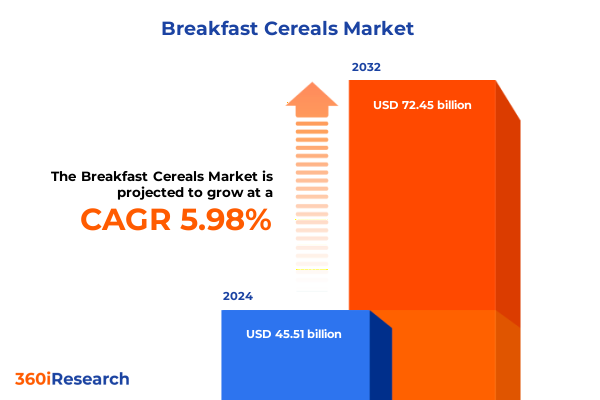

The Breakfast Cereals Market size was estimated at USD 48.24 billion in 2025 and expected to reach USD 50.47 billion in 2026, at a CAGR of 5.98% to reach USD 72.45 billion by 2032.

Exploring the Evolving Dynamics of the Breakfast Cereal Market in the United States and Beyond Amid Changing Consumer Preferences

The breakfast cereal market has transcended its traditional role as a simple morning staple to become a dynamic arena where health, convenience, and sustainability converge. Today’s consumers demand not only satisfying flavors but also functional nutrition and transparent sourcing. This shift has prompted manufacturers to innovate product formulations and packaging solutions that resonate with contemporary lifestyles while addressing environmental concerns.

As the competitive landscape intensifies, industry players must navigate a complex web of evolving consumer preferences, regulatory changes, and global supply chain challenges. From the surge in on-the-go consumption formats to the growing emphasis on plant-based and ancient grain ingredients, the market’s contours are being reshaped at a rapid pace. Consequently, stakeholders must cultivate agility and foresight to capitalize on emerging opportunities.

This executive summary distills the critical forces influencing the breakfast cereal sector in 2025. It examines the transformative shifts driving product and packaging innovation, evaluates the cumulative impact of recent U.S. tariff policies, and presents key insights derived from segmentation and regional analysis. Additionally, the performance and strategic initiatives of leading companies are explored, culminating in actionable recommendations for operators seeking to enhance their market positioning.

Identifying the Key Consumer and Technological Shifts Reshaping Breakfast Cereal Development Sustainability and Market Engagement

The breakfast cereal landscape is undergoing a fundamental transformation driven by health-conscious consumers and rapid technological advancements. Nutritional priorities have shifted toward protein enrichment, reduced sugar, and functional ingredients such as ancient grains and fiber-rich blends. This evolution is not merely a transient trend but a reflection of consumers’ deeper engagement with personalized wellness and dietary transparency. As a result, brands are reformulating classic offerings and launching novel variants that deliver targeted benefits without compromising taste or texture.

In parallel, packaging innovation has emerged as a critical differentiator. Eco-friendly materials and design philosophies are gaining prominence, propelled by both consumer expectations and regulatory mandates. Manufacturers are exploring biodegradable films, compostable options, and increased use of recycled content to minimize environmental footprints. Interactive features such as QR codes enable real-time access to ingredient sourcing and sustainability credentials, further enhancing brand transparency.

Moreover, digital technologies are reshaping product development and market engagement. Artificial intelligence and data analytics accelerate R&D cycles by identifying emerging flavor preferences and optimizing formulation parameters. At the same time, omnichannel marketing strategies leverage social media, e-commerce platforms, and in-store digital experiences to foster deeper consumer connections. Collectively, these forces are redefining the way breakfast cereals are formulated, packaged, and delivered.

Evaluating the Cumulative Effects of 2025 United States Tariffs on Ingredient Costs Packaging and Supply Chain Resilience in Breakfast Cereals

In 2025, the United States maintained a 50 percent tariff on imported steel and aluminum under Section 232 provisions, doubling the previous 25 percent rate and excluding only the United Kingdom from this elevation. These measures have direct implications for metal packaging used in canned and ready-to-eat cereal formats, as higher import duties translate into elevated material costs across the supply chain.

Industry associations have highlighted that increased tariffs on tinplate steel have inflated the cost of food-grade can production by upward of 15 percent in the first half of 2025. Ultimately, cereal manufacturers have faced pressure to absorb a portion of these expenses or pass them on to retailers and consumers. This dynamic has spurred a strategic pivot toward alternative packaging substrates, including recyclable paperboard and lightweight plastic alternatives, in order to mitigate cost pressures.

