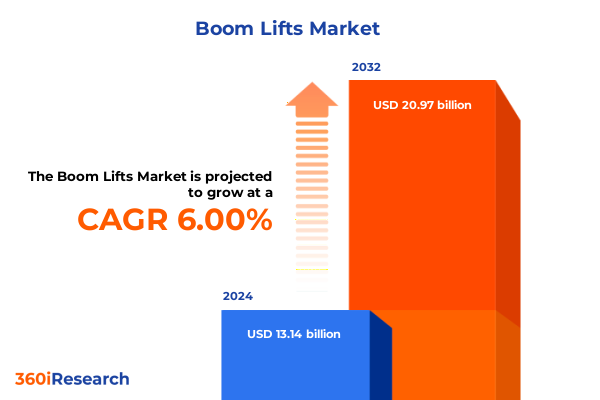

The Boom Lifts Market size was estimated at USD 13.95 billion in 2025 and expected to reach USD 14.82 billion in 2026, at a CAGR of 7.37% to reach USD 22.97 billion by 2032.

Unveiling Core Market Drivers Shaping the Future of Boom Lift Deployment Across Construction and Industrial Applications

The global boom lift sector has undergone remarkable evolution over the last decade, driven by rapid technological advancements and shifting operational requirements in end-use industries. In construction, maintenance, entertainment and energy applications, the demand for flexible access solutions capable of reaching elevated work sites with precision and safety has never been more pronounced. As project specifications grow increasingly complex, boom lift manufacturers are investing in innovations that enhance reach, maneuverability and operator control. Moreover, environmental imperatives and regulatory standards have heightened the appeal of electric and hybrid powertrains, prompting a transition away from traditional diesel platforms. These dynamics have established a foundation for accelerated adoption across both established and emerging markets.

Initial market momentum stemmed from robust infrastructure investment in North America and Europe, where both public and private stakeholders recognized the efficiency gains associated with hydraulic aerial platforms. Concurrently, Asia-Pacific markets leveraged localized manufacturing and competitive pricing to deploy high volumes of equipment in expanding construction and warehouse automation projects. Meanwhile, end users have increasingly sought digitally enabled solutions that integrate telematics, real-time diagnostics and predictive maintenance capabilities. This convergence of operational, environmental and digital factors sets the stage for a new era of boom lift deployment, characterized by smarter, greener and more cost-effective workflows.

How Electrification, Telematics and Modular Engineering Have Transformed Boom Lift Capabilities and Deployment

Recent years have witnessed transformative shifts redefining how boom lifts are designed, manufactured and utilized on job sites worldwide. Foremost among these is the proliferation of electric and hybrid power systems, which reduce greenhouse gas emissions and satisfy stringent emissions regulations in urban and indoor settings. Whereas a decade ago diesel remained the workhorse for heavy-duty lifts, the rising performance of lithium-ion battery systems and expanded charging infrastructure have made electric models viable alternatives for routine maintenance and light to mid-range height requirements. In parallel, telematics platforms now offer unprecedented transparency into equipment utilization, fuel efficiency and maintenance scheduling. This digital integration not only boosts lifecycle management but also drives operational cost savings by minimizing unplanned downtime.

In addition, manufacturers have embraced modular design philosophies, enabling rapid customization of platform heights, outreach capabilities and accessory configurations. Innovations in lightweight, high-strength materials have further enhanced lift capacity without proportionally increasing machine weight, thereby improving transport efficiency and operator safety. Beyond product features, the rise of rental and subscription models has upended traditional purchasing paradigms, allowing end users to scale their fleets dynamically in response to project demand. Taken together, these advances are catalyzing a shift from purely utility-focused equipment to intelligent, service-driven solutions that support predictive maintenance, remote diagnostics and real-time resource allocation.

Assessing the Complex Ripple Effects of 2025 Steel and Aluminum Tariffs on Boom Lift Manufacturing and Cost Structures

The introduction of United States tariff measures in 2025 has exerted a cumulative impact on the boom lift supply chain, reshaping cost structures and regional sourcing strategies. With tariffs imposed on certain steel and aluminum imports, manufacturers have faced increased raw material expenses. This escalation has driven leading OEMs to reevaluate procurement networks, shifting to domestic mill partnerships and diversifying supplier portfolios across Asia and Europe to mitigate exposure. Meanwhile, the knock-on effects have rippled through component pricing-hydraulic fittings, chassis assemblies and powertrain elements have experienced incremental cost inflation, prompting manufacturers to optimize designs for material efficiency and to accelerate the adoption of advanced alloys that deliver comparable strength at reduced volume.

