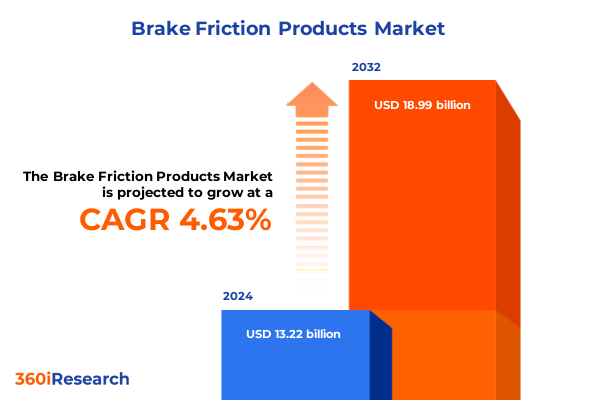

The Brake Friction Products Market size was estimated at USD 13.80 billion in 2025 and expected to reach USD 14.42 billion in 2026, at a CAGR of 4.66% to reach USD 18.99 billion by 2032.

Unveiling the Transformative Influence of Brake Friction Products on Safety, Efficiency, and Innovation Across Global Transportation Ecosystems and Markets

The modern transportation ecosystem increasingly relies on sophisticated braking systems to ensure safety, reliability, and operational efficiency. Over recent decades, the evolution of brake friction products has transcended simple mechanical components to become critical enablers of performance across automotive, rail, aerospace, and two-wheeler segments. As vehicles have grown more powerful, lighter, and interconnected, the demands placed on friction materials and designs have intensified, requiring manufacturers and end users to adopt more advanced solutions. Consequently, the brake friction market has emerged as a dynamic field shaped by technological breakthroughs, stringent regulatory standards, and a heightened focus on sustainability and noise reduction.

Within this context, stakeholders ranging from original equipment manufacturers to aftermarket distributors are tasked with balancing multiple objectives. Performance parameters such as stopping distance, thermal stability, and wear resistance must be reconciled with lifecycle costs, environmental compliance, and customer expectations for quiet operation. Indeed, the convergence of safety imperatives and consumer preferences has underpinned an era of rapid innovation, in which material science, computational modeling, and manufacturing precision are deployed to craft friction solutions that address the full spectrum of operational scenarios. This introduction sets the stage for a detailed exploration of the forces reshaping brake friction products, outlining the critical trends that stakeholders must understand to remain competitive and compliant in today’s market.

Navigating the Paradigm Shift in Brake Friction Technology Driven by Electrification, Autonomous Mobility, Advanced Materials, and Sustainability Demands

The brake friction landscape is undergoing paradigm-shifting transformations driven by the twin vectors of vehicle electrification and autonomous mobility. Electric vehicles generate distinct braking profiles characterized by regenerative braking and lower mechanical wear, compelling friction suppliers to adapt formulations and pad geometries accordingly. At the same time, the advent of advanced driver assistance systems and fully autonomous platforms has mandated unprecedented levels of repeatable performance, precise modulation, and integrated sensor capabilities within braking subsystems. Under these pressures, traditional suppliers have been compelled to invest in research and development to engineer next-generation friction materials that maintain consistent stopping power, resist fade under high-temperature cycling, and interface seamlessly with electronic control units.

Moreover, sustainability considerations have become central to product roadmaps, as regulators and consumers alike demand reduced particulate emissions and a shift toward eco-friendly raw materials. Manufacturers are increasingly exploring non-asbestos organic compounds, ceramic formulations, and bio-derived fibers to align with new environmental mandates. Concurrently, the digital transformation of manufacturing processes-encompassing additive manufacturing for rapid prototyping, artificial intelligence for performance prediction, and Industry 4.0-enabled quality control-has accelerated product development cycles and driven cost efficiencies. Together, these shifts illustrate a dynamic environment in which brake friction stakeholders must pivot their strategies to thrive in an era defined by electrification, automation, and sustainable innovation.

Assessing the Far-Reaching Consequences of United States 2025 Tariff Measures on Brake Friction Supply Chains, Cost Structures, and Strategic Sourcing Dynamics

In 2025, the United States implemented a series of tariff adjustments targeting key raw materials and finished friction components, aiming to protect domestic manufacturing and rebalance global trade dynamics. These measures have reverberated throughout the supply chain, placing upward pressure on production costs while incentivizing the localization of critical material sourcing. Raw material tariffs have particularly affected imported metallic alloys and specialized ceramic precursors, creating a cascading effect that has compelled downstream manufacturers to reevaluate supplier relationships and stock inventory strategies. As a result, many friction component producers have shifted toward dual-sourcing agreements and increased buffer inventories to mitigate potential disruptions.

Beyond direct cost implications, the tariff environment has driven a more nuanced strategic calculus around vertical integration and nearshoring. Some manufacturers have accelerated investments in domestic processing capabilities, expanding capacity for in-house material synthesis and component machining. Simultaneously, strategic partnerships with regional material suppliers have gained prominence, illustrating a broader trend toward supply chain resilience and agility. Although these adaptations have required significant capital outlays, the net effect has been a reduction in exposure to global trade fluctuations and improved lead time predictability. As regulatory policies continue to evolve, organizations that proactively realign sourcing footprints and fortify supplier networks will be best positioned to absorb future trade shocks and maintain uninterrupted production.

