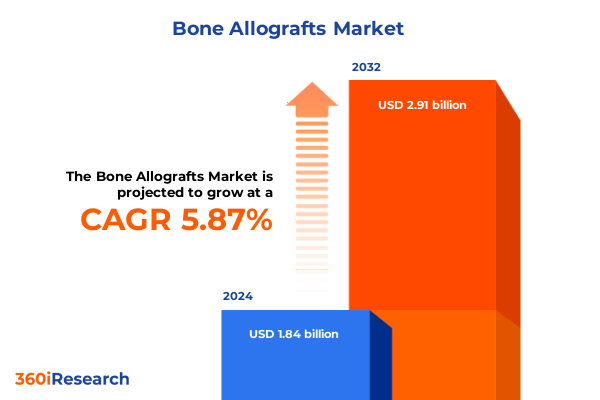

The Bone Allografts Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.05 billion in 2026, at a CAGR of 5.93% to reach USD 2.91 billion by 2032.

A clear, contemporary framing of how clinical demand, tissue science, and supply complexity are redefining bone allograft selection and use

The bone allograft landscape intersects clinical need, tissue‑banking science, and supply chain complexity in ways that are reshaping clinical pathways and commercial strategies. Surgeons and hospital systems continue to favor biologic materials that replicate the triad of osteogenic cells, osteoconductive scaffolds, and osteoinductive signals, while advancements in preservation and processing have broadened product availability and handling characteristics. At the same time, tighter regulatory attention, evolving standards for tissue banking, and supply chain pressures have elevated the importance of validated quality systems and multi‑site sourcing strategies.

Taken together, these forces mean that product selection is no longer determined solely by historical preference; decision‑makers now weigh handling and logistical convenience, demonstrated biological activity, and the compatibility of graft formats with minimally invasive and outpatient procedures. Transitional care models and a growing emphasis on value-based outcomes are pushing clinicians toward graft solutions that can reduce operative time, lower revision rates, and support faster rehabilitation. The introduction of viable cellular allografts and novel DBM carriers is therefore not merely an incremental shift but a structural change in how regenerative options are matched to patient and procedural complexity.

How viable cellular grafts, DBM handling innovations, supply consolidation, and ambulatory shifts are jointly transforming clinical practice

The past five years have seen a cluster of transformative shifts that are changing the operative calculus for orthopedic and dental clinicians. First, the maturation of cellular and viable allograft technologies has created alternatives that bridge the biological gap between traditional allografts and autograft, enabling surgeons to consider off‑the‑shelf grafts for procedures that previously required patient harvest. Second, product format innovation-particularly within demineralized bone matrix formulations and moldable composites-has materially improved intraoperative handling, allowing more consistent packing of irregular defects and reducing time in the operating room.

Concurrently, consolidation across tissue banks and strategic partnerships between biologics specialists and implant OEMs have concentrated capabilities, increased distribution scale, and accelerated product development cycles. These organizational changes are accompanied by more prescriptive tissue banking standards and renewed public attention to traceability, which together raise the bar for new entrants. Finally, clinical pathways are shifting as more procedures move to ambulatory settings; this operational trend favors grafts that offer extended shelf stability, simplified logistics, and robust surgeon training resources. The aggregate effect is a market that rewards biologic performance, proven handling characteristics, and operational reliability.

Evaluating the 2025 tariff environment that elevated input costs and forced manufacturers and tissue banks to overhaul sourcing and operational strategies

Policy and trade developments in 2025 introduced a sustained layer of cost and operational uncertainty for medical manufacturers and implant suppliers, with downstream implications for allograft logistics and pricing. Tariff actions targeted at a range of imports have increased the cost of key components, packaging substrates, and ancillary instrumentation for many medtech and biologics producers, prompting manufacturers to reassess sourcing, nearshore production strategies, and contract terms with hospital systems. Several large medical product firms have reported material tariff headwinds to operating margins and have signaled that cost pass‑through or production relocation may be necessary to preserve supply continuity and margins.

For tissue banks and allograft providers this policy environment translates into higher landed costs for imported materials and equipment, potential delays in qualification of alternate suppliers, and greater incentive to onshore critical steps such as sterilization and packaging. The net result is a tactical reorientation: organizations are prioritizing dual‑sourcing, investing in domestic capacity where feasible, and renegotiating supply agreements to include tariff‑related escalation clauses. Clinically, the immediate effects include tighter inventory buffers for specialized graft formats and a renewed emphasis from procurement departments on total cost of care analyses when evaluating allograft options. These dynamics are likely to persist while trade policy remains fluid, so industry leaders must bake tariff scenarios into near‑term commercial and operational planning.

