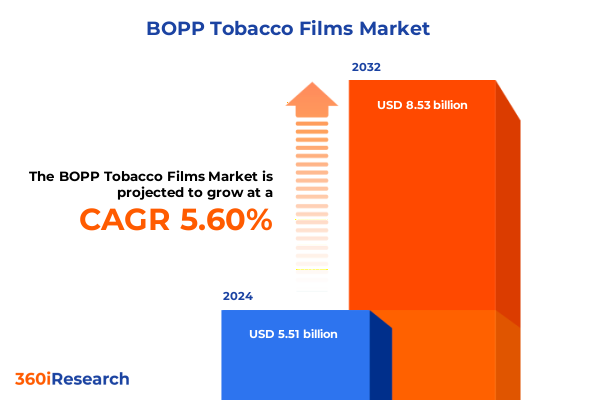

The BOPP Tobacco Films Market size was estimated at USD 12.55 billion in 2025 and expected to reach USD 13.77 billion in 2026, at a CAGR of 10.81% to reach USD 25.77 billion by 2032.

Establishing the Context and Importance of BOPP Tobacco Films in Modern Tobacco Packaging and Emerging Global Supply Chain Dynamics

Biaxially oriented polypropylene (BOPP) tobacco films have emerged as a cornerstone of modern tobacco packaging due to their exceptional barrier properties, versatility, and aesthetic appeal. In an era where regulatory scrutiny and consumer expectations are intensifying, these films play a pivotal role in preserving product freshness, enhancing shelf presence, and ensuring compliance with evolving health and safety standards. Beyond their functional advantages, BOPP tobacco films also contribute to brand differentiation through advanced printing capabilities, enabling tobacco manufacturers and packaging converters to deliver visually compelling solutions that resonate with discerning consumers.

As the tobacco industry confronts mounting pressures-ranging from stringent environmental mandates to shifting consumer preferences toward sustainability-the significance of high-performance packaging materials has never been greater. BOPP tobacco films offer a blend of mechanical strength and moisture resistance that supports extended shelf life, while also providing opportunities for lightweighting and waste reduction. Furthermore, advancements in film technology have facilitated the development of specialized coatings and barrier enhancements, addressing the growing demand for product integrity and regulatory compliance.

This executive summary distills key findings from a comprehensive market study, offering a strategic lens through which decision-makers can evaluate current dynamics, anticipate future disruptions, and align their portfolios with emerging opportunities. By examining transformative market shifts, tariff impacts, segmentation nuances, regional outlooks, and competitive strategies, this document equips industry leaders with the insights necessary to navigate complexity and drive sustainable growth in the BOPP tobacco films sector.

Examining the Major Transformative Shifts Shaping the BOPP Tobacco Films Market Amid Sustainability, Innovation, and Regulatory Evolution

The BOPP tobacco films landscape is undergoing a profound metamorphosis driven by a convergence of sustainability imperatives, digital innovation, and regulatory evolution. Firstly, environmental stewardship is reshaping production priorities, prompting manufacturers to integrate recycled content and explore bio-based alternatives. This shift is not merely a response to regulatory mandates; it reflects a broader industry commitment to circular economy principles, where resource efficiency and waste minimization generate tangible brand value. Concurrently, end-users are demanding transparency across the value chain, fostering traceability solutions that leverage digital tagging and blockchain platforms to authenticate origin and ensure compliance.

In parallel, technological advancements are catalyzing enhanced film functionalities. Coating technologies now deliver multi-layer barriers designed to inhibit moisture ingress and oxygen permeation, addressing critical shelf life requirements. Meanwhile, enhancements in film printing processes-such as high-definition rotogravure and flexographic techniques-enable intricate graphics and variable data printing, supporting anti-counterfeiting measures and dynamic marketing campaigns. Additionally, the integration of intelligent packaging elements, including QR codes and NFC tags, is creating new touchpoints for consumer engagement and post-purchase interaction.

