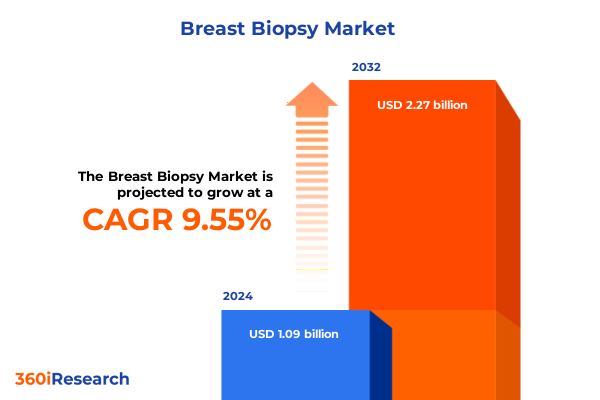

The Breast Biopsy Market size was estimated at USD 1.90 billion in 2024 and expected to reach USD 2.02 billion in 2025, at a CAGR of 6.63% to reach USD 3.17 billion by 2032.

Understanding the Critical Role of Breast Biopsy Market Dynamics and Innovations Guiding Healthcare Decision-Makers Toward Enhanced Patient Outcomes in 2025

Breast biopsy procedures lie at the heart of precise cancer diagnosis and personalized treatment planning, representing an indispensable component of contemporary oncology workflows. Clinicians rely on biopsy technologies to deliver tissue samples that inform critical decisions, from distinguishing benign anomalies to confirming malignant pathologies. In this evolving healthcare environment, stakeholders demand devices that offer not only the highest standards of safety and accuracy but also streamlined workflows and enhanced patient comfort. As breast cancer diagnosis rates rise worldwide, medical providers, technology developers, and healthcare payers alike are united by the imperative to refine biopsy approaches and integrate innovations that reduce procedural risk while elevating diagnostic yield.

This report provides a deep dive into the multifaceted breast biopsy landscape without focusing on numerical estimations, instead prioritizing qualitative analysis of the factors that influence market dynamics. Building upon an extensive review of technological advancements, clinical preferences, and macroeconomic influences, the study illuminates the forces driving adoption and disruption. Decision-makers will find clarity in the synthesis of emerging trends, regulatory impacts, and competitive strategies, enabling them to navigate complex choices with confidence. In particular, this work spotlights the interplay between device manufacturers, healthcare institutions, and regulatory frameworks, offering a holistic perspective on future growth trajectories.

Identifying the Transformational Technological and Clinical Shifts Reshaping Breast Biopsy Procedures Through Advanced Imaging AI Integration and Patient-Centric Approaches and Workflow Optimization

The breast biopsy sector is undergoing a profound transformation driven by leaps in imaging capabilities, data analytics, and patient-centered care models. Advanced imaging modalities now integrate artificial intelligence algorithms to provide real-time lesion characterization, enabling clinicians to target suspicious areas with unprecedented precision. These digital aids not only streamline procedural workflows but also augment diagnostic confidence, particularly in cases where tissue differentiation is subtle. Moreover, the introduction of three-dimensional ultrasound techniques and MRI enhancements has expanded the clinician’s ability to navigate complex breast architectures and capture high-resolution tissue samples.

Concurrently, device manufacturers are exploring novel needle designs, robotics-assisted platforms, and vacuum-based aspiration systems that promise to reduce invasiveness and procedural discomfort. By focusing on ergonomics and automation, these technologies aim to standardize biopsy protocols across diverse clinical settings, from high-volume hospitals to community-based specialty clinics. Patient experience is also being reimagined through minimally invasive approaches and digital interfaces that offer shorter recovery times and lower complication rates. Indeed, the convergence of these factors highlights a new era in breast biopsy practice, one characterized by smart devices, interconnected data streams, and a relentless pursuit of clinical excellence.

