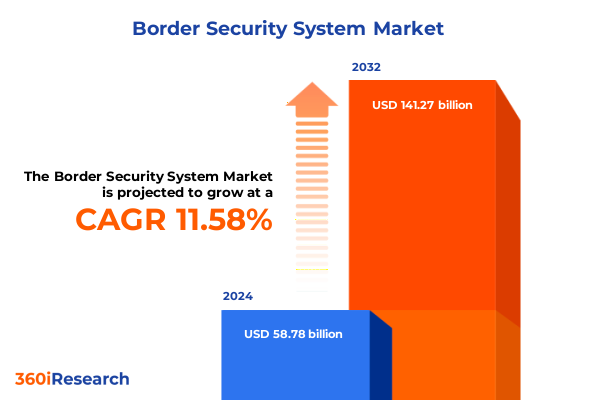

The Border Security System Market size was estimated at USD 65.74 billion in 2025 and expected to reach USD 72.70 billion in 2026, at a CAGR of 11.54% to reach USD 141.27 billion by 2032.

Harnessing Advanced Surveillance and Analytics to Secure Borders Against Emerging Threats in an Increasingly Complex Global Environment

Border security remains a cornerstone of national sovereignty and public safety, requiring a blend of cutting-edge technology and strategic operational frameworks. The complexity of threats facing modern nations has escalated over the past decade, driven by sophisticated smuggling networks, cyber-enabled breaches, and increasing volumes of cross-border traffic. To navigate this evolving landscape, agencies and private partners alike are turning to integrated surveillance and analytics platforms that can rapidly detect, identify, and respond to incursions at land, maritime, and aerial frontiers.

Against this backdrop, the convergence of infrared imaging, radar detection, and unmanned systems is redefining how borders are monitored and protected. Advanced sensors now capture high-fidelity data in challenging environmental conditions, while real-time video analytics enable automated alerts for anomalous behavior. Moreover, the adoption of biometric verification strengthens identity management processes, fostering seamless coordination between customs, defense, and law enforcement stakeholders. With these dynamic forces at play, the global border security system market demands a holistic understanding of emergent technologies and strategic imperatives. This executive summary distills the most salient trends, segmentation insights, regional drivers, and actionable recommendations to empower decision-makers in shaping resilient border defense architectures.

Navigating the Paradigm Shift in Border Security through Technological Innovation and Resilient Collaborative Intelligence Networks

Over the past several years, border security has undergone a seismic transformation driven by rapid advances in unmanned aerial vehicles, sensor miniaturization, and data fusion techniques. Unmanned aerial platforms equipped with thermal cameras and radar payloads now deliver persistent aerial monitoring, dramatically improving situational awareness in remote and challenging terrain. Simultaneously, edge computing capabilities embedded within fixed and portable surveillance systems have enabled real-time video analytics, reducing dependence on central command infrastructures and lowering latency for threat detection.

These technological breakthroughs coincide with a growing emphasis on multi-agency collaboration and shared intelligence frameworks. Cross-border data exchanges, fortified by secure cloud deployments, are breaking down information silos and empowering integrated command centers to achieve a unified operational picture. In parallel, enhanced biometric solutions-ranging from facial recognition to fingerprint and iris scanning-are automating identity management at points of entry and exit. Collectively, these shifts are redefining the border security paradigm, transitioning from reactive checkpoint controls toward proactive, intelligence-driven perimeter defense.

Evaluating the Compound Effects of United States Trade Tariffs in 2025 on Border Security System Development and Procurement Strategies

In 2025, a wave of new tariffs imposed by the United States on key surveillance and aerospace components has reshaped procurement strategies and supply chain dynamics for border security system integrators. These levies have particularly affected the importation of high-performance infrared sensors, UAV propulsion units, and specialized semiconductors sourced from principal overseas manufacturers. As a result, project lead times have lengthened and acquisition budgets have been stretched by elevated equipment costs.

