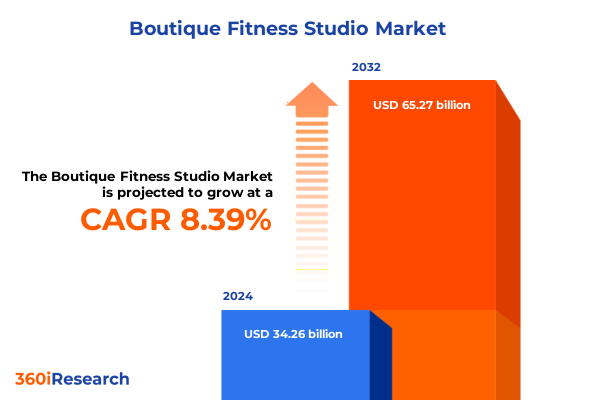

The Boutique Fitness Studio Market size was estimated at USD 36.73 billion in 2025 and expected to reach USD 39.38 billion in 2026, at a CAGR of 8.56% to reach USD 65.27 billion by 2032.

Uncovering the Dynamics of Boutique Fitness Studios to Illuminate Market Drivers and Strategic Imperatives for Stakeholders to Unlock Growth

Boutique fitness studios have emerged as dynamic hubs of specialized exercise experiences, redefining traditional gym models by offering curated workouts, community-driven atmospheres, and cutting-edge technology integrations. This summary sets out to illuminate the foundational elements shaping the boutique fitness sector, tracing both consumer motivations and competitive tactics that inform strategic decision-making. Through a deep dive into the forces driving studio performance, this report empowers industry leaders to better understand market complexities and capitalize on key growth levers.

The introduction of high-intensity interval training into small group settings, the proliferation of technology-enabled workout tracking, and the elevation of instructor-led classes have converged to create a consumer landscape that values personalization, accountability, and tangible results. As we embark on this analysis, we will contextualize these dynamics within broader economic and policy trends, ensuring readers possess a robust framework for evaluating opportunities and risks. By synthesizing primary research insights, expert interviews, and secondary data, this segment lays the groundwork for a comprehensive exploration of the boutique fitness universe.

Charting the Transformative Shifts in Consumer Behavior Technology and Service Delivery Redefining the Boutique Fitness Industry Landscape

Over the past several years, the boutique fitness industry has undergone transformative shifts driven by evolving consumer expectations, technological innovations, and novel delivery models. On the consumer side, demand has pivoted from purely performance-oriented goals toward holistic wellness, with members seeking classes that balance physical conditioning with mental well-being. This transition has prompted studios to expand offerings beyond traditional high-intensity programs, introducing restorative and mindfulness-based experiences.

Simultaneously, the integration of digital platforms and wearable technology has allowed studios to extend their reach beyond physical locations, enabling hybrid class formats and on-demand content that maintain engagement between in-person visits. In addition, service delivery innovations-such as micro-studio concepts and pop-up activations-have lowered barriers to entry in urban markets, fostering nimble approaches to market penetration. These combined trends underscore a landscape in which agility, community cultivation, and seamless technology adoption define competitive advantage.

Analyzing the Cumulative Impact of 2025 United States Tariff Policies on Equipment Costs Supply Chains and Operational Strategies for Studios

In 2025, the United States implemented a series of targeted tariffs on imported fitness equipment, apparel, and accessories, aiming to bolster domestic manufacturing while responding to evolving trade balances. These measures have led to increases in the landed cost of bikes, strength machines, and specialized flooring materials, prompting studios to reassess procurement strategies. Many operators have responded by negotiating volume-discount commitments with U.S. suppliers or by exploring alternative supply hubs in regions exempt from higher duties.

Beyond equipment costs, these tariffs have generated ripple effects across global supply chains, creating delays and inventory shortages that studios must navigate to maintain class schedules. Owners have increasingly prioritized local vendor relationships to ensure continuity, while also absorbing a portion of the cost burden to preserve competitive pricing for members. As a result, studio operators are reevaluating capital expenditure plans and considering phased equipment rollouts to align spending with cash flow constraints and shifting demand patterns.

