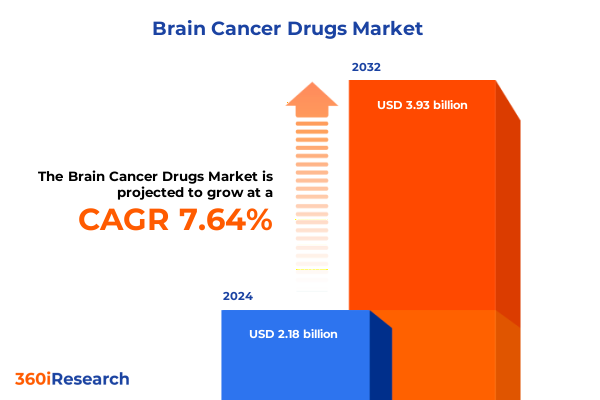

The Brain Cancer Drugs Market size was estimated at USD 2.34 billion in 2025 and expected to reach USD 2.51 billion in 2026, at a CAGR of 7.66% to reach USD 3.93 billion by 2032.

Unveiling the Evolving Paradigm of Brain Cancer Therapeutics: A Comprehensive Introduction to Advances, Challenges, and Strategic Imperatives

The landscape of brain cancer therapeutics has witnessed an extraordinary evolution driven by scientific breakthroughs, shifting regulatory frameworks, and unmet clinical needs. In recent years, novel treatment modalities have emerged from the convergence of precision medicine, immuno-oncology, and advanced drug delivery technologies. As clinicians and researchers push the boundaries of what is possible, patients with complex diagnoses such as high-grade gliomas and metastatic brain lesions stand to benefit from therapies that promise improved efficacy and tolerability. This executive summary aims to provide a foundational understanding of the major trends and critical factors shaping the current environment of brain cancer drugs, setting the stage for deeper exploration of transformative shifts, segmentation nuances, and strategic imperatives.

Revolutionary Therapeutic Innovations and Treatment Modalities Reshaping the Landscape of Brain Cancer Drug Development and Clinical Practice

The last decade has seen transformative shifts that are redefining how brain cancer is treated and how therapies progress from concept to clinic. Advances in molecular characterization have enabled the identification of actionable targets, which in turn has accelerated the development of targeted agents that can cross the blood–brain barrier with unprecedented specificity. In parallel, the advent of immunotherapies such as checkpoint inhibitors and CAR-T cell platforms has introduced modalities capable of engaging the patient’s own immune system against malignant glial populations. Furthermore, progress in supportive care agents, including next-generation anti-emetics and growth factor therapies, has enhanced treatment tolerability, thereby improving patient adherence and quality of life. These converging technologies have catalyzed a shift toward combination regimens that leverage synergistic mechanisms of action, underscoring a new era of integrated therapeutic strategies.

Assessing the Long Term Consequences of 2025 US Tariff Policies on Pharmaceutical Supply Chains and Access to Brain Cancer Medications

The implementation of United States tariffs in 2025 has introduced a layer of complexity to the pharmaceutical supply chain that has evolved significantly since their inception. Initially aimed at broadening domestic production, these measures have cumulatively impacted the availability and cost structure of active pharmaceutical ingredients imported from key manufacturing hubs. Over time, stakeholders have reported extended lead times for critical components and increased pressure on contract manufacturers to localize production capabilities. Consequently, strategic sourcing teams have had to reengineer procurement processes and explore alternative suppliers outside traditional channels. While these adaptations have improved supply chain resilience, they have also underscored the importance of close collaboration between drug developers, raw material providers, and logistics partners to mitigate operational disruptions and ensure uninterrupted patient access.