Assessing the Aggregate Effects of United States Tariff Policy Adjustments on Medical Device Supply Chains and Cost Structures Impacting Breast Biopsy Accessibility in 2025

In recent years, changes to tariff structures in the United States have introduced both challenges and strategic inflection points for medical device suppliers specialized in breast biopsy solutions. Adjustments to duty rates on imported diagnostic equipment have increased the landed costs of certain biopsy systems, prompting manufacturers to reassess global sourcing strategies and explore localized production models. As a result, supply chain stakeholders face pressure to balance tariff-related expenses against quality benchmarks and delivery timelines, which in turn influences procurement decisions within healthcare networks.

The ripple effects extend beyond cost considerations. Heightened import levies have spurred partnerships between domestic contract manufacturers and international technology developers, fostering co-manufacturing arrangements aimed at mitigating tariff exposure. These collaborative efforts not only safeguard supply continuity but also catalyze technology transfer and know-how sharing. In parallel, some device innovators have accelerated the development of in-country design centers and pilot production lines to preserve competitiveness. Consequently, the cumulative impact of tariff shifts is reshaping commercial strategies by emphasizing supply chain resilience, regulatory agility, and regional value creation across the breast biopsy market.

Uncovering Key Insights from Segmenting Breast Biopsy Markets by Technology Procedure Type and End User Profiles to Drive Tailored Strategic Approaches

Analysis based on technology reveals that core needle biopsy devices remain a cornerstone of tissue extraction, with both automated and semi-automated variants gaining traction for their balance of accuracy and user control. Fine needle aspiration needles, whether enhanced by echo-guidance or in standard form, continue to appeal for superficial lesion sampling where minimal invasiveness is paramount. Meanwhile, vacuum-assisted systems, offered in handheld and table-configured formats, are increasingly employed for complex or larger tissue requirements, underscoring their versatility and patient comfort advantages.

When considering procedure type, MRI-guided approaches are divided between closed and open bore architectures, enabling clinicians to select configurations that suit lesion accessibility and patient claustrophobia considerations. Palpation-guided methods, whether executed freehand or with grid assistance, remain relevant in scenarios where tactile cues guide sampling, particularly in early detection programs. Stereotactic biopsies, practiced in both prone and upright orientations, provide targeted options for calcification-driven interventions. In addition, the evolution toward two-dimensional and three-dimensional ultrasound guidance reflects a pursuit of procedural efficiency and real-time visualization.

End users of breast biopsy technologies are equally diversified, encompassing ambulatory surgery centers subdivided into diagnostic centers and outpatient surgery centers that prioritize cost-effective, high-throughput procedures. Hospital settings, including both private and public institutions, continue to invest in advanced systems to support comprehensive oncology services. Specialty clinics, whether focused on oncology or radiology, leverage their clinical expertise to adopt niche tools that align with patient demographics and referral patterns. This foundational segmentation framework provides a nuanced lens through which manufacturers and providers can shape product offerings and service models.

This comprehensive research report categorizes the Breast Biopsy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedure Type

- Guidance Modality

- Biopsy Site

- End User

- Clinical Indication

Exploring Regional Market Dynamics across the Americas Europe Middle East Africa and Asia-Pacific Revealing Unique Drivers and Barriers Influencing Breast Biopsy Adoption

Regional dynamics in the breast biopsy domain exhibit pronounced variation shaped by regulatory landscapes, healthcare infrastructure, and economic maturity. In the Americas, robust reimbursement schemes and a well-established network of private hospitals and specialty centers drive sustained demand for state-of-the-art biopsy devices. Stakeholders in this region prioritize streamlined regulatory approval pathways and post-market surveillance initiatives that reinforce confidence in device safety and performance.

Across Europe, the Middle East and Africa, a mosaic of regulatory jurisdictions and varying levels of healthcare investment define market contours. Western European nations often set the pace for technology adoption, supported by centralized reimbursement policies and large academic medical centers. In contrast, emerging markets within the broader region are navigating infrastructure constraints, where cost-effective solutions and public-private partnerships play a pivotal role in expanding access to biopsy services.

