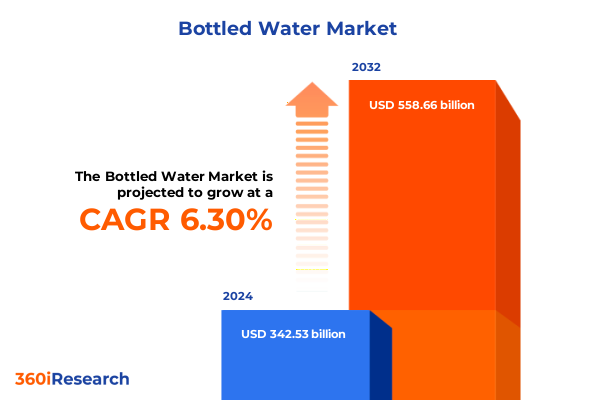

The Bottled Water Market size was estimated at USD 362.95 billion in 2025 and expected to reach USD 384.98 billion in 2026, at a CAGR of 6.35% to reach USD 558.66 billion by 2032.

Illuminating the Bottled Water Arena with a Comprehensive Overview of Emerging Opportunities and Strategic Imperatives in the 2025 Market Landscape

The bottled water industry stands at a pivotal juncture, shaped by shifting consumer behaviors, environmental imperatives, and evolving trade policies. Rising awareness of health and hydration has propelled consumption to unprecedented levels, transforming bottled water into a universal staple across demographic groups. Concurrently, growing scrutiny of plastic waste and carbon footprints has compelled manufacturers to reevaluate packaging strategies and invest in sustainable solutions. This landscape demands a nuanced understanding of market drivers, regulatory frameworks, and technological advancements to navigate emerging challenges and seize new growth opportunities.

Against this backdrop, the global supply chain faces mounting pressure from logistical complexities and geopolitical uncertainties. Navigating distribution bottlenecks and managing costs require agility, particularly in light of recent tariff changes that have reshaped import and export dynamics. Innovators are responding with novel materials, digital supply chain platforms, and direct-to-consumer channels that enhance transparency and operational efficiency. At the same time, premium and functional water segments are expanding, fueled by consumers’ quest for enhanced wellness experiences and flavor diversity.

This executive summary assembles critical insights into the forces redefining the bottled water market, offering decision-makers a consolidated view of trends, segmentation nuances, and regional variations. The following sections distill transformative developments, tariff impacts, segmentation intelligence, and strategic imperatives to empower stakeholders with the knowledge needed to achieve sustained competitive advantage.

Capturing the Transformative Shifts Reshaping Bottled Water Consumer Preferences Supply Chains and Innovation Trajectories for a Future-Ready Approach

Consumer expectations and market structures are undergoing profound transformations, reshaping the bottled water industry into a more dynamic, innovation-driven ecosystem. Health-conscious individuals increasingly seek enriched water formulations that deliver specific functional benefits, prompting brands to introduce botanical infusions, electrolyte enhancements, and adaptogenic blends. This trend toward premiumization has elevated per-bottle price points and fostered product differentiation beyond basic hydration.

Simultaneously, sustainability concerns have precipitated a shift toward eco-friendly packaging and circular economy models. Lightweight bottles, plant-based polymers, and refillable systems are gaining traction as consumers scrutinize environmental credentials. Behind the scenes, digital platforms are streamlining procurement and distribution, with real-time analytics enhancing inventory management and transporting efficiency. Supply chains are becoming more transparent as traceability solutions such as blockchain enable end-to-end visibility from source to shelf.

Innovation extends beyond product and packaging into engagement strategies. Direct-to-consumer sales channels and subscription services offer brands closer relationships with end users, facilitating personalized marketing and feedback loops that accelerate product development. At the same time, partnerships between established players and agile startups are catalyzing new approaches to resource management and consumer education. These collaborative initiatives are redefining how brands connect with consumers and reinforcing sustainability as a core value proposition.

In this evolving landscape, agility and foresight are paramount. Organizations that anticipate technological breakthroughs, embrace circularity, and harness data-driven decision-making will differentiate themselves and capture the next wave of bottled water growth.

