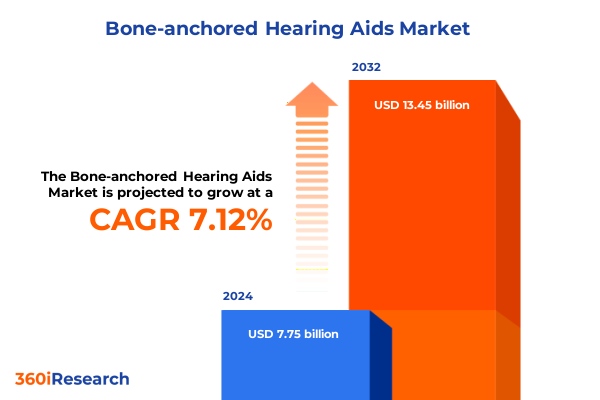

The Bone-anchored Hearing Aids Market size was estimated at USD 8.22 billion in 2025 and expected to reach USD 8.71 billion in 2026, at a CAGR of 7.28% to reach USD 13.45 billion by 2032.

Exploring the Current Terrain of Bone-Anchored Hearing Solutions and the Critical Role They Play in Modern Audiology Practice

Bone-anchored hearing aids represent a critical intersection of surgical innovation and auditory rehabilitation, offering life-changing solutions for individuals with conductive hearing loss, mixed hearing loss, or single-sided deafness. Unlike traditional air-conduction devices, these systems bypass the outer and middle ear by transmitting sound vibrations directly to the skull, providing a clearer auditory experience for patients with anatomy or clinical conditions that preclude standard hearing aids. Over the past decade, the field has witnessed a meaningful shift toward minimally invasive procedures and patient-centric device designs, underscoring the importance of collaborative efforts among audiologists, surgeons, and manufacturers to address evolving clinical needs.

As demographic trends and heightened awareness of hearing health continue to drive demand, the regulatory environment and reimbursement frameworks have become increasingly important in determining patient access and provider adoption. Amid these changes, both active and passive transcutaneous implants, as well as percutaneous systems, are competing on parameters such as sound quality, surgical ease, and long-term outcomes. The growing emphasis on remote fitting, wireless connectivity, and smart features further positions bone-anchored technology at the forefront of audiology practice. Ultimately, understanding the interplay of clinical, technological, and regulatory factors is essential for stakeholders aiming to navigate this rapidly advancing market.

How Technological Innovations and Strategic Collaborations Are Redefining the Bone-Anchored Hearing Aid Landscape Across the Globe

Recent years have demonstrated transformative shifts in the bone-anchored hearing aid landscape, driven by breakthroughs in actuator technology and platform versatility. Manufacturers have introduced active transcutaneous implants that integrate microprocessor-driven transducers directly beneath the skin, substantially improving sound fidelity and reducing skin reaction risks compared to earlier percutaneous systems. Parallel to this, passive transcutaneous models have gained traction among clinicians seeking MRI-compatible solutions that simplify postoperative imaging while maintaining unfaltering audio performance. These innovations are reshaping surgical protocols and postoperative care, as evidenced by landmark product launches and updated clinical guidelines recommending tailored device selection based on individual patient anatomy and lifestyle requirements.

Strategic collaborations between medtech companies and academic institutions have further accelerated research into novel materials and surgical robotics, enhancing procedural precision and shortening operative times. User feedback is now being harnessed through integrated software platforms, enabling real-time device adjustments and remote support. Beyond clinical settings, emerging non-surgical bone conduction solutions, such as adhesive coupling systems and softband options, are broadening the addressable patient pool by offering low-risk alternatives for pediatrics and patients with contraindications to surgery. Taken together, these developments illustrate a market in flux, with a clear progression toward personalized, data-driven hearing care.