Decoding the Brake Friction Market’s Diverse Dimensions Through Product, Material, Vehicle, and Sales Channel Segmentation Perspectives

Detailed analysis of the brake friction market reveals a multifaceted segmentation framework that underlies product development and market positioning. Across product types, offerings span brake blocks, discs, drums, linings, pads, shims, and shoes, each requiring tailored design considerations to meet distinct performance demands. In parallel, material segmentation highlights ceramic, metallic, and non-asbestos organic compounds as the primary classes, with each composition delivering unique balances of friction coefficient, wear behavior, and thermal resilience. Further granularity emerges when examining end-use applications, where aerospace platforms-encompassing both commercial and military aircraft-demand exacting certifications and extreme reliability under cyclical loading. Automotive users, ranging from heavy and light commercial vehicles to passenger cars, require solutions optimized for high-volume production, cost efficiency, and regulatory compliance.

If attention turns to rail transport, stakeholders must navigate the divergent performance requirements of freight trains, high-speed passenger lines, and metro or tram systems, each presenting unique duty cycles and safety mandates. Likewise, two-wheeler applications such as motorcycles and scooters call for compact, lightweight friction assemblies capable of rapid response and minimal noise. Overlaying these product and material dimensions is the sales channel segmentation, where offline distributors and service networks coexist alongside direct-to-customer online channels. Within the digital sphere, eCommerce platforms and manufacturer websites have emerged as influential routes for aftermarket sales and end-user engagement, reshaping marketing strategies and customer service models. This segmentation tapestry underscores the necessity for friction suppliers to craft bespoke offerings and channel strategies that resonate with divergent customer cohorts.

This comprehensive research report categorizes the Brake Friction Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Vehicle Type

- Sales Channel

Exploring the Distinctive Market Dynamics of Brake Friction Products Across Americas, Europe Middle East Africa, and Asia-Pacific Regions

Regional dynamics in the brake friction landscape underscore the heterogeneity of growth drivers, regulatory pressures, and customer expectations. The Americas region continues to be influenced by stringent safety regulations, advanced automotive manufacturing clusters, and a growing shift toward electric and hybrid vehicle platforms. In North America, regulatory frameworks around particulate emissions have spurred the adoption of low-dust and eco-friendly friction solutions, while South American markets are gradually upgrading infrastructure and modernizing fleets, opening new opportunities for robust, cost-effective brake components.

In Europe, Middle East, and Africa, the landscape is shaped by rigorous safety standards and ambitious emissions targets that accelerate the uptake of premium friction materials and advanced braking technologies. The European Union’s focus on decarbonization and stringent type-approval requirements has led suppliers to intensify investments in lightweight composite discs and noise-attenuating pads. In the Middle East and Africa, infrastructure projects and urban mass transit expansions fuel demand for high-performance rail and metro braking systems, even as supply chain constraints and geopolitical dynamics introduce complexity. Meanwhile, the Asia-Pacific region remains the largest and most varied market, driven by rapid automotive production in China, expansive rail network growth in India, and burgeoning scooter and motorcycle ownership in Southeast Asia. Here, manufacturers must tailor their product portfolios to address cost sensitivity, regulatory divergence, and escalating demand for high-durability friction solutions.

This comprehensive research report examines key regions that drive the evolution of the Brake Friction Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Initiatives and Competitive Positioning of Leading Brake Friction Manufacturers Shaping the Industry Landscape

Leading brake friction producers are differentiating themselves through a combination of technological innovation, strategic partnerships, and supply chain optimization. Several global manufacturers have established dedicated material science research centers to accelerate the development of hybrid formulations that blend ceramic and metallic fibers for enhanced durability. Parallel investments in advanced manufacturing techniques-including precision machining, laser surface texturing, and automated inspection-have strengthened quality control and enabled the customization of friction surfaces to meet specific end-use requirements. Collaborative agreements with automotive and rail OEMs have further permitted co-development of tailored friction solutions, embedding sensor technologies that provide real-time wear and temperature data to on-board diagnostic systems.

Beyond technology, strategic mergers and acquisitions have reshaped the competitive landscape, as companies seek to secure proprietary materials, expand geographic presence, and bolster aftermarket portfolios. Some suppliers have pursued joint ventures with regional distributors to establish localized manufacturing hubs, thereby reducing lead times and currency exposure. Others have diversified their product mix by extending into adjacent safety components such as brake actuators and calipers. This combination of organic innovation and inorganic growth underscores an industry-wide recognition that sustained leadership in the brake friction space demands both technical excellence and agile, forward-looking corporate strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brake Friction Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABS Friction Inc.

- AISIN Corporation

- Akebono Brake Industry Co., Ltd.

- American Friction

- ANAND Group

- APLS Automotive Industries Pvt. Ltd.

- Brake Parts Inc. LLC by First Brands Group

- Brembo S.p.A.

