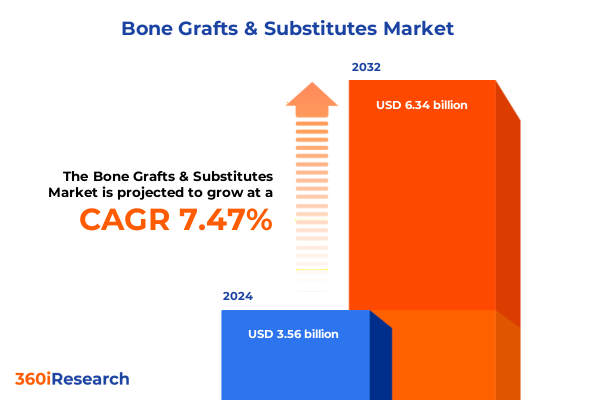

The Bone Grafts & Substitutes Market size was estimated at USD 3.80 billion in 2025 and expected to reach USD 4.07 billion in 2026, at a CAGR of 7.56% to reach USD 6.34 billion by 2032.

Shaping the Future of Skeletal Repair: A Comprehensive Overview of Innovations, Challenges, and Growth Drivers in Bone Grafts and Substitutes

The intersection of demographic shifts, technological advancements, and evolving clinical needs is rapidly reshaping the landscape of skeletal repair. As the global population ages and incidences of osteoporosis and traumatic injuries rise, the demand for effective bone regeneration solutions has never been more acute. In parallel, healthcare providers continue to advocate for improved patient outcomes, shorter hospital stays, and cost containment, placing unprecedented pressure on implant manufacturers to deliver next-generation grafts and substitutes.

Against this backdrop of rising clinical demand and operational constraints, innovation in biomaterials and surgical techniques has emerged as a pivotal growth driver. From the refinement of demineralized bone matrices to the engineering of advanced synthetic scaffolds with biomimetic properties, breakthroughs in material science are unlocking new therapeutic possibilities. Additionally, the integration of digital diagnostics and minimally invasive procedures is enabling surgeons to tailor interventions more precisely, enhancing both safety and efficacy.

Taken together, these converging forces underscore the critical importance of comprehensive market insights. Stakeholders must navigate a complex array of product platforms, regulatory pathways, and pricing pressures to capitalize on emerging opportunities. This executive summary offers a strategic lens on the Bone Grafts & Substitutes sector, distilling key trends, segmentation dynamics, and actionable recommendations to guide informed decision-making.

From Biologics to Biomimetics: Unprecedented Technological and Clinical Shifts Redefining Bone Graft and Substitute Therapies

The past five years have witnessed transformative shifts in both the technological and clinical paradigms governing bone graft therapies. A surge in biologic innovations, including recombinant growth factors and cellular constructs, has elevated the therapeutic potential of allograft and synthetic alternatives. These advances are complemented by the advent of biomimetic scaffolds that replicate native bone architecture at the micro scale, thereby accelerating osteointegration and patient recovery.

Moreover, the convergence of 3D printing and composite biomaterials is revolutionizing the customization of graft shapes and porosities, enabling patient-specific implants that conform precisely to defect geometries. In tandem, the rise of minimally invasive delivery systems has reduced surgical trauma and postoperative complications, bolstering surgeon confidence and expanding the addressable patient pool. Regulatory agencies have responded by streamlining approval pathways for well-characterized materials and fostering collaborative dialogues on clinical trial design.

As digital health platforms gain traction, real-time intraoperative imaging and data analytics are further refining procedural accuracy and outcome monitoring. This holistic integration of material science, digital innovation, and regulatory alignment is redefining the competitive frontier in bone graft technologies and solidifying the market’s trajectory toward increasingly sophisticated, patient-centric solutions.

Navigating the Impact of 2025 United States Trade Policies: Comprehensive Analysis of Tariff Shifts Affecting Bone Graft Materials

In 2025, United States trade policy introduced new tariff considerations that carry significant implications for the procurement and pricing of bone graft and substitute materials. Building on broader medical device trade reviews, these measures target specific categories of imported graft substrates and scaffold precursors. As a result, manufacturers and healthcare providers face elevated landed costs, prompting a recalibration of supply chain strategies and vendor partnerships.

