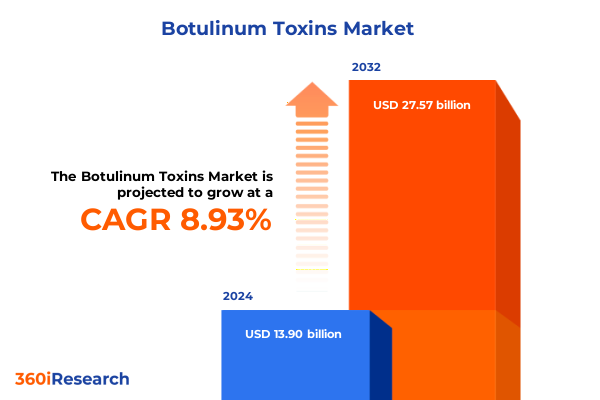

The Botulinum Toxins Market size was estimated at USD 13.90 billion in 2024 and expected to reach USD 15.10 billion in 2025, at a CAGR of 8.93% to reach USD 27.57 billion by 2032.

Botulinum toxins at the crossroads of aesthetic demand and therapeutic need, redefining minimally invasive care for diverse patient groups

Botulinum toxins have evolved from a niche therapeutic intervention into a central pillar of both aesthetic medicine and multiple clinical specialties. Derived from Clostridium botulinum and most commonly used in type A and type B formulations, these neurotoxins act by temporarily blocking neuromuscular transmission. In practice, they are used to soften facial lines, manage movement disorders, treat excessive sweating, and alleviate certain types of chronic pain, among other indications. Their ability to deliver measurable results with relatively short procedures and limited downtime has made them indispensable to dermatologists, plastic surgeons, neurologists, rehabilitation physicians, and other clinicians worldwide.

The current landscape is shaped by the convergence of several forces. In aesthetics, neuromodulator injections have become the leading non-surgical cosmetic procedure globally, outpacing many traditional surgical interventions as patients prioritize subtle outcomes and rapid recovery. At the same time, regulators have granted approvals for a growing list of therapeutic uses, ranging from chronic migraine and cervical dystonia to overactive bladder and spasticity, helping normalize these products in the eyes of both clinicians and patients.

This dual identity, straddling elective cosmetic care and medically necessary treatment, defines the strategic complexity of the botulinum toxin field. Manufacturers must address the expectations of self-paying aesthetic clients and insured medical patients, while navigating stringent safety standards and scrutiny around appropriate use. Providers, in turn, balance patient demand for visible aesthetic benefits with ethical considerations, long-term safety data, and the need for precise dosing and injection technique. As new competitors, new formulations, and new indications enter the scene, stakeholders increasingly require a nuanced, data-driven understanding of how these trends interact across segments and regions.

Against this backdrop, the following sections synthesize the most important shifts reshaping the botulinum toxin environment. They examine changing patient behavior, innovation trends, the implications of evolving United States tariff policy for supply chains, and detailed insights across product, application, end-user, and regional dimensions, culminating in clear recommendations for industry leaders.

Transformative shifts in botulinum toxin innovation, patient expectations, and care delivery reshaping competitive dynamics across indications

Over the past several years, the botulinum toxin ecosystem has undergone profound structural changes that are redefining what success looks like for both manufacturers and providers. On the demand side, the most visible transformation is the rise of preventive aesthetics. Younger adults are increasingly turning to neuromodulators not to correct deeply etched wrinkles, but to delay their formation, seeking subtle, natural-looking improvements that fit into busy professional and social lives. This shift is reinforced by the influence of social media, where both women and men openly discuss their use of injectable treatments, gradually eroding stigma and normalizing routine aesthetic maintenance.

Parallel to this demographic broadening, the care delivery model is also diversifying. Medical spas and dedicated aesthetic centers have expanded rapidly, offering a more consumer-oriented experience than traditional hospital environments. These facilities emphasize convenience, hospitality, and tailored treatment plans, positioning botulinum toxin injections as part of broader wellness and appearance management regimens. At the same time, hospitals and multispecialty clinics remain pivotal for complex therapeutic indications, where neuromodulators are used in integrated care pathways for neurological, ophthalmic, urological, and musculoskeletal disorders.

