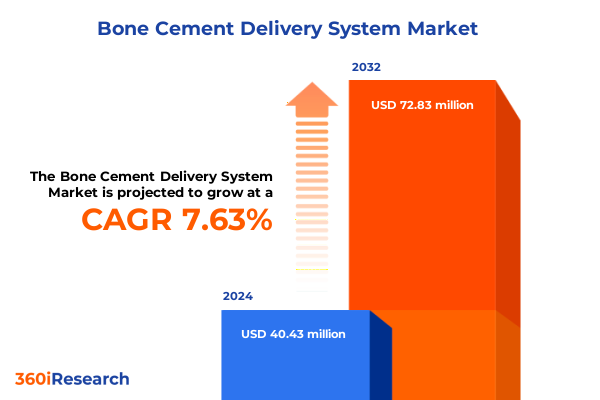

The Bone Cement Delivery System Market size was estimated at USD 43.59 million in 2025 and expected to reach USD 46.61 million in 2026, at a CAGR of 7.60% to reach USD 72.83 million by 2032.

Strategic Overview of the Bone Cement Delivery System Market Landscape Emphasizing Innovation Trends, Clinical Adoption Drivers, and Technological Advancements

In the rapidly evolving world of orthopedic and dental therapeutics, bone cement delivery systems have emerged as critical enablers of surgical success and patient satisfaction. Driven by an aging global population and rising prevalence of musculoskeletal disorders, clinicians and healthcare administrators alike are demanding solutions that offer consistency, safety, and streamlined workflows. Advancements in material science have yielded formulations that provide optimized viscosity, rapid in situ curing, and enhanced biocompatibility, addressing the inherent challenges of both load-bearing joint replacement procedures and minimally invasive spinal interventions. Moreover, the integration of automation and digital monitoring in delivery platforms has elevated the standard of procedural reproducibility, reducing human variability and improving overall clinical outcomes. As surgical case volumes continue their upward trajectory-with projections forecasting significant increases in both hip and knee arthroplasties by 2025-stakeholders are compelled to reassess their strategies for selecting and deploying bone cement systems that align with evolving clinical protocols and regulatory landscapes. The convergence of demographic imperatives, surgical innovation, and quality assurance frameworks underpins the modern bone cement delivery ecosystem, making it essential for industry participants to maintain a forward-looking perspective on emerging trends and technology adoptions.

Unprecedented Paradigm Shifts Redefining Bone Cement Delivery Systems Through Automation, Integration of Digital Surgical Guidance, and Patient-Specific Formulation Innovations

Traditional manual approaches to bone cement preparation are giving way to sophisticated, automated systems that deliver reproducibility at every stage of the mixing and application process. Automated mixing platforms now offer pre-programmed cycles that ensure precise cement viscosity and setting profiles, virtually eliminating the inconsistency that can arise from manual techniques. Simultaneously, vacuum mixing solutions are achieving broader adoption in operating theaters, as they effectively remove entrapped air and microvoids, resulting in formulations with superior mechanical integrity and predictable performance under load. Beyond mixing, the embedding of smart sensors and digital analytics into delivery syringes and applicators has unlocked real-time monitoring of critical parameters such as temperature, pressure, and cure kinetics. This data-driven paradigm empowers clinicians to make intraoperative adjustments and contributes to institutional quality assurance initiatives by capturing procedural metadata. Furthermore, the advent of robotic-assisted and image-guided delivery systems is redefining precision, enabling targeted cement placement in complex spinal vertebroplasty procedures or anatomically challenging joint revisions. Together, these transformative shifts reflect a broader movement toward integrated, bespoke workflows that harmonize advanced materials, intelligent hardware, and surgical navigation to enhance patient safety and clinical efficacy.

Assessment of the Cumulative Effects of 2025 United States Tariff Measures on Raw Material Sourcing, Pricing Dynamics, and Strategic Manufacturers’ Responses in Bone Cement Delivery Systems

In 2025, United States tariff actions targeting key polymer precursors and radiopaque additives have materially influenced bone cement delivery system supply chains. Adjustments to import duties on polymethyl methacrylate monomers and related compounds have generated acute cost pressures for manufacturers who traditionally rely on Asian and European suppliers. The resulting duty increases-ranging between six and seven percent for acrylic polymers under HTS code 3906.10, and in some cases as high as 25 percent on non-NAFTA-compliant formulations-have translated into short-term price volatility across the market. Beyond immediate cost impacts, these tariff measures have accelerated capacity expansions within domestic polymerization facilities, as leading vendors seek to insulate their operations from external supply disruptions. At the same time, smaller innovators have explored alternative formulation chemistries that reduce dependency on tariff-exposed feedstocks, fostering a wave of R&D investment in novel copolymers and bioactive cement blends. On the demand side, hospitals and surgical centers have recalibrated multi-year procurement contracts to incorporate tariff-adjusted pricing clauses, while distributors are leveraging digital sourcing platforms to optimize cost efficiency and traceability. Collectively, the 2025 tariff landscape has not only reshaped pricing dynamics but also catalyzed strategic realignment among suppliers, emphasizing supply security, domestic capacity building, and chemistry diversification as pillars of long-term resilience.