Examining the Cumulative Impact of 2025 United States Tariffs on Bottled Water Trade Economics and Market Accessibility Dynamics

The implementation of new United States tariffs in early 2025 has introduced significant complexities to bottled water trade and pricing. Import duties on select categories of glass and PET bottles have increased, elevating costs for brands relying on cross-border supply chains. Tariffs targeting packaging materials have precipitated a reevaluation of sourcing strategies, with many companies pivoting toward domestic suppliers to mitigate the impact of elevated import levies. At the same time, suspensions on certain tariff lines have provided temporary relief for glass packaging imports, underscoring the importance of a flexible approach to procurement.

These changes have cascading effects throughout the value chain. Producers of spring and mineral water sourced internationally now face higher landed costs, compelling some to adjust wholesale pricing or absorb margin pressures. Smaller bottlers, in particular, encounter liquidity constraints as cash flow tightens under increased duties, leading to consolidation and collaboration initiatives aimed at sharing distribution networks and warehousing facilities. Conversely, domestic producers stand to benefit from a competitive advantage as import-dependent rivals grapple with tariff-related cost escalations.

Retailers and distributors are adapting shelf assortments, favoring products with more predictable cost structures or those manufactured locally. This shift influences consumer choices at the point of sale, with imported premium waters experiencing relative price inflation compared to domestically bottled alternatives. Looking ahead, the alignment of tariff policies with broader trade negotiations could further redefine cross-border flows, making proactive scenario planning essential for industry stakeholders.

Ultimately, the cumulative impact of 2025 tariffs underscores the critical need for dynamic sourcing, collaborative partnerships, and data-driven supply chain optimization to maintain profitability and market resilience.

Unveiling Key Segmentation Insights That Illuminate Packaging Source Size and Distribution Channel Dynamics in the Bottled Water Industry

Dissecting market segmentation reveals nuanced demand patterns that guide targeted strategies and product innovation. Packaging type preferences diverge across regions and consumer segments, with carton-based waters appealing to environmentally conscious households seeking recyclable formats, while premium glass bottles resonate with high-end foodservice establishments and luxury retailers. Plastic formats, namely PET bottles, dominate value-driven channels due to cost efficiencies and lightweight transport benefits, whereas flexible pouches find favor in on-the-go consumption scenarios and emerging markets where portability and reduced breakage are essential.

Water source differentiation further refines product positioning. Distilled waters occupy functional niches such as laboratory and medical applications, while still achieving limited commercial adoption. Mineral waters with high mineral content command premium pricing and artisanal branding, contrasting with low and medium mineral variants that emphasize balanced taste profiles. Purified waters produced through reverse osmosis processes cater to health-focused consumers seeking maximum impurity removal, whereas UV-treated purified options emphasize chemical-free sanitation. Sparkling waters continue to grow through flavored extensions, and spring waters leverage natural source stories to connect with authenticity-seeking consumers.

Volume segmentation underscores the importance of tailoring offering sizes to consumption occasions. Standard 500 to 1000 milliliter bottles address single-use hydration needs, whereas below 500 milliliter containers target impulse purchases and convenience channels. Larger formats above one liter are positioned for home and office consumption, optimizing price per volume dynamics.

Distribution channels shape market access and promotional strategies. Convenience stores capitalize on impulse-driven sales with single-serve packs, while supermarkets and hypermarkets drive broad visibility and promotional activity. Online retail, segmented into direct-to-consumer websites and e-commerce marketplaces, empowers brands with subscription capabilities and targeted digital marketing, enabling deeper consumer relationships and personalized fulfillment options.

This comprehensive research report categorizes the Bottled Water market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Packaging Size

- Closure Type

- Distribution Channel

- End User

Exploring Critical Regional Insights Across Americas Europe Middle East Africa and Asia Pacific to Inform Strategic Expansion in Bottled Water Sector

Regional nuances significantly influence bottled water trends and competitive positioning. In the Americas, consumption remains robust, supported by widespread distribution networks and high consumer awareness of wellness and hydration. The United States leads demand for premium and functional waters, while Latin American markets present growth opportunities driven by urbanization and expanding retail infrastructures. Trade agreements within the region continue to shape sourcing economics and cross-border flows.

Across Europe, the Middle East, and Africa, regulatory landscapes diverge widely. European Union member states enforce stringent packaging standards and microplastic limits, compelling manufacturers to innovate recyclable and biodegradable formats. In the Middle East, water scarcity concerns drive investments in spring water exports, while premium branding capitalizes on affluent consumer bases. African markets, still emerging in bottled water adoption, exhibit strong potential as infrastructure improvements enhance cold chain capabilities and urban retail expansion accelerates.