On the innovation front, competition is no longer driven solely by brand equity; it increasingly revolves around clinical differentiation. Longer-acting formulations, such as newer botulinum toxin type A products designed to sustain effect over extended intervals, are challenging traditional three-to-four-month treatment cycles and appealing to patients seeking fewer injection visits. Other entrants emphasize rapid onset of action, aiming to deliver visible improvements within the first days after treatment, a feature particularly valued for social or professional events.

The label expansion pipeline is equally transformative. Clinical research continues to explore new therapeutic applications, including conditions such as depression, bruxism, various gastrointestinal disorders, and chronic pain syndromes. Early-stage data have encouraged sustained institutional research funding and cross-disciplinary collaboration, signaling that neuromodulators will play an even broader role in future treatment algorithms.

Simultaneously, competition is intensifying through biosimilar and follow-on products, especially in Asia, where domestic manufacturers have started to launch their own botulinum toxin brands. Some of these products put pressure on pricing in local markets while driving discussions around equivalence, interchangeability, and long-term safety. As more brands enter, physicians gain greater flexibility to tailor product selection based on specific patient needs, dosing familiarity, onset and duration profiles, and cost considerations.

These transformative shifts mean that the historical playbook-relying heavily on a small number of dominant brands and relatively narrow indications-is no longer sufficient. Stakeholders must monitor not just clinical advances, but also evolving patient expectations, new care settings, intensifying regulatory scrutiny, and the growing role of digital engagement before, during, and after treatment. Those who adapt fastest to this multidimensional change will be best positioned to capture value in the next phase of the botulinum toxin market’s evolution.

Assessing cumulative effects of evolving United States tariff policies on botulinum toxin supply chains, pricing pressures, and investment decisions

Trade policy has emerged as a critical, if sometimes underappreciated, determinant of neuromodulator strategy. In recent years, the United States has explored and, in some cases, implemented new and expanded tariffs on a range of pharmaceutical products and active ingredients sourced from major manufacturing hubs, particularly China and India. Although many of the public debates have focused on generic small-molecule drugs and essential hospital injectables, the underlying logic of these policies-reducing dependence on foreign supply and incentivizing domestic production-has direct implications for botulinum toxin producers whose value chains remain highly globalized.

The cumulative effect of evolving tariffs and ongoing policy discussions is to inject a new layer of uncertainty into cost structures and supply continuity. Manufacturers that depend on imported raw materials, specialized equipment, or contract manufacturing in tariff-affected jurisdictions are facing pressures ranging from higher landed costs to more volatile lead times. At the same time, price-sensitive health systems and aesthetic providers may find it difficult to absorb higher acquisition costs, especially where reimbursement is limited or where neuromodulators compete with alternative therapies. This tension raises the risk that some lower-margin formulations or smaller indications could become less commercially attractive, even if clinical need persists.

In response, there is a visible trend toward reshoring or near-shoring critical pharmaceutical manufacturing capacity to the United States and other high-demand regions, supported in some cases by favorable tax policies and public incentives. High-profile investments in new domestic facilities for active ingredients and sterile injectables illustrate how large biopharmaceutical companies are reassessing their geographic footprint to mitigate trade and geopolitical risks. While many of these investments are not specific to botulinum toxins, they are part of the same strategic shift toward shorter, more controllable supply chains for high-value biologics and injectables.

For neuromodulator producers and distributors, 2025 marks a point at which tariff policy can no longer be treated as a short-term aberration. Instead, it must be integrated into scenario planning and long-range capital allocation. Companies that proactively diversify suppliers, secure dual manufacturing sites, and build stronger inventory and distribution resilience are better positioned to absorb shocks from new tariff rounds or related regulatory changes. Providers, likewise, benefit from engaging with suppliers that demonstrate transparent, robust plans for continuity of supply, particularly for therapeutic indications where treatment interruptions can have serious clinical consequences.

Looking ahead, trade policy will likely remain fluid, with potential for both escalation and targeted exemptions. The net impact on botulinum toxin availability and pricing will therefore depend on how quickly stakeholders implement mitigation strategies, how regulators balance supply security with price control, and how competitive dynamics influence the ability to pass cost increases along the value chain. What is clear is that tariff considerations are now structurally embedded in strategic decisions around manufacturing location, product pricing, and contractual arrangements with distributors and clinical customers.