A segmentation‑driven synthesis showing how product type, application, end‑user, graft source, and processing determine clinical choice and commercial strategy

Clinical adoption patterns must be understood through multiple, intersecting segmentation lenses that determine product preference, handling needs, and procurement logistics. Product type distinctions-between cellular allografts, demineralized bone matrix, and structural allografts-drive both the clinical indication and the intraoperative handling profile, with demineralized bone matrix occupying an important role because its powder, putty, and sheet forms are frequently selected for complex dental and spinal procedures requiring conformable carriers. Application segmentation clarifies where biologic performance is most valued: dental procedures such as ridge augmentation and sinus lift demand particulate and putty formulations optimized for minimally invasive delivery, while joint reconstruction and trauma cases rely on structural and corticocancellous formats to balance load sharing and biological incorporation.

End‑user context further refines selection, as ambulatory surgical centers typically prioritize shelf‑stable freeze‑dried formats and simplified handling to support higher procedural throughput, whereas hospitals and specialty clinics often adopt fresh‑frozen or irradiated options for higher‑acuity or revision surgeries. The source of the graft-cancellous, cortical, or corticocancellous-intersects with the processing type; for example, cancellous material may be favored when rapid revascularization is the clinical objective, while cortical or corticocancellous forms are selected where mechanical strength and structural support are primary concerns. Understanding these overlapping segments enables suppliers to tailor product portfolios, packaging, and training programs to the distinct procurement and clinical workflows of each customer cohort. Statements about handling, format preference, and end‑user behavior are well documented in product literature and clinical communications from major allograft and orthobiologic manufacturers.

This comprehensive research report categorizes the Bone Allografts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Processing Type

- Format

- Biologic Mechanism

- Donor Source

- Application

- End User

How divergent healthcare systems and reimbursement models shape distinct regional adoption patterns across the Americas, EMEA, and Asia‑Pacific

Regional dynamics are shaped by heterogenous healthcare infrastructures, reimbursement practices, and surgical mix, producing distinct demand drivers across the Americas, Europe–Middle East–Africa, and Asia‑Pacific. In the Americas, advanced hospital systems, well‑established tissue banking networks, and a concentrated base of high‑volume spine and joint reconstruction centres create strong adoption currents for advanced cellular grafts and versatile DBM formats. Europe, the Middle East, and Africa present a mosaic of regulatory regimes and procurement models; here, demand is shaped by national reimbursement policies, varying adoption rates for novel biologics, and an emphasis on demonstrable safety and traceability.

Asia‑Pacific is characterized by rapid infrastructure investment and expanding procedural volumes, particularly in China, India, and parts of Southeast Asia, which is increasing demand for both cost‑effective structural allografts and higher‑value biologic formats as surgical capacity grows. Across regions, clinicians and procurement leaders share common priorities-assured supply, validated sterilization and traceability, and evidence of clinical benefit-but the route to adoption differs. In practice, this means product launches and commercial playbooks must be localized: pricing models, distribution partnerships, and clinician education programs require regional tailoring to be effective. Evidence of regional commercialization activity and launch cadence among leading tissue suppliers supports these regional distinctions.

This comprehensive research report examines key regions that drive the evolution of the Bone Allografts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A concise analysis of how nonprofit tissue banks, biologics innovators, and medtech integrators are shaping competitive advantages and partnership strategies

Competitive dynamics in the allograft space now reflect a mix of mission‑driven tissue organizations, specialized biologics innovators, and large medtech firms that integrate allografts into broader procedural service lines. Nonprofit and mission‑oriented tissue banks continue to play a pivotal role in supply stability and research funding, advancing translational projects and granting awards that accelerate clinical validation for new allograft forms. At the same time, surgical implant companies and orthobiologics specialists have strengthened their portfolios through strategic acquisitions and distribution partnerships that expand their reach into dental, spine, and trauma segments.

Recent acquisitions and product launches illustrate a market that values vertical capability and cross‑discipline collaboration: manufacturers are investing to combine processing scale, regulatory expertise, and surgeon education to expedite adoption. This interplay between specialist tissue processors and established medtech channels increases barriers for smaller entrants but also opens opportunities for focused innovators who can demonstrate clear clinical differentiation or cost‑effective handling advantages. Consolidation and strategic partnering are therefore key commercial levers influencing competitive positioning and future product roadmaps. Industry announcements and operator filings confirm this consolidation trend and the strategic logic behind it.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bone Allografts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Medical Solutions Group plc

- AlloSource

- Arthrex, Inc.

- Baxter International Inc.

- Biomatlante

- Biowy Corporation

- botiss biomaterials GmbH

- Cerapedics Inc.

- Geistlich Pharma AG

- Globus Medical, Inc.

- HANSAmed Ltd.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- KLS Martin SE & Co. KG

- Kuros Biosciences A.G.

- Medtronic PLC

- Nobel Biocare Services AG

- Orthofix Medical Inc.

- Pinnacle Transplant Technologies

- Smith & Nephew PLC

- Straumann Holding AG

- Stryker Corporation

- Surgical Esthetics Biomedical

- SURGILOGIX

- TBF Tissue Engineering

- VIVEX Biologics, Inc.

- Xtant Medical

- Young Innovations, Inc.

- Zimmer Biomet

- ZimVie Inc.

