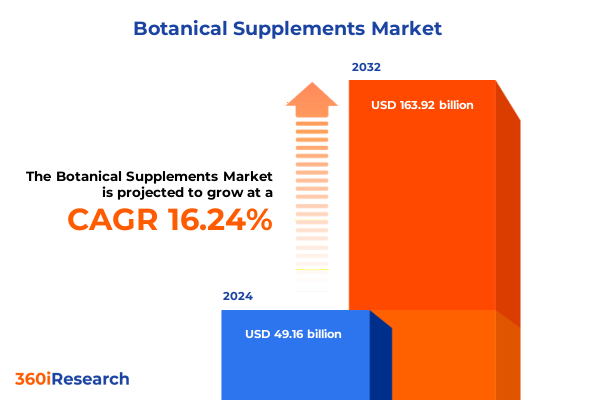

The Botanical Supplements Market size was estimated at USD 57.01 billion in 2025 and expected to reach USD 66.12 billion in 2026, at a CAGR of 16.28% to reach USD 163.92 billion by 2032.

Exploring the Rising Demand and Evolving Opportunities in Botanical Supplements Across Consumer Health and Wellness Ecosystems Fueled by Global Trends

The botanical supplements industry has witnessed a remarkable resurgence in recent years as consumers embrace natural health solutions and seek to complement traditional wellness routines. Fueled by growing awareness of plant-based bioactives and backed by a surge in scientific research exploring herbal efficacy, market participants have intensified efforts to develop products that harness nature’s therapeutic compounds. This evolution is underpinned by multidisciplinary collaborations among botanists, pharmacologists, and nutrition scientists, creating formulations that span from classic herbal extracts to sophisticated polyherbal blends. Overarching this dynamic, shifts in consumer demographics-particularly the rise of health-conscious millennials and the longevity focus of aging populations-have amplified demand for supplements that promise preventive care and holistic wellbeing.

Simultaneously, digital transformation has reshaped how botanical supplements are marketed and accessed. Brand websites and e-commerce platforms have emerged as primary channels for product discovery and purchase, leveraging social media, influencer partnerships, and targeted content to educate and engage users on ingredient benefits. Against this backdrop, regulatory authorities in key jurisdictions are enhancing scrutiny of safety, efficacy claims, and manufacturing practices, prompting manufacturers to adopt stringent quality assurance protocols and invest in traceability. As the industry navigates a confluence of consumer expectations, technological innovation, and regulatory oversight, the introduction sets the stage for an in-depth exploration of the market’s driving forces and strategic imperatives.

Unveiling Transformative Shifts Reshaping the Botanical Supplements Landscape Across Supply Chains, Consumer Preferences, and Technological Advancements

The botanical supplements sector has been fundamentally reshaped by a series of converging trends that are redefining traditional supply chains, manufacturing processes, and consumer engagement strategies. On one hand, the push for transparency and sustainability has driven companies to source raw materials via ethical and regenerative agricultural practices, reinforcing supply chain resilience and reducing environmental impact. Simultaneously, advances in extraction and encapsulation technologies have enabled more precise delivery of plant-derived phytonutrients, enhancing bioavailability and consumer trust in product efficacy. These technological innovations are complemented by a burgeoning landscape of digital health tools, as mobile applications and wearable devices facilitate real-time monitoring of supplement regimens and outcomes.

Consumer preferences have also transformed, as individuals gravitate toward personalized nutrition and holistic wellness solutions that integrate mental, emotional, and physical health dimensions. This shift has spurred the rise of subscription models and direct-to-consumer offerings that tailor botanical formulations to specific lifestyle needs. In parallel, strategic partnerships between established brands and agile start-ups have become a hallmark of market expansion, enabling quick adoption of novel ingredients and collaborative research initiatives. Together, these transformative shifts underscore a landscape where agility, scientific rigor, and consumer-centric innovation are paramount for sustained success.