To mitigate these headwinds, many organizations are accelerating efforts to onshore production and cultivate domestic supply bases for critical sensor modules and aerial platforms. Simultaneously, collaborative partnerships between government labs and private suppliers are fostering alternative component designs that bypass tariff-impacted sources. Though short-term price pressures persist, these strategic pivots are catalyzing a renewed focus on supply chain resilience, driving greater investment in local engineering talent and manufacturing capacity. Ultimately, while the 2025 tariffs have introduced complexity into system deployments, they are also stimulating innovation and diversification within the border security ecosystem.

Unveiling In-Depth Segmentation Perspectives Revealing Unique Border Security System Requirements and Opportunities Across Varied Technological and Operational Dimensions

A nuanced exploration of platform typologies, sensor and analytics technologies, functional use cases, deployment architectures, and end-user demands reveals the multifaceted nature of the border security market. Within platform offerings, fixed surveillance stations anchored with infrared and radar subsystems coalesce alongside portable towers and drone fleets encompassing both fixed wing glider configurations and rotary wing quadcopter and octocopter variants. Each configuration serves distinct operational theaters, from remote maritime corridors to densely trafficked land crossings.

Underpinning these platforms, a suite of enabling technologies drives capabilities: biometric identification methods such as facial recognition, fingerprint and iris scanning provide robust identity verification, while IoT-connected edge devices and video analytics engines transform raw sensor streams into actionable insights. In real-life scenarios, access control checkpoints leverage biometric and RFID authentication to streamline throughput, whereas intrusion detection zones integrate radar and thermal imaging to detect unauthorized approaches. Choice of deployment-cloud-hosted analytics or on-premises data centers-further influences integration complexity and data sovereignty considerations.

Finally, the spectrum of end users, comprising customs and border control agencies, national defense establishments, law enforcement units, and private sector infrastructure operators, underscores the market’s breadth. Each stakeholder cohort weighs system criteria differently, balancing durability and mobility, analytical sophistication and interoperability. Through this layered segmentation lens, decision-makers can identify optimal solution mixes aligned with mission objectives and operational environments.

This comprehensive research report categorizes the Border Security System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Technology

- Application

- Deployment Mode

- End User

Delivering Regional Intelligence on Border Security System Deployment Trends and Infrastructure Dynamics Across Major Global Territories

Regional dynamics exert powerful influence on border security priorities and adoption patterns. In the Americas, expansive land borders and high-volume transit corridors have driven deployment of integrated sensor arrays combined with unmanned aerial patrols. National and state-level agencies are increasingly deploying mobile surveillance units equipped with thermal imaging and radar to deter illicit trafficking between established checkpoints.

Within the Europe, Middle East & Africa region, the confluence of refugee flows, cross-border militant movements, and maritime migration routes has spurred investments in multi-domain monitoring solutions. Here, governments favor modular architectures that can be rapidly reconfigured to address shifting hotspot regions, harnessing video analytics and biometric authentication for controlled entry points and coastal surveillance.

Across Asia-Pacific, thriving trade volumes and complex maritime boundaries have elevated demand for long-range UAV patrols and integrated port security systems. Commercial hubs and island-states are adopting automated berth monitoring augmented by AI-driven anomaly detection to safeguard container flows. In tandem, joint maritime exercises and data-sharing pacts among neighboring countries are reinforcing regional security frameworks, fostering interoperability among diverse platform and sensor arrays.

This comprehensive research report examines key regions that drive the evolution of the Border Security System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Border Security System Providers with Strategic Insights into Technology Portfolios and Market Positioning

Leading defense and technology firms are at the vanguard of border security innovation, each advancing distinct technology portfolios and partnership networks. Global primes are marrying established radar and avionics expertise with emerging AI-driven analytics to deliver turnkey system integration for sovereign border agencies. Meanwhile, specialized sensor developers are innovating higher-resolution thermal cameras and compact radar arrays that can be installed on both fixed towers and unmanned platforms.

Strategic alliances between aerospace manufacturers and software companies are also proliferating, yielding end-to-end offerings that streamline data capture, processing, and operational command. In parallel, a cohort of agile entrants is challenging traditional models by focusing exclusively on cloud-native video analytics and biometric verification, enabling rapid deployment and software-driven feature enhancements. Collectively, these diverse competitive vectors are intensifying the pace of technological advancement, pushing border security systems toward ever-greater levels of automation, accuracy, and scalability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Border Security System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- Bosch Sicherheitssysteme GmbH

- Cobham Limited

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hensoldt AG

- Honeywell International Inc.