The Asia-Pacific landscape is characterized by high-growth potential fueled by expanding healthcare budgets and a growing prevalence of breast cancer awareness programs. Countries across the region are accelerating the adoption of minimally invasive biopsy tools, underpinned by government incentives for local manufacturing and technology transfer. A younger, tech-savvy patient population additionally drives interest in cutting-edge procedural modalities. Collectively, these regional insights underscore the importance of tailored market approaches that align device features, distribution strategies, and support services with local healthcare dynamics.

This comprehensive research report examines key regions that drive the evolution of the Breast Biopsy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Portfolio Innovations of Leading Medical Device Manufacturers Shaping the Future of Breast Biopsy Solutions Globally Through Market Positioning and Collaborative Endeavors

Leading manufacturers of breast biopsy solutions are pursuing diverse strategies to maintain and grow their market presence. Some established global firms differentiate through continuous investment in research collaborations that enhance imaging compatibility and needle design, reinforcing their reputation for quality and innovation. In contrast, emerging device developers focus on nimble product launches and targeted clinical partnerships to address unmet needs in niche segments, such as high-resolution vacuum-assisted sampling or advanced needle ergonomics.

Strategic acquisitions and alliances feature prominently as companies seek to bolster their portfolios with complementary technologies and expand geographic reach. Partnerships between diagnostic imaging specialists and biopsy system providers are creating integrated platforms that streamline procedural workflows and data management. Additionally, several industry leaders are enhancing their value propositions by offering end-to-end service models that encompass training, maintenance contracts and digital solutions to support remote monitoring and performance analytics.

This competitive environment is further defined by an emphasis on customizable offerings and modular system architectures. By enabling healthcare providers to adapt configurations to specific clinical requirements, manufacturers can foster deeper engagement and loyalty. Ultimately, the interplay between organizational agility, technological expertise and collaborative networks will determine which companies emerge as front-runners in advancing the state of breast biopsy care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Biopsy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.Menarini Industrie Farmaceutiche Riunite S.r.l.

- Argon Medical Devices, Inc.

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc

- Canon Medical Systems Corporation

- Cook Group Incorporated

- CooperSurgical, Inc.

- Danaher Corporation

- Exact Sciences Corporation

- FUJIFILM Corporation

- GE HealthCare

- Guardant Health, Inc.

- Halma PLC

- Hologic, Inc.

- INRAD, Inc.

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medax Srl Unipersonale

- Medtronic PLC

- Merit Medical Systems, Inc.

- Planmed Oy

- QIAGEN N.V.

- Resitu Medical AB

- Siemens Healthineers AG

- STERYLAB S.r.l.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- TransMed7, LLC

- Trivitron Healthcare

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Breast Biopsy Technologies and Navigate Regulatory Operational and Competitive Landscapes

To thrive amidst evolving clinical demands and regulatory intricacies, industry leaders must prioritize strategic initiatives that balance innovation with operational excellence. First, investment in artificial intelligence-driven imaging tools and data analytics platforms will enhance procedural accuracy and differentiate device offerings in a crowded marketplace. Embracing interoperability standards and open architecture designs can further accelerate integration with hospital information systems, facilitating seamless data exchange and workflow optimization.

Supply chain diversification represents another critical recommendation. By forging partnerships with multiple manufacturing and logistics providers, companies can mitigate the impact of geopolitical shifts, tariff fluctuations and component shortages. Establishing regional engineering and quality assurance centers will also reduce time-to-market for new products while strengthening relationships with local regulators.