Unlocking Nuanced Segmentation Insights Across Training Formats Objectives Demographics and Business Models to Drive Targeted Engagement

Deconstructing the market through multiple lenses reveals distinct pockets of demand and opportunity. When segmenting by training discipline, the research highlights the enduring popularity of high-intensity interval training alongside a robust appetite for yoga and barre classes, with cycling and dance-based workouts carving out dedicated followings. Meanwhile, boxing and martial arts classes continue to attract members seeking both fitness gains and practical skill development.

Class delivery formats further differentiate studio offerings: group sessions remain the backbone of social engagement, yet hybrid classes that blend virtual and in-person attendance are gaining traction as health-conscious consumers value flexibility. Private instruction also retains appeal for clients pursuing one-on-one coaching. Fitness objectives shape participation patterns, with studios tailoring programming to groups focused on endurance improvement, flexibility enhancement, strength building, or weight management. Demographic profiling uncovers varying preferences: professionals often gravitate toward early-morning express formats, seniors pursue low-impact mobility programs, and young adults are drawn to community-oriented high-energy classes. Finally, economic models span membership-based plans that incentivize frequent attendance, as well as pay-per-class options that appeal to sporadic users seeking no-commitment access.

This comprehensive research report categorizes the Boutique Fitness Studio market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Training Type

- Class Format

- Fitness Objectives

- Demographics

- Business Model

Harnessing Regional Variations in Consumer Preferences Infrastructure and Economic Drivers to Tailor Boutique Fitness Offerings Across Key Global Territories

Regional nuances play a critical role in shaping studio strategies and consumer uptake. In the Americas, rising household incomes and an urban-centric lifestyle have fueled demand for premium studio experiences, while infrastructure investments in secondary markets are creating new white-space opportunities outside coastal hubs. Conversely, in the Europe, Middle East & Africa region, studios face diverse regulatory environments and cultural preferences, prompting operators to adapt membership tiers and class schedules to local rhythms and seasonal patterns.

In the Asia-Pacific, rapid urbanization and a growing middle class are driving explosive growth in boutique formats, particularly in major metropolitan centers. Here, studios leverage bilingual instructors and culturally tailored fitness content to resonate with local consumers. Furthermore, regional differences in real estate costs and labor dynamics influence studio size and price positioning, requiring tailored go-to-market strategies. Cross-regional partnerships and franchise models have begun to bridge gaps, enabling best-practice transfers between high-growth and mature markets alike.

This comprehensive research report examines key regions that drive the evolution of the Boutique Fitness Studio market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovation Initiatives Among Leading Boutique Fitness Players to Uncover Best Practices and Growth Catalysts

Leading players in the boutique fitness arena are distinguished by their ability to marry brand storytelling with operational excellence. One innovative operator has built a loyal community around high-impact functional training, underpinned by data-driven performance tracking that keeps members motivated and engaged. Another has differentiated through immersive studio design and proprietary music curation, creating an ambience that fosters a sense of belonging and elevates perceived value.

Meanwhile, boutique brands expanding via franchise networks emphasize rigorous instructor certification programs and centralized marketing support to ensure consistency across locations. Digital-first entrants are leveraging live-streamed classes and interactive apps to capture online audiences, layering subscription models atop studio revenues. Additionally, strategic alliances with equipment manufacturers and wellness technology providers have enabled leading studios to pilot new offerings-such as AI-enhanced form correction tools and biometric feedback systems-thereby reinforcing their reputation as industry pioneers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Boutique Fitness Studio market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 9Round Franchising, LLC

- Anytime Fitness Franchisor, LLC

- Barry's Bootcamp LLC

- Blink Fitness

- Boutique Fitness Studios

- ClassPass Inc.

- Club Pilates Franchise, LLC

- CorePower Yoga LLC

- Crunch Fitness International, Inc..

- CycleBar Franchise SPV, LLC

- Equinox Holdings, Inc.

- F45 Training Holdings Inc.

- Fit Body Boot Camp

- Gold's Gym International, Inc.

- LA Fitness International, LLC

- Life Fitness Holdings, Inc..

- Life Time Fitness Inc.

- MINDBODY

- Peloton Interactive, Inc.

- Planet Fitness Inc.

- Pure Barre Inc.

