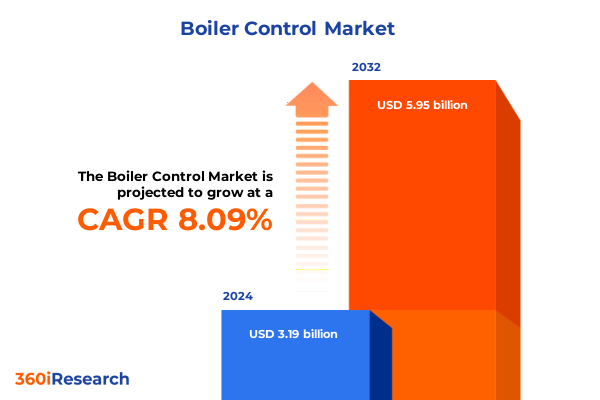

The Boiler Control Market size was estimated at USD 3.39 billion in 2025 and expected to reach USD 3.61 billion in 2026, at a CAGR of 8.35% to reach USD 5.95 billion by 2032.

Laying the Groundwork for Advanced Boiler Control by Exploring Core Drivers and Emerging Industry Forces

Modern boiler control systems are pivotal to optimizing efficiency, safety, and reliability across industrial operations. This introduction outlines the role of these systems in balancing fuel consumption, emission control, and process consistency. Recent advancements in industrial Internet of Things (IIoT) and edge computing have enabled real-time monitoring and dynamic adjustment of boiler parameters, reducing downtime and operating costs. Consequently, organizations are shifting from traditional pneumatic and analog controls toward digitally integrated solutions that offer greater precision, scalability, and remote accessibility.

Against this backdrop, regulatory frameworks targeting greenhouse gas emissions and energy efficiency have intensified, compelling operators to adopt smarter control mechanisms. These regulatory drivers, coupled with rising energy prices, have underscored the value of systems that can fine-tune combustion processes and minimize thermal losses. In tandem, the advent of machine learning and predictive analytics has introduced proactive maintenance capabilities, whereby anomalies can be detected and addressed before they escalate into critical failures. Building on this momentum, the boiler control market is poised to deliver transformative outcomes for manufacturers, utilities, and end-users seeking to enhance performance and sustainability.

Discover How Digitalization, Decarbonization, and Cybersecurity Are Redefining the Boiler Control Environment

The landscape of boiler control has undergone transformative shifts driven by digitalization, evolving regulatory mandates, and shifting customer expectations. Industry 4.0 initiatives have accelerated the integration of smart sensors, advanced controllers, and cloud-based analytics platforms, enabling a new era of connected operations. As a result, stakeholders are embracing holistic control architectures that interlink boilers with broader plant management systems, fostering seamless data exchange and system-wide optimization.

Moreover, the focus on decarbonization has spurred investment in low-emission combustion technologies and hybrid systems that combine fossil and renewable fuels. Underpinning this trend is the increasing importance of cybersecurity, where resilient control networks must guard against ever-more sophisticated cyber threats. In response, leading providers are embedding encrypted communication protocols and multi-layer authentication schemes into their solutions. Concurrently, labor shortages and skills gaps have prompted vendors to develop user-friendly interfaces and augmented reality-based training tools that simplify operation and maintenance tasks for on-site technicians.

Analyzing the 2025 U.S. Tariff Implications That Are Reshaping Boiler Control Supply Chains and Cost Structures

United States trade policy updates in 2025 have introduced tariffs on key raw materials and electronic components, exerting pressure on global boiler control supply chains. Steel and aluminum levies applied earlier in the year have elevated the cost of actuator housings and valve assemblies, compelling manufacturers to explore alternative sourcing strategies and renegotiate supplier agreements. These shifts have been compounded by duties on semiconductor chips used in advanced controllers and sensor modules, which have driven lead times upward and raised equipment pricing for end users.

In response, many control system providers have accelerated their localization efforts, establishing assembly facilities closer to core markets to mitigate tariff impacts and curb logistics expenses. At the same time, procurement teams are leveraging volume contracts and strategic partnerships to stabilize input costs. While some cost increases have been passed on to customers, others have been absorbed through lean manufacturing initiatives and redesigns that optimize material usage. As a result, agile companies that successfully adapt their supply chain architectures stand to maintain competitive pricing and improve delivery predictability in a landscape shaped by evolving tariff regimes.