Decoding botulinum toxin demand patterns through granular insights by type, form, administration mode, channel, application, and end user base

Understanding the botulinum toxin landscape requires a close examination of how demand distributes across product types. Type A formulations dominate contemporary practice, particularly in aesthetic medicine, where they are used extensively for facial lines and non-surgical rejuvenation. In contrast, type B preparations occupy more specialized niches, often in neurology, where their pharmacologic profile can offer benefits in certain forms of cervical dystonia or when patients fail to respond adequately to type A products. This dichotomy underscores the need for manufacturers to clarify their positioning: broad-appeal, high-volume type A offerings versus differentiated, indication-focused type B solutions.

Formulation type represents another decisive dimension. Traditional lyophilized powders that require reconstitution give physicians flexibility in dilution and dosing but demand meticulous preparation and handling. More recently, ready-to-use liquid formulations have begun to gain traction, appealing to practices that prioritize workflow efficiency, predictable dosing, and reduced preparation time. In high-throughput aesthetic centers and busy hospital services, this distinction can materially affect scheduling, staff allocation, and the perceived convenience of specific brands.

Mode of administration further shapes clinical practice patterns. Intramuscular injections remain the backbone for treating dynamic facial wrinkles and various neuromuscular disorders, as they directly modulate hyperactive muscles. Intradermal techniques, by contrast, are increasingly applied in "micro-droplet" approaches for fine textural improvements, pore refinement, and treatment of conditions such as hyperhidrosis. The choice between intradermal and intramuscular routes reflects both the targeted anatomy and the desired clinical effect, driving demand for products with dosing guidance and real-world evidence tailored to each technique.

Distribution channels are also evolving. Offline retail, encompassing hospitals, dermatology and plastic surgery clinics, and medical spas, continues to be the primary pathway through which licensed professionals procure botulinum toxin. These settings offer controlled storage, appropriate supervision, and the infrastructure needed to manage potential adverse events. At the same time, professional online retail platforms serving licensed providers are becoming more sophisticated, enabling streamlined ordering, inventory tracking, and price transparency. As regulatory authorities intensify enforcement against non-authorized online sales, legitimate digital channels operated by reputable wholesalers and manufacturers become increasingly important for ensuring that only properly credentialed end users can access genuine product.

Application segmentation reveals a balanced but evolving portfolio of uses. Aesthetic indications such as facial rejuvenation, treatment of glabellar lines and crow’s feet, hyperhidrosis management, and non-surgical facelifts remain the most visible and culturally salient applications, driven by consumer demand for minimally invasive appearance enhancement. In parallel, medical applications including management of muscle spasms and paralysis, gastrointestinal disorders such as certain sphincter dysfunctions, and diverse pain syndromes continue to expand as clinical evidence accumulates and guidelines evolve. This growing breadth supports resilient demand that is less dependent on purely discretionary spending.

Finally, end-user segmentation highlights distinct practice environments with differing needs. Dermatology clinics and medical spas tend to focus on high-volume aesthetic treatments, emphasizing patient experience, efficient appointment flow, and brand-driven marketing. Hospitals and general clinics integrate neuromodulators into complex treatment plans for neurologic and other medical conditions, with decisions heavily influenced by formularies, reimbursement policies, and multidisciplinary protocols. Research and academic institutes occupy a smaller but strategically vital niche, driving innovation through clinical trials, comparative effectiveness studies, and mechanistic research. Together, these diverse end users create a multifaceted demand structure in which product attributes, education, and support services must be carefully tailored to each setting.

This comprehensive research report categorizes the Botulinum Toxins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Mode of Administration

- Distribution Channel

- Application

- End User

Unearthing regional dynamics as Americas, Europe–Middle East–Africa, and Asia–Pacific redefine botulinum toxin access, adoption, and innovation

Geographic dynamics exert a powerful influence on how the botulinum toxin opportunity unfolds. In the Americas, the United States anchors demand, supported by high awareness of aesthetic procedures, widespread availability of trained injectors, and a robust private-pay ecosystem. Neuromodulator injections are deeply embedded in cosmetic culture, extending from major metropolitan centers to secondary markets, and increasingly appealing to diverse age groups and genders. In addition, the region maintains significant therapeutic usage, with neurologists, physiatrists, and other specialists integrating botulinum toxins into standardized care pathways for conditions such as chronic migraine and spasticity. Canada and key Latin American countries, including Brazil and Mexico, further contribute to regional strength through developed aesthetic industries and growing medical tourism sectors.

