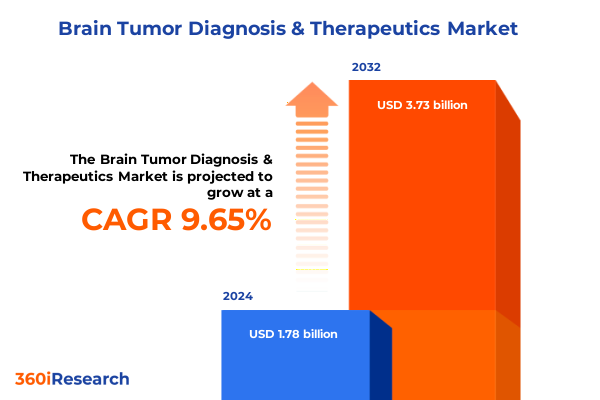

The Brain Tumor Diagnosis & Therapeutics Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.13 billion in 2026, at a CAGR of 9.66% to reach USD 3.73 billion by 2032.

Executive introduction to the evolving clinical, technological, and regulatory landscape shaping brain tumor diagnosis and therapeutics through 2025

The clinical and technological landscape of brain tumor diagnosis and therapeutics is moving through a period of dense innovation and systemic pressure that together will shape the next decade of care. Diagnostic capabilities now extend beyond conventional anatomic imaging to embrace molecular profiling, advanced MRI sequences, and amino acid–based molecular imaging, enabling more precise tumor characterization at initial presentation and at recurrence. At the same time, therapeutic strategies are diversifying: targeted small molecules and pathway inhibitors are complementing classic modalities such as surgery, radiation, and alkylating chemotherapy, while immune‑based and cell therapies are beginning to demonstrate early, and in some cases rapid, tumor regressions in carefully selected patients.

These changes are occurring within an environment of increased regulatory scrutiny, supply‑chain reconfiguration, and payer demand for robust clinical evidence of meaningful benefit. Consequently, stakeholders across industry, clinical care, and policy are recalibrating priorities: clinical teams are adopting multidisciplinary pathways that integrate advanced diagnostics with trial enrollment; manufacturers are redesigning supply chains to reduce single‑source dependencies; and investors are reallocating capital toward platforms that couple diagnostic certainty with an actionable therapeutic pathway. In sum, the introduction sets the stage for an executive‑level review that emphasizes translational linkage between diagnostic innovation and therapeutic impact, and identifies the operational stresses that require strategic responses across the ecosystem.

Transformative shifts redefining standards of care as precision medicine, advanced imaging, and immune- and cell-based therapies converge in neuro-oncology

Neuro‑oncology is experiencing transformative shifts as immune modulation, engineered cell therapies, and combination regimens seek to overcome intrinsic tumor heterogeneity and the immune‑suppressive central nervous system microenvironment. In the past several years, clinical programs testing chimeric antigen receptor T‑cell constructs and next‑generation cellular products have produced compelling early responses in select solid tumor cohorts, prompting intensified investment in locoregional delivery, multi‑antigen targeting, and combinatorial regimens designed to extend durability. Parallel to cellular approaches, immune checkpoint strategies continue to be studied in gliomas with increasingly sophisticated trial designs that pair checkpoint inhibitors with tumor‑focused biologics, oncolytic vectors, or tumor‑microenvironment modulators to enhance susceptibility.

At the same time, targeted agents against defined molecular drivers, including BRAF V600E and other actionable lesions, are shifting treatment paradigms for discrete molecular subgroups and enabling orally dosed regimens that improve quality‑of‑life metrics for pediatric and adult patients alike. These therapeutic advances are most effective when informed by high‑resolution diagnostics and longitudinal molecular monitoring, reinforcing a model of care in which diagnostics and therapeutics are co‑designed. Despite encouraging signals, major challenges remain: achieving durable responses in broadly heterogeneous tumors, managing neurotoxicity and on‑target adverse events, scaling cell‑therapy manufacturing, and creating reproducible biomarkers to guide patient selection. Continued multidisciplinary collaboration-linking neurosurgery, radiation oncology, neuropathology, and translational immunology-will determine whether these innovations translate into consistent clinical benefit beyond case‑level responses and early‑phase promise.