Unveiling Key Insights from Component to Output Type That Illuminate Diverse Segments of the Boiler Control Market

A granular look at boiler control market segmentation reveals diverse dynamics across component, end use, control type, installation type, communication technology, and output type. Component variations range from mechanical actuators, including control valves and motorized valves, to advanced controllers such as distributed control systems, microprocessor-based controllers, and programmable logic controllers. In parallel, sensors measuring flow, pressure, and temperature feed critical data streams into integration and orchestration software as well as monitoring and diagnostic platforms, underscoring the importance of end-to-end digital ecosystems.

When viewed through the lens of end-use applications, chemical processing plants requiring specialized solutions for petrochemicals and specialty chemicals co-exist with stringent OEM requirements in pharmaceuticals, food and beverages, and power generation. Control types vary from mass flow and volume flow regulation to precise management of steam states, whether saturated or superheated, and seamless temperature control. Meanwhile, the decision between new installation and retrofit projects shapes purchasing cycles, with retrofit demand rising as operators seek to extend the lifespan of legacy assets. Communication infrastructures offer wired networks or wireless protocols-Bluetooth, proprietary systems, Wi-Fi, and Zigbee-enabling flexible system designs that match plant footprints. Output characteristics, spanning adaptive, on/off, PID, and proportional responses, complete the segmentation picture, illuminating how different technology stacks align with unique process requirements.

This comprehensive research report categorizes the Boiler Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Control Type

- Installation Type

- Communication Technology

- Output Type

- End Use

Examining Regional Drivers from the Americas to Asia-Pacific That Define Distinct Trajectories in Boiler Control Adoption

Regional dynamics play a crucial role in steering boiler control investment patterns and technology adoption curves. In the Americas, modernization programs in North American manufacturing hubs are driving a resurgence in retrofit projects, fueled by a desire to meet stringent environmental regulations and enhance system uptime through digital upgrades. South American markets are witnessing a rise in cost-effective solutions designed for emerging industrial zones, where energy efficiency gains can deliver rapid returns on investment.

In Europe, Middle East, and Africa, regulatory frameworks targeting carbon neutrality have catalyzed the deployment of high-performance boiler control systems across chemical, power generation, and oil and gas sector installations. European Union directives emphasize interoperability and open communication standards, encouraging suppliers to develop modular solutions that can integrate seamlessly into heterogeneous plant environments. The Middle East continues to invest in large-scale petrochemical complexes, necessitating robust and scalable control systems. Meanwhile, African markets are gradually adopting entry-level digital controls as part of broader industrialization initiatives.

Asia-Pacific remains the fastest growing region, with China and India at the forefront of capacity expansion in chemicals, power generation, and food processing. Local OEMs and global players alike are competing to capture share by offering cost-optimized solutions tailored to high-volume installations and emerging smart city projects. Southeast Asian markets show particular enthusiasm for wireless and cloud-enabled control systems, reflecting a regional push toward Industry 4.0.

This comprehensive research report examines key regions that drive the evolution of the Boiler Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing How Market Leaders and Niche Providers Are Shaping Competitive Strategies through Innovation and Collaboration

Leading suppliers in the boiler control arena are expanding their footprints through strategic partnerships, product innovation, and targeted acquisitions. Major automation conglomerates are enhancing their core portfolios by integrating software analytics, cloud-based services, and AI-driven optimization engines. These moves are complemented by collaboration agreements with technology startups specializing in next-generation sensors and edge computing platforms, enabling rapid time-to-market for novel offerings.

Meanwhile, independent specialists are carving niches by focusing on high-precision control valves, retrofitting solutions, and customized service contracts that guarantee performance metrics. Competitive differentiation is increasingly defined by the ability to offer turnkey solutions-from initial assessment and system design to installation, commissioning, and lifecycle support. As the market matures, the emphasis is shifting toward ecosystem plays that unify hardware, software, and professional services under a single contractual framework, thereby simplifying procurement and accountability for end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boiler Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Bosch Industriekessel GmbH

- Cleaver-Brooks, Inc.

- Emerson Electric Co.

- Forbes Marshall Pvt. Ltd.

- GESTRA AG

- Honeywell International Inc.

- Hurst Boiler & Welding Co., Inc.

