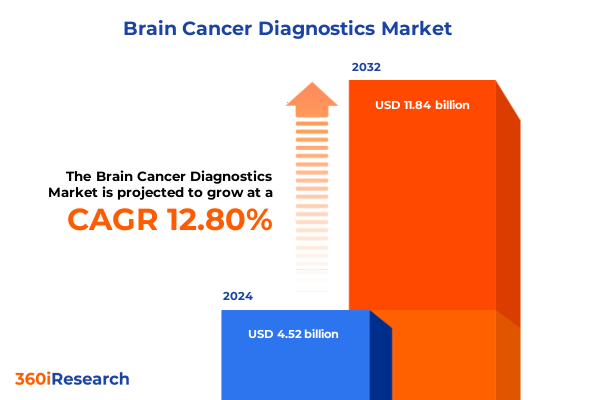

The Brain Cancer Diagnostics Market size was estimated at USD 5.11 billion in 2025 and expected to reach USD 5.78 billion in 2026, at a CAGR of 12.76% to reach USD 11.84 billion by 2032.

Unveiling the Complexities of Brain Cancer Diagnostics Through Emerging Innovative Technologies, Clinical Protocols, and Patient-Centered Imperatives

The journey of diagnosing brain cancer has been profoundly transformed by technological advances and evolving clinical protocols. Early detection remains the cornerstone of improving patient outcomes, with magnetic resonance imaging continuing as the gold standard due to its superior soft-tissue contrast and multiplanar capabilities. Complementary modalities such as computed tomography and positron emission tomography expand clinicians’ ability to characterize lesion morphology and metabolic activity, informing nuanced treatment strategies. Emerging techniques in molecular diagnostics, including next-generation sequencing assays for IDH1/2 mutations and 1p/19q co-deletion status, are redefining the concept of precision oncology in neuro-oncology practice. Moreover, noninvasive liquid biopsy research exploring circulating tumor DNA and microRNA signatures in cerebrospinal fluid shows promise for real-time monitoring of tumor dynamics and recurrence risk.

Despite these strides, challenges persist in harmonizing multimodal data streams and ensuring equitable access to advanced diagnostics. Integrating artificial intelligence and radiomic analysis into routine workflows offers a path to enhance reproducibility and accelerate interpretive accuracy, yet requires robust clinical validation. As the prevalence of primary brain tumors rises globally, multidisciplinary collaboration among radiologists, pathologists, neurosurgeons, and bioinformaticians has become essential for translating innovation into improved care pathways. Looking ahead, patient-centered imperatives demand scalable solutions that can be seamlessly adopted across diverse healthcare environments, ensuring that breakthroughs in diagnostic science translate into tangible survival and quality-of-life gains for individuals diagnosed with brain cancer.

Navigating Transformative Shifts in Brain Cancer Diagnostics: Integration of AI, Advanced Imaging Modalities, and Molecular Profiling

Over the past decade, the brain cancer diagnostic landscape has undergone transformative shifts driven by artificial intelligence, hybrid imaging systems, and integrated digital pathology platforms. Advanced AI-powered radiomic tools now enable automated segmentation of tumor boundaries and extraction of high-dimensional imaging biomarkers, supporting noninvasive grading and prognostic modeling with accuracy rates approaching 90 percent in recent glioma studies. Meanwhile, the convergence of positron emission tomography with magnetic resonance imaging (PET/MR) has ushered in an era of theranostics, where metabolic and anatomical insights inform targeted intervention planning in a single examination.

In parallel, the rise of digital pathology open environments has accelerated the adoption of AI-driven histopathological analysis, allowing pathologists to access a curated suite of predictive algorithms through unified software ecosystems. These platforms facilitate collaborative annotation, quantitative immunohistochemistry, and integration of molecular assay data, streamlining the diagnostic workflow from biopsy to final report. Additionally, simulation-based physical AI initiatives are pioneering autonomous imaging systems capable of optimizing patient positioning and scan parameters in real time, effectively reducing technician burden and mitigating understaffing concerns. As technology matures, the focus is shifting toward interoperability, regulatory validation, and reimbursement pathways to ensure that these innovations are accessible within routine clinical practice.

