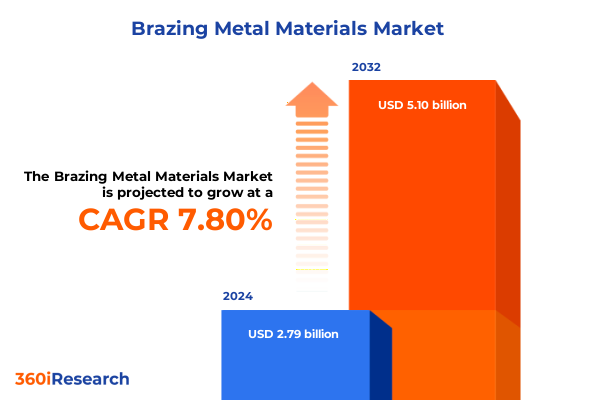

The Brazing Metal Materials Market size was estimated at USD 3.00 billion in 2025 and expected to reach USD 3.24 billion in 2026, at a CAGR of 7.88% to reach USD 5.10 billion by 2032.

Pioneering the Future of Brazing Metals with Insights into Material Evolution, Industry Drivers, and Emerging Opportunities Shaping Market Trajectories

The brazing process stands at the intersection of precision engineering and materials science, enabling the reliable joining of diverse metal components through the controlled melting of filler alloys. As modern manufacturing continues to demand ever-greater performance, brazing metals have evolved to deliver improved temperature resistance, exceptional mechanical strength, and enhanced corrosion protection. Today’s market encompasses a spectrum of alloy systems, each engineered to address unique assembly challenges, from high-temperature aerospace joints to miniature electronic interconnects. This diversity underpins broad industry adoption, positioning brazing metal materials as a critical facilitator of innovation across sectors.

Emerging demands for lightweight designs, renewable energy infrastructure, and advanced electronics are driving the development of next-generation brazing alloys. Innovations in aluminum- and nickel-based systems are enhancing fuel efficiency in transportation, while silver-filler and copper-phosphorus chemistries cater to stringent electrical conductivity and thermal management requirements. Simultaneously, titanium-based alloys are gaining relevance in medical and aerospace applications, where biocompatibility and strength-to-weight ratios are paramount. These material advancements are occurring alongside breakthroughs in joining technologies, such as induction and vacuum processes, which optimize heating uniformity and atmospheric control for superior joint integrity.

This executive summary introduces the key drivers, emerging trends, and strategic considerations shaping the brazing metal landscape. By examining transformative shifts in production methods, evaluating the cumulative implications of recent tariff policies, and distilling segmentation, regional, and competitive insights, this report equips stakeholders with the actionable knowledge required to navigate a complex and rapidly evolving marketplace. As organizations seek to fortify supply chains and capture new application opportunities, a nuanced understanding of the brazing metal domain becomes essential.

Uncovering the Disruptive Technological and Sustainability-Driven Transformations Reshaping Brazing Metal Manufacturing and Application Practices

The brazing metal industry is experiencing a period of rapid transformation fueled by digitalization, sustainability mandates, and advanced process controls. Digital twins and real-time process monitoring have emerged as game-changers, allowing manufacturers to simulate thermal cycles, predict joint quality, and minimize waste before production even begins. These tools are complemented by artificial intelligence–driven analytics that interpret sensor data from induction and furnace brazing equipment to proactively identify deviations in temperature profiles or atmospheric composition, thereby reducing defects and optimizing cycle times.

Sustainability considerations are reshaping alloy formulation and process selection. Low-environmental-impact brazing fillers, including silver-free alternatives and oxygen-compatible copper-phosphorus alloys, are gaining traction as OEMs seek to align with circular economy principles and stringent emissions targets. Controlled-atmosphere continuous furnaces now integrate advanced filtration and gas recycling systems to curtail greenhouse gas emissions while ensuring consistent joint quality across high-volume production runs. Meanwhile, vacuum brazing innovations-spanning high- and low-vacuum configurations-are enabling the joining of ultra-high-performance alloys without compromising corrosion resistance or mechanical properties.

Concurrently, supply chain resilience has emerged as a strategic focus following recent global disruptions. Companies are diversifying their raw material sources and co-developing alloy variants with regional foundries to mitigate the risk of material shortages. This trend is underscored by collaborative consortiums that bring together material suppliers, equipment manufacturers, and end users to accelerate standardization efforts and harmonize quality protocols. As a result, the brazing metal landscape is evolving into a more interconnected ecosystem, where technological integration, environmental stewardship, and cross-industry partnerships define competitive advantage.