These tariff adjustments have a twofold impact. On one hand, increased import duties on raw biomaterials challenge margin structures for distributors who rely on offshore production hubs. On the other hand, heightened costs create a strategic tailwind for domestic manufacturers, encouraging investment in local production capabilities and vertical integration. Consequently, several leading suppliers have accelerated expansions of U.S.-based facilities to mitigate exposure to import levies and to reinforce supply chain resilience.

Looking ahead, industry stakeholders must adopt proactive measures to navigate this shifting terrain. Collaborative engagement with customs authorities, strategic diversification of sourcing channels, and reassessment of contract pricing models will be essential. By anticipating potential regulatory updates and aligning procurement processes with evolving trade frameworks, organizations can safeguard profitability and ensure uninterrupted access to critical graft technologies.

Decoding Market Diversification: In-Depth Insights into Bone Graft Segmentations by Graft Type, Material, Form, Application, and End User

Understanding market segmentation is essential for identifying growth arenas and tailoring go-to-market strategies within the bone grafts and substitutes domain. When examining products by graft type, allograft offerings benefit from established clinical track records, whereas autograft continues to set the performance benchmark despite sourcing constraints. Synthetic platforms, in contrast, distinguish themselves through scalable manufacturing and tunable resorption profiles, while xenografts present a niche option grounded in proprietary decellularization methods.

Delving deeper, materials such as beta tricalcium phosphate and calcium phosphate form the backbone of cost-effective synthetic matrices, delivering consistent biocompatibility and osteoconductivity. Composite constructs marry the strengths of multiple inorganic phases, and demineralized bone matrix harnesses the biological potency of native collagen and growth factors. In parallel, form factors influence surgical workflows; block geometries provide structural support in load-bearing contexts, gels facilitate minimally invasive injections, granules adapt to irregular defect sites, and putty formulations combine ease of handling with defect filling versatility.

Clinical applications span dental augmentation, joint reconstruction, and orthopedic trauma, with spinal fusion emerging as a high-value segment subdivided into cervical, lumbar, and thoracic procedures according to anatomical requirements. Finally, end users range from high-volume hospitals-encompassing private and public institutions-to ambulatory surgical centers and specialized clinics, each exhibiting unique procurement preferences, procedural volumes, and reimbursement frameworks. This layered segmentation approach equips decision-makers with the granularity needed to optimize portfolio positioning and resource allocation.

This comprehensive research report categorizes the Bone Grafts & Substitutes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Graft Type

- Material

- Form

- Application

- End User

Global Landscape Dissected: Key Regional Perspectives and Emerging Opportunities Across Americas, EMEA, and Asia-Pacific in Bone Grafts

Regional dynamics play a pivotal role in shaping the competitive and regulatory environments for bone grafts and substitutes. In the Americas, the United States market leads in procedural volume and reimbursement complexity, driven by a high incidence of spinal fusion and trauma surgeries, while Canada follows with a more centralized procurement framework that emphasizes cost containment. Latin American markets are gradually embracing advanced graft technologies as healthcare infrastructure investments expand, yet variable regulatory pathways and import considerations introduce timing and pricing challenges.

Across Europe, the Middle East, and Africa, Western Europe remains a mature landscape with stringent regulatory standards and consolidated distributor networks, fostering incremental innovation in biomaterials. The United Kingdom’s post-Brexit realignment has introduced trade nuances, while emerging markets in the Gulf Cooperation Council are prioritizing medical tourism, creating pockets of accelerated adoption. In Africa, clinical uptake is nascent, hindered by limited specialist facilities and fragmented procurement, though philanthropic initiatives and public-private partnerships are helping to bridge treatment gaps.

