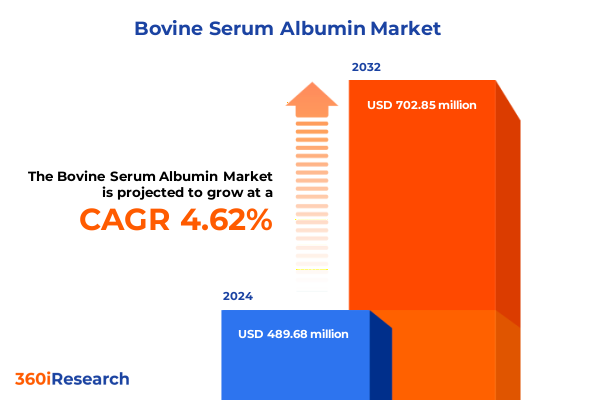

The Bovine Serum Albumin Market size was estimated at USD 512.59 million in 2025 and expected to reach USD 534.08 million in 2026, at a CAGR of 4.61% to reach USD 702.85 million by 2032.

Discover How Bovine Serum Albumin Has Emerged as an Indispensable Protein Component Driving Advances Across Biotech and Diagnostic Applications

Bovine serum albumin is a highly soluble monomeric protein with a molecular weight of approximately 66.5 kDa synthesized primarily in the bovine liver. Its unique ability to stabilize extracellular fluid volume and bind a wide variety of small molecules-including fatty acids, steroids, and hormones-has established it as a cornerstone reagent in life science research and biopharmaceutical manufacturing. This versatile protein serves not only as a critical standard for protein quantification assays but also as a stabilizing agent that enhances enzyme activity during storage and processing.

The adoption of bovine serum albumin spans a broad spectrum of applications, from its role as a blocking reagent in immunoassays to its function as a nutrient supplement in cell culture media. In mammalian and insect cell culture systems, the addition of BSA facilitates cell attachment, growth, and viability by effectively delivering essential lipids and growth factors. Its antioxidative properties further mitigate cellular stress, thereby supporting more robust yields in both research and scale-up biomanufacturing processes.

Manufacturers have responded to diverse application requirements by offering multiple grades of BSA-from biochemistry and immunoassay grades to protease-free and fatty acid-free variants-each tailored to meet stringent purity standards. The capacity to trace the origin of raw materials and leverage closed-loop manufacturing processes underscores the industry’s emphasis on quality assurance and supply chain transparency, ensuring that BSA continues to meet the evolving needs of diagnostics, therapeutic formulation, and analytical workflows.

Unveiling the Major Industry Disruptions and Technological Evolution Reshaping the Global Bovine Serum Albumin Supply and Demand Dynamics

Recent years have witnessed a dramatic shift in the production and utilization of bovine serum albumin, propelled by an expanding pipeline of biologics and heightened demand for serum-free cell culture systems. As leading biopharmaceutical firms intensify their focus on monoclonal antibodies, vaccines, and cell-based therapies, the requirement for consistent, high-performance supplements such as recombinant albumin has surged. Analysts report that recombinant albumin accounted for the largest revenue share within the U.S. recombinant cell culture supplements segment in 2024, underscoring its critical role in driving next-generation biologic manufacturing.

This surge has catalyzed investments in innovative purification and downstream processing techniques. Producers are increasingly implementing single-use bioreactors and closed-system filtration units to enhance yield and reduce contamination risks. Such advancements in continuous processing and modular facility designs have streamlined BSA production, enabling manufacturers to swiftly adjust capacity in response to fluctuating demand while maintaining rigorous quality control parameters.

At the same time, regulatory bodies and end users have heightened scrutiny over animal-origin materials, prompting efforts to develop recombinant and animal-free alternatives. Manufacturers of native BSA have responded by refining proprietary fractionation methods, including modified Cohn and heat-shock procedures, to deliver protease-free, endotoxin-free formulations suitable for sensitive therapeutic and diagnostic applications. This dynamic landscape continues to shape the competitive frame, as companies balance legacy processes with emerging technological imperatives.