Analyzing the Comprehensive Effects of 2025 United States Tariff Policies on Global Brazing Metal Trade Flows and Cost Structures

The imposition of new United States tariffs on imported brazing metals in 2025 has introduced both cost pressures and strategic realignments across global supply chains. By targeting specific alloy categories, particularly nickel-based and silver-filler systems, these measures have elevated landed costs for import-reliant manufacturers, prompting a reassessment of procurement strategies. Domestic producers have seized the opportunity to scale operations, investing in capacity expansions and accelerating advanced alloy certifications to capture market share from higher-cost imports.

At the same time, end users sensitive to raw material price fluctuations have explored long-term offtake agreements and hedging mechanisms to stabilize their input costs. The tariff-driven pricing dynamics have spurred collaborative partnerships between alloy developers and original equipment manufacturers, aimed at co-innovating lower-cost brazing solutions that maintain performance while aligning with new duty structures. Some companies have begun establishing regional alloy blending centers in North America, leveraging duty exemptions for value-added processing to offset import surcharges.

These shifts have also reverberated through secondary markets for scrap and recycled brazing alloys, as stakeholders seek to reclaim value from manufacturing offcuts and return flows. While the short-term impact has been heightened price volatility, the longer-term effect is likely to crystallize into a more diversified blend of domestic and import sources, fortified by strategic alliances and process-based value additions. Ultimately, the cumulative impact of the 2025 tariff policies underscores the importance of agile sourcing strategies and cross-sector collaboration to preserve both cost competitiveness and product quality.

Discovering Actionable Market Intelligence from Comprehensive Segment Analysis across Material Types, Industries, Processes, and Form Factors

The brazing metal market’s complexity is best understood through its multi-dimensional segmentation, each revealing distinct growth drivers and competitive landscapes. Material-based categorizations span aluminum-based alloys, bronze alloys, copper-phosphorus alloys, nickel-based alloys, silver-filler alloys, and titanium-based alloys, with each system further refined into specific delivery forms. For instance, the aluminum-based, bronze, and copper-phosphorus categories are predominantly supplied as powders and wires, supporting both automated and manual joining operations. Nickel-based alloys extend this versatility with paste formulations alongside powder and wire configurations, enabling precision application across critical assemblies. Silver-filler chemistries introduce yet another layer of flexibility through paste, strip, and wire formats, well-suited for electronics and specialized HVAC joints. Meanwhile, titanium-based variants are emerging primarily in wire form for high-strength, corrosion-resistant medical and aerospace applications.

Looking through the lens of end-user industries uncovers parallel nuances. Aerospace applications, including airframe, engine, and landing gear assemblies, demand high-temperature stability and exceptional fatigue resistance, driving a preference for nickel-based and titanium-based filler metals. The automotive sector, covering brake systems, electrical assemblies, engine components, and HVAC systems, values cost-effective paste and powder alloys that streamline high-volume manufacturing. Electronics manufacturers, spanning printed circuit board assembly, power modules, and semiconductor packaging, increasingly rely on silver-filler alloys in paste and strip forms for their superior conductivity and minimal thermal impact during joining.

Process-based segmentation further differentiates market opportunities. Dip brazing remains a choice for large-scale heat exchangers, while furnace brazing-across continuous, controlled-atmosphere, and manual configurations-serves diverse volume requirements, from heavy equipment to custom industrial fabrications. Induction brazing is gaining ground in precision manufacturing, and torch brazing retains a foothold in field service and maintenance applications. Vacuum brazing, under high- and low-vacuum conditions, caters to aerospace and medical parts requiring ultra-clean joints and tight dimensional tolerances.

Form factor analysis rounds out the picture with distinct supply chain and application considerations. Paste and flux systems are prized for automated deposition in electronics and automotive assembly. Powder variants support additive brazing and robotic feeding mechanisms, while preforms deliver consistent joint fill in high-precision applications. Rod and wire formats remain staples for manual brazing and localized repair work. Together, these segmentation insights guide material developers and manufacturers in tailoring product portfolios and go-to-market strategies to address the nuanced requirements of each industry vertical, joining methodology, and application environment.