Evaluating the Far-Reaching Effects of the 2025 United States Tariff Policies on Bone-Anchored Hearing Aid Supply Chains and Costs

The United States’ tariff policies enacted in early 2025 have introduced significant considerations for the bone-anchored hearing aid supply chain and cost structure. A 10% tariff on Chinese medical device imports, coupled with targeted increases on select components, has heightened attention on sourcing strategies for titanium abutments, precision audio processors, and specialized implant fixtures. These measures, part of broader Section 301 actions announced in September 2024, imposed additional duties ranging from 25% to 100% on critical materials such as surgical instruments and textile consumables, impacting manufacturers who rely on cross-border shipments for both finished goods and subassemblies.

Although many companies had anticipated gradual cost escalation and pursued mitigations-such as nearshoring production or entering tariff exclusion processes-the accelerated timeline and expanded scope of the 2025 adjustments have necessitated rapid reassessment of procurement and pricing models. Payors and healthcare providers are closely monitoring these developments, as increased import duties have the potential to translate into higher device acquisition costs and pressures on reimbursement rates. In response, some leading OEMs have prioritized supply chain diversification, expanding manufacturing footprints in North America and Europe to cushion the impact of ongoing trade tensions. Such strategic pivots are essential not only for compliance but also for preserving patient access and maintaining competitive positioning in an environment where cost containment remains paramount.

Uncovering Critical Segmentation Patterns That Illuminate Diverse Patient Needs and Guide Strategic Positioning in Bone-Anchored Hearing Markets

In examining market segmentation for bone-anchored hearing aids, it is imperative to recognize how implant type, device type, application, distribution channel, end user, and patient age group each define distinct value propositions and adoption patterns. Active transcutaneous implants are frequently positioned toward patients seeking maximal audio clarity and long-term durability, while passive transcutaneous options may appeal to individuals prioritizing ease of imaging and lower soft tissue complications. Patients who opt for percutaneous systems often cite straightforward surgical protocols and historical familiarity with the technology when making their decisions.

Within device categories, abutments serve as the critical osseointegrated anchor point, audio processors deliver the signal processing intelligence, and implant fixtures ensure stable bone integration. This functional differentiation influences not only clinical selection but also aftermarket service models and warranty structures. When considering clinical indications, the technology mix shifts: conductive hearing loss cases often drive preferences for robust, surgical solutions; mixed hearing loss requires adaptable algorithms and power management; and single-sided deafness underscores the importance of binaural processing techniques and sound localization capabilities.

Distribution channels further shape adoption curves, as ENT clinics offer specialized fitting expertise, hospitals provide integrated surgical services and postoperative support, and online retail platforms enable direct-to-consumer accessibility for non-surgical solutions. In turn, end users-from outpatient clinics and homecare settings to large hospital systems-balance the trade-offs between in-clinic customization and patient convenience. Age group segmentation intersects with these dynamics, as adults may prioritize discreet design and mobile connectivity, geriatrics often focus on ease of handling and fall-risk mitigation, and pediatric cases demand minimally invasive approaches and durable retention systems.

This comprehensive research report categorizes the Bone-anchored Hearing Aids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Implant Type

- Device Type

- Age Group

- Distribution Channel

- Application

- End User

Mapping Regional Dynamics Across the Americas, EMEA, and Asia-Pacific to Identify Growth Opportunities in Bone-Anchored Hearing Solutions

Regional dynamics in the bone-anchored hearing aid market reveal unique opportunities and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, advanced healthcare infrastructure and well-established reimbursement pathways foster high device penetration, particularly in the United States where ENT specialists and audiology centers form robust referral networks. Meanwhile, Canada’s public healthcare system offers universal coverage for many implantable solutions, driving stable year-over-year adoption within a mature regulatory environment.

Across Europe, Middle East & Africa, reimbursement policies vary widely: Western European countries often provide comprehensive coverage, enabling clinicians to adopt cutting-edge active transcutaneous systems, whereas emerging economies in Eastern Europe and parts of the Middle East may lean toward cost-efficient percutaneous models. Africa as a whole is characterized by nascent market development but increasing collaboration between governments and NGOs to address hearing loss as a public health priority.