Illuminating Critical Segment Perspectives Across Indications, Therapeutic Classes, Administration Routes, End Users, and Distribution Channels

A holistic view of the brain cancer drug ecosystem emerges when examining the market through multiple segmentation lenses. Considering indication, distinct tumor types such as Glioblastoma Multiforme, Meningioma, Metastatic Brain Tumors, and Pituitary Tumors reveal differences in treatment complexity and research intensity, with high-grade gliomas commanding a focus on novel targeted and immunotherapy interventions. From the perspective of drug class, the landscape spans traditional chemotherapy agents including alkylating compounds, antimetabolites, and plant alkaloids; next-generation immunotherapies encompassing cancer vaccines, CAR-T platforms, and checkpoint blockade; supportive care products such as anti-emetics and growth factors; and precision-oriented targeted therapies like monoclonal antibodies and tyrosine kinase inhibitors. Each class carries distinct development pathways, regulatory considerations, and clinical endpoints that inform prioritization and investment decisions. Route of administration adds another dimension, with intrathecal delivery offering direct central nervous system exposure, intravenous infusions enabling systemic modulation, and oral regimens facilitating outpatient management. Meanwhile, end-user environments including clinics, home healthcare settings, and hospitals influence adoption dynamics and patient management strategies, while the choice of distribution channel-whether hospital pharmacies, online pharmacies, or retail outlets-affects availability and patient convenience.

This comprehensive research report categorizes the Brain Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Drug Class

- Route Of Administration

- End User

- Distribution Channel

Comparative Regional Perspectives Highlighting Unique Challenges and Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics exert a profound influence on the development, approval, and utilization of brain cancer drugs. In the Americas, regulatory authorities have demonstrated agility in expediting breakthrough therapy designations, fostering an environment conducive to rapid clinical evaluation and accelerated patient access. Meanwhile, healthcare infrastructure in North and South America supports broad clinical trial networks, enabling diverse patient enrollment and robust data generation. In Europe, the Middle East, and Africa, heterogeneity in reimbursement policies and healthcare funding models shapes market entry strategies, prompting innovators to devise region-specific pricing and access frameworks. Cooperative initiatives across national consortia have also facilitated multicenter studies, thereby enhancing the generalizability of clinical findings. In the Asia-Pacific, burgeoning investments in biotechnology research hubs and a growing focus on localized manufacturing capacity have elevated the region’s role in global supply chains while simultaneously attracting interest in cost-effective treatment solutions. These regional nuances highlight the importance of tailoring development roadmaps and commercialization approaches to align with local regulatory landscapes, payer expectations, and patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Brain Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical Innovators Driving Breakthrough Brain Cancer Therapies and Strategic Collaborations in Oncology Research

The competitive arena of brain cancer drug development is characterized by a diverse array of biopharmaceutical leaders, each leveraging unique capabilities to drive innovation. Established oncology giants with deep expertise in monoclonal antibody engineering have expanded into the central nervous system space, pursuing trials that combine targeted agents with standard-of-care chemoradiation. Simultaneously, specialized biotech firms focusing on cell-based immunotherapies have advanced pipelines of CAR-T platforms designed to recognize tumor-specific antigens within the brain microenvironment. Partnerships between large pharmaceutical companies and nimble research organizations have become increasingly prevalent, enabling the sharing of proprietary technologies and accelerating translational research. Additionally, academic spin-offs with pioneering gene-editing and nano-delivery platforms are emerging as catalysts for disruptive breakthroughs, bridging the gap between preclinical promise and clinical proof. Competitive differentiation is further reinforced through strategic collaboration with government agencies, patient advocacy groups, and clinical trial consortia, underscoring the multifaceted approach required to succeed in this complex therapeutic area.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brain Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Arbor Pharmaceuticals, LLC

- AstraZeneca PLC

- Bayer AG

- Bristol-Myers Squibb Company

- Celgene Corporation (a Bristol-Myers Squibb company)

- DNAtrix, Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Ipsen SA

- Johnson & Johnson

- Karyopharm Therapeutics Inc.