Practical, executable steps industry leaders must take now to build supply resilience, regulatory readiness, and differentiated clinical value

Industry leaders should prioritize a short list of near‑term actions to navigate regulatory scrutiny, tariff volatility, and evolving clinical preferences while positioning for long‑term growth. First, invest in validated quality systems and comprehensive traceability infrastructures that align with updated tissue banking standards and reduce commercial friction during tendering and hospital credentialing. Second, build flexible supply architectures that combine domestic processing capacity with vetted international partners, and include contractual protections for tariff and trade disruptions. Third, develop differentiated clinical dossiers that go beyond preclinical metrics to document real‑world performance, perioperative efficiencies, and downstream cost offsets that resonate with value‑based purchasers.

Additionally, establish modular training and onboarding programs for surgeons and ASC staff that demonstrate the handling advantages of specific graft formats and reduce variation in technique. Finally, leaders should evaluate adjacent product and service offerings-such as integrated fixation systems, biologic carriers, or instrumentation bundles-that create procedural packages and deepen institutional relationships. These steps will help organizations to preserve market access, defend margins, and accelerate adoption in an environment where purchasers increasingly seek total‑cost and outcome transparency.

An evidence‑based methodology combining primary company materials, authoritative standards, clinical literature, and scenario analysis to validate conclusions

The underlying research methodology employed for this analysis combined a structured review of primary industry announcements and standards, targeted product literature, and secondary literature focused on tissue processing, clinical adoption, and trade policy. Primary sources included press releases and technical documentation from leading tissue banks and device manufacturers, as well as standards and guidance documents issued by recognized tissue banking organizations. Secondary literature was reviewed to validate processing characteristics and clinical performance considerations, and to understand the operational implications of trade and tariff developments.

Analyst synthesis integrated qualitative interviews with industry stakeholders and a cross‑validation process that compared company disclosures, regulatory guidance, and peer‑reviewed summaries to ensure that conclusions reflect documented activity rather than conjecture. Wherever possible, statements about processing, clinical indications, and regulatory shifts were corroborated against authoritative sources, and scenario analysis was used to articulate plausible operational responses to tariff volatility and supply‑chain disruption. The research deliberately avoided granular market sizing or forecast models in this executive summary and focused instead on directional, evidence‑based insights and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bone Allografts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bone Allografts Market, by Product Type

- Bone Allografts Market, by Processing Type

- Bone Allografts Market, by Format

- Bone Allografts Market, by Biologic Mechanism

- Bone Allografts Market, by Donor Source

- Bone Allografts Market, by Application

- Bone Allografts Market, by End User

- Bone Allografts Market, by Region

- Bone Allografts Market, by Group

- Bone Allografts Market, by Country

- United States Bone Allografts Market

- China Bone Allografts Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

A forward‑looking conclusion that ties together biological advances, regulatory rigor, and commercial imperatives shaping the allograft sector now and into the near future

The bone allograft sector stands at an inflection point where biological innovation, operational rigor, and commercial strategy converge. Advances in viable cellular grafts and adaptable DBM carriers are responding directly to clinical needs for more predictable healing and simplified handling, while strengthened tissue banking standards and supply consolidation are raising expectations for safety and performance. Parallel pressures from trade policy and hospital procurement objectives are forcing suppliers to rethink sourcing and partnership models to maintain access and margin.

For stakeholders across the value chain the implication is clear: success will accrue to organizations that combine demonstrable biologic performance with robust quality systems, flexible supply architectures, and disciplined commercial engagement that proves value in the clinical setting. Those that fail to invest in traceability, surgeon education, and tariff‑resilient operations risk losing preferred status in procurement processes that increasingly emphasize total cost, clinical outcomes, and supply assurance. The path forward is strategic, evidence‑driven, and operationally demanding, and it rewards organizations that treat clinical efficacy and commercial reliability as inseparable priorities.

Arrange a personalized purchasing consultation with an Associate Director to secure the complete market report and tailored post-sale support options

To request the full, in-depth market research report and obtain customizable data packages, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can guide prospective buyers through report options, licensing terms, and bespoke research add-ons. Ketan will coordinate access to segmented intelligence, competitive benchmarking modules, and enterprise licensing that align with strategic commercial timelines. The outreach process is designed to respect confidentiality and can be tailored for executive briefings, technical deep dives, or distribution partnerships.

Prospective purchasers will be offered a short demo of the report’s structure and sample pages demonstrating methodology, key identifier tables, and the actionable playbooks that underpin the findings. A consultative pre-purchase call will identify which chapters and data layers are most relevant for organizational priorities, whether that is product innovation, regulatory preparedness, supply chain resilience, or go-to-market expansion. After purchase, Ketan will facilitate post-sale support, including optional analyst Q&A sessions and custom data extracts to accelerate internal decision cycles.

Engage now to secure priority access to ancillary datasets and workshop hours that are sometimes allocated on a first-come, first-served basis for clients seeking rapid implementation. Contact Ketan to schedule a purchasing consultation or to arrange a confidential preview of chapter highlights and executive workshops.

- How big is the Bone Allografts Market?

- What is the Bone Allografts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?