Additionally, secondary tariffs enacted on specialty grain imports from select trading partners have constrained access to premium ingredients such as barley and oats, compelling some producers to diversify sourcing strategies. In response, organizations are forging partnerships with domestic growers and nearshoring key supply segments to bolster resilience. The combined effect of these measures underscores the urgency for companies to reengineer procurement and logistics frameworks to preserve margin integrity and assure uninterrupted product availability.

Uncovering How Product Type Ingredient Packaging Flavor Distribution Channel and End User Segmentation Provide Strategic Market Opportunities

A nuanced understanding of market segmentation reveals the varied pathways to growth within the breakfast cereal sphere. Product type distinctions between hot preparations like Cream of Wheat and Oatmeal and ready-to-eat variants encompassing extruded shapes, flakes, granola clusters, oat clusters, and puffed grains define divergent consumer usage occasions and innovation opportunities. Hot cereals retain utility among health-conscious adults seeking warm, comforting breakfasts, whereas convenience-driven younger demographics gravitate toward portable, on-the-go formats.

Ingredient-based differentiation further segments the market along barley, corn, oats, rice, and wheat matrices. Each raw material category brings unique nutritional attributes and cost considerations. For instance, oats command premium positioning due to their beta-glucan content and heart health associations, while corn-based products often emphasize affordability and familiarity.

Packaging types ranging from traditional bags and boxes to single-serve cups and flexible pouches align with evolving consumption patterns. The choice of packaging medium affects shelf visibility, portion control, and sustainability credentials. Within flavor profiles, the dichotomy between sweetened and unsweetened offerings continues to shape product portfolios, reflecting the tension between indulgence and health optimization.

Distribution channels are equally diverse, with offline retail spanning grocery chains, convenience stores, and specialist retailers alongside robust online avenues via proprietary websites and third-party e-commerce platforms. Lastly, end-user segmentation distinguishes between adult and child consumers, each cohort exhibiting distinct purchasing drivers that inform marketing and product development strategies.

This comprehensive research report categorizes the Breakfast Cereals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient

- Packaging Type

- Flavor Profile

- Distribution Channel

- End User

Analyzing Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Reveal Growth Drivers and Consumer Behavior Trends

Regional dynamics in the breakfast cereal market demonstrate both shared themes and localized nuances. Across the Americas, North American consumers continue to demand high-protein, low-sugar formats and ready-to-eat options, while Latin American markets exhibit growing openness to international flavors and value-oriented products. Trade agreements within the Americas facilitate cross-border ingredient flows but also expose producers to shifting currency and tariff environments.

In Europe, Middle East, and Africa, the emphasis on clean-label and organic claims has catalyzed premiumization, particularly in Western Europe’s health-driven markets. Meanwhile, emerging economies in the Middle East and Africa showcase rising cereal consumption rates among urbanizing populations, albeit within a price-sensitive framework. Regulatory landscapes vary significantly, with some EMEA jurisdictions advancing extended producer responsibility (EPR) mandates that influence packaging design decisions.

Asia-Pacific markets exhibit the most rapid expansion, fueled by rising disposable incomes and accelerating urbanization. In East Asia, innovative flavors and limited-edition collaborations resonate strongly with younger generations, whereas Southeast Asian consumers display a preference for fortified cereals addressing micronutrient deficiencies. Moreover, e-commerce penetration in APAC outpaces global averages, prompting brands to customize digital promotions and ensure seamless logistics integration.

This comprehensive research report examines key regions that drive the evolution of the Breakfast Cereals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies Innovation and Collaborations of Leading Breakfast Cereal Manufacturers Driving Market Leadership and Differentiation

Leading breakfast cereal manufacturers have adopted differentiated strategies to navigate the competitive terrain. Established global players such as Kellogg and General Mills invest heavily in R&D to reformulate legacy brands with functional ingredients and reduce sugar while maintaining flavor authenticity. Concurrently, they expand private label partnerships with retail chains to capture value-conscious segments without diluting brand equity.

Mid-tier multinational corporations leverage strategic acquisitions of niche brands specializing in organic, gluten-free, or plant-based products to broaden their portfolios and tap emerging consumer niches. These collaborations enable larger firms to augment shelf space and accelerate innovation cycles through co-development agreements and shared distribution networks.

Smaller regional specialists are capitalizing on local ingredient sourcing and artisanal processing techniques to differentiate through authenticity and transparency. By emphasizing shorter supply chains and farm-to-pack traceability, these companies address consumer demands for provenance and environmental stewardship. Technological investments in automated manufacturing and digital marketing platforms further enhance their ability to compete effectively against global incumbents.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breakfast Cereals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Associated British Foods plc

- B&G Foods Inc

- Bagrry's India Limited

- Bob's Red Mill Natural Foods

- Calbee Inc

- Carman's Fine Foods

- Freedom Foods Group Limited

- General Mills Inc

- Grain Millers Inc

- Kellanova

- Marico Limited

- McKee Foods Corporation

- Nature's Path Foods

- Nestlé S.A.

