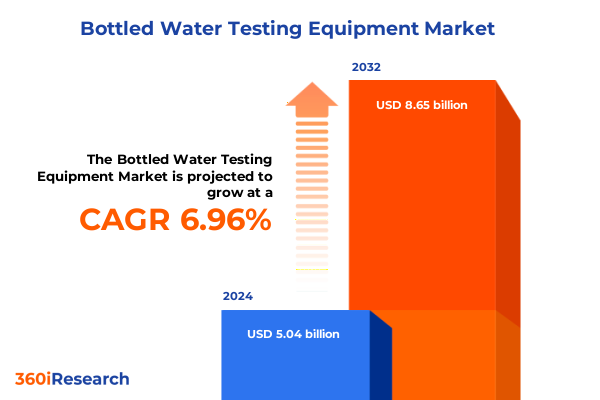

The Bottled Water Testing Equipment Market size was estimated at USD 5.40 billion in 2025 and expected to reach USD 5.78 billion in 2026, at a CAGR of 7.14% to reach USD 8.75 billion by 2032.

Adapting to stringent safety standards, evolving regulations, and technological advancements shaping the bottled water testing equipment landscape for quality assurance

In an era marked by growing consumer awareness and heightened regulatory scrutiny, the integrity of bottled water has never been more critically examined. The convergence of stringent safety standards, environmental concerns, and evolving quality benchmarks has compelled both regulators and industry participants to place unprecedented emphasis on advanced analytical testing methodologies.

As consumption patterns shift toward premium and functional bottled water products, manufacturers face mounting pressure to validate purity, detect emerging contaminants, and demonstrate sustained compliance with domestic and international frameworks. Regulatory authorities such as the U.S. Food and Drug Administration and the Environmental Protection Agency have amplified their oversight, introducing enhanced monitoring requirements for legacy contaminants like heavy metals while beginning to address newer challenges such as microplastics and PFAS compounds with planned compliance deadlines extending to 2029.

Against this backdrop, the bottled water testing equipment market has emerged as a vital enabler of consumer protection and corporate reputation management. Investments in next-generation instruments, data-driven quality assurance processes, and integrated digital platforms are reshaping laboratory workflows. Given the dynamic regulatory landscape and rapid technology advancements, stakeholders require holistic market intelligence to make informed procurement, R&D, and operational decisions.

Revolutionary advances in analytical platforms and stricter regulatory mandates are catalyzing transformative shifts in the bottled water testing equipment marketplace

Over the past three years, the bottled water testing sector has witnessed seismic shifts driven by both innovation and regulatory momentum. High-resolution chromatography systems now deliver faster separation of complex organic and inorganic constituents, while mass spectrometry platforms incorporate streamlined ionization techniques that improve sensitivity and reduce maintenance downtime. These technological leaps have broadened the analytical horizon, enabling laboratories to detect trace-level contaminants with greater throughput and precision.

Simultaneously, regulatory bodies have responded to emergent public health concerns by refining permissible limits and harmonizing international testing protocols. The rollout of the PFAS National Primary Drinking Water Regulation emphasizes advanced analytical methods, mandating the use of liquid chromatography tandem mass spectrometry to quantify “forever chemicals.” This has accelerated adoption of specialized instrumentation and sparked collaborative partnerships between regulatory agencies and equipment manufacturers to ensure method validation and operator training.

Moreover, digital transformation is reshaping workflows, with cloud-enabled monitoring systems and machine learning–driven data analytics providing real-time insights into quality metrics. Online, inline, and portable monitoring solutions are converging with laboratory analyzers, fostering hybrid testing models that balance centralized accuracy with field-ready agility. These transformative shifts underscore a market in flux, poised for continued evolution as technological innovation and policy reform intersect.

Evaluating the comprehensive effects of newly introduced United States tariffs in 2025 on the acquisition costs and supply chain resilience of bottled water testing equipment

The introduction of comprehensive tariff measures by the United States in early 2025 has fundamentally altered the cost structure and sourcing strategies for bottled water testing equipment. As of April 5, a universal 10% duty was applied to most imported laboratory instruments and components, while country-specific assessments imposed a staggering 145% tariff on goods originating from China. These levies have directly impacted procurement budgets, compelling laboratories and water processors to reassess supplier alliances and logistical frameworks to maintain cost efficiency.

Supply chain disruptions have compounded the burden of increased duties, with manufacturers reporting delayed deliveries and constrained component availability. In response, key industry participants have explored near-sourcing alternatives, leveraging U.S.-based distributors to secure critical chromatography columns, spectroscopic modules, and mass spectrometry accessories. Concurrently, service models emphasizing modular upgrades and extended equipment life cycles have gained prominence, enabling organizations to optimize total cost of ownership amid a volatile tariff environment.

