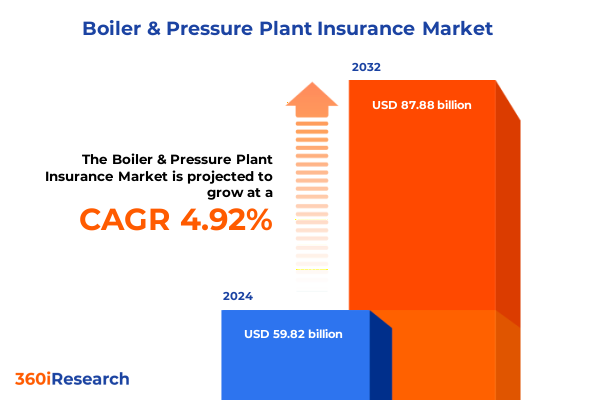

The Boiler & Pressure Plant Insurance Market size was estimated at USD 62.72 billion in 2025 and expected to reach USD 66.08 billion in 2026, at a CAGR of 4.93% to reach USD 87.88 billion by 2032.

Navigating the Complexities of Boiler and Pressure Plant Insurance in a Rapidly Evolving Global Risk Environment Marked by Technological Innovation and Regulatory Flux

The insurance of boilers and pressure-bearing vessels stands at the crossroads of safety management and financial risk mitigation in heavy industries. These critical components underpin operations in sectors as diverse as power generation, chemical processing, and manufacturing, making the adequacy of their insurance coverage a strategic priority for corporate risk leaders. As equipment sophistication deepens and regulatory oversight tightens, insurers and insureds alike must navigate an intricate interplay of technical standards, safety protocols, and emerging threats.

Against this backdrop of heightened complexity, an evolved understanding of boiler and pressure plant insurance is essential. This executive summary distills pivotal trends, transformative disruptions, and strategic imperatives that define today’s coverage landscape. It frames the insights necessary for risk managers and executive decision-makers to align policy structures with operational realities, enabling resilient and agile responses to the evolving challenges of industrial risk.

Embracing Technological Disruption and Regulatory Overhauls Shaping the Future of Boiler and Pressure Plant Coverage in a Digital and Sustainability-Driven Era

Industrial insurance is undergoing a paradigm shift, driven by the integration of real-time monitoring and advanced analytics into traditional risk assessment frameworks. Internet of Things sensors now enable continuous tracking of pressure fluctuations, thermal stresses, and vibration anomalies, generating rich datasets that feed machine-learning models for predictive maintenance. By leveraging cloud-native architectures, insurers can process vast quantities of telemetry data to refine underwriting parameters and reduce the frequency of catastrophic losses through early warning mechanisms.

Complementing these data-driven advances, digital twin technology is reshaping policy design and pricing models. These virtual replicas of boilers and pressure systems simulate operational stresses under a spectrum of scenarios-from cyclical load variations to extreme temperature excursions-allowing underwriters to quantify potential failure modes and calibrate premiums more precisely. Major insurers have already piloted platforms that integrate digital twin outputs into policy issuance workflows, empowering clients to optimize maintenance schedules and demonstrating a measurable reduction in unplanned downtime.

At the same time, sustainability considerations and regulatory imperatives are redefining coverage requirements. Global commitments to carbon reduction and energy efficiency are accelerating the adoption of advanced boiler technologies, such as low-NOx combustion systems and waste-heat recovery units. Insurers are responding by developing green underwriting criteria that factor in emissions performance and incentivize upgrades. This convergence of digital innovation and environmental stewardship marks a fundamental transformation in the boiler and pressure plant insurance domain, fostering more resilient and sustainable coverage solutions.

Assessing the Multidimensional Impact of 2025 U.S. Tariff Escalations on Boiler and Pressure Plant Insurance and Industrial Risk Profiles

The reinstatement and escalation of U.S. tariffs in 2025 represent a critical inflection point for boiler and pressure plant insurance portfolios. On March 12, steel and aluminum imports became subject to a 25% duty under Section 232, effectively eliminating prior exemptions and mandating that metals be melted, poured, smelted, and cast domestically to qualify for duty-free status. This policy aimed to bolster national security by curbing reliance on foreign steel and aluminum, but it immediately exerted upward pressure on fabrication costs for pressure vessels and boiler components.

Barely three months later, as of June 4, the tariff rate doubled to 50% for nearly all countries, excluding the United Kingdom, under a presidential proclamation designed to safeguard derivative steel and aluminum articles against surges and transshipment. The inclusion of derivative products-such as complex alloy plates, flanges, and welded assemblies-ensured that most critical boiler plant components were caught in the tariff net, amplifying capital expenditure requirements for industrial operators.