Analyzing the 2025 United States Tariff Regime’s Widespread Implications on Bovine Serum Albumin Procurement and Supply Chain Resilience

In early 2025, the United States implemented a 25 percent tariff on imported albumins and related derivatives under HS code 3502, marking a significant shift in trade policy. Effective February 1, 2025, this duty translates into elevated landed costs for BSA sourced from major exporting regions, compelling importers to reassess supply agreements and seek tariff-mitigating strategies. The tariff action has spurred contract renegotiations to incorporate duty-adjustment clauses and prompted distribution partners to explore transshipment through tariff-exempt jurisdictions to preserve competitive pricing.

The situation has been further complicated by a broad 10 percent global tariff on healthcare imports instituted on April 5, 2025, which encompasses active pharmaceutical ingredients, diagnostic reagents, and critical media supplements. By encompassing BSA within this sweeping levy, the policy has intensified cost pressures across pharmaceutical and biotechnology supply chains, directly affecting product development timelines and operating margins. Healthcare providers and research institutions are particularly vigilant about the cascading effect on reagent and media costs, with many seeking alternative sourcing models to maintain research continuity.

To navigate these headwinds, industry participants are preemptively strengthening supply chain resilience. Strategies include establishing inventory buffers, diversifying vendor portfolios with domestic and tariff-exempt producers, and leveraging digital compliance tools to expedite customs clearance. These measures, combined with proactive monitoring of trade policy updates, are essential for safeguarding uninterrupted access to high-purity BSA supplies and preserving long-term viability in the face of evolving tariff environments.

In-Depth Examination of Market Segmentation Revealing Form Grade Type Applications and End User Variability in the Bovine Serum Albumin Landscape

When examining bovine serum albumin through the lens of product form, two primary variants emerge: liquid formulations designed for immediate integration into bioprocessing workflows, and powdered preparations optimized for extended shelf life and storage efficiency. Powdered BSA remains a preferred choice for large-scale production environments due to its stability and ease of shipping, while liquid products have gained traction in high-throughput and automated cell culture platforms where rapid deployment is essential.

Grade differentiation plays a pivotal role in aligning BSA performance with application requirements. Biochemistry grade materials support general laboratory assays, whereas cell culture grade ensures stringent sterility and low endotoxin levels. Fatty acid-free and protease-free preparations cater to highly sensitive immunoassays and enzymatic reactions, while immunoassay grade formulations are optimized for minimal background binding. These tiered quality levels enable precise reagent selection, reducing the risk of assay interference and enhancing reproducibility in both research and clinical settings.

The classification of BSA into crystalline and native types addresses purity and solubility distinctions. Native BSA, harvested via traditional fractionation processes, is valued for its natural binding properties. Crystalline BSA undergoes additional purification to achieve higher monomeric content and reduced aggregate levels, making it well-suited for sensitive analytical applications and drug formulation workflows.

Application segmentation encompasses cell culture supplements, diagnostic agents, food and beverage additives, laboratory reagents, and therapeutic formulations. Within cell culture, BSA variants support insect, mammalian, and stem cell systems, while diagnostic agents find use in clinical chemistry, drug screening, and immunodiagnostics platforms. Food and beverage incorporations span bakery, confectionery, beverages, and dairy products, exploiting BSA’s emulsifying and gelling characteristics. Laboratory reagent uses extend across ELISA, general biochemical assays, immunohistochemistry, and western blotting, and therapeutic formulations leverage BSA in drug delivery systems and vaccine adjuvants.

End user industries reflect this diversity, encompassing diagnostic centers, food and beverage manufacturers, pharmaceutical and biotechnology companies, and research laboratories. Each segment demands tailored BSA specifications and supply chain configurations, underscoring the importance of flexible manufacturing and robust quality management systems.

