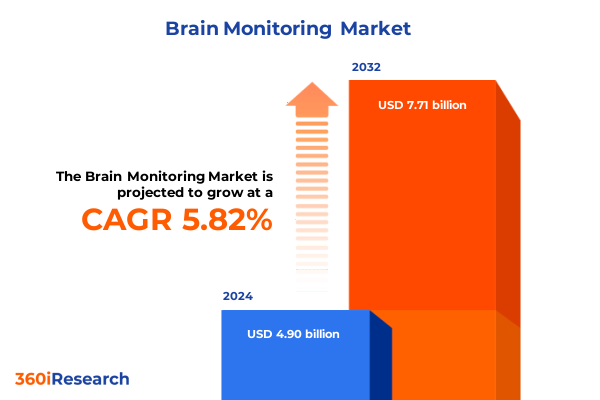

The Brain Monitoring Market size was estimated at USD 5.14 billion in 2025 and expected to reach USD 5.41 billion in 2026, at a CAGR of 5.95% to reach USD 7.71 billion by 2032.

Unveiling advanced brain monitoring technologies reshaping neurological diagnostics, therapeutic precision, and research capabilities worldwide

The landscape of brain monitoring is undergoing a profound transformation, driven by an escalating global focus on neurological health and the relentless pursuit of precision diagnostics. As neurological conditions ascend as the leading cause of disability worldwide, the need for advanced monitoring solutions has never been more urgent. In response, clinicians, researchers, and technology developers are collaborating to refine existing modalities and pioneer novel approaches that can deliver real-time, actionable insights.

Technological convergence is reshaping the way practitioners capture and interpret neural data. Traditional fixed systems are now complemented by portable and wearable sensors that support continuous monitoring outside the hospital setting, enabling decentralized care models and tele-neurology services. Meanwhile, breakthroughs in artificial intelligence and machine learning are streamlining data analysis, reducing the burden on clinical staff, and unearthing subtle biomarkers that were previously obscured in complex signal patterns.

Exploring transformative shifts in brain monitoring with AI-powered analytics, wearable sensors, and decentralized systems driving real-time personalized care

The brain monitoring arena is experiencing seismic shifts as AI-guided analytics become integral to interpreting multifaceted neural signals. Platforms that once relied solely on manual waveform review are now augmented by algorithms capable of detecting electrographic seizures and other critical events at the bedside. For example, adaptive deep-brain stimulation systems adjust in real time to a patient’s neural feedback, exemplifying how closed-loop interfaces are moving from experimental prototypes to clinical practice.

Simultaneously, the proliferation of wearable EEG devices and in-ear sensors is democratizing access to brain data. These innovations, leveraging miniaturized electronics and wireless connectivity, facilitate long-term, unobtrusive monitoring in home and ambulatory care environments. Cloud-based platforms with stringent FedRAMP High authorizations ensure that sensitive neural data can be securely streamed and analyzed across federal healthcare systems, expanding adoption among U.S. Department of Veterans Affairs facilities and beyond.

Analyzing the cumulative effects of 2025 U.S. tariffs on brain monitoring equipment: supply chain disruptions, cost inflation, and strategic industry responses

The introduction of new U.S. tariffs in 2025 has introduced a complex layer of cost pressures and supply chain vulnerabilities for brain monitoring equipment manufacturers. With baseline import levies and elevated duties on key components, the average price of EEG systems climbed by more than five percent, while delivery timelines in North America extended by over two weeks due to compliance processing and reconfigured logistics networks. These challenges have compelled companies to reevaluate sourcing strategies and accelerate efforts to localize production.

As a result of successive tariff announcements under the prior and current administrations, major industry participants have signaled potential margin contractions. GE HealthCare, for instance, forecasted a reduction in its adjusted margins by up to 2.4 percentage points, attributing the financial impact to duties on medical electronics and semiconductor components imported from China and other trading partners. Advocacy groups and manufacturers are now forging dialogues with policymakers to seek exemptions for critical medical devices, emphasizing patient care imperatives.

