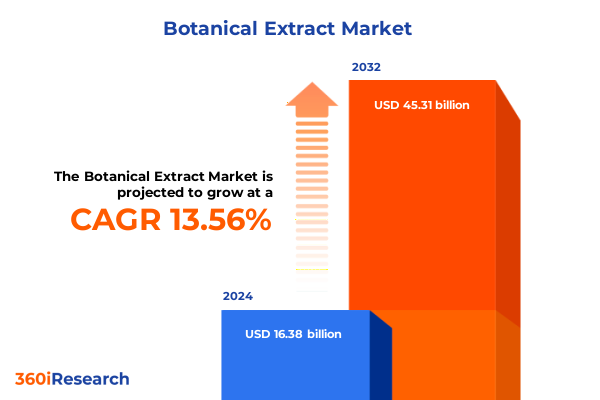

The Botanical Extract Market size was estimated at USD 18.36 billion in 2025 and expected to reach USD 20.59 billion in 2026, at a CAGR of 13.77% to reach USD 45.31 billion by 2032.

Exploring the dynamic world of botanical extracts and unveiling how emerging consumer preferences and technological breakthroughs are reshaping a centuries-old industry

Botanical extracts have emerged as a cornerstone of innovation across nutrition, personal care, and pharmaceutical industries, tapping into a growing consumer demand for natural and functional ingredients. The heightened interest in plant‐derived compounds is driven by robust consumer health consciousness and an overarching pursuit of wellness. As global populations embrace holistic lifestyles, these extracts are increasingly positioned as essential ingredients in dietary supplements, functional foods, and therapeutic formulations.

Alongside shifting consumer preferences, technological advancements in extraction and formulation have broadened the scope of botanical applications. Modern techniques now enable extraction of diverse phytochemicals with enhanced yield, purity, and stability. This synergy between consumer demand and scientific progress has invigorated supplier strategies, prompting collaborative ventures between ingredient formulators, research institutions, and product developers. As a result, botanical extracts are transitioning from niche offerings to mainstream ingredients underpinning new product development.

Against this backdrop, industry stakeholders must navigate evolving regulatory frameworks, sustainability mandates, and raw material sourcing complexities. This introduction sets the stage for an in‐depth exploration of emerging trends, trade considerations, segmentation insights, and regional dynamics shaping the botanical extract landscape in 2025.

Unraveling the fundamental shifts driving innovation in botanical extraction processes and the evolving preferences redefining industry growth trajectories worldwide

The botanical extract landscape is undergoing transformative shifts propelled by novel extraction technologies, evolving regulatory landscapes, and heightened sustainability imperatives. Supercritical CO₂ extraction has gained prominence, offering solvent‐free processing that preserves delicate phytochemicals while reducing environmental impact. Meanwhile, advances in steam distillation and water extraction have elevated the efficiency and scalability of traditional techniques, enabling producers to optimize throughput and maintain product integrity.

At the same time, digital traceability solutions such as blockchain‐enabled supply chain monitoring are redefining transparency and compliance. These platforms empower brands and consumers with verifiable sourcing data, fostering trust and enabling rapid response to quality concerns. In parallel, artificial intelligence and machine learning algorithms are accelerating formulation innovation by predicting bioactive compound interactions and streamlining product development cycles.

In response to heightened consumer interest in ethically sourced ingredients, many suppliers are integrating regenerative agriculture practices into raw material cultivation. This alignment with environmental, social, and governance (ESG) commitments not only mitigates supply risks but also appeals to conscious consumers and investors. Collectively, these transformative forces are charting a new course for botanical extract innovation and industry maturation.

Assessing the ripple effects of recent United States tariff implementations and their cumulative impact on botanical extract trade and supply chain resilience

Recent tariff measures implemented by the United States government have had a pronounced impact on global trade flows of botanical extracts, altering cost structures and procurement strategies for manufacturers and formulators. In mid-2025, additional duties were applied to key plant‐derived ingredients sourced from several trading partners, increasing landed costs and compressing margins for import-dependent companies. These measures have compelled firms to reassess their sourcing footprints and explore alternative supply origins to maintain price competitiveness.

Furthermore, compliance burdens have intensified as regulatory authorities enforce stricter documentation and country‐of‐origin verification requirements. Many organizations have responded by bolstering their internal trade compliance teams and investing in digital customs platforms to streamline declarations and reduce clearance delays. Some enterprises have opted to nearshore production, favoring domestic extraction facilities or partnerships within duty‐free zones to mitigate tariff exposure and preserve product affordability.

While these tariff shifts have created short-term disruptions, they have also catalyzed strategic realignments. Manufacturers are increasingly diversifying supplier bases and forging strategic alliances with agricultural cooperatives in regions unaffected by duties. This proactive adaptation enhances supply chain resilience, enabling firms to navigate evolving trade policies while preserving consistent access to botanical raw materials.