The Asia-Pacific region exhibits a duality of markets: established economies such as Japan and Australia enforce rigorous quality frameworks and drive demand for premium graft substitutes, whereas markets like China and India scale rapidly through growing orthopedic caseloads and local manufacturing expansion. Government-backed healthcare reforms and localized production incentives further propel adoption, underscoring the region’s status as a critical growth frontier for leading and emerging suppliers alike.

This comprehensive research report examines key regions that drive the evolution of the Bone Grafts & Substitutes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Frontiers: Profiling Leading Innovators and Emerging Players Driving Advances in the Bone Grafts and Substitutes Sphere

A diverse array of incumbent leaders and agile challengers defines the competitive topology of the bone grafts and substitutes space. Major medical device corporations leverage extensive R&D pipelines, established distribution networks, and integrated sales channels to reinforce their leadership in allograft and synthetic segments. They continue to invest in next-generation materials, including growth factor-enhanced matrices and bioresorbable polymers, while forging strategic alliances with biotech firms to accelerate clinical translation.

Concurrently, specialized innovators have emerged with differentiated portfolios centered on proprietary decellularization protocols, ceramic composites, and advanced carrier formulations that optimize cellular interactions. These agile entrants differentiate through rapid regulatory navigation and targeted clinical studies, enabling them to penetrate horizontal segments such as spinal fusion and dental augmentation. A subset of start-ups is also exploring tissue engineering platforms that deliver autologous cell therapies combined with scaffold technologies, signaling a potential paradigm shift toward regenerative medicine offerings.

Amid this dynamic environment, contract manufacturers and materials science experts play a critical role by providing scalable production capabilities and advanced characterization services. Their contributions underpin the commercialization viability of both established products and nascent technologies, helping manufacturers to mitigate development risk and accelerate time to market. This collaborative ecosystem of global leaders, niche specialists, and manufacturing partners shapes the contours of competition and innovation in the bone grafts landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bone Grafts & Substitutes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlloSource, Inc.

- Anand Mediproducts Pvt Ltd

- Arthrex, Inc.

- Baxter International Inc

- Bioventus

- Danaher Corporation

- Encore Medical Corporation

- Geistlich Pharma AG

- Graftys SA

- Institut Straumann AG

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- MedBone Biomaterials

- Medtronic PLC

- Musculoskeletal Transplant Foundation

- Nuvasive, Inc.

- Orthofix Holdings, Inc.

- OST Développement

- RTI Surgical, Inc.

- SigmaGraft Inc.

- Smith & Nephew, PLC

- Southern Implants

- Stryker Corporation

- TBF Tissue Engineering

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives for Industry Stakeholders: Actionable Recommendations to Thrive Amid Evolving Bone Graft Market Dynamics

To thrive amid the evolving bone grafts and substitutes environment, industry leaders must adopt a multifaceted strategic approach. First, investing in R&D collaborations between materials scientists, bioengineers, and clinical researchers will be crucial for driving breakthrough performance in osteoinductive and osteoconductive platforms. By fostering partnerships that bridge academic discoveries with commercial capabilities, organizations can accelerate the bench-to-bedside translation of next-generation graft solutions.

Second, enhancing supply chain agility through dual-sourcing strategies and localized manufacturing hubs will mitigate risks associated with tariff fluctuations and geopolitical disruptions. Companies should conduct scenario planning to evaluate alternative logistics routes and supplier diversification, ensuring uninterrupted access to critical biomaterials and minimizing cost volatility. Parallel to this, engaging proactively with regulatory authorities to clarify classification criteria and expedite review processes can reduce time to market and support premium pricing.

Finally, aligning commercial strategies with targeted segmentation insights-such as prioritizing high-value spinal fusion applications or partnering with ambulatory surgical centers for minimally invasive procedures-will drive optimized resource allocation. Tailoring value propositions to the specific procurement and clinical priorities of end users enables differentiated positioning and sustained revenue growth. By integrating innovation, operational resilience, and market precision, stakeholders can secure long-term leadership in this dynamic sector.