Assessing How New United States Tariff Policies Announced for 2025 Are Reshaping Neuroscience Diagnostic Supply Chains and Cost Structures

Recent updates to the United States’ Section 301 tariff regime, scheduled to take effect throughout 2025, are exerting notable pressure on the supply chain for essential brain cancer diagnostic products. Tariff increases of up to 50 percent on imported medical imaging components and noninvasive diagnostic consumables are heightening concerns among equipment manufacturers and healthcare providers alike. The reliance on cross-border sourcing for critical hardware subassemblies-ranging from detector modules for CT and PET systems to specialized radioisotopes-has rendered imaging OEMs vulnerable to cost escalations and inventory disruptions.

Consumables such as biopsy needles, syringes, and laboratory reagents are similarly affected, with duty hikes of up to 100 percent on select molecular testing kits prompting laboratories to consider alternative suppliers or localized manufacturing partnerships. These shifts may translate into longer procurement lead times and increased operational expenditures, challenging diagnostic laboratories to balance maintaining comprehensive service offerings against financial constraints. In response, several industry leaders are advocating for targeted tariff exemptions on life-saving medical goods, citing potential impacts on patient access and overall healthcare affordability. As trade policy remains in flux, stakeholders are urged to engage proactively with policymakers to mitigate supply chain risks and preserve momentum in diagnostic innovation.

Gaining Deeper Insights from Key Segmentation in Brain Cancer Diagnostics Spanning Technologies, Products, Indications, Channels, and End Users

A nuanced understanding of the brain cancer diagnostics market demands insight into five critical segmentation dimensions. Technological advancements span genetic testing, imaging, molecular diagnostics, and pathology, each harboring specialized subcategories such as CT scan, MRI, and PET under imaging, as well as next-generation sequencing and PCR within molecular diagnostics. Similarly, the product landscape encompasses consumables and reagents-ranging from assay kits to specialized probes-alongside sophisticated equipment categories like diagnostic and imaging systems, and value-added services including maintenance and training support.

From a clinical perspective, the spectrum of indications studied includes astrocytoma, glioblastoma multiforme, meningioma, and oligodendroglioma, reflecting the varied biological behaviors and therapeutic imperatives inherent to each tumor type. Distribution channels traverse both offline networks-through direct institutional sales and lab partnerships-and online portals facilitating rapid access to reagents and digital analysis tools. Finally, the end-user ecosystem comprises diagnostic laboratories, hospitals, and research institutes, each operating within distinct regulatory and reimbursement frameworks that influence procurement decisions and adoption rates. Together, these segmentation insights provide a holistic lens for stakeholders to align product development, marketing strategies, and investment priorities with evolving clinical and operational demands.

This comprehensive research report categorizes the Brain Cancer Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product

- Indication

- Distribution Channel

- End User

Exploring Critical Regional Variations in Brain Cancer Diagnostics Adoption Patterns Across Americas, EMEA, and Asia-Pacific Health Markets

Regional dynamics play an instrumental role in shaping the adoption and evolution of brain cancer diagnostic solutions across the Americas, EMEA, and Asia-Pacific markets. In the United States, imaging infrastructure remains among the world’s most advanced, with nearly 38 MRI units per million people-far exceeding the global average of 20.7 units-and widespread integration of AI in radiology workflows to enhance diagnostic throughput and accuracy. Service providers benefit from comprehensive reimbursement pathways and established clinical guidelines, enabling swift translation of novel modalities such as photon-counting CT into routine practice.

Within Europe, Middle East, and Africa, disparities in imaging capacity and regulatory frameworks are more pronounced. While countries like Germany and Italy report MRI densities above 30 units per million, emerging EMEA markets grapple with limited equipment penetration, leading to variable access to advanced diagnostics. Harmonized CE-mark processes facilitate cross-border distribution, yet national health technology assessments influence purchasing and funding decisions, underscoring the need for localized evidence generation. In Asia-Pacific, rapid expansion of hospital infrastructure-particularly in China and India-has driven double-digit growth in imaging system installations, though challenges persist in high-cost reagent availability and skilled operator training. Government-led initiatives to bolster cancer screening programs are accelerating demand, positioning the region as a critical growth frontier for diagnostic OEMs.