- Leslie Controls, Inc.

- Miura America Co., Ltd.

- Robert Bosch GmbH

- Sauter AG

- Schneider Electric SE

- Siemens AG

- Spirax Sarco, Inc.

- Thermax Limited

- U.S. Boiler Company, Inc.

- Vaillant Group

- Viessmann Werke GmbH & Co. KG

Guiding Industry Leaders toward Interoperable Architectures, Retrofit Solutions, and Resilient Supply Chains to Drive Value

Industry leaders must prioritize the development of open and interoperable control architectures that facilitate seamless integration with enterprise resource planning and asset management systems. By leveraging standardized communication protocols and modular hardware, organizations can accelerate deployment timelines and simplify upgrade paths. Simultaneously, investing in retrofit-friendly solutions will unlock new revenue streams as aging boiler fleets demand digital upgrades without full system replacements.

To mitigate supply chain volatility, executives should cultivate strategic supplier alliances and diversify sourcing across multiple regions. Embedding advanced analytics and remote monitoring capabilities into control platforms can yield predictive maintenance insights, thereby reducing unplanned downtime and optimizing operational expense. Furthermore, enhancing cybersecurity posture through regular vulnerability assessments and secure software development lifecycles will safeguard critical infrastructure against emerging threats. Finally, workforce development programs that combine virtual reality-based training with hands-on apprenticeships can bridge skills gaps and ensure that technical teams maintain proficiency with next-generation control technologies.

Detailing a Comprehensive Research Approach Integrating Primary Interviews, Secondary Sources, and Expert Validation

This study employs a rigorous research methodology combining primary and secondary data collection with qualitative and quantitative analysis. Primary research involved in-depth interviews with plant managers, control system integrators, and original equipment manufacturers to gather firsthand perspectives on adoption drivers, deployment challenges, and technology roadmaps. This was complemented by insights from independent consultants and regulatory experts who provided context on evolving emissions standards and compliance requirements.

Secondary research drew from industry publications, technical white papers, patent filings, and government databases to establish a comprehensive baseline of market conditions and technology trends. Data triangulation was performed by cross-referencing interview findings with documented case studies and financial reports to validate key themes. Segmentation frameworks were developed through meticulous mapping of product portfolios and application use cases, ensuring that each market slice accurately reflects real-world deployment scenarios. Finally, all findings underwent scrutiny by an expert advisory panel to ensure accuracy, relevance, and actionable clarity for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boiler Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boiler Control Market, by Component

- Boiler Control Market, by Control Type

- Boiler Control Market, by Installation Type

- Boiler Control Market, by Communication Technology

- Boiler Control Market, by Output Type

- Boiler Control Market, by End Use

- Boiler Control Market, by Region

- Boiler Control Market, by Group

- Boiler Control Market, by Country

- United States Boiler Control Market

- China Boiler Control Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Market Drivers, Segmentation Nuances, and Regional Variations to Highlight Core Takeaways in Boiler Control

In conclusion, the modern boiler control landscape is characterized by rapid digital transformation, heightened regulatory scrutiny, and evolving customer demands for efficiency and sustainability. Technological breakthroughs in IIoT, automation software, and advanced sensing are unlocking new levels of operational performance. Nevertheless, challenges persist as trade policy shifts, supply chain disruptions, and cybersecurity risks test the resilience of control system ecosystems.

By understanding the nuanced segmentation of components, end uses, control types, installations, communication technologies, and output responses, decision-makers can tailor strategies that align with both current requirements and future ambitions. Regional market dynamics further underscore the importance of local expertise, regulatory alignment, and partner ecosystems. As competitive pressures intensify, companies that embrace open architectures, retrofit pathways, and data-driven services will be best positioned to capture value and reinforce their market leadership. Armed with these insights, industry stakeholders can confidently navigate the complexities of the boiler control market and pursue transformative outcomes.

Unlock Exclusive Boiler Control Market Insights by Connecting with Our Dedicated Sales and Marketing Specialist

To explore the comprehensive boiler control market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can provide you with the full details of the study, answer any questions you may have, and facilitate the purchase of the complete analysis. By connecting with Ketan Rohom, you will gain direct access to all the insights, data points, and strategic recommendations essential for making well-informed decisions in the boiler control space.

- How big is the Boiler Control Market?

- What is the Boiler Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?