Across Europe, the Middle East, and Africa, the picture is nuanced but increasingly dynamic. Western Europe benefits from longstanding regulatory rigor and established clinical guidelines, which reinforce confidence in safety and appropriate use. Reimbursement frameworks in several European markets support therapeutic indications, while self-pay channels sustain aesthetic demand. In the Middle East, countries such as the United Arab Emirates and Saudi Arabia have invested heavily in advanced private healthcare infrastructure, positioning themselves as hubs for high-end cosmetic and wellness procedures that frequently feature neuromodulators. Parts of Africa remain at an earlier stage of adoption, with limited access, lower affordability, and fewer trained specialists, yet major urban centers are beginning to see rising interest as awareness and disposable income grow.

Asia-Pacific stands out as one of the most vibrant regions for botulinum toxin. South Korea has become synonymous with cutting-edge aesthetic innovation and high procedure volumes, underpinned by a dense network of specialized clinics and an image-conscious consumer base. China and India, with large urban populations and expanding middle classes, are seeing accelerated adoption of both aesthetic and therapeutic neuromodulator use, though availability and affordability still vary significantly between tiers of cities. Southeast Asian markets such as Thailand and Vietnam, together with countries like Turkey that bridge regions, are capitalizing on rising medical tourism with competitively priced aesthetic procedures that prominently feature botulinum toxin injections.

The interplay of regulatory environments, cultural attitudes toward aesthetics, insurance coverage, and the maturity of provider networks means that each region offers a distinct risk–reward profile. For companies and investors, this regional segmentation underscores the importance of tailored go-to-market strategies, calibrated pricing, and context-specific medical education. It also highlights the need to monitor local developments in regulation, advertising restrictions, and professional training standards, all of which can accelerate or constrain uptake in ways that differ markedly between the Americas, Europe–Middle East–Africa, and Asia–Pacific.

This comprehensive research report examines key regions that drive the evolution of the Botulinum Toxins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic moves of established and emerging botulinum toxin manufacturers as competition intensifies across brands, indications, and geographies

The competitive landscape for botulinum toxin products is characterized by a mix of long-established global brands and agile newer entrants, each pursuing distinctive strategies. Among the most prominent players are manufacturers of leading type A formulations used in both aesthetic and therapeutic indications, supported by extensive clinical data, broad regulatory approvals, and strong physician loyalty. Other major companies market well-known brands such as Dysport, Xeomin, and Jeuveau, each emphasizing particular strengths, whether in terms of diffusion characteristics, formulation purity, or branding and practice support.

Innovation is increasingly central to competitive positioning. The introduction of longer-acting agents, such as daxibotulinumtoxinA, has created a new category focused on durability, while emerging products like Letybo bring additional choice to the glabellar lines segment with claims around onset and patient experience. These advances are accompanied by investments in delivery systems, including finer-gauge needles, potential microneedle-based approaches, and adjunctive technologies designed to enhance comfort and precision.

Legal and intellectual property dynamics have also intensified. Recent patent disputes between incumbents and challengers, including high-profile litigation around manufacturing processes for rival products, underscore the strategic value of proprietary technology and established know-how. Outcomes in these cases not only impact the financial performance of individual companies, but also influence how aggressively new entrants pursue biosimilar or follow-on toxin development in key markets.

Alongside these global brands, regional and domestic manufacturers-particularly in Asia-are expanding their presence with locally produced botulinum toxin offerings. Some of these companies focus on cost-competitive products aimed at domestic clinics, while others have begun to seek regulatory approvals in international markets. Their rise contributes to a more fragmented but vibrant ecosystem, creating both pricing pressure and fresh partnership opportunities for distribution, co-development, or contract manufacturing.

For providers, this increasingly crowded field can be beneficial, as it widens the range of product attributes and commercial terms available. However, it also heightens the importance of evidence-based brand selection, robust pharmacovigilance, and careful management of parallel sourcing or substitution. For manufacturers, long-term competitiveness will depend on more than incremental formulation tweaks; it will require sustained investment in post-marketing research, education for injectors, digital engagement with patients, and differentiated service models that help practices grow profitably and safely.

This comprehensive research report delivers an in-depth overview of the principal market players in the Botulinum Toxins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Ajinomoto Bio-Pharma Services

- ATGC Co.,Ltd.

- Bioplus Co., Ltd.

- BMI KOREA CO., LTD.