This comprehensive research report categorizes the Bovine Serum Albumin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Grade

- Type

- Application

- End User Industry

Comprehensive Regional Breakdown Highlighting Key Growth Patterns and Challenges Impacting Bovine Serum Albumin Markets Across Major Global Territories

In the Americas, the United States stands as a central hub for BSA utilization, underpinned by a well-established biopharmaceutical ecosystem and extensive research infrastructure. Leading academic institutions and contract research organizations in North America have driven consistent demand for high-performance cell culture supplements, catalytic to the region’s prominence in albumin consumption. Domestic production capabilities have expanded through investments in purification facilities, creating a resilient supply base that mitigates exposure to international shipping disruptions.

Europe, the Middle East, and Africa collectively comprise a region with rigorous regulatory oversight and stringent quality standards governing animal-derived products. Germany’s robust biotech sector, exemplified by major life science companies offering premium BSA grades, anchors the region’s capacity. Simultaneously, the U.K. and emerging markets in Eastern Europe are leveraging tax incentives and innovation funding to bolster local production and reduce dependency on external imports, thereby strengthening regional supply chain integration.

Asia-Pacific has emerged as the fastest-expanding market for bovine serum albumin, driven by aggressive biopharmaceutical investment in China and India. Government initiatives aimed at building domestic biotechnology champions have catalyzed plant expansions and technology transfers, ensuring a steady stream of locally manufactured BSA. Japan and South Korea also contribute through advanced protein purification platforms that support the region’s growing biomanufacturing footprint. As domestic capacities scale, Asia-Pacific is poised to become both a major consumer and exporter of high-purity albumin products.

This comprehensive research report examines key regions that drive the evolution of the Bovine Serum Albumin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Bovine Serum Albumin Manufacturers Spotlighting Strategic Initiatives Product Innovations and Competitive Differentiators in 2025

Thermo Fisher Scientific leads the pack through its Gibco and Thermo Scientific brands, offering a comprehensive portfolio of BSA products optimized for cell culture, enzyme stabilization, and analytical assays. The company’s strategic focus on localized manufacturing and rapid delivery has strengthened its position in critical markets across North America and Europe, catering to high-throughput and regulatory-compliant environments.

Merck KGaA, operating under the Sigma-Aldrich banner, boasts an extensive range of albumin grades sourced from New Zealand and the U.S., with premium offerings such as heat-shock inactivated fractions and high-purity monomeric forms. Its global distribution network and quality certifications enable swift market entry in regions with stringent import regulations.

Proliant Biologicals differentiates itself by controlling the entire BSA production process-from USDA-inspected plasma collection to closed-loop fractionation-ensuring traceability and minimizing protease activity for sensitive diagnostic applications. This vertically integrated approach supports customized formulations tailored to end user specifications, reinforcing Proliant’s reputation for high-purity, fatty acid-free, and endotoxin-free BSA variants.

Bio-Rad Laboratories and Rocky Mountain Biologicals provide niche products, including recombinant albumin supplements and specialized clinical reagents, serving a growing segment of biomanufacturers seeking animal-origin-free alternatives. Collaborative partnerships with biotech startups have enabled these companies to expand their service offerings in contract manufacturing and formulation development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bovine Serum Albumin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akron Biotech

- Avantor Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Biological Industries

- Bovogen Biologicals Pty Ltd

- Canvax Biotech

- Capricorn Scientific GmbH

- HiMedia Laboratories Pvt Ltd

- Kraeber & Co GmbH

- LGC Group

- Merck KGaA

- MP Biomedicals

- Proliant Biologicals

- Promega Corporation

- Rockland Immunochemicals Inc.

- Rocky Mountain Biologicals

- Sartorius AG

- TCS Biosciences Ltd

- Thermo Fisher Scientific Inc.

Strategic Framework for Industry Stakeholders to Enhance Supply Chain Agility Diversify Sources and Drive Innovation in Bovine Serum Albumin Production

To thrive amidst shifting trade policies and evolving quality expectations, industry stakeholders must prioritize supply chain diversification by establishing relationships with multiple suppliers across geographic regions. This approach ensures access to both native and recombinant albumin sources while mitigating tariff-related risks and transportation disruptions.