Uncovering nuanced segmentation trends across diverse technologies, product types, applications, end users, and sales channels in the bottled water testing equipment market

The bottled water testing equipment market exhibits multifaceted segmentation dynamics that reflect the diversity of analytical requirements across industry stakeholders. On the technology front, high-performance liquid chromatography systems have become indispensable for resolving intricate chemical profiles, while gas chromatography platforms continue to excel in volatile organic compound detection. Conductivity testing solutions, available in both online and portable formats, provide continuous monitoring of ionic strength, and benchtop pH meters deliver precise acidity measurements alongside portable counterparts for in-field sampling. Spectroscopy techniques, spanning fluorescence, infrared, and UV-Vis modalities, address a broad spectrum of organic and inorganic analytes, and mass spectrometry tools, leveraging GC-MS and LC-MS configurations, push the frontiers of trace-level analysis.

Product type segmentation further defines market offerings, ranging from sophisticated laboratory analyzers that anchor centralized testing laboratories to online monitoring systems-both inline analyzers and continuous samplers-designed for proactive quality control. Portable testing instruments enable rapid field assessments, and reagents and kits supply essential consumables for targeted assays. Application-wise, the industry spans chemical parameter evaluations, including organic and inorganic contaminant quantification, microbiological assessments for pathogens, and physical parameter testing such as turbidity and conductivity. End users access these solutions in food and beverage processing, environmental and government agencies, private and academic laboratories, and municipal water treatment facilities. Finally, distribution channels range from direct sales engagements to distributor networks and online retail portals, each offering differentiated service levels and delivery models tailored to user-specific demands.

This comprehensive research report categorizes the Bottled Water Testing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Application

- End User

- Sales Channel

Analyzing region-specific dynamics and market trajectories in the Americas, Europe Middle East & Africa regions, and Asia-Pacific for bottled water testing equipment

Regionally, the Americas remain a dominant market, driven by stringent federal regulations and high per capita bottled water consumption. Investment in advanced filtration and analytical technologies has surged among North American bottlers seeking to enhance brand differentiation and comply with evolving state-level directives. Latin American markets, while smaller, are experiencing steady growth as regional governments bolster water quality initiatives and private investment in testing infrastructure expands.

In Europe, the Middle East, and Africa, regulatory frameworks such as the European Union’s Drinking Water Directive have catalyzed demand for high-sensitivity detection platforms, with PFAS monitoring emerging as a top priority in several member states. Private testing laboratories and agencies are scaling capabilities to meet both EU-wide standards and local requirements, while Middle Eastern nations invest in desalination monitoring and potable water analysis amid arid conditions. African markets, though nascent, are witnessing incremental adoption of portable testing instruments to address decentralized water supply challenges.

The Asia-Pacific region presents a heterogeneous landscape, where rapid industrialization and heightened environmental scrutiny in countries like China and India are driving uptake of robust chromatographic and spectroscopic systems. Australia and Japan maintain established testing infrastructures and prioritize method validation, whereas Southeast Asian economies are set to accelerate deployment of mobile and inline monitoring platforms to safeguard growing urban populations. Across all regions, integrated digital solutions and service-based models are gaining traction as end users seek to streamline operations and mitigate talent shortages in laboratory environments.

This comprehensive research report examines key regions that drive the evolution of the Bottled Water Testing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry stakeholders and their strategic initiatives that are shaping competitive positioning in the bottled water testing equipment industry

Competitive dynamics in the bottled water testing equipment sphere are shaped by a mix of global instrumentation leaders and emerging niche innovators. Established corporations leverage extensive distribution footprints and broad product portfolios that span chromatography, mass spectrometry, and spectroscopy solutions. Their robust R&D pipelines and strategic acquisitions enable them to introduce modular platforms that can adapt to shifting regulatory requirements and customer specifications.

Conversely, specialized entrants focus on agile software integration, offering cloud-enabled monitoring systems that enhance data visibility and compliance reporting. These players often partner with traditional OEMs to embed advanced analytics into existing workflows, creating synergistic alliances that amplify market reach. Service organizations also differentiate through aftermarket support, calibration services, and extended warranties, strengthening customer retention amid protracted capital expenditure cycles.

Increasingly, collaboration across industry consortia accelerates method validation for emerging contaminants, fostering standardized protocols that reduce barriers to entry for new testing solutions. Partnerships between equipment vendors and academic or government laboratories further drive certification processes and operator training, solidifying end-user confidence in advanced instrumentation deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bottled Water Testing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- IDEXX Laboratories, Inc.