In-Depth Examination of Key Market Segmentation Dimensions Highlighting Variances in Delivery Systems, Clinical Applications, End Users, and Material Types Across Healthcare Settings

A nuanced understanding of the market requires segmentation across multiple dimensions. When evaluating by delivery system type, the contrast between automated mixing platforms, ergonomic hand mixing kits, and low-air vacuum blenders underscores distinct value propositions related to throughput, capital investment, and clinical preference. In terms of applications, the bone cement market serves diverse procedural contexts-ranging from dental restorations in endodontics and implantology to high-load-bearing hip, knee, and shoulder replacements, and minimally invasive spinal kyphoplasty and vertebroplasty interventions, as well as complex external and internal trauma fixation procedures. Each subapplication demands tailored rheological and handling characteristics, which in turn influence product design and user training requirements. From the perspective of end users, differences in purchasing behavior and usage volume between ambulatory surgical centers, specialized clinics, and hospital-based operating rooms drive unique pricing strategies and service models. Lastly, material type segmentation-encompassing calcium phosphate variants like brushite and hydroxyapatite, alongside polymethyl methacrylate options that include both antibiotic-loaded and standard formulations-reflects divergent needs for bioactivity, infection control, and mechanical support. These four segmentation axes collectively frame a multi-dimensional market matrix, guiding portfolio optimization and go-to-market planning without oversimplification of user requirements.

This comprehensive research report categorizes the Bone Cement Delivery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Delivery System Type

- Material Type

- Application

- End User

Critical Regional Analysis Revealing Market Trajectories for Bone Cement Delivery Systems Across Americas, Europe Middle East Africa, and Asia Pacific Health Infrastructure Segments

Regional dynamics reveal differentiated growth trajectories driven by healthcare funding, infrastructure maturity, and policy frameworks. In the Americas, the combination of well-established orthopedic surgery centers and robust reimbursement mechanisms has sustained high adoption rates for premium delivery solutions, while consolidated distribution networks ensure wide availability of both standard and advanced cement formulations. Europe, Middle East & Africa reflects a heterogeneous landscape in which tier-one markets in Western Europe lead on automated and vacuum mixing adoption, and emerging economies in the Middle East and North Africa demonstrate rapid uptake of basic hand mixing systems as surgical volumes expand. Across Asia-Pacific, government-led investments in hospital modernization, coupled with the rising prevalence of osteoporosis and trauma cases, are fueling demand for integrated delivery systems, with China and Japan acting as regional innovation hubs. Local manufacturing partnerships and technology transfer agreements are also reshaping competitive dynamics, enabling cost-optimized solutions tailored to regional clinical protocols and budgetary constraints. These key regional insights guide market entry strategies, alliance considerations, and distribution channel development based on distinct healthcare ecosystem characteristics.

This comprehensive research report examines key regions that drive the evolution of the Bone Cement Delivery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Enterprises Shaping the Bone Cement Delivery System Ecosystem Through Innovation, Collaboration, and Competitive Positioning in 2025

Major players are leveraging strategic initiatives to fortify their market positions. Leading orthopedic device companies have expanded their product suites through in-house R&D as well as targeted acquisitions, enabling end-to-end solutions that combine bone cement with delivery hardware and digital analytics services. Cross-sector collaborations between polymer specialists and medical device firms have accelerated the roll-out of antibiotic-loaded and bioactive cement platforms optimized for specific clinical use cases. Venture-backed newcomers are challenging incumbents by introducing disruptive copolymer chemistries and point-of-care mixing innovations designed to reduce inventory complexity. In parallel, distributors and OEMs are forging value-added service agreements-spanning equipment maintenance, on-site technical training, and digital service subscriptions-to enhance customer retention and differentiate through post-sales support. Partnerships with contract research organizations and hospital networks also facilitate clinical data generation, driving product validation and broader acceptance among key opinion leaders. These strategic moves underscore a competitive ecosystem marked by convergence between material science, device engineering, and service-based business models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bone Cement Delivery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arthrex, Inc.