- PepsiCo Inc

- Post Holdings Inc

- Purely Elizabeth

- Sanitarium Health Food Company

- Shantis Food

- The Campbell Soup Company

- The Hain Celestial Group Inc

- The Jordans & Ryvita Company Ltd

- The Oetker Group

- TreeHouse Foods

Presenting Strategic Initiatives for Industry Leaders to Innovate Operations Enhance Consumer Engagement and Strengthen Market Positioning Effectively

Industry leaders seeking to fortify their market positions should prioritize sustainable innovation across both product formulation and packaging design. Incorporating plant-based, biodegradable, or recycled materials can reduce exposure to commodity price volatility and align with evolving regulatory frameworks. At the same time, partnerships with material science firms can accelerate development of next-generation flexible packaging and intelligent labels that track freshness and provide real-time consumer engagement.

Operational agility remains paramount in an environment marked by tariff-induced cost fluctuations. Establishing dual-sourcing agreements and nearshore supply nodes for key ingredients such as oats and barley will mitigate exposure to trade disruptions. Furthermore, investing in predictive analytics can enhance demand forecasting accuracy and optimize inventory levels across omnichannel networks.

Finally, fostering direct-to-consumer channels through subscription models and e-commerce loyalty programs can unlock higher margin streams while enabling personalized product bundles and trial opportunities. By leveraging consumer data insights, brands can refine product assortments and promotional messages to bolster engagement and drive long-term loyalty.

Outlining Rigorous Research Approaches Including Primary Interviews Secondary Analysis and Expert Validation Ensuring Robust Breakfast Cereal Market Insights

This research integrates a multi-tiered methodology combining primary and secondary sources to ensure robust and comprehensive insights. Primary research entailed in-depth interviews with senior executives from key cereal manufacturers, packaging suppliers, and industry associations to capture firsthand perspectives on strategic priorities and emerging challenges. These insights were complemented by structured surveys with retail buyers and foodservice operators to validate distribution trends and consumer purchasing behaviors.

Secondary research involved rigorous analysis of regulatory documents, trade publications, and cross-industry reports. Data on tariff modifications were sourced directly from official government proclamations and trade commission fact sheets. Packaging innovation trends were corroborated through industry news platforms and academic journals focused on material science advances.

A bottom-up approach was applied to segment analysis, synthesizing company-level disclosures, public financial filings, and expert commentary to map product and distribution archetypes. All findings underwent triangulation and were peer-reviewed by independent cereal market consultants to ensure accuracy and neutrality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breakfast Cereals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breakfast Cereals Market, by Product Type

- Breakfast Cereals Market, by Ingredient

- Breakfast Cereals Market, by Packaging Type

- Breakfast Cereals Market, by Flavor Profile

- Breakfast Cereals Market, by Distribution Channel

- Breakfast Cereals Market, by End User

- Breakfast Cereals Market, by Region

- Breakfast Cereals Market, by Group

- Breakfast Cereals Market, by Country

- United States Breakfast Cereals Market

- China Breakfast Cereals Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Market Implications to Provide a Comprehensive Perspective on the Future Trajectory of the Breakfast Cereal Industry

The breakfast cereal industry stands at an inflection point defined by converging forces of consumer-centric innovation, sustainability imperatives, and trade policy complexities. Core growth opportunities reside in addressing personalized nutrition requirements, reducing environmental footprints, and optimizing supply chain resilience in the face of tariff perturbations.

Segmentation analysis underscores the importance of tailoring value propositions to specific consumption occasions, ingredient preferences, and channel dynamics. Regional insights further reveal that while mature markets prioritize health and convenience, emerging markets in Asia-Pacific and EMEA present fertile ground for premium and fortified offerings.

Ultimately, companies that strike a balance between operational efficiency and strategic differentiation will be best positioned to thrive. Embracing collaborative partnerships, harnessing digital technologies, and maintaining agility in sourcing will serve as critical enablers of sustained competitive advantage.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence Insights and Tailored Guidance for Informed Investment Decisions in Breakfast Cereals

To secure the comprehensive executive research report and benefit from a tailored consultation, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the full breadth of market intelligence insights and discuss how this analysis can be customized to meet your strategic objectives. Engaging with Ketan ensures you gain the critical perspectives and actionable data needed to make informed investment and innovation decisions within the breakfast cereal industry

- How big is the Breakfast Cereals Market?

- What is the Breakfast Cereals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?