Illuminating key segmentation insights across offerings, technologies, applications, and end users to reveal nuanced market dynamics and growth opportunities

The market structure of brain monitoring spans equipment offerings and complementary services, beckoning a nuanced examination of value propositions. Equipment providers are investing in scalable platforms that cater to both fixed and portable use cases, while service experts deliver consulting, maintenance, and specialized training to optimize device utilization frameworks. Behind this segmentation, technological distinctions further refine product tiers, from high-resolution electrocorticography systems to minimally invasive fMRI scanners, each backed by a continuum of support solutions to drive adoption.

Beyond hardware and service delineations, the ecosystem fragments across clinical applications ranging from cognitive research studies to intraoperative surgical monitoring. Cognitive research demands sophisticated brain mapping and neurocognitive assessments, whereas neurosurgical monitoring requires robust, intraoperative solutions tailored to vascular and spinal interventions. Furthermore, end users span ambulatory centers, hospitals, home care, and research institutes, each with distinct workflow imperatives and regulatory considerations that influence purchasing and deployment decisions.

This comprehensive research report categorizes the Brain Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology

- Application

- End User

Decoding regional dynamics by examining Americas, EMEA, and Asia-Pacific landscapes to identify unique demand drivers and adoption patterns

Regional landscapes exhibit divergent adoption trajectories shaped by regulatory frameworks, reimbursement policies, and healthcare infrastructure maturity. In the Americas, robust investments in neuro-critical care and expanding telehealth networks are bolstering the demand for both bedside and at-home monitoring solutions, with the U.S. front-running advanced implementations and strategic tariff negotiations that could recalibrate global supply paradigms.

Meanwhile, Europe, the Middle East, and Africa present a tapestry of heterogeneous markets. EU nations are harmonizing medical device regulations under the MDR, spurring innovation but also elevating compliance costs for emerging modalities. Across the Middle East and Africa, targeted public–private partnerships aim to enhance access to neurological diagnostics, though procurement cycles remain subject to financial constraints and evolving policy landscapes.

Asia-Pacific stands out for its accelerating adoption curve, propelled by government-funded neuroscience research centers in China, Japan, and Australia, and burgeoning demand in India’s private healthcare sector. These regions are prioritizing indigenous manufacturing capabilities to mitigate import reliance, underscoring a strategic pivot toward self-reliant supply chains and localized service networks.

This comprehensive research report examines key regions that drive the evolution of the Brain Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading brain monitoring innovators through their strategic priorities, technological breakthroughs, and competitive positioning

Leading innovators across the brain monitoring sector are distinguished by their commitment to clinical validation, software integration, and ecosystem partnerships. Siemens Healthineers’ state-of-the-art CT and MRI systems, integral to hybrid neuroimaging suites, face headwinds from elevated EU–U.S. tariffs but continue to invest in localized production strategies to sustain market penetration. Medtronic’s Percept deep-brain stimulator exemplifies closed-loop neuromodulation, having secured regulatory approvals for adaptive, real-time therapy in movement disorders and psychiatric indications.

GE HealthCare is recalibrating its supply chain, focusing on local-for-local manufacturing across 43 sites to offset duty burdens and preserve margin integrity, while Ceribell is leveraging its FedRAMP High authorization and pediatric seizure detection clearance to expand its footprint within federal and civilian institutions. Philips has deepened its collaboration with Medtronic, integrating BIS brain monitoring and advanced capnography into its patient monitoring platforms, thereby reinforcing end-to-end solutions that span anesthesia, critical care, and neurology. Meanwhile, Nihon Kohden continues to advance remote neurology care through its Live View Panel Pro and aireeg wireless EEG systems, responding to clinical demand for high-fidelity, secure, and mobile monitoring architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brain Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun SE

- Brain Products GmbH

- Brainlab SE

- BrainScope Company, Inc.

- Cadwell Laboratories, Inc.

- CAS Medical Systems, Inc.