Discerning critical segmentation insights by product form extraction methodologies and end use applications to unlock targeted growth pathways

In the botanical extract arena, product form segmentation reveals a distinct differentiation in consumer and industrial uptake. Capsules continue to dominate applications where dosage precision and convenience are paramount, particularly in dietary supplements. Oil formulations enjoy strong traction within personal care and functional beverage categories due to their solubility and sensorial appeal, whereas liquid concentrates unlock flexible dosing for both therapeutic applications and custom blending. Powdered extracts serve nutraceutical and food applications by offering extended shelf stability and ease of incorporation, while tablets remain favored for standardized therapeutic regimens.

Extraction methodologies further delineate market dynamics. Solvent extraction retains its foothold for broad‐spectrum phytochemical recovery, but its use is increasingly balanced against supercritical CO₂ extraction, which garners preference for high‐purity bioactive acquisition. Steam distillation remains the method of choice for volatile essential oils, with water extraction sustaining relevance in the production of heat-stable compounds and traditional herbal derivatives. Companies often deploy hybrid extraction protocols to tailor ingredient profiles for specific end uses.

End use segmentation underscores divergent pathways in animal use and human use categories. Within animal applications, feed formulations leverage botanical extracts for performance enhancement, spanning aquaculture, livestock, pet food, and poultry nutrition. Veterinary supplement developers similarly integrate plant actives to support animal health. In human use, dietary supplement producers lead adoption, while therapeutic developers harness targeted extracts for pharmaceutical and over-the-counter solutions.

Application segmentation paints a nuanced picture of industry integration. Botanical ingredients enrich animal feed with immunomodulatory and growth-promoting properties. In food and beverage, functional bakery, beverage, and dairy products capitalize on health claims. Nutraceutical trends intersect with dietary supplements, functional refreshments, and specialty foods. Personal care brands incorporate botanical extracts across hair, oral, and skincare formulations, prioritizing gentle yet efficacious actives. Pharmaceutical players utilize botanical compounds in both prescription and OTC preparations, underscoring their therapeutic versatility.

Lastly, distribution channel segmentation highlights the coexistence of offline and online pathways. Traditional direct sales, pharmacy networks, specialty stores, and supermarkets sustain widespread product access, while digital commerce platforms facilitate end-consumer engagement, rapid order fulfillment, and data‐driven marketing strategies.

This comprehensive research report categorizes the Botanical Extract market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Extraction Method

- Distribution Channel

- Application

Highlighting diverse regional dynamics across the Americas EMEA and Asia-Pacific to reveal nuanced opportunities and strategic challenges in botanical extracts

Regional analysis of botanical extracts exposes a tapestry of distinct market drivers and regulatory frameworks across the globe’s three major hubs. In the Americas, North American consumers’ preference for nutraceutical supplementation and clean label personal care ingredients fuels robust demand. The regulatory climate, led by the U.S. Food and Drug Administration’s dietary ingredient guidelines, promotes ingredient safety and quality consistency, prompting advanced quality assurance investments.

Conversely, Latin American nations such as Brazil exhibit a rich biodiversity heritage that underpins local sourcing opportunities. However, logistical hurdles and certification disparities necessitate collaborative frameworks between local cultivators and international buyers to ensure sustainable supply and compliance.

Europe, Middle East, and Africa (EMEA) present a complex mosaic where stringent European Union novel food regulations and cosmetic ingredient directives drive premiumization and standardization. In the Middle East, growing health consciousness and rising disposable incomes expand nutraceutical and personal care segments. Africa’s emerging markets deliver novel sourcing prospects but require infrastructure development and regulatory harmonization to unlock full potential.

Asia-Pacific stands at the forefront of botanical innovation, with China and India as traditional extract powerhouses. Enhanced extraction technologies and government support for high-value agricultural exports strengthen these nations’ roles as top suppliers. Simultaneously, mature markets such as Japan and Australia emphasize clean label certifications and sustainability credentials, compelling exporters to adapt to elevated quality and traceability demands.

This comprehensive research report examines key regions that drive the evolution of the Botanical Extract market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading industry players and competitive strategies that are shaping the botanical extract landscape through collaboration innovation and differentiation

The competitive landscape of botanical extracts is guided by a select group of global ingredient suppliers, each leveraging unique strengths in technology, scale, and vertical integration. Large agribusiness and specialty ingredient conglomerates continue to invest heavily in proprietary extraction platforms and formulation science, enabling them to introduce high-purity product lines targeted at demanding end-use applications.

Innovative mid‐tier enterprises differentiate through strategic collaborations with botanical growers and research institutions, securing exclusive raw material sources and co-development opportunities. By integrating regenerative farming initiatives with community engagement programs, these companies bolster ESG credentials and establish reliable supply chains that cater to eco-conscious brands.

Smaller, agile start-ups focus on niche botanical extracts with well‐defined bioactive profiles, often securing intellectual property rights for novel extraction methods or unique compound fractions. These entities are adept at rapid product innovation cycles, responding swiftly to emerging health trends and regulatory shifts.

Technology service providers also play a critical role, offering contract extraction and custom formulation services that allow both established suppliers and new entrants to scale production without capital‐intensive facility expansions. Such collaborative models undergird a dynamic ecosystem where innovation is shared and accelerated across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Botanical Extract market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bio-Botanica Inc.