Rigorous and Transparent Research Foundations: Methodological Framework Underpinning the Comprehensive Bone Grafts and Substitutes Study

This study draws upon a robust methodological framework designed to ensure comprehensive, reliable, and actionable insights. Beginning with an extensive secondary research phase, analysts reviewed peer-reviewed journals, regulatory filings, industry reports, and corporate disclosures to map the technological landscape, reimbursement paradigms, and competitive activity. Key information from trade associations, government databases, and patent registries provided a foundational understanding of market drivers and barriers.

Subsequently, primary research was conducted through structured interviews and surveys with a cross-section of stakeholders, including orthopedic and dental surgeons, procurement executives, materials science experts, and policy makers. These engagements yielded qualitative perspectives on clinical adoption trends, purchasing behaviors, and innovation priorities. Data triangulation techniques were employed to validate findings across multiple independent sources, enhancing the credibility and accuracy of the analyses.

Quantitative modeling incorporated scenario-based analyses and sensitivity tests to examine the impact of tariff changes, regional variations, and segmentation shifts on market dynamics. Rigorous data quality controls, including consistency checks and peer reviews, were applied throughout the research lifecycle. This transparent and methodical approach underpins the integrity of the insights presented in this executive summary and ensures that stakeholders can rely on the findings to inform strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bone Grafts & Substitutes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bone Grafts & Substitutes Market, by Graft Type

- Bone Grafts & Substitutes Market, by Material

- Bone Grafts & Substitutes Market, by Form

- Bone Grafts & Substitutes Market, by Application

- Bone Grafts & Substitutes Market, by End User

- Bone Grafts & Substitutes Market, by Region

- Bone Grafts & Substitutes Market, by Group

- Bone Grafts & Substitutes Market, by Country

- United States Bone Grafts & Substitutes Market

- China Bone Grafts & Substitutes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Insights and Forward Outlook: Concluding Perspectives on the Evolving Trajectory of Bone Grafts and Substitutes

The evolving bone grafts and substitutes market stands at the intersection of pressing clinical needs, rapid technological progress, and shifting trade environments. Innovative materials and advanced manufacturing methods are redefining therapeutic standards, while regional diversification and tariff considerations are reshaping supply chain strategies. Segmentation analyses reveal intricate dynamics across graft types, biomaterials, delivery forms, clinical applications, and end-user channels, emphasizing the importance of a targeted approach to portfolio development and market entry.

Competitive landscapes are increasingly characterized by collaboration between established medical device leaders, specialized biomaterials developers, and manufacturing service providers, signaling a move toward integrated solutions that span from raw materials to tailored surgical kits. Strategic recommendations highlight the necessity of aligning R&D investments with clinical value propositions, bolstering operational resilience against trade policy shifts, and calibrating commercialization strategies to nuanced regional and end-user demands.

As stakeholders navigate this multifaceted environment, a clear, data-driven perspective is indispensable. The insights provided here offer a strategic roadmap to identify high-value opportunities, mitigate emerging risks, and foster sustained innovation. By leveraging these findings, decision-makers can position their organizations to deliver superior patient outcomes, drive competitive differentiation, and capitalize on the full potential of the bone grafts and substitutes ecosystem.

Empowering Decision-Makers with Tailored Insights: Engage with Ketan Rohom to Secure Your Definitive Bone Grafts Market Research Report

We invite decision-makers and market experts to take the next strategic step in cementing their competitive edge in the bone grafts and substitutes domain by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom’s in-depth knowledge of market dynamics, coupled with his experience in tailoring insights to specific business objectives, ensures that your organization receives a comprehensive, actionable intelligence package.

By partnering with Ketan Rohom, stakeholders gain a personalized consultation to align the research findings with their unique strategic priorities. Whether refining product pipelines, identifying optimal partnership opportunities, or calibrating pricing strategies amidst evolving trade policies, this engagement unlocks the full potential of the market report. Take advantage of this opportunity to secure a definitive intelligence resource that goes beyond generic analyses and supports informed, high-impact decisions.

- How big is the Bone Grafts & Substitutes Market?

- What is the Bone Grafts & Substitutes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?