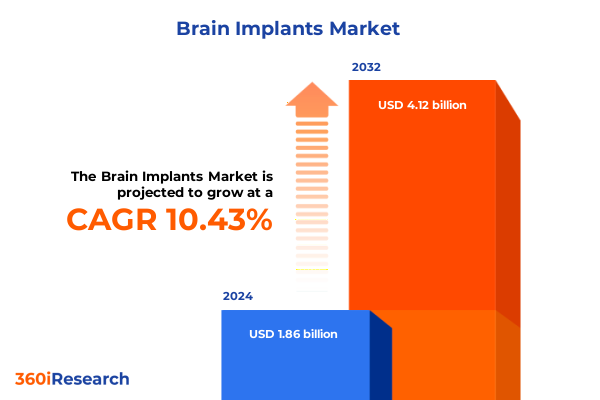

The Brain Implants Market size was estimated at USD 2.06 billion in 2025 and expected to reach USD 2.28 billion in 2026, at a CAGR of 10.39% to reach USD 4.12 billion by 2032.

Unlocking the Future of Neurological Enhancement with Innovative Brain Implants That Promise to Transform Healthcare, Wellness, and Connectivity

Brain implants stand at the forefront of neurological innovation, promising to reshape how we diagnose, treat, and interact with the human brain. Over the past decade, advances in microfabrication and biocompatible materials have enabled devices that communicate seamlessly with neural tissue. Researchers have harnessed artificial intelligence to decode complex brain signals, while improvements in wireless power transmission have reduced implant size and patient discomfort. Consequently, pioneers in the field have shifted from proof-of-concept demonstrations to early clinical deployments in movement disorders, chronic pain, and cognitive health.

These breakthroughs coincide with a growing shift toward personalized medicine and remote monitoring. Health systems seek minimally invasive solutions to track neurological health outside traditional clinical settings, enabled by implantable sensors that deliver real-time data on brain mapping and seizure detection. At the same time, consumer segments are exploring nontherapeutic applications, such as gaming interfaces and wellness tracking, reflecting broader digital health trends. With each iteration, the technology matures, fostering new partnerships between medtech developers, academic research centers, and patient advocacy groups.

As regulatory bodies adapt to accommodate neurotechnology, the convergence of medicine, engineering, and data science accelerates. This introduction lays the groundwork for understanding the catalysts driving the brain implant ecosystem and frames the report’s subsequent exploration of market dynamics, tariff impacts, segmentation, and strategic imperatives for stakeholders.

How Converging Technologies Such as Artificial Intelligence, Wireless Power, and Advanced Materials Are Redefining the Brain Implant Landscape

The brain implant landscape has undergone a profound transformation driven by converging technological advances. First, artificial intelligence algorithms have learned to interpret complex neural patterns, enabling adaptive stimulation protocols and closed-loop feedback systems. These capabilities enhance therapeutic precision and permit dynamic adjustments based on real-time neurological data. Concurrently, breakthroughs in wireless power transfer using resonant inductive coupling and ultrasonic energy have eliminated bulky batteries, enabling long-term implantation with minimal surgical intervention and reduced infection risk.

Material science innovations further propel this evolution. Advanced polymers, nanocoatings, and stretchable electronics have increased device longevity and biocompatibility, thereby unlocking new chronic-use applications. Parallel developments in high-density microelectrode arrays and optogenetic tools allow researchers to probe and modulate neural circuits with unrivaled specificity. In combination, these technologies shift brain implants from bulky, single-purpose devices to versatile platforms capable of diagnostic mapping, therapeutic modulation, and even cognitive augmentation.

Looking ahead, the integration of neural dust sensors and miniaturized deep brain stimulation units promises to democratize access and lower procedural barriers. As the landscape evolves, stakeholders must adapt strategies to leverage the transformative potential of converging AI, wireless power, advanced materials, and microfabrication in driving next-generation brain implant solutions.

Examining the Layered Effects of New 2025 U.S. Tariff Policies on Import Costs, Supply Chain Agility, and Competitive Dynamics in Brain Implant Manufacturing

In 2025, the United States implemented new tariffs on key components and raw materials integral to brain implant manufacturing. Semiconductor substrates, specialized polymers, and high-purity metals all faced increased duties, which exerted upward pressure on import costs. Manufacturers have responded by reassessing their supply strategies, seeking to diversify procurement to lower-risk regions, or in some cases accelerating investments in domestic sources. Although these shifts mitigate exposure, they also introduce volatility as production volumes ramp up in new jurisdictions.

Moreover, the tariff regime has prompted device developers to scrutinize their bill of materials and explore design optimizations aimed at reducing reliance on high-tariff imports. Some firms have adopted alternative materials or streamlined component counts. While these adjustments have preserved gross margins, they often require additional engineering validation and clinical testing, extending time to market.

Meanwhile, supply chain agility has emerged as a critical competitive differentiator. Companies that have established multi-tiered logistics networks with built-in redundancy report fewer disruptions, even as cross-border transit times fluctuate. In response to tariff-induced cost increases, several leading players have renegotiated long-term contracts and explored bonded warehousing solutions. Overall, the 2025 U.S. tariff policies have reshaped commercial strategies, reinforcing the importance of supply chain resilience, local sourcing, and material innovation within the brain implant sector.