Regulatory frameworks continue to evolve, with global jurisdictions imposing stricter labeling requirements and environmental regulations that directly influence packaging specifications. As a result, players must continuously adapt their materials portfolio to align with new mandates related to recyclability, migration limits, and chemical safety. By staying attuned to these transformative shifts, manufacturers, converters, and tobacco producers can proactively design robust strategies that mitigate risk and harness emerging opportunities.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on BOPP Tobacco Film Supply Chains and Cost Structures Worldwide

The escalation of United States tariffs on imported BOPP films in 2025 has introduced new complexities into global supply chains, compelling stakeholders to reassess sourcing strategies and cost structures. With duties applied at varying rates across product categories, importers have experienced pronounced input cost increases, prompting many to investigate near-shoring opportunities and diversify their supplier base. This redirection toward domestic and regional producers has strengthened local manufacturing ecosystems, yet has also placed pressure on capacity and led to competitive tensions in North American markets.

Furthermore, the tariff landscape has accelerated strategic partnerships between converters and film producers, as organizations seek to stabilize pricing and lock in long-term supply agreements under fixed-rate contracts. Such collaborations often incorporate joint investments in production capacity and technology upgrades, aiming to realize economies of scale and offset the financial burden of duties. Simultaneously, some market participants have explored alternative material blends and laminate structures to optimize performance while managing overall cost of ownership.

In addition to commercial adaptations, the tariff regime has influenced broader industry consolidation dynamics. Smaller suppliers facing margin pressures are evaluating merger and acquisition opportunities to attain critical mass and enhance resilience. Conversely, larger multinational firms are leveraging their integrated supply chains to absorb tariff impacts more effectively, reinforcing their competitive advantage. As the market continues to recalibrate, stakeholders who adopt agile sourcing frameworks and foster strategic alliances will be best positioned to navigate the ongoing tariff environment and sustain operational continuity.

Deriving Critical Segmentation Insights Across Film Type, Thickness, Application, and End User Dimensions in the BOPP Tobacco Films Market

Insights derived from the market’s segmentation by film type reveal distinct performance attributes and demand patterns. Metallized films maintain a strong foothold where oxygen barrier requirements are paramount, capitalizing on their reflective properties to extend product freshness. Transparent films, in contrast, are driving growth in premium packaging applications that emphasize visual inspection of tobacco contents, aligning with consumer preferences for authenticity. Meanwhile, white opaque films continue to support traditional branding strategies by providing a reliable, neutral canvas for high-contrast graphics and text.

When analyzing the thickness dimension, films within the 15 to 25 micron range emerge as a balanced choice, offering an optimal trade-off between mechanical integrity and material consumption. Those above 25 microns address specialized requirements for heavy-duty applications, where puncture resistance and tensile strength are critical. Conversely, sub-15 micron films are gaining traction in ultra-lightweight formats, facilitating reduced material usage and cost savings while still delivering essential barrier properties.

Application-focused segmentation underscores that cigarette cartons represent the largest end-use category, driven by premium product launches and anti-counterfeiting initiatives. Cigarette packs also remain significant, particularly where compact formats cater to on-the-go lifestyles. Loose tobacco bags are evolving, with customized film solutions integrating resealable features and enhanced barrier technologies to preserve aroma and flavor.

From an end-user perspective, cigarette manufacturers dominate consumption through direct procurement of high-performance films, whereas packaging converters play a crucial intermediary role by providing value-added services such as slitting and printing. Tobacco manufacturers are also exploring in-house envelopment solutions to optimize turnkey packaging operations and achieve greater control over material specifications.

This comprehensive research report categorizes the BOPP Tobacco Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Film Type

- Thickness

- Application

- End-Users

Uncovering Key Regional Insights Across the Americas, Europe Middle East and Africa, and Asia Pacific in the BOPP Tobacco Films Landscape

Regional analysis reveals diverse growth trajectories shaped by regulatory landscapes, consumer habits, and manufacturing capabilities. In the Americas, robust domestic production capacity and a focus on lightweighting initiatives are driving innovation in recyclable and biodegradable film formats. Investment flows into capacity expansion projects continue to favor integrated supply chains, where proximity to major tobacco manufacturing hubs enhances responsiveness and reduces lead times.

Europe, the Middle East, and Africa exhibit nuanced dynamics owing to stringent environmental regulations and varied economic conditions. In Western Europe, producers are leveraging advanced recyclability guidelines to develop mono-material solutions that simplify end-of-life recycling streams. Simultaneously, markets in the Gulf Cooperation Council are emerging as strategic export gateways, benefiting from favorable trade agreements and rising tobacco consumption levels. Across Africa, the nascent plastic processing industry is gradually scaling up, presenting both challenges in infrastructure and opportunities for capacity development.