In Asia-Pacific, rapid urbanization and expanding private healthcare sectors are catalyzing growth. Japan has updated national insurance rules to include specific indications for bone-anchored implants, while Australia’s classification of these devices as standard auditory implants has improved approval timelines. China and India present vast untapped potential, with rising awareness campaigns and local manufacturing ventures aimed at reducing dependence on imports. Each region’s regulatory nuances, payer landscapes, and clinical training requirements must be considered to tailor market entry and expansion strategies effectively.

This comprehensive research report examines key regions that drive the evolution of the Bone-anchored Hearing Aids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Companies Driving Bone-Anchored Hearing Aid Innovation and Their Strategic Moves in a Competitive Global Arena

The competitive landscape of bone-anchored hearing aids is dominated by a handful of multinational and specialized players, each leveraging unique strengths to drive innovation. Cochlear Limited, an Australian pioneer, continues to lead with its BAHA and Osia product lines, supported by a global distribution network and ongoing investments in active osseointegration research. Oticon Medical, part of Demant A/S in Denmark, has carved a niche with its Ponto range and passive transcutaneous solutions, emphasizing MRI compatibility and streamlined surgical workflows. The company’s targeted acquisitions and collaborative research efforts have reinforced its position among clinicians seeking reliable and patient-friendly implant options.

MED-EL, headquartered in Austria, offers the Bonebridge active bone conduction implant and the ADHEAR non-surgical system, underscoring its commitment to diversifying treatment modalities and enhancing patient comfort. Medtronic’s Sophono brand focuses on magnetic coupling technology, catering to patients who require minimally invasive options without percutaneous abutments. Additionally, emerging entrants and allied audio solution providers-such as Sonova (Advanced Bionics), WS Audiology (Signia), and Starkey-are expanding their footprints through AI-driven sound processors and strategic partnerships with healthcare institutions. This competitive tapestry compels all players to refine their value propositions, optimize supply chains, and invest in post-market surveillance to maintain differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bone-anchored Hearing Aids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AudioBone

- Aurica LLC

- BHM-Tech Produktionsgesellschaft mbH

- Cochlear Limited

- Demant Group

- Envoy Medical Corporation

- GN Hearing A/S

- HearNU

- MED-EL Elektromedizinische Geräte GmbH

- Medtronic plc

- Oticon Medical AB

- Sonitus Medical, Inc.

- Sonova

- Starkey Hearing Technologies

- WS Audiology A/S

Actionable Strategies for Industry Leaders to Navigate Market Complexities and Accelerate Adoption of Bone-Anchored Hearing Technologies

Industry leaders must adopt a multifaceted strategy to navigate the complexities of the bone-anchored hearing aid market. First, accelerating digital transformation through integrated remote fitting platforms and patient engagement apps can enhance post-implant rehabilitation outcomes and reduce in-person follow-up burdens. By leveraging data analytics from connected devices, manufacturers can continuously refine firmware updates, personalize sound profiles, and anticipate maintenance needs before they escalate.

Second, supply chain resilience is paramount in an environment of rising tariffs and geopolitical uncertainty. Building regional manufacturing hubs or forging partnerships with toll manufacturers in North America and Europe can mitigate import duties and shorten lead times. Concurrently, pursuing targeted tariff exclusion petitions for critical device components can preserve cost competitiveness while maintaining quality standards.

Third, industry stakeholders should refine their market segmentation strategies by aligning product portfolios with clinical pathways. Tailoring sales training to emphasize the clinical and lifestyle benefits of different implant types will enable field teams to engage effectively with ENT surgeons, audiologists, and payors. Collaborating with professional societies to develop updated procedural guidelines and surgeon training programs will also reinforce best practices and foster confident adoption of new technologies.

Finally, strengthening regional alliances through public-private initiatives and academic collaborations can expand awareness and reimbursement access. By participating in global consensus-building efforts and contributing to real-world evidence studies, companies can demonstrate value to payors, accelerate regulatory approvals, and broaden patient reach across diverse healthcare ecosystems.