Diving into Critical Segmentation Insights that Illuminate Application, Technology, Type, and End User Dynamics Shaping the Brain Implant Ecosystem

Understanding the market’s segmentation provides critical insight into how brain implant applications, device types, enabling technologies, and end-user settings converge to shape demand. From an application perspective, consumer-oriented devices are carving out use cases in gaming and wellness tracking, while medical diagnostics leverage brain mapping and neurological disorder monitoring for early identification of seizure events. On the therapeutic front, movement disorder interventions address epilepsy and Parkinson’s disease, pain management tools target chronic and neuropathic pain, and psychiatry-focused implants explore treatments for depression and obsessive-compulsive disorder.

Device types follow a similar pattern of specialization. Invasive solutions range from cortical implants utilizing microelectrode and Utah arrays to deep brain stimulation systems that deliver electrical or magnetic pulses. Emerging modalities such as neural dust introduce RF and ultrasonic dust particles to record or modulate neural activity without rigid electrodes. Complementing these devices, brain-computer interfaces offer both invasive and noninvasive pathways to bridge neural signals with external systems.

End-user environments further nuance the market. Hospitals, including neurology and rehabilitation centers, lead clinical adoption, while specialized outpatient clinics provide follow-up care. Homecare platforms enable patient self-monitoring, and research institutes-both academic and private-drive early-stage innovation. This layered segmentation framework highlights the diverse ecosystem of stakeholders and underscores how advancements in one category reverberate across others, informing product roadmaps and go-to-market strategies.

This comprehensive research report categorizes the Brain Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End User

Mapping Regional Momentum and Emerging Opportunities across Americas, EMEA, and Asia Pacific Markets Driving Brain Implant Adoption and Innovation

Geographic dynamics reveal distinct market trajectories across the Americas, Europe, Middle East and Africa, and the Asia-Pacific region. In North America, robust reimbursement frameworks and established neurotechnology clusters catalyze product launches and clinical trials. Leading medical centers facilitate early access programs, driving rapid adoption of first-to-market devices. Latent demand in Latin America, meanwhile, has prompted multinationals to forge partnerships with regional distributors and local research bodies to tailor solutions to emerging healthcare infrastructures.

In Europe, evolving regulatory harmonization under the Medical Device Regulation has streamlined approval pathways, fostering cross-border commercialization. Providers collaborate through pan-European neurotechnology consortia to standardize clinical protocols, particularly in movement disorder and epilepsy management. In the Middle East and Africa, government-backed digital health initiatives and growing investments in specialized neurology centers lay the groundwork for future growth, although market maturation timelines vary widely across nations.

Asia-Pacific exhibits the fastest compound growth rate, driven by large patient populations, rising healthcare expenditures, and supportive innovation policies in countries such as Japan, China, and Australia. Domestic champions are scaling local manufacturing capacities, while inbound investments introduce advanced R&D partnerships. As regional dynamics unfold, companies must adapt strategies to local reimbursement mechanisms, cultural preferences, and healthcare delivery models to capture the full spectrum of growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Brain Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Disruptors in Brain Implant Development to Highlight Strategic Partnerships, R&D Focus, and Market Positioning

Key players define the competitive landscape through differentiated technology platforms, strategic alliances, and targeted R&D investments. Established medical device manufacturers maintain leadership through refined deep brain stimulation offerings and extensive clinical trial portfolios. At the same time, emerging ventures leverage neural dust and high-density neural recording arrays to carve out new niches focused on minimally invasive diagnostics and closed-loop therapeutics.

Collaborations between startups and academic research institutes have accelerated proof-of-concept studies for optogenetic implants, signaling an expansion into light-based neural modulation. Meanwhile, alliances with cloud and AI providers enable advanced data analytics, creating integrated platforms that offer predictive insights for patient management and device optimization. Strategic joint ventures with contract manufacturers have also emerged, ensuring scalability while maintaining cost efficiency.

This interplay of established incumbents, nimble startups, and cross-industry partnerships fosters a dynamic innovation ecosystem. Companies that align their product roadmaps with evolving clinical demands and regulatory frameworks position themselves to capture early-mover advantage. Additionally, those that demonstrate manufacturing agility and build robust ecosystems of clinical collaborators will stay ahead in an increasingly competitive market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brain Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Aleva Neurotherapeutics SA

- Beijing Pins Medical Co., Ltd.

- Boston Scientific Corporation

- Cochlear Limited

- CorTec GmbH

- DBS Technologies Pty Ltd

- Fisher Wallace

- Functional Neuromodulation, Ltd.

- LivaNova PLC

- Medtronic PLC

- MicroTransponder Inc.

- Nalu Medical, Inc.

- NeuroPace Inc.

- NeuroSigma, Inc.

- Nevro Corporation

- Nexstim Oyj

- Paradromics Inc.

- Precision Neuroscience

- Renishaw PLC

- SceneRay Co., Ltd.