This comprehensive research report examines key regions that drive the evolution of the Brain Cancer Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Diagnostic Industry Players Driving Innovation in Brain Cancer Detection Through Strategic Collaborations and Technological Leadership

Leading diagnostic industry players are driving innovation in brain cancer detection through strategic investments, collaborations, and portfolio expansions. Siemens Healthineers, for instance, has advanced photon-counting CT with its Naeotom Alpha system, delivering unmatched image clarity while grappling with tariff-related cost headwinds that threaten to impact U.S. procurement decisions. The company also continues to refine sustainable MRI platforms, exemplified by the Magnetom Flow RT Pro Edition, which reduces helium dependency and accelerates adaptive radiation therapy workstreams through AI-powered reconstruction algorithms.

Roche Diagnostics has expanded its molecular diagnostics suite by obtaining CE-mark for the cobas 6800/8800 system upgrade, enhancing throughput and multiplexing capabilities via innovative TAGS chemistry technology. Furthermore, its navify Digital Pathology environment has integrated over 20 AI algorithms to streamline histopathology analysis, reinforcing Roche’s commitment to open, collaborative ecosystems. Illumina continues to lead the genomic profiling segment with FDA-approved TruSight Oncology Comprehensive tests, enabling pan-cancer companion diagnostic claims across more than 500 gene targets and broadening access to in-house precision oncology services. GE HealthCare, in partnership with NVIDIA, is pioneering AI-driven autonomous imaging research that promises to automate routine X-ray and ultrasound workflows, potentially alleviating radiologist shortages and standardizing image quality. Collectively, these players are shaping a competitive landscape defined by technological leadership and strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brain Cancer Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Associated Regional and University Pathologists, Inc.

- Becton, Dickinson and Company

- Bristol Myers Squibb Co.

- Canon Medical Systems Corporation

- F. Hoffmann-La Roche Ltd.

- Fujifilm Holdings Corporation

- General Electric Company

- Grail, LLC

- Henry Ford Health

- Hitachi, Ltd.

- Hologic, Inc.

- Illumina, Inc.

- Invitae Corporation

- Koninklijke Philips N.V.

- Laboratory Corporation of America Holdings

- NantOmics

- NeoGenomics Laboratories, Inc.

- Novocure GmbH

- Oncologica Limited

- QIAGEN N.V.

- Quibim, S.L.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Actionable Recommendations to Advance Brain Cancer Diagnostic Excellence Through Collaboration, Regulatory Alignment, and Technology Adoption

To capitalize on the dynamic advancements in brain cancer diagnostics, industry leaders should pursue a series of actionable strategies. First, fostering deeper engagement with regulatory bodies to secure targeted tariff exemptions for high-value diagnostic equipment will help stabilize supply chains and control cost inflation. Concurrently, establishing public-private partnerships to bolster local manufacturing capabilities for consumables can mitigate dependency on cross-border imports and ensure continuity of critical reagent supplies.

Second, healthcare organizations and OEMs must invest in interoperable AI platforms that seamlessly integrate imaging, molecular, and pathology data, enabling multidisciplinary teams to derive holistic patient insights. Collaborative pilot programs within academic medical centers can generate real-world evidence to support reimbursement discussions and accelerate adoption. Third, expanding training initiatives-both virtual and on-site-to upskill technicians and pathologists in cutting-edge modalities will address workforce shortages and maximize technology utilization. Finally, fostering cross-industry consortia focused on data governance, standardization, and cybersecurity will establish the trust framework necessary for scalable digital pathology and autonomous imaging solutions. By executing these recommendations, stakeholders can unlock the full potential of emerging diagnostics and deliver improved outcomes for patients diagnosed with brain cancer.