The Asia-Pacific region represents a dynamic mosaic of mature and nascent markets. Japan and Australia showcase high per capita consumption of sparkling and premium waters, supported by health-driven consumer cultures. Southeast Asian economies register rapid growth in affordable PET formats, balancing cost sensitivity with rising aspirations for wellness products. Meanwhile, China’s surge in e-commerce adoption and direct-to-consumer subscription models has redefined distribution paradigms for domestic and international brands alike.

Understanding these regional distinctions enables strategic resource allocation, targeted product development, and promotional campaigns that resonate with local tastes, regulatory requirements, and distribution ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Bottled Water market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Bottled Water Market Through Innovation Sustainability and Strategic Partnerships

Leading players in the bottled water industry continue to invest heavily in brand differentiation, sustainable packaging innovations, and strategic alliances. Global conglomerates leverage their supply chain scale to introduce lightweight bottles and recycled content while maintaining cost leadership. Mid-tier companies focus on niche source stories, highlighting artisanal springs or unique mineral profiles to justify premium positioning. Smaller challengers emphasize agility, launching limited-edition flavors and collaborating with wellness influencers to gain rapid traction among targeted demographics.

Innovation extends to joint ventures and partnerships with material science firms, driving development of biodegradable films, plant-based resins, and deposit-return solutions. These collaborations demonstrate a collective commitment to meeting consumer demand for reduced environmental impact without compromising on functionality or safety. Meanwhile, digital-native entrants are forging alliances with last-mile delivery providers and e-commerce platforms to streamline logistics and capture younger, digitally engaged audiences.

Mergers and acquisitions remain a key strategy for expanding portfolios and entering new geographic markets. Acquiring regional bottlers and crafting brands accelerates market entry, while joint ventures ensure local expertise in navigating regulatory and cultural complexities. Additionally, strategic partnerships with retailers enable exclusive product launches and co-branded promotions that reinforce retailer loyalty and drive incremental revenues.

Through these multifaceted initiatives, leading companies are reshaping competitive boundaries and setting new benchmarks for performance in sustainability, consumer engagement, and operational excellence across the global bottled water market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bottled Water market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acqua Minerale San Benedetto S.p.A.

- Agua Mineral San Mateo, S.A. de C.V.

- Antipodes Water Company Limited.

- Bisleri International Pvt. Ltd

- CG Roxane, LLC

- Danone S.A

- Ferrarelle S.p.A.

- Gerolsteiner Brunnen GmbH & Co. KG

- Grupo Peñafiel, S.A. de C.V. by Keurig Dr Pepper

- Hangzhou Wahaha Group Co., Ltd.

- Hassia Mineralquellen GmbH & Co. KG

- Highland Spring Ltd

- Ice River Springs Water Co., Inc.

- Keurig Dr Pepper Inc

- Mountain Valley Spring Water Inc. by DSS Group, Inc.

- Nestlé S.A.

- Otsuka Pharmaceutical Co., Ltd

- PepsiCo, Inc

- Primo Brands Corporation

- Talking Rain Beverage Company

- Tata Consumer Products Limited

- The Coca-Cola Company

- The Coca-Cola Company

- The Wonderful Company LLC

- Voss of Norway ASA

- Waiakea Bottling Inc.

Delivering Actionable Recommendations for Industry Leaders to Navigate Regulatory Complexities Consumer Demands and Supply Chain Resilience

To thrive amid regulatory shifts and evolving consumer expectations, industry leaders must adopt a proactive, integrated strategy that spans sourcing, production, and marketing. Investing in diversified sourcing frameworks reduces exposure to tariff volatility and geopolitical disruptions. Establishing relationships with domestic and nearshore suppliers ensures resilience while supporting local economies and reducing transportation emissions.

Advancing packaging innovation is imperative for balancing environmental commitments with cost considerations. Brands should pilot refillable systems and explore high-recycled-content bottles, while collaborating with material scientists to scale next-generation biodegradable polymers. Engaging consumers through transparent sustainability reporting and deposit-return incentives will strengthen brand loyalty and differentiate offerings in competitive channels.

Optimizing supply chain operations through digital platforms enables real-time visibility into inventory, demand forecasting, and logistics. Leveraging predictive analytics fosters more accurate production planning and reduces waste from overproduction. In parallel, embracing direct-to-consumer and subscription-based models not only expands reach but also provides invaluable first-party data to refine product portfolios and tailor personalized promotions.