Assessing the Cumulative Impact of United States Tariffs in 2025 on the Botanical Supplements Market Dynamics and Cost Structures

In 2025, the cumulative impact of newly imposed United States tariffs has exerted significant pressure on cost structures within the botanical supplements industry. Imports of critical herbs and extracts from key producing regions have experienced heightened duties, compelling manufacturers to reevaluate sourcing strategies and negotiate with suppliers to mitigate margin compression. These tariff adjustments have spurred an acceleration of nearshoring initiatives, as companies explore domestic cultivation and processing capabilities to reduce dependency on tariff-affected imports. Simultaneously, some industry players have pursued diversification of raw material origins, forging partnerships with producers in untapped regions to spread risk and maintain ingredient continuity.

Beyond raw material procurement, the upward pressure on ingredient costs has necessitated operational efficiencies across manufacturing, packaging, and distribution channels. Companies have responded by streamlining production workflows, adopting lean inventory practices, and leveraging economies of scale within contract manufacturing networks. Moreover, brands with significant direct-to-consumer footprints have gained a competitive edge by internalizing portions of the supply chain, from cultivation to fulfillment. As regulatory frameworks continue to evolve in response to trade policy shifts, market leaders that proactively adapt their sourcing, production, and pricing strategies will be best positioned to navigate the complexities of tariff-driven cost volatility.

Unlocking Strategic Insights Through Sophisticated Segmentation Across Form, Distribution Channels, Applications, Ingredients, End Users, and Nature

Strategic segmentation is essential for unlocking granular insights into the botanical supplements market, as it illuminates nuanced consumer preferences and competitive differentiators. When examining product forms, it becomes clear that capsules-encompassing both hard and soft formats-remain a consumer favorite due to their convenience and precise dosing, while softgels leverage advanced encapsulation methods to protect sensitive oils. Gels offer targeted delivery of liquid formulations, and powders-available as single or multi-serving options-cater to functional nutrition enthusiasts who appreciate customizable strength and flavor profiles. Syrups and tinctures under the liquid category appeal to consumers seeking quick absorption and versatility in consumption.

Distribution channel segmentation further reveals diverging growth trajectories: direct sales, which include both direct-to-consumer initiatives and multi-level marketing, facilitate personalized experiences, while online retail via brand websites and e-commerce platforms extends reach and data-driven engagement. Pharmacy and drugstores contribute a trusted point of purchase, whereas specialty stores and the supermarkets & hypermarkets sector-comprising supermarkets and hypermarkets-serve as high-visibility retail anchors. Application-based segmentation highlights diverse usage contexts, from beauty and personal care formulations targeted at skin health to sports nutrition blends engineered for performance support, alongside immune support, digestive health, cardiovascular wellness, and weight management offerings. Ingredient-type segmentation underscores the prominence of herbal extracts such as turmeric, ginseng, and echinacea alongside vitamins, minerals, probiotics-featuring both bifidobacterium and lactobacillus-and superfoods and amino acids that cater to specialized nutritional requirements. End-user segmentation delineates focus on adult wellness, with dedicated geriatrics products emphasizing joint and cognitive health and pediatric formulations prioritizing safety and palatability. Finally, nature segmentation differentiates conventional and organic products, reflecting consumer demand for purity and sustainability.

This comprehensive research report categorizes the Botanical Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form

- Nature

- Distribution Channel

- Application

- End User

Revealing Key Regional Dynamics Driving Growth and Adoption in the Botanical Supplements Industry Across Americas, EMEA, and Asia-Pacific

Regional market dynamics reveal distinct pathways of growth and adoption across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, consumer advocacy for natural health solutions continues to drive innovation, supported by a robust regulatory landscape that balances safety with market access. North American manufacturers are increasingly investing in domestic herb cultivation, while Latin American exporters are establishing quality certifications to meet stringent import requirements. Meanwhile, the Europe, Middle East & Africa region presents a tapestry of market maturity levels, where Western European markets lean heavily on clinical validation and heritage botanical traditions, and Gulf Cooperation Council countries exhibit strong demand for premium and fortified formulations. In parts of sub-Saharan Africa, nascent local enterprises are tapping into indigenous plant knowledge to develop regionally focused product lines.