- BNC KOREA, INC.

- Chong Kun Dang Pharmaceutical Corp.

- Croma-Pharma GmbH

- Daewoong Pharmaceuticals Co.Ltd.

- Eirion Therapeutics, Inc.

- Evolus, Inc.

- Galderma SA

- Genetox Co., Ltd.

- Gufic Biosciences Ltd.

- HUGEL, Inc.

- Hugh Source International Ltd.

- Huons Global Co., Ltd.

- INIBIO Co., Ltd.

- Ipsen Pharma

- JETEMA, Co., Ltd.

- Lanzhou Institute of Biological Products Co. Ltd.

- Medytox Co., Ltd.

- Merz Pharma GmbH & Co.KGaA

- Object Pharma, Inc.

- PharmaResearch Co. Ltd

- Revance Therapeutics, Inc.

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

- Supernus Pharmaceuticals, Inc.

- Taj Life Sciences Pvt. Ltd.

Translating botulinum toxin market intelligence into clear strategic actions for manufacturers, providers, and investors navigating rapid change

Given the pace and complexity of change in the botulinum toxin environment, industry leaders need a focused agenda that links high-level trends to concrete actions. First, manufacturers should prioritize supply chain resilience as a strategic imperative rather than an operational afterthought. That means diversifying sources of critical inputs, considering dual-site manufacturing for key products, and building transparent risk-sharing arrangements with distributors and large provider networks. Such measures can help mitigate the impact of evolving tariff regimes, geopolitical tensions, and logistics disruptions on both availability and cost.

Second, differentiation through clinically meaningful innovation remains essential. Investments should concentrate on attributes that matter most to patients and clinicians: duration of effect, onset time, safety profile, injection comfort, and ease of integration into clinical workflows. Strategically expanding into high-potential therapeutic indications-such as chronic pain conditions, gastrointestinal disorders, and specific movement disorders-can help balance exposure to purely discretionary aesthetic demand. Collaborations with academic centers and specialist societies can accelerate evidence generation and support guideline inclusion, increasing confidence among prescribers.

Third, companies and providers alike should refine their segmentation strategies around form, mode of administration, application, and end user. High-volume aesthetic-focused settings, such as dermatology clinics and medical spas, may benefit from ready-to-use liquid formulations, patient membership models, and robust training in advanced intradermal techniques. Hospitals and multidisciplinary clinics may prioritize formulary efficiency, long-term therapeutic outcomes, and integration with rehabilitation or pain management programs. Tailored education and service packages that reflect these differences can significantly improve adoption and loyalty.

Fourth, stakeholders must elevate training and quality assurance. As the spectrum of injectors broadens-from board-certified specialists to practitioners in medical spa settings-the risk of improper technique or product misuse increases. Manufacturers should support structured training curricula, certification pathways, and ongoing education that emphasize anatomy, dosing, complication management, and ethical patient selection. Providers, in turn, should implement internal protocols, peer review, and outcome tracking to maintain high standards and protect patient safety.

Finally, commercial models should reflect an increasingly discerning and digitally connected patient base. Transparent communication about product attributes, realistic outcome expectations, and potential adverse events can strengthen trust and support informed consent. Practices that leverage teleconsultation for pre-treatment evaluation and post-treatment follow-up, as well as digital tools for appointment management and outcomes documentation, can enhance patient experience while optimizing resource use. Collectively, these actions enable stakeholders not just to respond to current trends, but to shape the future trajectory of botulinum toxin utilization in a responsible and sustainable way.

Robust research methodology integrating clinical, regulatory, and commercial evidence to deliver reliable insights on botulinum toxin dynamics

The insights presented in this executive summary are grounded in a structured research methodology designed to balance breadth and depth. The analytical process begins with comprehensive secondary research drawing on peer-reviewed clinical literature, regulatory databases capturing approvals and safety updates, public filings and presentations from relevant pharmaceutical and biotechnology companies, procedure statistics from professional associations, and reputable industry and trade publications. Particular attention is paid to developments in minimally invasive aesthetics, emerging therapeutic indications, and documented changes in regulatory and trade policy affecting pharmaceuticals and biologics.

