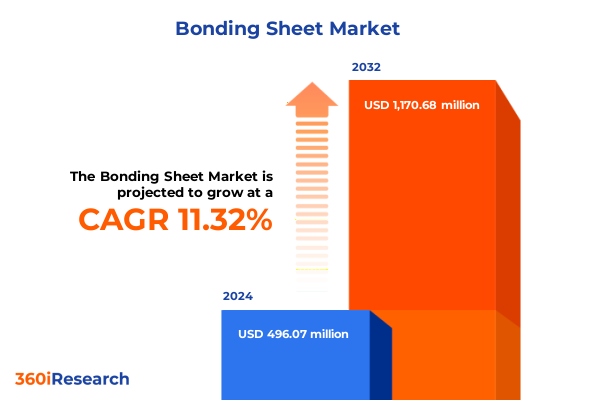

The Bonding Sheet Market size was estimated at USD 546.27 million in 2025 and expected to reach USD 603.64 million in 2026, at a CAGR of 11.50% to reach USD 1,170.67 million by 2032.

Unveiling the dynamic realm of bonding sheet applications: exploring technological advances, market drivers, and challenges reshaping adhesion solutions

Unveiling the dynamic realm of bonding sheet applications, the introduction provides a holistic backdrop for stakeholders seeking to comprehend this multifaceted sector. Bonding sheets, comprised of advanced polymer matrices and adhesive systems, play a critical role in joining dissimilar substrates across automotive, electronics, medical, construction, and packaging industries. They unite performance characteristics such as high shear strength, flexibility, electrical insulation, and environmental resistance, which collectively enable next-generation design and lightweighting initiatives. As global manufacturing paradigms shift toward greater efficiency and sustainability, bonding sheets have emerged as indispensable enablers of assembly processes that require precision and durability beyond conventional adhesives.

Consideration of evolving regulatory frameworks, growing emphasis on volatile organic compound reduction, and heightened demand for bio-based solutions underscores how environmental factors are reshaping product development and end use. Manufacturers of bonding sheets are aligning R&D efforts with sustainable sourcing of raw materials and integrating circular economy principles to satisfy both corporate social responsibility mandates and consumer expectations. Amid growing complexities in supply chain networks and the push for operational cost optimization, the importance of understanding core market drivers has never been more pronounced.

This executive summary serves as a strategic compass, spotlighting transformative shifts in technology adoption, the cumulative impact of United States tariff measures enacted in 2025, deep segmentation insights that reveal critical inflection points, key regional dynamics across major territories, leading company profiles, and actionable recommendations for industry leaders. Supported by rigorous methodological frameworks, the findings culminate in a forward-looking conclusion and a direct call-to-action to engage with specialized expertise for a competitive edge.

Exploring catalysts and shifts redefining bonding sheet development through sustainability imperatives, digital automation, and groundbreaking material innovations

Exploring the forces catalyzing rapid evolution within the bonding sheet sector, it becomes evident that sustainability imperatives, digital automation, and material innovation are collectively redrawing the industry landscape. Environmental regulations targeting greenhouse gas emissions and volatile organic compound content have propelled the formulation of low-emission and bio-based adhesive systems. This shift is driven not only by legislative mandates but also by growing customer demand for eco-friendly alternatives that do not compromise performance. As a result, manufacturers have intensified R&D investments to develop renewable resin chemistries and recyclable composite constructions aligning with circular economy objectives.

Simultaneously, the integration of digital automation in coating, lamination, and quality inspection processes has elevated throughput and precision. Advanced robotics and machine-vision systems allow for real-time defect detection and process adjustments, reducing material waste and enhancing consistency. Additionally, data analytics platforms capture process metrics that inform continuous improvement initiatives, driving higher yield and lower operational costs.

Breakthroughs in additive manufacturing and precision coating technologies are enabling the creation of bonding sheets with graded properties and bespoke geometries that meet the exacting requirements of lightweight automotive assemblies, flexible electronics, and implantable medical devices. The convergence of these technological streams underscores a transformative trajectory in which bonding sheet solutions evolve from commodity offerings to highly engineered components at the forefront of innovation.