- Kazia Therapeutics Limited

- Merck KGaA

- Mundipharma International Limited

- Novartis AG

- Novocure GmbH

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

Strategic Recommendations to Empower Industry Leaders in Navigating Regulatory Complexities and Capitalizing on Emerging Brain Cancer Drug Opportunities

Industry leaders must adopt a forward-looking strategy that integrates regulatory intelligence, patient engagement, and supply chain optimization. By proactively aligning development programs with emerging guidance on central nervous system drug approvals, organizations can streamline clinical designs and expedite regulatory submissions. Engaging patient communities early in the development continuum-through advisory boards, real-world evidence initiatives, and digital health platforms-will enrich trial protocols and reinforce advocacy partnerships. To mitigate operational risks associated with fluctuating trade policies, executives should diversify manufacturing footprints and establish strategic alliances with regional contract development organizations. In parallel, investment in advanced analytics to monitor safety signals and treatment outcomes will enable dynamic portfolio reprioritization and reinforce evidence generation. Finally, cultivating a culture of cross-functional collaboration-uniting research and development, commercial, medical affairs, and access teams-will ensure that therapeutic innovations are supported by cohesive launch plans and patient-centric access models.

Methodological Framework Underpinning Rigorous Analysis of Brain Cancer Therapeutic Trends Including Data Sources, Validation, and Analytical Approaches

The insights presented in this executive summary are grounded in a rigorous methodological framework that leverages both primary and secondary research. Primary data sources include in-depth interviews with key opinion leaders, oncologists, and supply chain specialists, as well as detailed surveys of pharmaceutical executives responsible for central nervous system pipelines. Secondary research encompasses a comprehensive review of peer-reviewed literature, regulatory agency publications, clinical trial registries, and patent filings. Cross-validation through triangulation techniques ensured consistency between qualitative insights and documented findings. Analytical approaches included thematic content analysis to identify emerging therapeutic trends, comparative regulatory mapping to elucidate regional approval pathways, and value chain assessment to evaluate the impact of trade policies. This blended methodology provides a robust foundation for actionable intelligence, balancing depth of insight with methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brain Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brain Cancer Drugs Market, by Indication

- Brain Cancer Drugs Market, by Drug Class

- Brain Cancer Drugs Market, by Route Of Administration

- Brain Cancer Drugs Market, by End User

- Brain Cancer Drugs Market, by Distribution Channel

- Brain Cancer Drugs Market, by Region

- Brain Cancer Drugs Market, by Group

- Brain Cancer Drugs Market, by Country

- United States Brain Cancer Drugs Market

- China Brain Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Insights on Brain Cancer Therapeutics to Inform Strategic Decision Making and Chart the Path Forward for Stakeholders

In conclusion, the brain cancer drug landscape is undergoing a period of unparalleled innovation, marked by the rise of targeted therapies, immuno-oncology advances, and enhanced supportive care strategies. While evolving regulatory frameworks and shifting trade policies present challenges, they also offer opportunities for organizations that can adapt with agility and strategic foresight. By embracing a segmented understanding of tumor indications, therapeutic classes, administration routes, and end-user dynamics, stakeholders can refine development priorities and optimize patient outcomes. Regional considerations further underscore the need for tailored approaches that align with local regulations, funding environments, and healthcare infrastructures. As biopharmaceutical innovators and research institutions continue to collaborate, the field is poised to deliver transformative breakthroughs that will redefine standards of care for patients facing brain cancer.

Engage with Ketan Rohom to Unlock Comprehensive Brain Cancer Drug Market Intelligence and Elevate Your Strategic Initiatives

To explore the full spectrum of insights into brain cancer therapeutics and strengthen your strategic planning, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in synthesizing complex market dynamics will guide you toward actionable intelligence and support your pursuit of competitive advantage. Engage directly to discuss custom research options, gain access to comprehensive analyses, and secure the clarity needed for confident decision making. Unlock the specialized knowledge that will propel your organization’s initiatives in the rapidly evolving landscape of brain cancer drug development and commercialization.

- How big is the Brain Cancer Drugs Market?

- What is the Brain Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?