Detailing a Rigorous Multi-Source Research Methodology Underpinning the Brain Cancer Diagnostics Analysis for Enhanced Decision-Making

The findings and insights presented in this report are grounded in a rigorous, multi-source research methodology designed to ensure comprehensive coverage and analytical integrity. We began by conducting systematic reviews of peer-reviewed literature, regulatory filings, and clinical trial registries to capture the latest developments in imaging technologies, molecular assays, and digital pathology applications. Industry-leading databases and financial disclosures from key diagnostics and medtech companies were analyzed to identify strategic initiatives, technology launches, and market entry decisions.

Primary interviews with senior executives, clinical experts, and policy advisors provided qualitative context on tariff impact mitigation strategies and regional adoption challenges. Furthermore, trade and tariff notices from the United States Trade Representative, complemented by third-party analysis from GlobalData and Fitch Solutions, were synthesized to assess the supply chain ramifications of Section 301 tariffs. Lastly, global infrastructure benchmarking-drawing on OECD statistics and independent surveys of MRI density per million inhabitants-enabled regional comparisons of diagnostic capacity. Throughout the research process, data triangulation and cross-validation protocols were employed to uphold accuracy, while advisory board consultations ensured that analytical frameworks reflect real-world decision-making imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brain Cancer Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brain Cancer Diagnostics Market, by Technology

- Brain Cancer Diagnostics Market, by Product

- Brain Cancer Diagnostics Market, by Indication

- Brain Cancer Diagnostics Market, by Distribution Channel

- Brain Cancer Diagnostics Market, by End User

- Brain Cancer Diagnostics Market, by Region

- Brain Cancer Diagnostics Market, by Group

- Brain Cancer Diagnostics Market, by Country

- United States Brain Cancer Diagnostics Market

- China Brain Cancer Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Drawing Comprehensive Conclusions on the Evolving Landscape of Brain Cancer Diagnostics and Its Implications for Clinical and Industry Stakeholders

In conclusion, the brain cancer diagnostics landscape is poised at an inflection point characterized by rapid technological innovation and shifting regulatory frameworks. Advanced imaging modalities, AI-driven radiomics, and comprehensive genomic profiling are converging to enable truly personalized diagnostic pathways, yet equitable access and cost containment remain ongoing challenges. The escalation of U.S. tariffs on imported diagnostic components underscores the critical need for strategic policy engagement and diversified supply chains to maintain affordability and continuity of care.

Segmentation insights highlight the importance of targeting specific technology subsegments and end-user needs, while regional analysis reveals divergent maturity levels that demand tailored go-to-market approaches. The competitive landscape is defined by a small cohort of leading OEMs-Siemens Healthineers, Roche, Illumina, and GE HealthCare-whose collaborative ventures and AI investments will shape the trajectory of diagnostic capabilities. Moving forward, stakeholders that align regulatory advocacy, multi-disciplinary data integration, and workforce development will be best positioned to translate scientific breakthroughs into enhanced diagnostic accuracy and improved patient outcomes. The imperative now is to forge partnerships across industry, clinical practice, and policymaking to navigate complexity and deliver on the promise of next-generation brain cancer diagnostics.

Take Immediate Action to Secure Comprehensive Brain Cancer Diagnostics Insights by Contacting Ketan Rohom for Your Research Report

Begin your journey toward deeper insights and strategic advantage in brain cancer diagnostics by connecting directly with Ketan Rohom, Associate Director of Sales & Marketing. Engage personalized research briefings tailored to your organization’s unique needs and uncover critical intelligence that can shape your next steps. Secure access to proprietary analysis on cutting-edge imaging platforms, advanced molecular diagnostics, regional adoption trends, and tariff impacts by reaching out for a comprehensive market research report. Don’t miss the opportunity to leverage expert guidance, refine your market positioning, and drive informed decision-making. Reach out today to initiate a partnership that empowers your team with the knowledge to navigate the evolving landscape of brain cancer diagnostics with confidence and clarity.

- How big is the Brain Cancer Diagnostics Market?

- What is the Brain Cancer Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?