Concurrently, the tariff environment has prompted localized assembly and light manufacturing initiatives within the United States. Companies with established production footprints have accelerated capacity expansions in Ohio, Texas and Georgia, leveraging incentives offered by state economic development agencies. By increasing domestic value-add operations, these manufacturers have partially sheltered themselves from tariff pass-through effects. However, secondary impacts persist; rental firms and end users continue to contend with elevated leasing rates and purchase prices, which in turn influence fleet composition decisions. As the industry adapts to this tariff landscape, stakeholders are focusing on collaborative strategies-such as bulk purchasing agreements and long-term supplier partnerships-to stabilize cost trajectories and safeguard profitability.

Deep Dive into Product, Powertrain, Height, End-User, Application, and Sales Channel Segmentation Narratives

A multidimensional segmentation framework reveals nuanced insights into how various boom lift categories perform under different market conditions. Product type segmentation distinguishes articulating, hybrid and telescopic platforms as fulfilling distinct operational roles: articulating lifts excel in confined spaces and intricate outreach tasks, telescopic variants deliver superior height and horizontal reach for large-scale construction, and hybrid models blend electric drive flexibility with diesel-grade power for mixed work environments. Engine type segmentation highlights a pronounced shift toward electric solutions-lead-acid and lithium-ion systems are rapidly gaining traction in indoor and noise-sensitive applications-while diesel platforms, spanning Tier 1-2 and Tier 3-4 configurations, remain preferred for heavy-load, outdoor projects. Gasoline engines, segmented by power output above and under 50 horsepower, maintain a niche presence in specialized tasks where portability and rapid refueling are paramount.

Platform height segmentation uncovers that models within the 31-40 and 41-60 foot ranges account for the majority of rentals in maintenance and entertainment sectors, whereas lifts above 60 feet are indispensable in infrastructure builds and oil & gas operations. The up-to-30-foot category continues to dominate indoor facilities management, particularly in warehousing and retail environments. End-user segmentation reflects enduring leadership by construction firms, yet a rising share of revenue is attributed to entertainment production and industrial maintenance projects. Application segmentation underscores a nearly balanced split between indoor and outdoor deployments, with seasonal demand shifts shaping utilization cycles. Finally, sales channel segmentation points to the growing prominence of rental services-both long-term and short-term-alongside direct OEM sales via authorized dealerships and digital platforms, signaling a diversification of go-to-market strategies across the value chain.

This comprehensive research report categorizes the Boom Lifts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Engine Type

- Platform Height

- End User

- Application

- Sales Channel

Uncovering Distinct Regional Growth Drivers and Deployment Trends Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics underscore the heterogeneous nature of boom lift adoption across the globe. In the Americas, the United States leads with sustained construction spending and infrastructure upgrades fueling demand for heavy-duty telescopic and hybrid models, while in Central and South America, incremental growth is driven by urban development and resource extraction projects requiring rugged outdoor lifts. Across Europe, Middle East & Africa, stringent environmental regulations in Western Europe have catalyzed widespread uptake of electric and lead-acid configurations, whereas in the Middle East, oil & gas sector expansion sustains a robust market for high-capacity diesel and Tier 3-4 platforms. Africa’s nascent infrastructure agenda is beginning to harness articulated and up-to-30-foot units for building maintenance and telecommunications tower installations.

In the Asia-Pacific region, China’s rapid urbanization and manufacturing scale continue to dominate global production and consumption of boom lifts, with local OEMs increasingly capturing market share through cost-competitive offerings. India’s infrastructure push and renewable energy installations have stimulated demand for specialty lifts above 60 feet, while Australia and Japan emphasize safety and operator ergonomics, driving innovation in telematics integration and operator assistance systems. Meanwhile, Southeast Asian markets are progressively investing in rental fleets to support seasonal construction peaks and industrial maintenance cycles. These region-specific patterns highlight that supply chain localization, regulatory frameworks and end-user priorities collectively shape the deployment strategies of market participants across geographies.