This comprehensive research report categorizes the Brazing Metal Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Brazing Metal Type

- Joining Process

- Form Factor

- End-User Industry

Evaluating Diverse Regional Dynamics and Growth Drivers Influencing Brazing Metal Demand across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics within the brazing metal domain are defined by distinct economic drivers, regulatory landscapes, and supply chain infrastructures. In the Americas, North America leads through advanced manufacturing hubs in aerospace, automotive, and electronics, underpinned by robust steel and specialty metal production. Mexico is emerging as a competitive production base for value-added brazing alloys, leveraging nearshoring trends that favor shorter lead times and cost efficiencies. South America’s markets, while smaller, are characterized by growing demand in power generation and heavy equipment maintenance, where lower-cost bronze and copper-phosphorus systems dominate.

Europe, the Middle East, and Africa encompass divergent sub-regional trends. Western Europe’s stringent environmental regulations and emphasis on clean energy infrastructure drive the adoption of low-emission furnace brazing technologies and silver-free alloys. Central and Eastern European manufacturing centers are rapidly scaling capacity in response to resurgent automotive and industrial machinery investments. Meanwhile, the Middle East is leveraging its petrochemical infrastructure to expand supply chain capabilities for nickel-based and titanium-based alloys, aimed at high-temperature oil and gas applications. Africa’s market remains nascent, with opportunities centered on mining equipment maintenance and burgeoning renewable energy projects.

Asia-Pacific is distinguished by both scale and innovation. China maintains dominance in raw alloy production, while Japanese and South Korean manufacturers lead in high-performance paste and wire formulations tailored for semiconductor and electronics assembly. India’s growing electrification initiatives and expanding automotive market are catalyzing investments in domestic alloy refinement and furnace brazing facilities. Southeast Asia is emerging as a regional hub for cost-competitive production, balancing automation-driven quality with low-cost labor. Across the region, strategic initiatives in regional free trade agreements and infrastructure modernization are continuing to shape competitive positioning and investment flows.

This comprehensive research report examines key regions that drive the evolution of the Brazing Metal Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Driving Innovation, Market Expansion, and Competitive Differentiation in Brazing Metals

The competitive arena of brazing metals is anchored by a mix of global multinationals and specialized regional players, each pursuing strategies to enhance technological differentiation and market reach. Industry leaders have prioritized R&D investments to advance alloy formulations, targeting next-generation applications such as electric vehicle battery modules and compact heat exchangers for renewable energy systems. Strategic collaborations between filler metal producers and equipment manufacturers have also intensified, driven by joint development agreements that co-optimize alloy chemistry and heating processes for enhanced joint performance.

Alongside internal innovation, mergers and acquisitions have reshaped market structure. Companies have acquired complementary product lines to expand their form factor portfolios and strengthen regional distribution networks. This consolidation accelerates new product introductions by integrating specialized R&D teams with established application engineering groups in key markets. Collaborative consortiums continue to form, bringing together material science experts, end users, and equipment suppliers to standardize performance benchmarks and accelerate regulatory approvals for novel brazing chemistries.

In parallel, targeted marketing initiatives and digital engagement platforms are increasingly crucial for differentiation. Leading players have launched e-learning modules, virtual process demonstrations, and predictive joint failure simulators to educate customers on optimal alloy selection and best practices. Such initiatives foster deeper customer relationships and position these companies as thought leaders in an industry undergoing rapid technological and sustainability-driven change. Ultimately, the synthesis of innovation, strategic partnerships, and customer-centric engagement defines the competitive landscape for brazing metal materials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brazing Metal Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aimtek Inc.

- Harris Products Group

- Indian Solder and Braze Alloys Pvt Ltd.

- Linbraze S.r.l.

- Lucas‑Milhaupt Inc.

- Materion Corporation

- Morgan Advanced Materials Plc

- Saru Silver Alloy Private Limited

- Stella Welding Alloys S.r.l.

- Umicore N.V.

- Vacuumeschmelze GmbH & Co. KG

- VBC Group Ltd.

- Voestalpine Böhler Welding GmbH

- Wieland Edelmetalle GmbH (SAXONIA)

Delivering Strategic Recommendations Empowering Industry Leaders to Optimize Competitiveness, Operations, and Seize Emerging Brazing Metal Opportunities

To navigate the evolving brazing metal landscape, industry leaders should embrace a multi-pronged strategy that aligns innovation, sustainability, and supply chain resilience. First, investing in advanced alloy development focused on low-emission chemistries and circular-economy feedstocks will address tightening environmental regulations while differentiating product offerings. Companies should co-develop alloys with key end users to tailor performance characteristics-such as thermal fatigue resistance and electrical conductivity-to emerging applications in aerospace, electric vehicles, and renewable energy.