- B. Braun Melsungen AG

- DePuy Synthes, Inc.

- Enovis Corporation

- Exactech, Inc.

- Heraeus Medical GmbH

- IZI Medical

- Medacta International SA

- Medmix Systems AG

- Medtronic plc

- OSARTIS GmbH

- OsteoMed L.P.

- Shandong Weigao Group Medical Polymer Co., Ltd.

- Smith & Nephew plc

- Stryker Corporation

- Tecres S.p.A.

- XLO

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Recommendations for Industry Leaders to Enhance Competitiveness, Drive Innovation, and Mitigate Supply Chain and Regulatory Risks in Bone Cement Delivery Systems

To navigate evolving market complexities, industry leaders should prioritize the integration of advanced analytics within their delivery platforms, harnessing real-time usage and performance data to optimize procedural protocols and demonstrate clinical value. Investment in domestic manufacturing capabilities-particularly for critical polymer precursors and radio-opacity additives-can mitigate tariff exposure and strengthen supply chain resilience. Engaging early with regulatory agencies to align on emerging standards for bioactive and antibiotic-loaded cements will expedite product approvals and market penetration. Collaboration with healthcare providers on training programs and digital workflow solutions can reinforce end-user loyalty and highlight operational efficiencies. In parallel, pursuing strategic partnerships with specialized material suppliers and AI-driven analytics providers will enable differentiated offerings and support lifecycle management of delivery assets. Finally, adopting a customer-centric approach that bundles product innovation with advisory services and outcome-based contracting can elevate pricing power and accelerate adoption of next-generation bone cement delivery technologies.

Comprehensive Overview of Research Methodology Incorporating Robust Primary and Secondary Data Collection, Expert Validation, and Rigorous Analytical Frameworks Ensuring Report Credibility

This report’s methodology combines comprehensive secondary research, including peer-reviewed journals, regulatory filings, and industry publications, with primary insights derived from structured interviews with orthopedic surgeons, device engineers, procurement executives, and supply chain managers. Data from public and proprietary databases were triangulated to validate market trends, technology adoption rates, and competitive landscapes. Qualitative assessments were supported by expert panel workshops to refine scenario analyses and stress-test key assumptions under varying regulatory and tariff conditions. The analysis was conducted following established best practices, including rigorous source verification, iterative review cycles, and alignment with global classification standards for medical devices and biomaterials. Market segmentation matrices were constructed through cross-referencing product registries and usage pattern data, while regional evaluations incorporated macroeconomic indicators, healthcare expenditure metrics, and infrastructure development indices to ensure robust contextualization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bone Cement Delivery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bone Cement Delivery System Market, by Delivery System Type

- Bone Cement Delivery System Market, by Material Type

- Bone Cement Delivery System Market, by Application

- Bone Cement Delivery System Market, by End User

- Bone Cement Delivery System Market, by Region

- Bone Cement Delivery System Market, by Group

- Bone Cement Delivery System Market, by Country

- United States Bone Cement Delivery System Market

- China Bone Cement Delivery System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Insights Summarizing Key Findings on Market Dynamics, Strategic Imperatives, and Future Outlook for Bone Cement Delivery Systems in Evolving Healthcare Environments

In summary, the bone cement delivery system market stands at an inflection point driven by demographic pressures, material science breakthroughs, and digital technology integration. The strategic implications of 2025 U.S. tariff measures have underscored the importance of supply chain agility and domestic capability expansion, while segmentation insights reveal diverse user needs across delivery types, applications, end-user settings, and material preferences. Regional analyses highlight distinctive dynamics in mature and emerging healthcare markets, guiding tailored market access strategies. Leading companies are responding through collaborative innovation, value-added service models, and strategic partnerships, setting the stage for accelerated adoption of next-generation delivery solutions. By implementing the actionable recommendations outlined herein, stakeholders can position their offerings for sustained growth and heightened clinical impact in an increasingly competitive landscape.

Engaging Invitation to Connect with Associate Director Sales Marketing Ketan Rohom for Tailored Market Research Solutions on Bone Cement Delivery Systems

To explore unparalleled insights into bone cement delivery system dynamics, secure your comprehensive market research report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, for a tailored consultation that addresses your organization’s strategic objectives and information needs. Connect with Ketan to discuss customized data packages, subscription options, and bespoke advisory services designed to empower informed decision-making. Take this opportunity to gain a competitive edge in the evolving bone cement landscape by leveraging expert guidance and proprietary analysis tailored to your business goals.

- How big is the Bone Cement Delivery System Market?

- What is the Bone Cement Delivery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?