- Indra Sistemas S.A.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leidos Holdings Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Magal Security Systems Ltd.

- NEC Corporation

- Northrop Grumman Corporation

- OSI Systems Inc.

- Raytheon Technologies Corporation

- Safran SA

- Smiths Detection Group Ltd.

- Thales Group

Presenting Actionable Strategic Recommendations to Optimize Border Security System Performance, Integration, and Stakeholder Collaboration

To maintain competitive advantage and operational effectiveness, industry leaders should prioritize comprehensive integration of artificial intelligence capabilities across sensor and analytics layers, thereby reducing manual monitoring burdens and accelerating threat response times. Additionally, diversifying supply chains by cultivating local manufacturing partnerships will buffer procurement pipelines against geopolitical and tariff-related disruptions.

Fostering cross-agency data-sharing frameworks and standardized communication protocols can further enhance situational awareness, enabling unified command centers to orchestrate multi-domain engagements. At the same time, adopting hybrid deployment models that balance cloud scalability with on-premises control ensures both flexibility and data sovereignty. Finally, investing in ongoing personnel training and simulation-based exercises will equip operators with the expertise necessary to leverage advanced system functionalities, ultimately elevating the overall resilience and deterrence posture of border security operations.

Detailing Rigorous Research Methodology and Data Collection Frameworks Ensuring Integrity, Accuracy, and Transparency in Border Security Market Analysis

This analysis was built upon a rigorous methodology combining primary stakeholder interviews, secondary open-source intelligence, and validation through expert peer review to ensure comprehensive coverage and accuracy. Primary insights were gathered via structured discussions with government officials, system integrators, and technology suppliers, supplemented by data extracted from publicly available regulatory filings, technical white papers, and industry symposia presentations.

To enhance analytical fidelity, triangulation techniques were employed, cross-referencing qualitative findings with technical specifications and procurement records. Data integrity and transparency were upheld through a multi-tiered peer validation process led by domain specialists in border security and defense technology. This structured approach underpins the reliability of all strategic insights and recommendations presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Border Security System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Border Security System Market, by Platform Type

- Border Security System Market, by Technology

- Border Security System Market, by Application

- Border Security System Market, by Deployment Mode

- Border Security System Market, by End User

- Border Security System Market, by Region

- Border Security System Market, by Group

- Border Security System Market, by Country

- United States Border Security System Market

- China Border Security System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Illustrate the Transformational Role of Border Security Systems in Safeguarding National Frontiers and Enhancing Operational Resilience

Across evolving threat vectors, transformative technology shifts, and diverse stakeholder demands, modern border security systems have emerged as critical enablers of national safety and global trade resilience. The combined effects of advanced unmanned platforms, real-time analytics, and biometric verification are reshaping how agencies detect and deter cross-border incursions. At the same time, geopolitical developments such as trade tariffs have amplified the importance of supply chain independence and domestic manufacturing.

Segmentation analysis highlights that no single solution fits all operational scenarios; rather, a modular integration of fixed towers, portable units, and UAV fleets, underpinned by IoT and AI analytics, best addresses the spectrum of mission requirements. Regionally, tailored approaches reinforce national priorities, from the expansive corridors of the Americas to the complex maritime zones of Asia-Pacific and the dynamic migration landscapes of EMEA. With leading technology providers advancing hybrid hardware-software ecosystems, the border security market stands at the cusp of unprecedented capability growth.

Ultimately, by embracing the strategic recommendations outlined herein-driven by diversified procurement, cross-sector collaboration, and continuous skills development-decision-makers can architect resilient, future-proof border security frameworks capable of adapting to the next generation of threats.

Connect with Ketan Rohom to Unlock Comprehensive Border Security System Insights and Secure Access to the Definitive Market Research Report

Ready to advance your border security capabilities with actionable insights and robust data, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive report and gain an unparalleled competitive advantage in this dynamic market.

- How big is the Border Security System Market?

- What is the Border Security System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?