Analyzing the ripple effects of 2025 United States tariff measures on resin raw materials, operational costs, and global supply chain resilience in bonding sheet markets

The 2025 introduction of revised United States tariffs on select resin and polymer imports has sent ripples through global supply chains and cost structures for bonding sheet producers. Tariffs applied to acrylic and polyurethane precursors have elevated raw material expenditures, compelling manufacturers to reexamine supplier portfolios and explore alternative sourcing strategies. In response, some producers have accelerated the qualification of domestic resin suppliers to mitigate the risk of price volatility, while others have sought long-term agreements with international partners capable of sharing duty burdens.

These tariff measures have not only impacted input costs but also reshaped competitive dynamics. Companies that successfully optimized production footprints and leveraged scale economies have managed to maintain gross margin stability, whereas smaller or regionally constrained players have faced pressure to adjust pricing or absorb cost increases. To a degree, cost pass-through to end users has been achievable in sectors where bonding sheet performance is mission-critical and price sensitivity is lower, particularly in aerospace, medical, and high-end electronics applications.

Looking ahead, the tariff landscape is likely to drive further consolidation among suppliers and incentivize vertical integration initiatives as companies aim to secure feedstock availability. Strategic responses have included investments in resin modification technologies that reduce reliance on tariffed monomers, as well as collaborative development programs targeting local production of specialty adhesives. Ultimately, these shifts underscore the importance of agile supply chain management and proactive scenario planning in a tariff-impacted environment.

Delving into critical segmentation across resin types, application domains, technology modalities, physical forms, end-user verticals, and distribution channels shaping market trajectories

Segmentation analysis reveals nuanced performance drivers across each critical dimension of the bonding sheet market. Resin chemistry types encompass acrylic for rapid curing cycles, epoxy for superior strength and chemical resistance, polyurethane for flexibility in dynamic applications, and silicone for high-temperature and electrical insulation use cases. Distinct resin attributes align with specific performance requirements, guiding formulators toward targeted chemistries that deliver optimal adhesion, durability, and process efficiency.

End-use applications span automotive body assembly and light-weighting structures, construction joint sealing and facade lamination, electronics encompassing automotive modules, consumer gadgets, and industrial controls, medical device assembly, and flexible packaging for hygiene or food contact. Each application sector imposes unique criteria on bonding sheet properties, driving bespoke formulation strategies and specialized fabrication workflows to meet rigorous industry standards around safety, reliability, and aesthetic finish.

Technological platforms in the market include heat-activated systems that harness thermal energy for rapid cure, moisture-cured chemistries that leverage ambient humidity to trigger crosslinking, and pressure-sensitive adhesives designed for peel-and-stick convenience. In parallel, product form factors vary from thin film constructions suitable for automated lamination to liquid dispersions applied via coating lines and pre-cut sheets that enable manual or semi-automated placement in lower-volume production contexts.

Market channels connect producers to end users through direct sales operations that build strategic partnerships, distributor networks providing broad regional coverage, e-commerce platforms enabling rapid procurement, and traditional retail outlets catering to light-duty or aftermarket requirements. Understanding the interplay of resin type, application sector, technology modality, form factor, and distribution pathway is central to uncovering targeted growth opportunities and alignment with customer priorities.

This comprehensive research report categorizes the Bonding Sheet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Form

- Application

- End User

- Channel

Uncovering regional dynamics in the Americas, Europe Middle East Africa and Asia Pacific to highlight key drivers and growth catalysts unique to each market

Regional market dynamics exhibit distinct characteristics that influence strategy and investment priorities across the Americas, Europe Middle East Africa, and Asia Pacific territories. In the Americas, strong demand from automotive and aerospace manufacturers, supported by local production of acrylic and epoxy resins, underpins a mature bonding sheet ecosystem. Regional policies favor reshoring and incentives for advanced manufacturing, prompting suppliers to expand production capacity and R&D facilities to support tailored formulations in the United States and Brazil.