Assessment of the cumulative impact of United States tariff actions in 2025 on supply chains, device access, drug inputs, and clinical trial logistics in neuro-oncology

Policy interventions in 2025 that expanded tariff coverage and raised duties on a range of imported goods have introduced tangible headwinds for the life sciences and medical technology supply base, with immediate implications for neuro‑oncology. Tariff adjustments have amplified the cost of semiconductors, specialty chemicals, and components used in imaging platforms and cell‑therapy manufacturing, creating pressure on capital expenditure plans and the unit economics of complex therapeutics. In addition, higher import costs for raw materials and disposables have forced some manufacturers to accelerate localization of production or to reconfigure component sourcing, which can improve long‑term resilience but often raises near‑term operating costs and creates temporary capacity constraints.

Hospitals and diagnostic laboratories are experiencing these impacts through increased procurement costs for imaging hardware, contrast agents, and high‑volume disposables, prompting procurement teams to extend equipment replacement cycles and to prioritize dual‑use capital investments that support broad clinical service lines. Clinical trial operations have also felt downstream effects: sponsors report higher logistics and reagent costs for centralized assays, and some investigator sites are encountering delays when specialized consumables are sourced internationally. While targeted exemptions and phased implementation schedules have been discussed by stakeholders, organizations operating in neuro‑oncology should plan for sustained supply‑chain friction and factor tariff exposure into pricing, contracting, and sourcing strategies to preserve access to advanced diagnostics and complex therapeutics.

Segmentation-driven insights highlighting how therapeutic modality, imaging technology, end user, tumor classifications, grade, and patient age shape clinical pathways and investment priorities

Segmentation analysis exposes where clinical decision pathways and commercial opportunity intersect, and why diagnostic precision matters for therapeutic selection. When therapeutic modality is the organizing axis, conventional modalities such as surgery and radiation remain foundational for cytoreduction and symptom control, while chemotherapy subtypes-particularly alkylating agents-continue to be used for broad cytotoxic backbone therapy. Targeted therapies guided by molecular profiling are most meaningful for patients whose tumors harbor actionable alterations, and immunotherapy modalities, including CAR‑T, vaccine approaches, and checkpoint strategies, are evolving as adjuncts or alternatives for patients who can be molecularly or immunologically profiled. The presence of these discrete therapeutic options places a premium on timely, actionable diagnostics to ensure that modality selection aligns with tumor biology and patient condition.

Imaging technology segmentation demonstrates how advanced modalities create diagnostic granularity: computed tomography remains important for initial surgical planning and acute presentations, while magnetic resonance enhancements-such as diffusion tensor imaging, functional MRI, and spectroscopy-inform surgical approach and functional risk assessment. Molecular diagnostics and amino acid PET tracers are increasingly used to delineate tumor boundaries, differentiate treatment effect from progression, and guide biopsy or resection strategy. From an end‑user perspective, hospitals and specialized ambulatory surgical centers serve as primary integration points for multimodal care pathways, diagnostic laboratories provide centralized molecular characterization and companion testing, and research institutes drive translational protocols that feed novel therapeutics into practice. Tumor type and grade segmentation further refine expectations for treatment intensity: indolent lesions and low‑grade tumors often prioritize preservation of function and long‑term surveillance, whereas high‑grade and diffusely infiltrative tumors require aggressive multimodal strategies and enrollment in early‑phase trials. Finally, patient age groups-pediatric, adult, geriatric-demand tailored diagnostic algorithms and therapeutic risk‑benefit considerations that influence both clinical trial design and commercial development programs. Collectively, segmentation underscores that a unified strategy in neuro‑oncology must integrate modality, imaging, end‑user workflow, tumor biology, grade, and patient demographics to achieve meaningful clinical and commercial outcomes.

This comprehensive research report categorizes the Brain Tumor Diagnosis & Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Modality

- Imaging Technology

- Tumor Type

- Tumor Grade

- Patient Age Group

- End User

Regional dynamics and competitive contours across the Americas, Europe Middle East & Africa, and Asia-Pacific that influence access, regulation, and translational research in brain tumors

Regional dynamics shape regulatory pathways, reimbursement norms, and access to advanced diagnostics and therapeutics, producing divergent operational priorities across the Americas, Europe Middle East & Africa, and Asia‑Pacific. In the Americas, consolidated payer markets and sophisticated tertiary care centers facilitate early adoption of high‑cost therapeutics and multidisciplinary tumor boards, but access is tempered by reimbursement scrutiny and cost‑containment pressures that require clear value demonstration. Meanwhile, Europe Middle East & Africa presents a heterogeneous environment where regional regulators and health technology assessment bodies emphasize comparative effectiveness and incremental benefit; as a result, manufacturers often pursue phased market entry with real‑world evidence packages that address national standards of care.