Concurrent investment in advanced analytics and digital compliance tools will empower procurement and quality teams to rapidly assess supplier performance, track regulatory updates, and forecast potential bottlenecks. By integrating real-time data platforms with supplier management systems, organizations can preemptively identify alternative sourcing routes and optimize inventory buffers without incurring excessive carrying costs.

Furthermore, collaboration with academic and process development centers can accelerate the validation of next-generation purification technologies, including membrane chromatography and single-use tangential flow filtration. Such partnerships will enhance yield, reduce aggregate formation, and support scalability in response to demand surges. Finally, a concerted focus on sustainability-encompassing solvent reduction, energy-efficient drying methods, and eco-friendly packaging-will resonate with stakeholders seeking to balance operational efficiency with environmental stewardship.

Robust Research Methodology Outline Detailing Data Collection Verification and Analytical Approaches Underpinning the Bovine Serum Albumin Market Study

The research methodology underpinning this executive summary combines primary interviews with procurement leaders, quality assurance managers, and R&D directors at leading biopharmaceutical and diagnostic organizations to capture firsthand insights into BSA application requirements and sourcing challenges. Secondary research involved careful review of company publications, product datasheets, and regulatory filings to map the competitive landscape and trace evolving quality standards.

Quantitative data was triangulated through analysis of import-export records, tariff schedules, and patent filings related to albumin purification technologies. This triangulation was bolstered by leveraging public trade databases and customs documentation to assess the impact of the 2025 U.S. tariff measures on imported BSA volumes.

To ensure accuracy and relevance, findings were subjected to a rigorous validation process involving cross-referencing with industry associations, academic publications, and market advisory firm white papers. The methodology prioritizes transparency and repeatability, providing stakeholders with the confidence that the insights presented are grounded in reliable data and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bovine Serum Albumin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bovine Serum Albumin Market, by Product Form

- Bovine Serum Albumin Market, by Grade

- Bovine Serum Albumin Market, by Type

- Bovine Serum Albumin Market, by Application

- Bovine Serum Albumin Market, by End User Industry

- Bovine Serum Albumin Market, by Region

- Bovine Serum Albumin Market, by Group

- Bovine Serum Albumin Market, by Country

- United States Bovine Serum Albumin Market

- China Bovine Serum Albumin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings Emphasizing Market Resilience Emerging Opportunities and Critical Considerations for Stakeholders in the Bovine Serum Albumin Sector

Throughout this analysis, bovine serum albumin has demonstrated enduring relevance as a multifunctional reagent, from its foundational role in cell culture supplementation to its critical applications in diagnostics and therapeutic formulation. The confluence of regulatory scrutiny, technological innovation, and evolving trade policies underscores the necessity for adaptable sourcing strategies and continuous process optimization.

As recombinant albumin gains traction and regional production capacities expand, stakeholders can anticipate a more diversified supply base that lessens dependence on traditional sourcing channels. Simultaneously, the advent of advanced purification methods and closed-system manufacturing platforms promises to enhance product consistency and minimize contamination risks.

Ultimately, success in the BSA landscape will hinge on a proactive approach to navigating tariff environments, fostering cross-sector collaborations, and embracing sustainability imperatives. By aligning strategic investments with rigorous quality management and digital visibility, industry participants can capitalize on emerging opportunities and sustain competitive advantage in a dynamically evolving market environment.

Secure Advanced Access to the Full Report on Bovine Serum Albumin Market Trends and Insights by Connecting with Ketan Rohom Associate Director Sales Marketing

Unlock the potential of Bovine Serum Albumin in your strategic planning and gain a competitive edge by acquiring the comprehensive market research report. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how the in-depth insights can inform your decision-making and accelerate growth initiatives. Leverage expert guidance on procurement strategies, emerging applications, and regulatory landscapes to optimize operations and capitalize on upcoming opportunities. Reach out today to secure instant access to the full report and begin your journey toward sustainable success in the Bovine Serum Albumin market.

- How big is the Bovine Serum Albumin Market?

- What is the Bovine Serum Albumin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?