive view of competitive strategies and technological advancements.

Quantitative analysis leveraged a proprietary database of sensor shipments, clinical trial registrations, and reimbursement records to identify historical adoption curves and region-specific usage patterns. Advanced statistical techniques, including regression modeling and cohort analysis, were applied to isolate growth drivers and project near-term shifts in application demand. Furthermore, scenario planning was employed to assess the potential impact of policy changes, tariff variations, and emerging technology breakthroughs on market evolution.

The combined application of qualitative insights, quantitative rigor, and scenario-based evaluations ensures that stakeholders receive a balanced, objective, and actionable view of the body sensor ecosystem. Ethical considerations and data privacy standards were strictly adhered to throughout the research process, reinforcing the credibility and applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Body Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Body Sensor Market, by Product Type

- Body Sensor Market, by Technology

- Body Sensor Market, by Distribution Channel

- Body Sensor Market, by Application

- Body Sensor Market, by End User

- Body Sensor Market, by Region

- Body Sensor Market, by Group

- Body Sensor Market, by Country

- United States Body Sensor Market

- China Body Sensor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Conclusive Insights Emphasizing the Imperative for Stakeholders to Leverage Emerging Technologies and Collaborative Practices to Elevate the Body Sensor Market Trajectory

In summary, the body sensor market stands at a pivotal juncture where technological advancements, shifting regulatory landscapes, and evolving consumer and clinical demands converge to redefine health monitoring paradigms. The introduction of multi-functional, AI-enabled devices promises to augment diagnostic precision and patient engagement, while tariff-driven supply chain adaptations underscore the necessity for diversified sourcing strategies and local manufacturing capacities.

Key segmentation insights highlight that both clinical implantable systems and consumer-oriented wearable patches will coexist as complementary pillars of the ecosystem, each benefiting from specialized applications spanning chronic disease management, remote patient monitoring, veterinary diagnostics, and sports performance analytics. Regionally, the Americas, EMEA, and Asia-Pacific each present unique growth trajectories shaped by local policy frameworks, infrastructure readiness, and investment priorities.

As competition intensifies, industry leaders equipped with a deep understanding of segmentation nuances, regional drivers, and competitive dynamics will be best positioned to steer innovation, optimize operations, and deliver value across the full sensor-to-insight continuum. These collective insights lay the foundation for informed decision making and strategic planning in the rapidly evolving body sensor industry.

Engage with Associate Director Ketan Rohom Today to Access Detailed Body Sensor Market Research and Unlock Strategic Opportunities for Growth and Innovation

To gain comprehensive insights into the evolving body sensor landscape and secure a competitive edge, engage directly with Associate Director Ketan Rohom to acquire the complete market research report tailored to your strategic objectives. By collaborating with Ketan, you can access in-depth analyses, customized data sets, and expert guidance that will empower your organization to identify growth opportunities, optimize product development roadmaps, and refine go-to-market strategies. Reach out to Ketan Rohom today to discuss how the full suite of research findings can inform investment decisions, support business expansion plans, and accelerate innovation in your body sensor initiatives.

- How big is the Body Sensor Market?

- What is the Body Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?