The Asia-Pacific region stands out for its dual role as both a production hub and a growth engine, with Southeast Asian and South Asian countries supplying a significant portion of global botanical raw materials while domestic consumption in markets such as China, India, Japan, and Australia surges. Consumer education campaigns and e-commerce expansion have catalyzed uptake of novel herbal combinations, while regulatory harmonization efforts under regional trade agreements seek to facilitate cross-border ingredient flows. Across these regions, success hinges on the ability to navigate local preferences, regulatory climates, and distribution infrastructures, as well as to leverage regional expertise in botanical cultivation and product innovation.

This comprehensive research report examines key regions that drive the evolution of the Botanical Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Influencers Shaping the Competitive Landscape of Botanical Supplements Through Product and Strategic Leadership

Leading companies within the botanical supplements arena distinguish themselves through a holistic blend of research leadership, brand equity, and supply chain mastery. Pillars of innovation have emerged among organizations that consistently invest in clinical trials and advanced extraction techniques to substantiate product claims and enhance bioavailability. Equally important are firms that cultivate robust relationships with agricultural partners, ensuring ethical sourcing of premium ingredients while fostering community development and environmental stewardship. Brands leveraging digital platforms to gather consumer insights, personalize marketing, and deliver seamless purchasing experiences have achieved superior engagement metrics and customer lifetime value.

Strategic mergers and acquisitions have accelerated portfolio diversification, enabling established players to incorporate niche brands and specialty formulations that address emerging consumer segments. Collaboration with academic institutions and contract research organizations has further bolstered the evidence base for new botanical applications. Companies demonstrating agility in responding to regulatory updates, such as new labeling requirements or import restrictions, have preserved market continuity, while those pioneering sustainable packaging and circular economy initiatives have strengthened brand reputation. In this competitive landscape, market influencers combine scientific credibility with operational excellence to shape the future trajectory of botanical supplements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Botanical Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway Corporation

- BASF SE

- Bio-Botanica Inc.

- Blackmores Corporation

- Botanicalife International of America, Inc.

- Gaia Herbs, Inc.

- Glanbia plc

- GNC Holdings, LLC

- Herbal Pharm, LLC

- Herbalife Nutrition Ltd.

- Irwin Naturals, LLC

- Jamieson Wellness Inc.

- Jarrow Formulas, Inc.

- Life Extension Foundation, Inc.

- Nature's Bounty Co.

- Nature's Sunshine Products, Inc.

- Nature’s Answer, Inc.

- Nature’s Way Brands, LLC

- NOW Health Group, Inc.

- Nutraceutical International Corporation

- Organic India Private Limited

- Pharmavite LLC

- Ricola AG

- Swanson Health Products, Inc.

- The Himalaya Drug Company

Empowering Industry Leaders with Targeted, Actionable Strategies to Accelerate Innovation, Sustainability, and Market Penetration in Botanical Supplements

To thrive in the evolving botanical supplements industry, leaders should prioritize investments in ingredient traceability and sustainability to meet consumer expectations and regulatory standards. Implementing blockchain or digital ledger technologies can enhance supply chain transparency and foster consumer trust, while partnerships with regenerative agriculture projects support long-term resource availability. Embracing a consumer-centered approach to product development-utilizing data analytics to identify unmet needs-can guide the creation of personalized formulations that resonate with distinct demographic and lifestyle cohorts.

Operational efficiency should be reinforced through collaborations with contract manufacturers that possess scalable capacity and quality certifications. Simultaneously, brands ought to diversify distribution strategies by balancing direct-to-consumer digital channels with strategic alliances in pharmacy networks and retail chains to optimize market penetration. In R&D, forging alliances with academic and clinical research institutions will strengthen scientific validation and drive differentiation. Finally, aligning sustainability goals with packaging innovations and carbon footprint reductions will not only satisfy regulatory scrutiny but also position organizations as responsible stewards of botanical resources, unlocking additional brand advocacy and loyalty.