In the Europe Middle East Africa region, stringent environmental regulations and a robust construction sector drive uptake of low-VOC bonding sheets for infrastructure projects and architectural glazing. European engineering standards emphasize performance consistency and recyclability, leading to a proliferation of silicone-based and heat-activated solutions. Meanwhile, Middle Eastern investments in large-scale energy and commercial developments are creating pockets of demand for high-durability adhesives, and African markets are emerging for cost-effective formulations targeting light industry and packaging applications.

The Asia Pacific landscape remains highly dynamic, fueled by robust growth in consumer electronics, medical device manufacturing, and packaging industries across China, Japan, South Korea, and emerging Southeast Asian economies. Local resin production capacity continues to expand, driving competitive pricing but necessitating ongoing innovation to differentiate value propositions. Market participants in this region emphasize collaboration with global OEMs to co-develop pressure-sensitive and moisture-cured bonding sheets that meet exacting performance and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Bonding Sheet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players and their strategic maneuvers to showcase innovation, competitive positioning, collaborations, and market leadership dynamics

Industry leaders are deploying a range of strategic initiatives to consolidate competitive positioning and accelerate innovation pipelines. Established multinational corporations have expanded their adhesive portfolios through targeted acquisitions of specialty formulators, enhancing their ability to offer end-to-end bonding sheet solutions with integrated technical support. In parallel, a number of mid-tier companies are forging alliances with upstream resin producers to secure preferential access to novel monomers and co-development programs, fueling proprietary formulation capabilities.

R&D investment remains a critical differentiator, with top players establishing collaborative research centers focused on next-generation polymer chemistries, bio-derived adhesives, and smart bonding sheets that incorporate sensing elements for process monitoring. Such initiatives are often supported by partnerships with academic institutions and government research grants aimed at advancing sustainable materials science.

Commercial strategy is also evolving through digital engagement platforms that streamline technical consultation and accelerate sample-to-production workflows. Virtual product demonstrations and interactive selection tools enable end users to specify performance criteria and receive custom recommendations, shortening the development cycle. These combined efforts underscore how leading companies are leveraging innovation, strategic partnerships, and customer-centric service models to solidify leadership in a competitive marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bonding Sheet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M company

- Adhesives Technology Corporation

- Arisawa Manufacturing Co., Ltd.

- Dexerials Corporation

- Dongyi

- DuPont de Nemours, Inc.

- Ecoplast Ltd.

- Fujikura Ltd.

- H.B. Fuller Company

- Hanwha Solutions Advanced Materials Division

- Henkel AG & Co. KGaA

- ITEQ Corporation

- Microcosm Technology Co., Ltd.

- Namics Corporation

- Nikkan Industries Co., Ltd.

- Nitto Denko Corporation

- Panasonic Holding Corporation

- RISHO KOGYO CO., LTD

- Shandong Golding Electronics Materials Co., Ltd

- SHENGYI TECHNOLOGY CO., LTD.

- Shin-Etsu Polymer Co., Ltd.

- SOPREMA

- Sumitomo Bakelite Co., Ltd.

- Toray Industries, Inc.

Offering actionable guidance for industry leaders to harness innovations, manage tariff impacts, enhance market positioning, and drive sustainable growth

Offering actionable guidance for industry leaders to harness innovations, manage tariff impacts, enhance market positioning, and drive sustainable growth, the following recommendations provide a strategic roadmap. First, prioritize investment in green resin chemistries that reduce dependency on tariff-exposed monomers and align with evolving environmental regulations; co-development partnerships can accelerate commercialization timelines and share R&D risk.

Second, enhance supply chain resilience by diversifying sourcing strategies, including qualification of regional resin suppliers and exploration of hybrid procurement models that balance cost, quality, and lead times. Scenario planning across tariff and trade policy landscapes will enable rapid decision-making in response to sudden regulatory shifts.