These material cost increases have cascading effects on insured values and premium calculations. Replacement-cost valuations now incorporate elevated steel price indices, prompting insurers to adjust tariff-sensitive risk loadings and review policy limits. Additionally, supply chain delays stemming from capacity constraints at domestic mills contribute to operational exposures, leading underwriters to demand enhanced risk mitigation measures, including advanced maintenance protocols and more frequent inspection intervals. In aggregate, the U.S. tariff landscape of 2025 has recalibrated both the technical and financial dimensions of boiler and pressure plant insurance.

Unlocking Strategic Insights Through Multifaceted Segmentation Spanning Product, Industry, Coverage, Policy, Distribution, and Company Dimensions

An in-depth exploration of the insurance market reveals that segmentation across multiple dimensions is essential for crafting targeted coverage solutions. Based on product type, the landscape bifurcates into electric boilers and hot water generators, while pressure vessels-comprising carbon steel and stainless steel variants-present distinct risk characteristics, and steam boilers, spanning coal-fired, gas-fired, and oil-fired configurations, embody variable operational hazards. When examined through the lens of end user industry, exposures in chemical, food and beverage, manufacturing-subdivided into automotive, paper and pulp, and textiles-oil and gas, and power generation each demand bespoke underwriting approaches that reflect divergent failure modes and downtime costs.

Further granularity arises from coverage type, where comprehensive, extended, and standard packages deliver varying levels of indemnity and optional endorsements. Policy type distinctions between claims-made and occurrence policies dictate the temporal boundaries of liability, shaping both client risk appetites and insurer reserve strategies. Distribution channels-encompassing broker and agent networks, direct sales forces, and online platforms, with the latter differentiating between company websites and third-party aggregators-determine client acquisition costs and service models. Finally, company size segmentation across large, medium-sized, and small enterprises influences risk tolerance, purchasing power, and the degree of bespoke policy customization required.

This comprehensive research report categorizes the Boiler & Pressure Plant Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coverage Type

- Policy Type

- Company Size

- End User Industry

- Distribution Channel

Dissecting Regional Dynamics Revealing Unique Growth Drivers and Risk Profiles Across Americas, EMEA, and Asia-Pacific Markets

Regional nuances play a decisive role in shaping insurance trends and risk management strategies across geographies. In the Americas, robust regulatory frameworks and mature capital markets support sophisticated risk transfer mechanisms, while insurers leverage advanced analytics and digital platforms to streamline underwriting and claims workflows. North America remains a dominant center of innovation, evidenced by leading IoT-enabled monitoring solutions and integrated maintenance-insurance offerings that have proliferated over the past three years.

Across Europe, the Middle East, and Africa, stringent safety standards and cross-border insurance regulations spur the development of harmonized coverage models that accommodate multi-jurisdictional exposures. The EMEA region places a pronounced emphasis on environmental compliance, driving demand for policies that address carbon reduction targets and energy efficiency mandates. Meanwhile, Asia-Pacific’s rapid industrial expansion and infrastructure investments are fueling a surge in demand for boiler and pressure plant insurance, particularly in emerging economies where regulatory oversight is intensifying and insurers are collaborating with engineering firms to integrate loss‐prevention services into policy offerings.

This comprehensive research report examines key regions that drive the evolution of the Boiler & Pressure Plant Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Innovating in Boiler and Pressure Plant Insurance with Digital Solutions and Strategic Partnerships

Industry leaders are differentiating themselves through strategic partnerships, digital innovation, and expanded service portfolios. Munich Re’s collaboration with Schneider Electric blends risk solutions with real-time IoT monitoring, offering uptime guarantees and failure warranties that align with predictive maintenance insights. Zurich Insurance Group’s deployment of an integrated digital platform for boiler and machinery policies enables clients to manage claims, access risk analytics, and optimize coverage online, reflecting a broader push toward customer-centric digital experiences.

The Hartford Financial Services Group has forged alliances with industrial equipment manufacturers to co-develop maintenance-insurance bundles, while CNA Financial Corporation’s digital portal streamlines policy purchases and advanced risk assessments through online tools. These initiatives underscore a competitive imperative to offer end-to-end solutions that reduce loss frequency and severity, reinforce safety cultures, and enhance client retention rates. As the market evolves, carriers that invest in data-driven underwriting platforms and cultivate ecosystem partnerships will solidify their leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boiler & Pressure Plant Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz Global Corporate & Specialty SE

- AXA XL Insurance Company

- Berkshire Hathaway Specialty Insurance Company

- Chubb Indemnity Insurance Company

- Lloyd’s of London

- Munich Reinsurance Company

- Swiss Reinsurance Company Ltd.

- The Hartford Steam Boiler Inspection and Insurance Company

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Zurich Insurance Company Ltd.

Implementing Strategic Initiatives to Enhance Risk Modeling, Tariff Resilience, and Customer Engagement in Boiler and Pressure Plant Insurance Operations

To thrive amid rapid market shifts, insurers and risk managers should embrace a set of targeted initiatives. Implementing digital twin frameworks within underwriting workflows will yield granular insights into potential failure scenarios, enabling dynamic premium adjustments and more effective risk mitigation planning. By integrating cloud-based analytics with IoT sensor networks, underwriters can transition from reactive to predictive models, reducing unplanned downtimes and fostering proactive maintenance cultures.