Finally, aligning marketing narratives with consumer values-such as wellness benefits, ethical sourcing, and environmental stewardship-will resonate with both mass-market and premium segments. Leaders should curate multi-channel campaigns that blend educational content with experiential activations to build emotional connections and foster long-term brand advocacy.

Elucidating a Rigorous Research Methodology That Ensures Data Integrity Analytical Depth and Actionable Insights for Bottled Water Analysis

This study is grounded in a rigorous, multi-phase methodology designed to deliver reliable, actionable insights. Initial research commenced with extensive secondary data review, encompassing industry reports, trade publications, and regulatory documents to establish a foundational understanding of market structures and evolving policies. Primary research followed, engaging stakeholders across the value chain through structured interviews with brand executives, packaging suppliers, distributors, and retail operators to capture firsthand perspectives on challenges and innovation trajectories.

Quantitative data collection involved bespoke surveys targeting consumer attitudes and purchase behavior across key regions. Statistical analyses were applied to validate emerging patterns in packaging preferences, source perceptions, and size segmentation. Data triangulation provided cross-verification by comparing survey outcomes with sales and distribution metrics obtained from leading channel partners.

Analytical frameworks such as PESTLE and SWOT were employed to contextualize macroeconomic, regulatory, and competitive factors. Scenario planning exercises simulated tariff adjustments and supply disruptions, enabling assessment of potential impacts on cost structures and pricing strategies. All findings underwent peer review by internal experts to ensure methodological integrity and minimize bias.

The result is a comprehensive suite of insights that balances depth with practical relevance, equipping decision-makers with the context and data needed to formulate robust strategies in a rapidly transforming bottled water landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bottled Water market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bottled Water Market, by Product Type

- Bottled Water Market, by Packaging Type

- Bottled Water Market, by Packaging Size

- Bottled Water Market, by Closure Type

- Bottled Water Market, by Distribution Channel

- Bottled Water Market, by End User

- Bottled Water Market, by Region

- Bottled Water Market, by Group

- Bottled Water Market, by Country

- United States Bottled Water Market

- China Bottled Water Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Observations on Bottled Water Market Evolution Highlighting Strategic Imperatives and Future Pathways for Sustainable Growth

As the bottled water industry continues to evolve, strategic agility and informed decision-making are paramount. The interplay of sustainability imperatives, consumer health trends, and regulatory interventions has created a complex yet opportunity-rich environment. Navigating the cumulative impact of 2025 tariffs demands a shift toward diversified sourcing, local partnerships, and adaptive pricing models, while segmentation insights highlight the need for tailored approaches across packaging formats, water sources, and distribution channels.

Regional dynamics further underscore the importance of contextualized strategies, as growth trajectories vary between the Americas, EMEA, and Asia-Pacific. Leading companies have demonstrated that innovation in materials science, digital engagement, and collaborative ventures can deliver tangible competitive advantages and foster long-term brand loyalty.

Ultimately, the future of bottled water will be shaped by those who anticipate market shifts, embrace sustainable practices, and harness data-driven insights to align products with consumer values. By building resilience into supply chains, investing in technology, and refining segmentation strategies, industry participants can unlock new pathways to growth and position themselves at the forefront of a sector defined by constant transformation.

This synthesis of market intelligence serves as both a roadmap and a call to action for businesses seeking to thrive in an increasingly dynamic global bottled water arena.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Bottled Water Market Insights and Secure Your Strategic Market Intelligence Today

Engaging with Ketan Rohom is your gateway to unlocking deep, actionable insights into the bottled water market and reporting on emerging trends. By reaching out directly, you gain access to detailed data on segment dynamics, regional growth patterns, and competitive landscapes sculpted by the 2025 tariff environment. Ketan’s expertise in sales and marketing within the research landscape ensures that every facet of the report can be tailored to address your organization’s strategic priorities. Whether you seek guidance on packaging innovation, source differentiation, or distribution channel optimization, Ketan’s personalized consultation will clarify how to translate market intelligence into measurable results. Taking this step accelerates decision-making, mitigates risks associated with shifting regulations and consumer preferences, and establishes a roadmap for sustainable growth. Connect today to secure unparalleled market knowledge and position your organization at the forefront of a rapidly evolving industry.

- How big is the Bottled Water Market?

- What is the Bottled Water Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?