In the Asia‑Pacific region, dynamic investment in biotech and diagnostics infrastructure is creating rapid pockets of clinical capacity, yet regulatory timelines and local reimbursement pathways vary widely between markets. Across all regions, translational research ecosystems and centers of excellence serve as hubs for clinical trials, but the ability to enroll diverse patient populations and to scale manufacturing capacity for cell therapies or complex biologics is influenced by local regulatory clarity and industrial policy. Strategic market access plans must therefore be regionally calibrated to balance early clinical adoption at reference centers with broader access initiatives that address price sensitivity and infrastructural gaps, while leveraging partnerships with academic centers, payers, and regional manufacturers to accelerate sustainable adoption.

This comprehensive research report examines key regions that drive the evolution of the Brain Tumor Diagnosis & Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive and collaborative strategies among device makers, biopharma innovators, and diagnostics labs that are accelerating translation and commercial pathways in brain tumor care

Key company behavior in this sector demonstrates a mixture of vertical integration, platform specialization, and partnership economics. Device manufacturers are investing in modular imaging platforms and software‑driven analytics to extract more diagnostic value from existing hardware, while diagnostics firms are focusing on high‑sensitivity molecular assays and validated liquid biopsy workflows intended to shorten the time from sample to actionable report. Biopharma and biotech organizations are pursuing complementary paths: some prioritize precision small‑molecule or biologic programs targeting well‑defined oncogenic drivers, while others invest in cell‑therapy and immune‑modulatory platforms that promise high individual patient benefit but require significant manufacturing and regulatory investments.

Commercially, successful companies are those that can demonstrate a coherent therapeutic narrative anchored by robust diagnostic evidence, while also solving operational challenges such as cold‑chain logistics, reproducible manufacturing of biologics, and decentralized diagnostics. Collaboration between diagnostic providers and therapeutic developers is increasingly commonplace, either through co‑development of companion diagnostics or through commercial partnerships that align reagent supply with trial enrollment. In addition, service providers that offer scalable cell‑therapy manufacturing, quality systems, and regulatory support are becoming strategic enablers for emerging therapies. Overall, the competitive landscape favors organizations that can marry clinical evidence generation with operational scale and that can articulate clear value propositions to providers and payers across diverse healthcare systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brain Tumor Diagnosis & Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Agios Pharmaceuticals, Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Bristol Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Ipsen Pharma

- Johnson & Johnson

- Karyopharm Therapeutics Inc.

- Merck & Co., Inc.

- Mundipharma International Limited

- Novartis AG

- Novocure GmbH

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- VBL Therapeutics

Actionable recommendations for industry leaders to prioritize resilience, evidence generation, regulatory alignment, and equitable access across brain tumor diagnosis and therapeutics

Leaders in industry and clinical practice should pursue a coordinated set of actions to convert scientific advances into durable clinical benefit and sustainable commercial models. First, prioritize investments in diagnostic‑therapeutic co‑development so that companion assays, imaging biomarkers, and targeted agents are validated together and produce clinical decision pathways that payers can evaluate. Second, strengthen supply‑chain resilience by diversifying suppliers for critical reagents and by pursuing regional manufacturing hubs for high‑value modalities such as cell therapies and specialty radiotracers, thereby reducing exposure to tariff and logistics shocks.

Third, commit to rigorous, pragmatic evidence generation: sponsor randomized and well‑designed comparative studies where feasible, and embed prospective real‑world data capture into registries and post‑market studies to demonstrate long‑term benefit and safety across diverse populations. Fourth, invest in clinical‑operational readiness at reference centers through training, multidisciplinary tumor boards, and pathways that integrate imaging, molecular testing, and clinical trial enrollment. Fifth, pursue adaptive pricing and value‑based contracting arrangements with payers that align payment to outcomes for high‑cost interventions, while simultaneously expanding patient assistance and access programs to mitigate equity concerns. Collectively, these steps will not only accelerate patient access to meaningful innovations but will also create defensible commercial propositions that stand up to payer and regulatory scrutiny.