Third, leverage digital tools for end-to-end process optimization, from precision coating automation to advanced analytics for quality assurance. Adoption of integrated data platforms will uncover efficiency gains, reduce material waste, and support predictive maintenance in high-volume coating lines.

Finally, refine market segmentation strategies by aligning resin and form factor innovations with high-growth application sectors, and develop tailored value propositions for each distribution channel. Strengthening technical support capabilities and customer engagement through virtual demonstration platforms will drive conversion and client retention in a competitive environment.

Outlining the research design, data collection approaches, analytical techniques, and quality controls that underpin robust bonding sheet market insights

Outlining the research design, data collection approaches, analytical techniques, and quality controls that underpin robust bonding sheet market insights, the methodology section ensures comprehensive rigour. The study commenced with an exhaustive review of publicly available technical literature, patent filings, regulatory publications, and trade association reports to map core technological trends and materials advancements.

Primary data collection involved structured interviews with adhesive formulators, OEM engineers, procurement managers, and distribution executives across key regions. These in-depth discussions provided clarity on performance requirements, sourcing criteria, and end-user challenges. Complementary surveys captured quantitative perspectives on technology adoption rates, channel preferences, and regional demand patterns.

Data triangulation was achieved by cross-referencing secondary intelligence with proprietary shipment and import/export statistics. Advanced analytical techniques, including segmentation modeling and scenario analysis, were applied to identify inflection points and evaluate the cumulative economic impact of tariff measures. Quality assurance protocols entailed multi-tier validation by industry experts and iterative review cycles to confirm the accuracy and relevance of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bonding Sheet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bonding Sheet Market, by Resin Type

- Bonding Sheet Market, by Technology

- Bonding Sheet Market, by Form

- Bonding Sheet Market, by Application

- Bonding Sheet Market, by End User

- Bonding Sheet Market, by Channel

- Bonding Sheet Market, by Region

- Bonding Sheet Market, by Group

- Bonding Sheet Market, by Country

- United States Bonding Sheet Market

- China Bonding Sheet Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing the critical findings and overarching trends to crystallize the strategic implications and future outlook for bonding sheet industry stakeholders

Summarizing the critical findings and overarching trends elucidates how sustainability drivers, automation technologies, and regulatory shifts are converging to redefine bonding sheet applications across industries. Environmental mandates and customer sustainability goals have catalyzed the development of low-emission and bio-based chemistries, positioning green adhesives as a growth imperative. Concurrently, digital automation and advanced coating methodologies are enhancing production efficiency, precision, and quality control in high-volume manufacturing environments.

The analysis also highlights the strategic importance of mitigating 2025 tariff impacts through diversified sourcing, domestic supplier qualification, and resin innovation. Region-specific insights underscore varied adoption curves, with mature markets in the Americas and EMEA emphasizing performance and compliance, while Asia Pacific continues to drive volume growth and cost optimization. Leading companies are responding through targeted acquisitions, co-development partnerships, and digital engagement platforms to meet evolving end-user demands.

These findings reinforce the need for agile strategic planning, investment in sustainable materials, and deep customer collaboration to capture emerging opportunities and navigate market complexities. As the bonding sheet sector advances, stakeholders equipped with these insights will be poised to implement innovative solutions that drive operational excellence and competitive differentiation.

Take decisive action now and connect with Ketan Rohom to secure your comprehensive bonding sheet market research report and drive informed decision-making

Act now to elevate your strategic initiatives by gaining access to comprehensive insights into bonding sheet innovations and market dynamics. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to tailor a research package that addresses your unique challenges and opportunities within the bonding sheet sector. By leveraging expert analysis on resin types, application trends, tariff implications, and competitive landscapes, you will be equipped to make informed decisions that accelerate growth and enhance operational resilience. Reach out to arrange a personalized briefing or to purchase the full market research report and secure a competitive advantage in a rapidly evolving industry.

- How big is the Bonding Sheet Market?

- What is the Bonding Sheet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?