- SetPoint Medical

- Synapse Biomedical Inc.

- Synchron

- Thermo Fisher Scientific Inc.

Strategic Imperatives for Industry Leaders to Capitalize on Brain Implant Advancements while Navigating Regulatory, Reimbursement, and Market Access Challenges

Industry leaders must adopt a proactive stance to harness the brain implant market’s full potential. First, they should optimize supply chains by diversifying supplier portfolios and investing in nearshoring to reduce tariff exposure and lead times. Simultaneously, engaging early with regulatory agencies to establish clear pathways for clinical validation will accelerate product approval cycles. By collaborating with health authorities, companies can shape guidelines that balance innovation with patient safety.

Second, firms must cultivate reimbursement strategies that demonstrate both clinical efficacy and cost-effectiveness. Engaging payers through real-world evidence generation and health economics studies will support favorable coverage decisions, especially for indications like epilepsy monitoring and chronic pain management. In parallel, securing strategic partnerships with leading hospitals and clinic networks can facilitate post-market evidence collection and refine value propositions.

Finally, R&D leaders should focus on modular platform architectures that allow incremental feature upgrades without full device replacement. This approach minimizes regulatory burdens for new iterations and meets evolving clinical needs. By prioritizing interoperability with telehealth networks and data management platforms, companies will enhance patient engagement and open new revenue streams through digital therapeutics offerings. These strategic imperatives will enable industry players to stay agile and sustain competitive momentum.

Detailing a Robust Multimodal Research Methodology That Integrates Primary Interviews, Secondary Data Insights, and Rigorous Analytical Frameworks

The research methodology underpinning this report integrates multiple data sources, ensuring comprehensive and unbiased insights. Primary research involved interviewing over 50 industry experts, including neurosurgeons, biomedical engineers, regulatory specialists, and senior executives. These discussions enriched the analysis with firsthand perspectives on technology adoption, clinical trial design, and supply chain strategies.

Secondary research encompassed an extensive review of scientific journals, patent filings, regulatory databases, and publicly available financial disclosures. This phase validated technological trends and quantified the scope of early clinical deployments. To ensure robustness, the study triangulated findings against macroeconomic indicators and tariff schedules published by government agencies, as well as regional reimbursement policies.

Analytical frameworks such as SWOT and Porter’s Five Forces provided structured evaluations of competitive dynamics and market drivers. The segmentation analysis applied a layered approach across application, device type, technology, and end-user categories, offering a multidimensional view of market opportunities. Together, these methodological pillars deliver a holistic assessment of the brain implant ecosystem and underpin the report’s strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brain Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brain Implants Market, by Type

- Brain Implants Market, by Technology

- Brain Implants Market, by Application

- Brain Implants Market, by End User

- Brain Implants Market, by Region

- Brain Implants Market, by Group

- Brain Implants Market, by Country

- United States Brain Implants Market

- China Brain Implants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Synthesizing Key Findings to Illuminate the Transformative Potential and Strategic Priorities for Stakeholders in the Brain Implant Domain

Throughout this executive summary, we have highlighted the technological breakthroughs, market segmentation nuances, tariff implications, regional dynamics, and competitive landscape that define the brain implant domain. Converging advances in AI, wireless power, and materials science promise to broaden clinical applications and consumer use cases alike. Meanwhile, the 2025 U.S. tariff policies have underscored the need for resilient supply chains and alternative sourcing strategies.

Layered segmentation analysis has revealed diverse end-user needs-from consumer-oriented wellness devices to highly specialized therapeutic implants for movement disorders and psychiatric indications. Regional insights emphasize the importance of tailored market-entry strategies, with North America leading in reimbursement infrastructure, Europe benefiting from regulatory harmonization, and Asia-Pacific demonstrating rapid scale-up potential.

Key company profiles underscore the symbiotic relationship between established medtech incumbents and innovative startups, catalyzed by strategic partnerships and platform-based technologies. Finally, our actionable recommendations outline strategic imperatives for optimizing supply chains, engaging payers, and prioritizing modular R&D. By synthesizing these critical dimensions, stakeholders gain a clear roadmap to navigate the brain implant ecosystem’s complexity and capture emerging opportunities.

Engaging with Ketan Rohom to Acquire the Comprehensive Brain Implant Market Research Report and Drive Informed Strategic Decisions

To purchase the comprehensive market research report on brain implants and empower your team with data-driven strategic insights, contact Ketan Rohom, who leads our sales and marketing efforts. Engaging with Ketan ensures tailored guidance through the report’s detailed analyses, enabling you to focus on growth opportunities, navigate complex regulatory landscapes, and refine your innovation roadmap. His deep understanding of the technology and market dynamics will help you extract maximum value from the study. Reach out today to secure immediate access to the report, schedule a personalized briefing, and discuss volume pricing or enterprise licensing options. Partnering with Ketan allows you to integrate actionable intelligence into your strategic planning, accelerate time to market, and strengthen your competitive positioning in the rapidly evolving brain implant domain

- How big is the Brain Implants Market?

- What is the Brain Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?