- Compumedics Limited

- Electrical Geodesics, Inc.

- Elekta AB

- EMOTIV Inc.

- g.tec medical engineering GmbH

- Integra LifeSciences Corporation

- Koninklijke Philips N.V.

- Medtronic plc

- Natus Medical Incorporated

- Neurable Inc.

- NeuroPace, Inc.

- NeuroSky, Inc.

- Neurosoft Ltd.

- NeuroWave Systems, Inc.

- Nihon Kohden Corporation

- Nonin Medical, Inc.

- Rimed Inc.

- Spiegelberg GmbH & Co. KG

- Yokogawa Electric Corporation

Actionable recommendations for industry leaders to optimize innovation, supply chain resilience, and market expansion in brain monitoring

Industry leaders must prioritize resilience and agility to navigate evolving market dynamics. Cultivating diversified supply chains, including nearshoring critical component production and expanding multi-source agreements, will buffer against future tariff fluctuations and logistical disruptions. At the same time, accelerating the rollout of AI-driven analytics modules as software-as-a-medical-device offerings can foster recurring revenue streams and deepen clinical integration.

Strategic partnerships between device manufacturers, cloud providers, and academic centers are essential to co-create interoperable platforms that serve research and clinical use cases. Additionally, advocacy for regulatory clarity and tariff exemptions on essential medical electronics should be pursued through industry coalitions. Investing in comprehensive training programs will ensure clinical teams maximize diagnostic yield and procedural safety, thereby strengthening value propositions and supporting premium pricing models.

Detailing the comprehensive research methodology encompassing primary interviews, secondary data analysis, and rigorous validation processes

This analysis synthesizes insights from primary and secondary research methodologies. Expert interviews with neurologists, hospital procurement executives, and device engineers were conducted to capture end-user requirements and product performance metrics. Secondary data was gathered from regulatory filings, published federal tariff notices, and industry news outlets, ensuring real-time relevance.

Quantitative data points were triangulated across multiple sources to validate cost and timeline impacts of tariff measures. Group discussions with clinical advisory boards and feedback from early adopters of AI-enabled monitoring platforms informed the evaluation of technological readiness and integration challenges. A rigorous validation process, including peer review by subject-matter experts, underpins the credibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brain Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brain Monitoring Market, by Offering

- Brain Monitoring Market, by Technology

- Brain Monitoring Market, by Application

- Brain Monitoring Market, by End User

- Brain Monitoring Market, by Region

- Brain Monitoring Market, by Group

- Brain Monitoring Market, by Country

- United States Brain Monitoring Market

- China Brain Monitoring Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding perspectives on the evolving brain monitoring market synthesizing insights to inform strategic decision making and future directions

The brain monitoring domain is at an inflection point defined by rapid technological innovation, shifting regulatory landscapes, and macroeconomic headwinds. AI-enhanced analytics and wearable sensors are democratizing access to continuous neural monitoring, while supply chain realignments and tariff pressures demand strategic adaptability.

Future growth will depend on collaborative ecosystems that align device capabilities with clinical imperatives, regulatory support, and robust training infrastructures. By leveraging the detailed segmentation, regional insights, and company profiles outlined here, stakeholders can make informed decisions that accelerate adoption, drive research breakthroughs, and ultimately enhance patient outcomes.

Take definitive next steps by partnering with Ketan Rohom to acquire the comprehensive brain monitoring market research report and gain strategic market edge

To gain an in-depth understanding of these insights and translate them into effective strategies, connect with Ketan Rohom, Associate Director of Sales & Marketing, who can provide access to the complete brain monitoring market research report. This comprehensive resource offers a detailed exploration of technology trends, competitive landscapes, regulatory impacts, and actionable recommendations designed to guide investment decisions, inform product development, and strengthen market positioning. Reach out today to secure your copy and empower your organization with data-driven intelligence that will drive growth and innovation in the evolving brain monitoring domain.

- How big is the Brain Monitoring Market?

- What is the Brain Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?