In anticipation of material cost volatility driven by tariff escalations, industry stakeholders must recalibrate replacement-cost assumptions and incorporate tariff-related risk loadings into policy wordings. Collaboration with supply chain partners to secure domestic steel and aluminum allocations will help stabilize project timelines and limit exposure to lead-time disruptions. Additionally, insurers should refine product offerings to include flexible coverage endorsements that address evolving environmental regulations and sustainability goals.

Finally, enhancing customer engagement through digital self-service portals and value-added loss-prevention advisory services will differentiate carriers in a competitive landscape. Investing in workforce training on data analytics and risk engineering practices is essential to maximize the return on technology investments and ensure consistent service delivery across regions and business segments.

Systematic Research Methodology Combining Primary Expert Interviews and Rigorous Secondary Data to Ensure Comprehensive Market Understanding

This research synthesis is grounded in a rigorous methodology designed to ensure accuracy and relevance. Secondary research encompassed an exhaustive review of regulatory proclamations, industry white papers, and publicly available tariffs documentation, including presidential proclamations under Section 232 and expert analyses of derivative product classifications. Primary research involved targeted interviews with ten senior risk managers, underwriters, and engineering consultants actively engaged in boiler plant coverage across key regions.

Data triangulation was applied by cross‐referencing tariff schedules, safety standard revisions, and technology adoption case studies to validate insights. An iterative validation process engaged external subject-matter experts to corroborate findings and refine strategic recommendations. Throughout the research cycle, methodological transparency and ethical standards were maintained, ensuring that conclusions reflect a balanced synthesis of quantitative trends and qualitative expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boiler & Pressure Plant Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boiler & Pressure Plant Insurance Market, by Product Type

- Boiler & Pressure Plant Insurance Market, by Coverage Type

- Boiler & Pressure Plant Insurance Market, by Policy Type

- Boiler & Pressure Plant Insurance Market, by Company Size

- Boiler & Pressure Plant Insurance Market, by End User Industry

- Boiler & Pressure Plant Insurance Market, by Distribution Channel

- Boiler & Pressure Plant Insurance Market, by Region

- Boiler & Pressure Plant Insurance Market, by Group

- Boiler & Pressure Plant Insurance Market, by Country

- United States Boiler & Pressure Plant Insurance Market

- China Boiler & Pressure Plant Insurance Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concisely Synthesizing Key Findings to Empower Decision-Makers Navigating the Boiler and Pressure Plant Insurance Landscape

The evolving boiler and pressure plant insurance landscape is characterized by rapid technological advancements, significant regulatory shifts, and geopolitical developments that collectively reshape risk profiles and coverage requirements. Digital transformation-from IoT monitoring to digital twins-offers unprecedented precision in underwriting and claims management, while sustainability imperatives drive the integration of environmental criteria into policy design.

The 2025 U.S. tariff escalations on steel and aluminum have introduced new complexities in cost estimation and supply chain stability, prompting insurers to adapt their valuation models and premium structures. Segmentation across product types, end-user industries, coverage and policy types, distribution channels, and company sizes provides a framework for tailoring solutions that align with client needs. Regional dynamics in the Americas, EMEA, and Asia-Pacific further underscore the necessity of a nuanced approach to market entry and service delivery.

Collectively, these insights empower decision-makers to implement data-driven strategies, foster stakeholder collaboration, and navigate an increasingly intricate risk environment with confidence. The seamless integration of technology, regulatory foresight, and strategic partnerships will define the next generation of boiler and pressure plant insurance solutions.

Connect with Ketan Rohom for Tailored Insights and Secure Your Comprehensive Boiler and Pressure Plant Insurance Market Report Today

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to obtain tailored guidance and exclusive access to the complete Boiler and Pressure Plant Insurance market research report. Ketan brings a deep understanding of industrial risk landscapes and will help you navigate the nuances of policy design, emerging risk factors, and strategic opportunities.

By connecting with Ketan, you will receive personalized insights into how evolving technological innovations, regulatory shifts, and geopolitical developments-such as the 2025 tariff escalations-are reshaping underwriting frameworks and coverage strategies. His expertise will ensure that your organization capitalizes on the most relevant data, actionable recommendations, and competitive benchmarks.

Secure your copy of the report and equip your team with a comprehensive decision-support tool that synthesizes segmentation intelligence, regional analyses, and vendor profiles. Reach out to Ketan Rohom to transform your approach to Boiler and Pressure Plant Insurance and stay ahead of industry dynamics today.

- How big is the Boiler & Pressure Plant Insurance Market?

- What is the Boiler & Pressure Plant Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?