This foundational layer is supplemented with targeted primary research where appropriate. Interviews and structured conversations with practicing dermatologists, plastic surgeons, neurologists, physiatrists, and pain specialists help validate real-world practice patterns and highlight regional nuances that may not be fully captured in published data. Discussions with executives from manufacturers, distributors, and medical spa operators contribute context on supply chain considerations, pricing pressures, product positioning, and adoption barriers. These qualitative inputs provide an important counterbalance to secondary data, ensuring that the analysis aligns with on-the-ground realities.

Analytical frameworks are then applied to synthesize findings across the defined segmentation dimensions: type and form of botulinum toxin, mode of administration, distribution channel, application category, and end-user environment, as well as the key regions of the Americas, Europe–Middle East–Africa, and Asia–Pacific. Scenario analysis is used in areas of elevated uncertainty-such as the potential trajectory of tariff policy-to explore a range of plausible outcomes and their implications for stakeholders. Throughout, careful cross-checking and triangulation are employed to minimize inconsistencies and maintain a high standard of reliability and relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Botulinum Toxins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Botulinum Toxins Market, by Type

- Botulinum Toxins Market, by Form

- Botulinum Toxins Market, by Mode of Administration

- Botulinum Toxins Market, by Distribution Channel

- Botulinum Toxins Market, by Application

- Botulinum Toxins Market, by End User

- Botulinum Toxins Market, by Region

- Botulinum Toxins Market, by Group

- Botulinum Toxins Market, by Country

- United States Botulinum Toxins Market

- China Botulinum Toxins Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Botulinum toxin poised to remain a cornerstone of aesthetic and therapeutic practice amid technological advances and shifting policy landscapes

Taken together, the evidence paints a picture of a botulinum toxin landscape that is both mature and rapidly evolving. These products have become deeply embedded in aesthetic practice, where they are now viewed as routine components of appearance management, and they are steadily gaining ground in therapeutic domains where their neuromodulatory properties can deliver clinically meaningful benefits. The coexistence of discretionary and medically driven demand provides a degree of resilience, buffering the category against purely cyclical swings in consumer sentiment.

At the same time, the environment is anything but static. New formulations with differentiated onset and duration profiles are challenging established treatment paradigms, while ongoing research continues to expand the range of conditions for which neuromodulators are considered. Competitive intensity is climbing as additional brands, including biosimilar and regional entrants, seek to establish themselves in both established and emerging markets. Regulatory expectations around safety, quality, and professional training are tightening, and public scrutiny of aesthetic interventions remains high.

Overlaying these clinical and commercial dynamics are structural forces such as evolving trade policy, supply chain reconfiguration, and changing patient expectations around transparency, convenience, and personalization. Leaders who respond by investing in robust manufacturing and distribution capabilities, clinically meaningful innovation, high-quality education for injectors, and sophisticated segmentation and engagement strategies will be best placed to sustain advantage.

Ultimately, neuromodulators are poised to remain a cornerstone modality in both aesthetic and therapeutic practice. Their future trajectory will depend less on any single breakthrough and more on the cumulative effect of many incremental improvements-in product science, service delivery, policy adaptation, and ethical standards. Organizations that view these developments holistically, rather than through a narrow pricing or promotional lens, will be best positioned to unlock long-term value while safeguarding patient outcomes and trust.

Leverage this comprehensive botulinum toxin insight by engaging with Ketan Rohom for deeper intelligence and tailored strategic decision support

Organizations that rely on neuromodulators for aesthetic and therapeutic portfolios cannot afford to make strategic decisions on fragmented or outdated intelligence. This executive overview has highlighted the most critical themes, but the full report offers a far more granular view of product pipelines, clinical indications, regulatory trajectories, technology innovation, competitive benchmarking, and evolving patient demand across each key segment and region.

To translate these insights into concrete, organization-specific plans, decision-makers are encouraged to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He can facilitate access to the complete report, walk senior stakeholders through the most relevant findings in a customized briefing, and align the research with your immediate strategic priorities, whether that involves portfolio optimization, geographic expansion, or partnership evaluation.

Engaging with Ketan also provides an opportunity to clarify assumptions, stress-test scenarios around tariffs and supply chain resilience, and identify underappreciated opportunities in emerging applications or end-user settings. By investing in a comprehensive evidence base now, leaders place themselves in a stronger position to navigate regulatory shifts, competitive pressures, and rapidly changing patient expectations, turning the complexity of the botulinum toxin landscape into a defensible strategic advantage.

- How big is the Botulinum Toxins Market?

- What is the Botulinum Toxins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?