- Carlisle Companies Incorporated

- Cook Bonding & Manufacturing Co., Inc.

- Cummins Inc.

- Fisher Barton

- GMP Friction Products

- Great Lakes Friction Products, Inc.

- Hi-Pad Brake Technology Co., Ltd.

- Hitachi Astemo, Ltd.

- ITT Inc.

- Logan Clutch Corporation

- Masu Brakes Pvt. Ltd

- Max Advanced Brakes

- Miba AG

- Muller Brakes America Inc.

- Nisshinbo Holdings Inc.

- ProTec Friction Group

- Rane Holdings Limited.

- Robert Bosch GmbH

- SGL Carbon SE

- Supergrip Friction Products

- Tenneco Incorporated

Advancing Competitive Advantage Through Actionable Strategies for Manufacturers to Optimize Sustainability, Supply Resilience, and Technological Leadership

To maintain and enhance leadership in this evolving environment, industry participants should prioritize integration of sustainable raw materials, ensuring that future formulations meet both performance benchmarks and environmental regulations. By forging partnerships with bio-fiber innovators and ceramic precursor producers, organizations can build resilient supply chains that are less susceptible to trade fluctuations and resource constraints. Additionally, investment in digital manufacturing platforms will enable rapid prototyping and predictive analytics, reducing time to market and optimizing inventory levels.

Strengthening collaboration with OEMs through co-development agreements can further align product roadmaps with emerging vehicle architectures, particularly electrified and autonomous platforms. Embedding sensor arrays and leveraging data analytics will allow manufacturers to shift from reactive to proactive maintenance models, adding value for end users and generating new revenue streams through connected service offerings. Lastly, cultivating a global network of service and distribution partners-balanced across offline and online channels-will ensure comprehensive market coverage and enhance customer engagement, supporting long-term growth in both mature and emerging regions.

Comprehensive Multistage Research Methodology Highlighting Data Sources, Expert Validation, and Analytical Frameworks Underpinning the Market Study

This research study integrates a multi-stage methodology to ensure comprehensive and reliable insights into the brake friction market. Primary data collection involved in-depth interviews with cross-functional stakeholders, including design engineers, procurement directors, and maintenance specialists, across the automotive, rail, aerospace, and two-wheeler segments. These expert discussions were complemented by an extensive review of industry journals, regulatory publications, and technical standards to verify performance benchmarks and compliance frameworks.

Secondary research encompassed analysis of company filings, patent databases, and trade association reports to map competitive dynamics and technology adoption curves. Data triangulation techniques were applied to reconcile discrepancies and validate thematic findings. Quantitative inputs from industry surveys were synthesized with qualitative case studies to produce a balanced perspective on innovation trajectories, supply chain risks, and strategic imperatives. Finally, the findings were subjected to internal peer review and expert validation workshops to ensure that the conclusions accurately reflect real-world market conditions and emerging trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brake Friction Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brake Friction Products Market, by Product Type

- Brake Friction Products Market, by Material

- Brake Friction Products Market, by Vehicle Type

- Brake Friction Products Market, by Sales Channel

- Brake Friction Products Market, by Region

- Brake Friction Products Market, by Group

- Brake Friction Products Market, by Country

- United States Brake Friction Products Market

- China Brake Friction Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Converging Insights on Brake Friction Market Evolution Emphasizing Strategic Imperatives for Stakeholders to Outpace Emerging Industry Trends

The confluence of electrification, automation, and regulatory evolution is reshaping the brake friction market in profound ways. Suppliers that embrace advanced material formulations, integrate digital manufacturing capabilities, and cultivate resilient sourcing strategies will capture greater value and forge stronger partnerships with OEMs. Regional market nuances-from North America’s sustainability mandates to Asia-Pacific’s scale-driven innovation-demand tailored approaches that balance cost, performance, and compliance.

By synthesizing segmentation insights, tariff-related challenges, and competitive dynamics, organizations can develop cohesive strategies that address both immediate operational pressures and long-term technological shifts. Ultimately, success in the brake friction arena will hinge on the ability to transform data-driven insights into agile execution plans, ensuring that safety, performance, and environmental stewardship remain at the forefront of product development and market expansion.

Unlock In-Depth Market Analysis and Strategic Guidance by Reaching Out to Ketan Rohom to Secure Your Brake Friction Products Research Report Today

If you are ready to transform your approach to brake friction product development, procurement, and strategic planning, now is the time to act. Ketan Rohom, Associate Director of Sales & Marketing, possesses in-depth expertise and an acute understanding of industry nuances that will empower your organization to navigate evolving regulatory landscapes, supply chain complexities, and technological innovations. By securing this comprehensive research report, you will gain exclusive access to nuanced analyses, expert interviews, and actionable insights tailored to your organization’s needs. Reach out directly to Ketan Rohom to discuss how this research can be customized for your strategic objectives and to arrange immediate delivery of the full report. Enhance your competitive advantage by leveraging this invaluable resource-contact Ketan today to purchase and begin unlocking the strategic intelligence that will define the next era of brake friction market leadership.

- How big is the Brake Friction Products Market?

- What is the Brake Friction Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?