Finally, a concerted focus on clinician education and patient engagement is essential for driving adoption of novel biopsy techniques. Comprehensive training programs, augmented by virtual simulation environments and digital learning modules, will build professional competency and confidence. Concurrently, patient-facing initiatives-such as interactive pre-procedure counseling tools-will enhance satisfaction and adherence to follow-up care. Through these combined efforts, organizations can position themselves as trusted partners in advancing minimally invasive diagnostic solutions.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Ensure Robust Data Validation and Insight Generation within the Breast Biopsy Market Landscape

This study employs a rigorous, multi-tiered research methodology designed to deliver credible and actionable insights into the breast biopsy market. At its core, qualitative interviews with leading clinicians, pathologists and procurement managers provided first-hand perspectives on device performance, clinical preferences and operational challenges. These expert conversations were complemented by secondary data analysis, drawing on peer-reviewed publications, regulatory databases and clinical trial repositories to validate emerging trends.

To ensure robustness, the analytical framework incorporated triangulation techniques, cross-referencing insights from clinical specialists, supply chain experts and healthcare economists. This approach minimized biases and reinforced the reliability of thematic findings. Furthermore, the study adhered to stringent ethical standards, securing informed consent for all primary interviews and maintaining data confidentiality throughout the research process.

Finally, iterative validation workshops with a subset of industry stakeholders enabled real-time feedback and refinement of key hypotheses. This dynamic engagement fostered collaborative dialogue and ensured that the final deliverables resonate with both strategic and operational priorities. The resulting methodology delivers a balanced synthesis of clinical acuity, market intelligence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Biopsy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Biopsy Market, by Product Type

- Breast Biopsy Market, by Procedure Type

- Breast Biopsy Market, by Guidance Modality

- Breast Biopsy Market, by Biopsy Site

- Breast Biopsy Market, by End User

- Breast Biopsy Market, by Clinical Indication

- Breast Biopsy Market, by Region

- Breast Biopsy Market, by Group

- Breast Biopsy Market, by Country

- United States Breast Biopsy Market

- China Breast Biopsy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Reflect on the Evolution and Collective Implications of Current Trends Driving Breast Biopsy Practices and Market Strategies

In synthesizing the core thematic insights, it becomes clear that the breast biopsy market is at an inflection point driven by technological convergence and strategic realignments. Advanced imaging modalities infused with data analytics capabilities promise to redefine procedural precision, while minimally invasive device architectures are setting new benchmarks for patient comfort and safety. Concurrently, tariff dynamics and regulatory shifts are encouraging supply chain innovation and local value creation.

Segment analysis underscores the nuanced demands of clinicians and end users, highlighting the necessity for device variability across technology types, procedural contexts and care settings. Regional perspectives further reveal that a one-size-fits-all approach is untenable; instead, successful market engagement hinges on tailored solutions attuned to reimbursement norms, infrastructure maturity and clinical workflows.

Finally, the competitive landscape demonstrates that strategic partnerships, modular product designs and clinician-centric service models will differentiate market leaders. As industry stakeholders navigate this complex terrain, they must align R&D investments, operational practices and go-to-market strategies with the evolving needs of healthcare providers and patients. In doing so, they will unlock new avenues for growth and reinforce the critical role of biopsy in the broader oncology ecosystem.

Inviting Collaboration with Ketan Rohom to Unlock Comprehensive Breast Biopsy Market Insights and Empower Strategic Decision-Making Through Tailored Research Solutions

If you are seeking to elevate your understanding of the breast biopsy market with actionable insights tailored to your strategic imperatives, reach out to Ketan Rohom, our Associate Director of Sales & Marketing. By engaging directly, you can secure a bespoke consultation that highlights the latest technological breakthroughs, regulatory developments, and competitive benchmarks critical for optimizing your product portfolio and growth strategies. Ketan’s expert guidance will ensure you leverage comprehensive intelligence to make informed decisions that drive clinical adoption and market success. Embark on a collaborative journey to access the full breadth of our findings, gain early visibility into emerging opportunities, and position your organization at the forefront of innovation. Contact Ketan today to purchase the detailed market research report and empower your team with the insights that matter most for sustainable advancement within the dynamic breast biopsy landscape

- How big is the Breast Biopsy Market?

- What is the Breast Biopsy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?