- Blackmores Limited

- Blue Sky Botanics Ltd.

- Chr. Hansen Holding A/S

- DKSH Holding Ltd.

- Dr. Willmar Schwabe GmbH & Co. KG

- DÖHLER GmbH

- Gaia Herbs, Inc.

- Givaudan SA

- Hunan NutraMax Inc.

- Indena S.p.A.

- International Flavors & Fragrances Inc.

- Kalsec Inc.

- Mane Kancor Ingredients Private Limited

- Martin Bauer GmbH & Co. KG

- PLT Health Solutions, LLC

- Prinova Group LLC

- Ransom Naturals Limited

- Sabinsa Corporation

- Symrise AG

- Synthite Industries Limited

Translating industry insights into actionable strategies for leadership to optimize operations navigate trade complexities and capture emerging market niches

Industry leaders ought to fortify supply chain resilience by diversifying sourcing strategies and engaging in forward‐integration partnerships with agricultural cooperatives. This approach mitigates raw material price volatility and circumvents trade policy uncertainties. Simultaneously, investing in advanced extraction technologies-such as supercritical CO₂ and hybrid distillation systems-will optimize yield while aligning with sustainability objectives and consumer expectations for clean processing.

To maintain regulatory compliance amid evolving global guidelines, organizations should implement integrated digital traceability platforms that automate documentation, facilitate rapid audits, and enhance transparency from farm to finished product. Aligning these systems with robust quality management frameworks will expedite new product introductions and reinforce stakeholder trust.

Strategic collaborations with research institutions, start-ups, and technology vendors will accelerate formulation innovation and reduce time-to-market for high-value ingredients. By co-developing tailored botanical fractions for specific end uses, companies can command premium positioning and address unmet consumer needs.

Lastly, embracing omnichannel distribution models that blend direct sales, specialty retail partnerships, and e-commerce platforms will expand market reach and provide rich consumer insights. Data analytics drawn from multiple channels can inform targeted product development and marketing strategies, ensuring sustainable growth in a competitive environment.

Outlining a comprehensive research methodology integrating primary interviews secondary sources and multi-layered data analysis for robust insights

This study synthesizes findings from a rigorous research design that blends qualitative and quantitative methodologies to ensure depth, reliability, and relevance. Primary research included in‐depth interviews with senior R&D executives, procurement directors, and key opinion leaders across agriculture, processing, and end‐use segments. These dialogues provided nuanced perspectives on emerging trends, technology adoption, and regulatory challenges.

Secondary research encompassed a comprehensive review of publicly available regulatory filings, scientific journals, industry association publications, and government trade data. This desk research informed the contextual framework for tariff analysis and regional assessments.

Quantitative validation leveraged proprietary databases to map historical trade flows, product launches, and patent filings, enabling triangulation of primary insights and secondary benchmarks. Data integrity checks and peer reviews by external subject‐matter experts fortified the credibility of conclusions.

The combined research approach ensures that the insights presented are both actionable and grounded in empirical evidence, equipping stakeholders with a robust foundation for strategic decision‐making in the botanical extract domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Botanical Extract market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Botanical Extract Market, by Product Form

- Botanical Extract Market, by Extraction Method

- Botanical Extract Market, by Distribution Channel

- Botanical Extract Market, by Application

- Botanical Extract Market, by Region

- Botanical Extract Market, by Group

- Botanical Extract Market, by Country

- United States Botanical Extract Market

- China Botanical Extract Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing key findings and strategic imperatives into a cohesive narrative guiding stakeholders toward decisive action in the botanical extract sector

In summary, the botanical extract industry stands at a pivotal juncture characterized by rapid technological evolution, shifting consumer behaviors, and complex trade landscapes. Emerging extraction advancements, driven by sustainability and purity imperatives, are redefining product innovation and enabling new applications across health and wellness sectors. Concurrently, evolving tariff measures have introduced short-term challenges that necessitate strategic adaptations in sourcing and compliance.

Segmentation insights reveal differentiated opportunities across product forms, extraction techniques, and end-use categories, underscoring the importance of targeted strategies to capture value in specific niches. Regional dynamics highlight varied regulatory frameworks and market drivers, from stringent EU directives to burgeoning Asia-Pacific supply capabilities. Competitive positioning is influenced by scale, vertical integration, and collaborative innovation models, which collectively shape industry consolidation and differentiation.

By synthesizing these multifaceted factors, stakeholders can forge resilient supply chains, accelerate sustainable product development, and optimize market entry approaches. The collective urgency for strategic foresight, technological investment, and partnership cultivation sets the stage for accelerated growth and value creation in the years ahead.

Empowering decision makers with a direct invitation to engage with Associate Director Ketan Rohom for customized insights and comprehensive market research solutions

To explore how this industry analysis can drive your strategic initiatives and operational efficiencies, reach out today to Associate Director Ketan Rohom to secure your comprehensive botanical extracts research report and personalized consultation

- How big is the Botanical Extract Market?

- What is the Botanical Extract Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?