Second, firms must digitize their production and quality assurance processes by integrating real-time monitoring, predictive maintenance algorithms, and process simulation tools. These capabilities will reduce scrap rates, optimize cycle times, and bolster joint consistency across high-volume and specialized production environments. Simultaneously, forging strategic partnerships with regional foundries and service centers can mitigate geopolitical risks and import surcharges by localizing critical alloy blending and finishing operations.

Third, enhancing customer engagement through immersive digital platforms and technical training programs will solidify thought leadership and facilitate cross-selling of complementary joining solutions. By offering end-to-end technical support-from material selection matrices to on-site process audits-suppliers can cultivate deeper loyalty and capture broader wallet share. Finally, establishing robust sustainability roadmaps that incorporate lifecycle assessments, recycling initiatives for scrap materials, and transparent reporting frameworks will resonate with eco-conscious OEMs and unlock new business avenues in regulated markets.

Outlining Rigorous Research Methodology Leveraging Quantitative and Qualitative Approaches to Ensure Accuracy and Relevance of Brazing Metal Insights

The insights presented in this report are grounded in a rigorous research methodology combining quantitative data analysis and qualitative expert validation. Secondary research encompassed extensive review of technical journals, industry white papers, and peer-reviewed publications, alongside analysis of trade association data, corporate filings, and patent landscapes. Key performance indicators such as alloy adoption rates, process cycle time improvements, and sustainability metrics were compiled and normalized across multiple sources to ensure consistency and reliability.

Primary research involved in-depth interviews and workshops with a cross-section of stakeholders, including materials scientists, process engineers, procurement executives, and equipment OEMs. These dialogues provided nuanced perspectives on emerging challenges, regional market dynamics, and technology adoption barriers. Triangulation of primary and secondary inputs was achieved through iterative feedback loops, enabling the refinement of assumptions and the validation of trend analyses. Data integrity protocols included outlier detection, anomaly reconciliation, and sensitivity testing of critical variables.

The combination of systematic data collection, robust analytical frameworks, and expert review underpins the credibility of the findings. By leveraging both macroeconomic and application-specific lenses, this methodology ensures that strategic recommendations and market insights are both actionable and aligned with evolving industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brazing Metal Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brazing Metal Materials Market, by Brazing Metal Type

- Brazing Metal Materials Market, by Joining Process

- Brazing Metal Materials Market, by Form Factor

- Brazing Metal Materials Market, by End-User Industry

- Brazing Metal Materials Market, by Region

- Brazing Metal Materials Market, by Group

- Brazing Metal Materials Market, by Country

- United States Brazing Metal Materials Market

- China Brazing Metal Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing Strategic Key Takeaways and Future Outlook Highlighting the Imperative of Innovation and Collaboration in Brazing Metal Applications

The brazing metal sector is poised for sustained advancement as it responds to rising demands for performance, sustainability, and supply chain resilience. Key takeaways highlight the importance of material innovation-particularly in low-emission and high-temperature alloy systems-combined with digital process controls that enhance productivity and quality. The 2025 tariff environment has catalyzed a diversification of sourcing strategies, underscoring the need for agile procurement models and collaborative value-added processing.

Segmentation analysis reveals that successful participants will tailor their portfolios to the nuanced requirements of end-user industries, joinery processes, and form factors. Regional dynamics continue to evolve across the Americas, EMEA, and Asia-Pacific, with each geography presenting distinct investment imperatives and regulatory considerations. Competitive intensity remains high, driven by R&D partnerships, M&A activity, and customer-centric digital engagement efforts.

Moving forward, the convergence of advanced materials science, sustainability imperatives, and digital transformation will define success in brazing metal applications. Stakeholders that proactively align their strategies with these imperatives will be best positioned to capture emerging growth opportunities and build resilient, future-ready supply chains.

Empower Decision-Making with Customized Insights by Engaging Ketan Rohom for Comprehensive Brazing Metal Market Research Report

For decision-makers seeking specialized insights and comprehensive data on brazing metal materials, connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, can unlock tailored guidance. Engaging with him ensures direct access to detailed analyses, customized briefings, and priority support in securing the full market research report. By collaborating with Ketan, stakeholders can accelerate their strategic planning cycles and gain competitive advantage in identifying optimal material selections, emerging supplier partnerships, and risk mitigation strategies. His expertise in translating complex market data into actionable roadmaps will empower your organization to drive innovation, optimize procurement, and secure high-value opportunities. Reach out today to transform market intelligence into concrete growth outcomes.

- How big is the Brazing Metal Materials Market?

- What is the Brazing Metal Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?