The Asia-Pacific region remains a focal point for both production and consumption growth, underpinned by escalating demand in China, Southeast Asia, and India. Local manufacturers are increasingly investing in state-of-the-art extrusion lines and co-extrusion technologies to meet stringent local regulations and performance expectations. Partnerships between global and regional players are facilitating technology transfer and capacity building, while digitalization in manufacturing processes is enhancing product traceability and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the BOPP Tobacco Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Company Strategies and Competitive Dynamics Driving Innovation and Growth in the BOPP Tobacco Films Industry

Leading companies in the BOPP tobacco films sector are adopting multifaceted strategies to differentiate their offerings and capture incremental value. Strategic investments in research and development have yielded proprietary barrier coatings and anti-microbial film variants that address emerging health and safety concerns. Concurrently, mergers and acquisitions activity is reshaping the competitive landscape, as major players consolidate to enhance their production footprints and broaden their geographic reach.

Supply chain integration remains a central theme, with top-tier firms forging alliances with raw material suppliers to secure preferential access to high-quality polypropylene resin and specialty additives. This vertical alignment not only mitigates volatility in feedstock pricing but also expedites the rollout of novel film grades. Marketing initiatives are also evolving, as companies increasingly emphasize full-service capabilities, including custom printing, slitting, and value-added coating services, to offer end-to-end packaging solutions.

Moreover, sustainability commitments are becoming core competitive differentiators. Several key players have publicly announced targets to increase recycled content in their film portfolios, while pilot programs for reusable and compostable packaging formats are underway. These strategic moves align with broader corporate social responsibility objectives and resonate with stakeholder expectations for environmentally responsible practices.

By prioritizing technology leadership, supply chain resilience, and sustainability, industry frontrunners are setting new benchmarks for performance and value creation in the BOPP tobacco films market.

This comprehensive research report delivers an in-depth overview of the principal market players in the BOPP Tobacco Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cosmo Films

- Dunmore Corporation by API Group plc

- Innovia Films by CCL Industries, Inc.

- Irplast S.p.A.

- JPFL Films Private Limited

- Manucor S.p.A. by Plastchim-T Group

- Polyplex Corporation Ltd.

- Shangdong Tianchen Plastic industry Co.,Ltd

- SIBUR

- SML Films Limited

- SRF Limited

- Taghleef Industries LLC

- Toppan Speciality Films Private Limited

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Treofan Group

- Uflex Limited

- Vibac Group

- Zhejiang Huafeng Packaging Co., Ltd.

Presenting Actionable Recommendations to Empower Industry Leaders to Navigate Challenges and Capitalize on Opportunities in BOPP Tobacco Films

Industry leaders should prioritize agility and foresight to navigate the evolving BOPP tobacco films landscape. First, refining procurement strategies by implementing multi-sourcing frameworks can mitigate risk stemming from tariff fluctuations and supply disruptions, ensuring that material availability remains consistent even under adverse conditions. At the same time, establishing strategic partnerships with converters and tier-one resin suppliers can secure preferential pricing and collaborative development of next-generation film technologies.

Secondly, embedding sustainability as a core operational tenet will yield long-term benefits. Organizations should conduct lifecycle assessments of existing film grades, identify opportunities to incorporate post-consumer recycled content, and pilot bio-based polymer blends. Transparent reporting on environmental performance through recognized frameworks will further bolster stakeholder confidence and preempt regulatory pressures. As the market shifts toward circularity, proactively adapting packaging designs for recyclability and compostability will reinforce brand credibility.

Furthermore, investing in digital capabilities-from advanced manufacturing execution systems to blockchain-enabled traceability platforms-will enhance process visibility and quality control. These tools not only optimize production efficiency but also facilitate compliance with tightening labeling and content disclosure requirements. In parallel, cultivating in-house expertise in data analytics will enable real-time trend monitoring and scenario planning.

Ultimately, by combining strategic procurement, sustainability integration, and digital transformation, industry leaders can unlock new value propositions. This holistic approach will position organizations to outpace competitors, capitalize on emerging market niches, and drive sustained growth in a complex regulatory and economic environment.

Detailing Rigorous Research Methodology and Analytical Frameworks Underpinning Insights into the BOPP Tobacco Films Market Study

This study integrates a blend of primary and secondary research methodologies to ensure robustness and credibility of insights. Primary research involved in-depth interviews with key stakeholders across the value chain, including film manufacturers, packaging converters, tobacco producers, and regulatory experts. These discussions were supplemented by site visits and manufacturing process audits to validate technical claims and gather first-hand observations on operational best practices.