Detailing a Rigorous Mixed-Methodology Approach That Ensures Robust, Reliable Insights into Bone-Anchored Hearing Aid Market Dynamics

Our research methodology combines both primary and secondary approaches to ensure comprehensive, accurate insights into the bone-anchored hearing aid market. The initial phase involved a systematic review of peer-reviewed literature, regulatory filings, and public financial disclosures to map the landscape of implant and audio processor technologies. This desk research included examination of Section 301 tariff notices, professional society guidelines, and global reimbursement policy documents to contextualize cost and access dynamics.

In the primary research stage, we conducted in-depth interviews with key opinion leaders, including otologists, audiologists, clinical trial investigators, and supply chain executives. These discussions provided direct perspectives on surgical preferences, device performance in real-world settings, and strategic responses to emerging tariff challenges. Additionally, we surveyed device distributors and healthcare administrators across multiple regions to gauge market demand, channel preferences, and patient demographics.

Data triangulation was performed by cross-referencing findings from primary interviews with secondary data points such as device approval timelines, clinical trial registries, and published case studies. Quantitative analyses of shipment volumes and product registrations helped validate qualitative insights, while regional regulatory expertise ensured accurate interpretation of policy shifts. Finally, continuous engagement with industry forums and trade associations allowed for real-time updates and scenario planning, reinforcing the robustness and reliability of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bone-anchored Hearing Aids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bone-anchored Hearing Aids Market, by Implant Type

- Bone-anchored Hearing Aids Market, by Device Type

- Bone-anchored Hearing Aids Market, by Age Group

- Bone-anchored Hearing Aids Market, by Distribution Channel

- Bone-anchored Hearing Aids Market, by Application

- Bone-anchored Hearing Aids Market, by End User

- Bone-anchored Hearing Aids Market, by Region

- Bone-anchored Hearing Aids Market, by Group

- Bone-anchored Hearing Aids Market, by Country

- United States Bone-anchored Hearing Aids Market

- China Bone-anchored Hearing Aids Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Highlight the Evolutionary Trajectory and Future Imperatives for Bone-Anchored Hearing Solutions

In synthesizing our findings, it is clear that bone-anchored hearing aids stand at the cusp of a new era defined by technological sophistication, patient-centric customization, and resilient supply chain architectures. The proliferation of active transcutaneous implants and non-surgical adhesive solutions underscores the market’s commitment to broadening patient access and reducing clinical risk. At the same time, the strategic ripple effects of 2025 tariff policies have catalyzed a recalibration of manufacturing footprints and procurement strategies, compelling stakeholders to pursue both nearshoring and tariff exclusion pathways.

Segmentation insights reveal that tailored product offerings-whether by implant type, device function, clinical application, distribution channel, end user, or patient age group-are imperative for resonating with diverse clinician and consumer needs. Regional analysis highlights the importance of navigating varied reimbursement landscapes, from the mature systems of North America and Western Europe to the emerging opportunities in Asia-Pacific and parts of EMEA. Competitive profiling illustrates that innovation leadership and strategic partnerships will continue to differentiate top players in an otherwise consolidated arena.

Ultimately, this comprehensive overview emphasizes an evolutionary trajectory toward integrated, data-enabled hearing care, supported by adaptive strategies that address clinical, regulatory, and economic forces. Stakeholders who proactively embrace digital capabilities, reinforce supply chain agility, and align their offerings with precise market segments will be best positioned to capture growth in this dynamic field.

Engage Directly with Associate Director of Sales & Marketing to Secure Your Comprehensive Market Intelligence Report on Bone-Anchored Hearing Technologies

Ready to gain a competitive edge in the rapidly evolving bone-anchored hearing aid market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your full market intelligence report today. Ketan stands ready to provide you with tailored insights, answer your questions, and guide your team through the process of acquiring the comprehensive analysis you need to make informed strategic decisions. Don’t miss the chance to empower your organization with the latest data and expert perspectives-contact Ketan now to discuss how this report can support your business objectives and drive growth in this dynamic sector.

- How big is the Bone-anchored Hearing Aids Market?

- What is the Bone-anchored Hearing Aids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?