- Solidcore Holdings, LLC

- SoulCycle Inc.

- Ultimate Fitness Group, LLC

- Wexer by Core Health & Fitness, LLC

- Xponential Fitness LLC

- YogaWorks Inc.

Charting Actionable Recommendations to Capitalize on Emerging Consumer Trends Technological Advancements and Operational Efficiencies in Boutique Fitness

To capitalize on emerging trends, industry leaders should prioritize investing in digital infrastructure that supports both virtual and in-studio engagement, ensuring seamless transitions between channels. Embracing flexible class formats with dynamic pricing structures will allow studios to capture a broader membership base, while premium add-on services-such as personalized nutrition coaching-can boost lifetime value. Cultivating strong partnerships with local health and wellness brands will also deepen community ties and extend marketing reach.

Operationally, studios can enhance resilience by diversifying supply chains and adopting scalable equipment deployment strategies. Implementing real-time attendance and satisfaction tracking enables rapid adjustments to class schedules and programming, fostering customer loyalty. Finally, committing to continuous instructor development and wellness education not only improves class quality but also solidifies brand reputation in an increasingly competitive environment.

Detailing Comprehensive Research Methodology Combining Quantitative Data Qualitative Insights and Stakeholder Engagement for Holistic Market Understanding

This analysis integrates both primary and secondary research methodologies to deliver a holistic view of the boutique fitness market. Primary research encompassed in-depth interviews with studio owners, instructors, and equipment suppliers, supplemented by surveys capturing consumer satisfaction and class preferences. Qualitative insights were gathered through focus groups conducted in key metropolitan areas, ensuring representativeness across age brackets and fitness objectives.

Secondary research drew upon industry publications, trade association reports, and financial filings to contextualize findings within broader macroeconomic and trade environments. Data triangulation techniques were employed to reconcile discrepancies between sources, while statistical analyses validated correlations among pricing, attendance, and retention metrics. Together, these approaches underpin a robust framework that combines quantitative rigor with experiential depth, equipping stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Boutique Fitness Studio market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Boutique Fitness Studio Market, by Training Type

- Boutique Fitness Studio Market, by Class Format

- Boutique Fitness Studio Market, by Fitness Objectives

- Boutique Fitness Studio Market, by Demographics

- Boutique Fitness Studio Market, by Business Model

- Boutique Fitness Studio Market, by Region

- Boutique Fitness Studio Market, by Group

- Boutique Fitness Studio Market, by Country

- United States Boutique Fitness Studio Market

- China Boutique Fitness Studio Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Insights and Strategic Imperatives to Equip Industry Stakeholders With Clarity and Confidence for Next-Level Boutique Fitness Growth

The boutique fitness sector stands at an inflection point where consumer expectations, technological innovation, and policy environments intersect to redefine success parameters. Key insights from this executive summary highlight the importance of segmentation sophistication, regional customization, and strategic adaptability in navigating tariffs and supply chain complexities. Furthermore, leading companies demonstrate that continuous investment in brand experience and digital capabilities is critical for maintaining relevance amid evolving market dynamics.

As studios chart their path forward, the strategic imperatives distilled here serve as a roadmap for enhancing member acquisition, deepening engagement, and optimizing operational resilience. By aligning offerings with nuanced consumer preferences, leveraging data-driven decision frameworks, and pursuing targeted investments, industry stakeholders can position themselves to thrive in a landscape characterized by both opportunity and disruption.

Engage With Ketan Rohom Today to Discover How Tailored Insights and Strategic Expertise Can Accelerate Your Boutique Fitness Studio Success

To explore the full breadth of insights, gain access to the complete market research report by reaching out directly to Ketan Rohom. As Associate Director of Sales & Marketing, he is prepared to guide you through tailored data, customized analyses, and strategic frameworks designed to position your studio for lasting success. By engaging with Ketan, you’ll receive expert consultation on how to apply these findings to your unique operational context and customer base.

Connect with Ketan Rohom today to schedule a personalized briefing and discover the next steps toward driving growth, enhancing member satisfaction, and capitalizing on the evolving boutique fitness landscape.

- How big is the Boutique Fitness Studio Market?

- What is the Boutique Fitness Studio Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?