This comprehensive research report examines key regions that drive the evolution of the Boom Lifts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Market Leadership Dynamics and Competitive Differentiation Strategies Among Global and Regional Boom Lift Manufacturers

Competitive analysis reveals a landscape dominated by a handful of global players alongside agile regional specialists. Leading OEMs such as Terex’s Genie division have fortified their product portfolios with electric and lithium-ion models, leveraging extensive service networks to maintain strong aftermarket revenues. JLG, now part of Oshkosh Corporation, continues to expand its hybrid lift lineup while investing heavily in telematics platforms to offer predictive maintenance solutions. Haulotte has emphasized cost-effective modular platforms, optimizing material usage to deliver competitive pricing, especially in Europe and Asia. Skyjack has carved out a niche with simplified electronics and robust steel-fabricated chassis, appealing to rental operators favoring reliability and ease of maintenance.

Beyond these frontrunners, several specialized manufacturers are gaining traction in targeted segments. Companies based in Germany and Italy are focusing on ultra-compact articulating lifts with advanced safety systems, catering to the indoor and urban maintenance markets. Chinese OEMs are scaling up production of hybrid and diesel models, leveraging lower manufacturing costs to undercut established brands in emerging economies. Meanwhile, North American rental conglomerates are consolidating equipment fleets through strategic partnerships with OEMs to secure favorable procurement terms. Collectively, these competitive maneuvers illustrate a market in which technological differentiation, service excellence and supply chain resilience determine long-term positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boom Lifts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Changzhou Sinoboom Equipment Co., Ltd.

- Haulotte Groupe SA

- JLG Industries, Inc.

- Manitou BF SA

- MEC Aerial Work Platforms Inc.

- Skyjack Inc.

- Terex Corporation

- XCMG Construction Machinery Co., Ltd.

- Zhejiang Dingli Machinery Co., Ltd.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Strategic Imperatives for OEMs to Enhance Innovation, Digital Service Offerings, and Supply Chain Resilience in Boom Lift Markets

Industry leaders seeking to capitalize on emerging opportunities should prioritize a multi-pronged strategic agenda focused on innovation, supply chain resilience and customer engagement. First, accelerating research and development investments in next-generation battery chemistries and lightweight materials will address the dual imperatives of emissions reduction and performance enhancement. Simultaneously, embracing digital services-such as remote diagnostics, automated maintenance alerts and fleet utilization analytics-will enable service providers to transition from reactive field support to proactive uptime optimization.

Comprehensive Dual-Method Research Framework Combining Executive Interviews and Secondary Data Analysis to Validate Market Insights

The research approach underpinning this analysis integrates both primary and secondary methodologies to ensure rigorous triangulation of findings. Primary data collection involved in-depth interviews with senior industry executives, including product development heads, rental fleet managers and end-user procurement officers. These insights provided qualitative perspectives on emerging technology adoption, procurement patterns and regional regulatory impacts. Complementing this, a comprehensive secondary review of trade publications, regulatory filings and financial disclosures from leading manufacturers furnished quantitative context on material costs, sales channel performance and competitive investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boom Lifts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boom Lifts Market, by Product Type

- Boom Lifts Market, by Engine Type

- Boom Lifts Market, by Platform Height

- Boom Lifts Market, by End User

- Boom Lifts Market, by Application

- Boom Lifts Market, by Sales Channel

- Boom Lifts Market, by Region

- Boom Lifts Market, by Group

- Boom Lifts Market, by Country

- United States Boom Lifts Market

- China Boom Lifts Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Market Transformation Themes to Guide Equipment Providers in Adapting to a Sustainable and Digitally-Driven Boom Lift Ecosystem

In summary, the boom lift market is at an inflection point where sustainability, digital innovation and strategic supply chain adaptations intersect to create new value propositions for end users and equipment providers alike. Technological advances in electric powertrains and telematics are redefining product expectations, while tariff-driven cost pressures are reshaping sourcing and manufacturing architectures. Differential growth trajectories across product types, platform heights and global regions emphasize the need for targeted strategies that align with localized demand and regulatory environments. Moreover, market leadership will increasingly hinge on the ability to forge integrated service ecosystems that deliver uptime assurance, predictive maintenance and flexible access through rental and subscription models.

As the industry converges on these themes, stakeholders who proactively invest in advanced materials, digital services and strategic partnerships will position themselves for sustained competitive advantage. Ultimately, navigating this complex landscape requires an integrated approach that balances product innovation, operational excellence and customer-centric business models to meet the evolving demands of diverse end-use sectors.

Empower Decision-Making with a Personalized Consultation to Unlock Strategic Insights from the Complete Boom Lift Market Research Report

Ready to elevate your strategic vision and secure in-depth insights into the global boom lift market? Contact Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance and a comprehensive briefing on how this research can empower your decision-making and drive your competitive advantage.

- How big is the Boom Lifts Market?

- What is the Boom Lifts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?