Secondary research encompassed a comprehensive review of industry publications, patent filings, and regulatory documents to contextualize technological advancements and compliance trends. Trade association reports and scholarly articles provided additional depth on material science innovations, environmental policies, and consumer behavior. Market intelligence databases were leveraged to map competitive positioning and track merger and acquisition activity, while financial filings and corporate sustainability reports offered transparency on strategic priorities.

Quantitative analysis employed rigorous data triangulation techniques, cross-referencing production capacity figures, import-export statistics, and company disclosures. Analytical frameworks such as SWOT and Porter’s Five Forces were applied to evaluate market structure, competitive pressures, and risk factors. Scenario modeling was conducted to assess potential impacts of tariff changes and regulatory shifts, ensuring that strategic recommendations are grounded in probabilistic forecasts.

By combining qualitative insights with quantitative rigor, this methodology provides a holistic perspective on the BOPP tobacco films market. The result is an authoritative foundation for strategic planning, innovation prioritization, and operational optimization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our BOPP Tobacco Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- BOPP Tobacco Films Market, by Film Type

- BOPP Tobacco Films Market, by Thickness

- BOPP Tobacco Films Market, by Application

- BOPP Tobacco Films Market, by End-Users

- BOPP Tobacco Films Market, by Region

- BOPP Tobacco Films Market, by Group

- BOPP Tobacco Films Market, by Country

- United States BOPP Tobacco Films Market

- China BOPP Tobacco Films Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections on Emerging Trends, Strategic Imperatives, and the Future Outlook for the BOPP Tobacco Films Sector

In conclusion, the BOPP tobacco films segment stands at a pivotal juncture defined by technological innovation, regulatory evolution, and shifting market dynamics. The confluence of heightened sustainability mandates, advanced barrier requirements, and evolving consumer preferences underscores the need for strategic agility. Companies that excel will be those capable of integrating digital traceability solutions, embracing circular economy principles, and fostering resilient supply chains in the face of policy uncertainties.

Moreover, the 2025 United States tariff adjustments have catalyzed a reevaluation of sourcing strategies, compelling industry participants to balance cost optimization with operational continuity. Stakeholders who proactively adapt through strategic partnerships, capacity enhancements, and material innovations will secure a competitive edge. Equally important is the ability to interpret segmentation insights-across film types, thicknesses, applications, and end-user segments-to tailor product portfolios that resonate with nuanced market demands.

Regionally, the Americas, Europe Middle East and Africa, and Asia Pacific each present unique growth vectors, driven by local regulatory frameworks, manufacturing capabilities, and consumption patterns. Companies with a global footprint must adopt hybrid strategies that respect regional idiosyncrasies while leveraging centralized R&D and technology hubs.

Ultimately, the future trajectory of the BOPP tobacco films market hinges on a delicate balance between innovation, sustainability, and supply chain resilience. By harnessing the insights and strategic imperatives outlined in this summary, decision-makers are equipped to chart a course toward sustainable growth and enduring competitive advantage.

Connect Directly with Associate Director Sales & Marketing to Access the Comprehensive BOPP Tobacco Films Market Research Report Today

Empowering your strategic decision making requires direct access to expert insights crafted to address your specific challenges and objectives in the BOPP tobacco films space. Ketan Rohom, Associate Director of Sales & Marketing, is prepared to guide you through a tailored discussion on how this comprehensive market research report can enhance your competitive positioning, streamline your procurement processes, and uncover new revenue streams.

By scheduling a consultation, you will gain personalized recommendations on navigating regulatory complexities, optimizing your supply chain resilience, and leveraging emerging technological innovations. This engagement is not merely about obtaining data; it is an opportunity to collaborate with a seasoned industry professional who understands the nuances of the tobacco packaging sector and can translate intangible market signals into actionable initiatives.

Take the next step in fortifying your market intelligence toolkit. Reach out to Ketan Rohom today to secure your copy of the full BOPP Tobacco Films Market Research Report. Through this partnership, you will acquire unparalleled visibility into market dynamics, expert interpretation of critical trends, and strategic foresight that positions your organization for sustained growth. Elevate your decision-making process by connecting directly with an expert dedicated to your success in this rapidly evolving market.

- How big is the BOPP Tobacco Films Market?

- What is the BOPP Tobacco Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?