Transparent research methodology describing data sources, clinical literature synthesis, stakeholder interviews, and analytic framing used to prepare the executive-level assessment

This research synthesis integrates a multi‑source approach designed to produce actionable executive insight grounded in clinical evidence and market realities. The primary components included a systematic review of peer‑reviewed clinical literature, regulatory announcements, and clinical trial registries to capture therapeutic and diagnostic advances; targeted searches of imaging and molecular diagnostics literature to assess technological maturation; and an operational scan of public filings and industry commentary to understand supply‑chain and manufacturing implications. Where possible, priority was given to high‑quality sources such as randomized trials, systematic reviews, regulatory approval summaries, and consensus guidance from clinical societies.

The analysis also incorporated qualitative inputs from published industry reports, procurement and hospital association briefings, and expert commentary to contextualize logistics and market‑access constraints. Data synthesis emphasized reproducibility: methods and search strategies were documented, and analytic assumptions were limited to qualitative interpretation rather than numerical market projections. Limitations of the methodology include potential publication lag in rapidly evolving areas such as cell therapy manufacturing and the variable maturity of evidence across modalities; to mitigate this, conclusions were framed conservatively and grounded in reproducible clinical signals and policy statements. This transparent methodology ensures that conclusions are traceable to their evidence base and suitable for strategic planning and further bespoke analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brain Tumor Diagnosis & Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brain Tumor Diagnosis & Therapeutics Market, by Therapeutic Modality

- Brain Tumor Diagnosis & Therapeutics Market, by Imaging Technology

- Brain Tumor Diagnosis & Therapeutics Market, by Tumor Type

- Brain Tumor Diagnosis & Therapeutics Market, by Tumor Grade

- Brain Tumor Diagnosis & Therapeutics Market, by Patient Age Group

- Brain Tumor Diagnosis & Therapeutics Market, by End User

- Brain Tumor Diagnosis & Therapeutics Market, by Region

- Brain Tumor Diagnosis & Therapeutics Market, by Group

- Brain Tumor Diagnosis & Therapeutics Market, by Country

- United States Brain Tumor Diagnosis & Therapeutics Market

- China Brain Tumor Diagnosis & Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding perspectives that synthesize clinical progress, technological inflection points, economic constraints, and strategic imperatives for the neuro-oncology ecosystem

The current moment in brain tumor diagnosis and therapeutics combines scientific opportunity with operational and economic complexity. Advances in molecular imaging, sequence‑level diagnostics, targeted agents, and immune‑based therapies are creating pathways to more personalized treatment, yet these clinical gains require parallel investment in evidence generation, manufacturing infrastructure, and supply‑chain resilience to be broadly realized. Stakeholders that align diagnostic precision with therapeutic strategy, that invest in regionally appropriate manufacturing and deployment, and that generate pragmatic real‑world evidence will be best positioned to translate early clinical promise into sustained patient benefit.

In closing, the imperative for decision‑makers is clear: integrate diagnostics and therapeutics from the outset of development, build flexible operational models that can weather policy and tariff fluctuations, and commit to transparent evidence pathways that demonstrate clinical value across diverse patient populations. The combination of technological progress and strategic operational planning can deliver meaningful improvements in outcomes and access for patients with brain tumors, provided that public‑ and private‑sector partners coordinate around shared priorities of efficacy, safety, and equitable availability.

Call to action to secure a comprehensive market research report and connect with Ketan Rohom, Associate Director Sales & Marketing, for tailored access and licensing options

For executives ready to convert strategic insight into commercial momentum, request the full market research report and arrange a direct consultation with Ketan Rohom, Associate Director, Sales & Marketing, to review licensing tiers, enterprise access, and bespoke advisory add‑ons. A tailored briefing will align the report’s diagnostic and therapeutic intelligence to your commercial objectives and highlight sections relevant to product development, regulatory strategy, and go‑to‑market planning.

Engaging with a named sales lead streamlines procurement, accelerates internal distribution of research assets, and unlocks options for custom analyst briefings, slide‑ready summaries, and data extracts optimized for investor or board presentations. To initiate the purchase process and schedule a private consultation, indicate your preferred time zone and scope of interest, and the sales team will coordinate next steps and nondisclosure arrangements to protect proprietary planning discussions.

Act now to secure priority access to the full report and ancillary advisory services that translate clinical, technological, and policy intelligence into actionable business decisions for diagnosis and treatment portfolios across neuro‑oncology.

- How big is the Brain Tumor Diagnosis & Therapeutics Market?

- What is the Brain Tumor Diagnosis & Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?