- Lamotte Company

- Merck KGaA

- Metrohm AG

- Mettler-Toledo International Inc.

- PerkinElmer, Inc.

- Prerana Laboratories

- Pure Aqua, Inc.

- Restek Corporation

- Shimadzu Corporation

- Taylor Water Technologies LLC

- Thermo Fisher Scientific Inc.

- Waters Corporation

Strategic imperatives and tactical initiatives industry leaders must adopt to navigate evolving trade policies, technological disruptions, and competitive pressures

To thrive in this rapidly evolving market, industry leaders must prioritize supply chain resilience by diversifying sourcing strategies and maintaining flexible manufacturing footprints. Establishing relationships with multiple distributors and exploring nearshoring opportunities will mitigate the risk of future tariff escalations and geopolitical disruptions. Additionally, adopting modular instrument architectures and extending equipment life cycles through targeted upgrade programs can preserve capital budgets while maintaining analytical performance.

Innovation investments should concentrate on digital convergence and predictive maintenance, integrating IoT sensors and cloud-based analytics to preempt downtime and optimize throughput. Collaborations with regulatory bodies and standard-setting organizations will expedite method approvals for novel contaminants, positioning first movers as compliance enablers. Expanding service offerings into reagent sharing and refurbishment programs will address total cost of ownership concerns and foster recurring revenue streams. Finally, cultivating cross-functional teams that blend technical expertise with regulatory intelligence will ensure agile responses to shifting policy landscapes and technological breakthroughs.

Detailing the rigorous research framework integrating primary insights, secondary intelligence, and analytical validation methodologies ensuring report accuracy

This report’s findings are underpinned by a rigorous research framework that blends comprehensive secondary intelligence with targeted primary validation. Secondary research encompassed an extensive review of regulatory documents, industry white papers, and corporate filings to map the competitive and regulatory landscape accurately. Data triangulation techniques were applied to reconcile disparate sources and ensure coherence across market dimensions.

Primary research involved in-depth interviews with senior stakeholders in manufacturing, quality assurance, regulatory affairs, and procurement from leading end-user organizations. These discussions provided nuanced insights into evolving purchasing criteria, technology adoption drivers, and strategic imperatives. A global advisory panel comprising analytical chemists, laboratory directors, and supply chain experts further validated core assumptions and identified emerging trends.

Quantitative data analysis employed cross-segment comparisons and trend extrapolations to highlight growth pockets and potential vulnerabilities. All methodologies adhered to strict quality control protocols and were subjected to peer review to reinforce the credibility and robustness of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bottled Water Testing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bottled Water Testing Equipment Market, by Technology

- Bottled Water Testing Equipment Market, by Product Type

- Bottled Water Testing Equipment Market, by Application

- Bottled Water Testing Equipment Market, by End User

- Bottled Water Testing Equipment Market, by Sales Channel

- Bottled Water Testing Equipment Market, by Region

- Bottled Water Testing Equipment Market, by Group

- Bottled Water Testing Equipment Market, by Country

- United States Bottled Water Testing Equipment Market

- China Bottled Water Testing Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing critical insights and outlining future scenario outlooks for stakeholders in the dynamic bottled water testing equipment market environment

The bottled water testing equipment market stands at the intersection of heightened safety imperatives, technological innovation, and complex global trade dynamics. From advanced chromatography platforms that elucidate detailed contaminant profiles to portable monitoring solutions that enable agile field assessments, the industry is rapidly adapting to address both legacy and emergent quality concerns.

Trade policy shifts in early 2025 have underscored the importance of supply chain diversification and resilient procurement frameworks. Concurrently, collaborative efforts among regulators, equipment providers, and end users are fostering standardized methodologies for novel analytes, including PFAS and microplastic particles. Digital transformation is further redefining operational paradigms, with cloud-driven analytics and predictive maintenance models enhancing efficiency across laboratory and inline environments.

Looking ahead, sustained growth will hinge on the ability to integrate multi-technology platforms, align with evolving regulatory mandates, and deploy service-centric models that optimize total cost of ownership. Stakeholders who proactively embrace modular designs, strategic partnerships, and data-enabled workflows will secure competitive advantage and deliver on the shared objective of safeguarding public health and water quality.

Engage with Ketan Rohom, Associate Director of Sales & Marketing expertise, to access comprehensive bottled water testing equipment insights and secure your report

Ready to elevate your strategic decision-making with in-depth, bespoke insights, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of this comprehensive market research report and position your organization at the forefront of the bottled water testing equipment landscape.

- How big is the Bottled Water Testing Equipment Market?

- What is the Bottled Water Testing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?