Detailing Rigorous Research Methodologies and Analytical Frameworks Underpinning Insights into the Botanical Supplements Sector

This study employs a hybrid research methodology that integrates primary and secondary sources to ensure robust and comprehensive market insights. Primary research encompasses in-depth interviews with industry stakeholders, including C-suite executives, product developers, regulatory experts, and supply chain managers, to capture nuanced perspectives on emerging trends and strategic priorities. These insights are corroborated through surveys of distribution partners and consumer focus groups, designed to gauge evolving preferences and receptivity toward novel botanical formulations.

Secondary research supplements these findings with an extensive review of regulatory filings, scientific publications, trade association reports, and company disclosures, cross-referencing data to validate market developments. A bottom-up qualitative analysis of segmentation categories-spanning form, distribution channel, application, ingredient type, end user, and nature-provides a granular view of competitive dynamics. Furthermore, regional assessments draw on country-level policy frameworks, import-export data, and cultural considerations to contextualize market behavior. The analytical framework leverages SWOT and PESTLE analyses to evaluate strategic implications, while scenario planning exercises anticipate potential trade policy and consumer sentiment shifts. Together, these methodologies underpin the reliability and strategic relevance of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Botanical Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Botanical Supplements Market, by Ingredient Type

- Botanical Supplements Market, by Form

- Botanical Supplements Market, by Nature

- Botanical Supplements Market, by Distribution Channel

- Botanical Supplements Market, by Application

- Botanical Supplements Market, by End User

- Botanical Supplements Market, by Region

- Botanical Supplements Market, by Group

- Botanical Supplements Market, by Country

- United States Botanical Supplements Market

- China Botanical Supplements Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing Critical Findings and Strategic Imperatives to Navigate the Future Landscape of the Botanical Supplements Market

In synthesizing the report’s findings, key themes emerge highlighting the importance of innovation, resilience, and consumer engagement. The botanical supplements market is navigating a period of maturation, where scientific validation and sustainable practices are becoming differentiators rather than optional attributes. Companies that excel in harnessing innovative extraction technologies and clinical research are poised to command greater brand credibility, while those that embed transparency and ethical sourcing into their supply chains will strengthen long-term viability. Moreover, the convergence of digital health tools and e-commerce provides a fertile ground for personalized wellness solutions that deepen customer loyalty.

Regulatory landscapes and trade policies, particularly the 2025 U.S. tariff measures, underscore the necessity for agile sourcing strategies and operational adaptability. Regional dynamics reveal that success is contingent on localization-adapting formulations to cultural preferences and nutrient profiles, and forging local partnerships to navigate distribution channels effectively. Ultimately, organizations that align strategic investments in R&D, sustainability, and consumer insights will be best equipped to capitalize on growth opportunities and mitigate emerging risks. This conclusion reinforces a call for an integrated approach that balances scientific rigor, digital innovation, and responsible stewardship of botanical resources.

Connect with Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch to Secure the Comprehensive Botanical Supplements Market Research Report

Engaging directly with Ketan Rohom, an expert Associate Director in Sales and Marketing, offers an invaluable opportunity to access the full suite of in-depth analyses and strategic insights contained within the botanical supplements market research report. By reaching out, stakeholders will secure a resource that delves into the nuances of supply chain shifts, regulatory influences, innovative formulation trends, and competitive dynamics driving the sector. This collaboration ensures that decision makers are equipped with actionable intelligence to refine product portfolios, optimize go-to-market strategies, and anticipate future disruptions. With personalized guidance on how to leverage the report’s findings, partners can accelerate product development, expand into emerging channels, and fortify relationships with distribution and retail allies. Contacting the Associate Director of Sales and Marketing will also facilitate tailored support for integrating the report’s conclusions into broader corporate planning cycles. As the botanical supplements landscape continues to evolve, engaging now secures early insights into advances in ingredient technologies, sustainability practices, and consumer behavior shifts. Take this step to empower your organization with the comprehensive market intelligence necessary to achieve competitive differentiation and sustained growth in a dynamic industry.

- How big is the Botanical Supplements Market?

- What is the Botanical Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?