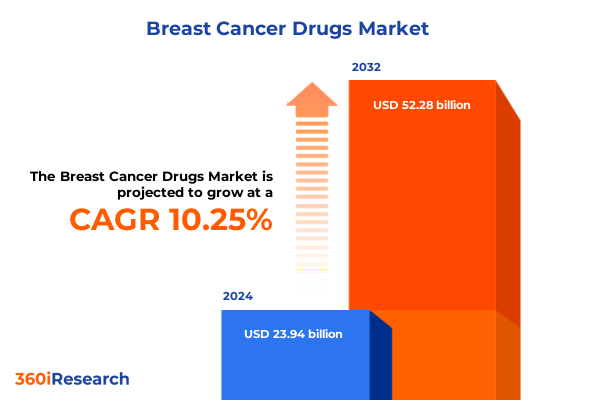

The Breast Cancer Drugs Market size was estimated at USD 26.38 billion in 2025 and expected to reach USD 28.93 billion in 2026, at a CAGR of 10.26% to reach USD 52.28 billion by 2032.

Exploring the Transformative Evolution of Breast Cancer Therapeutics and Emerging Frontiers in Precision Oncology Shaping Patient Outcomes

Breast cancer continues to represent a significant public health challenge, underscored by the American Cancer Society’s projection of approximately 316,950 new invasive cases and 42,170 deaths in the United States for 2025. With the disease accounting for about 30 percent of all new female cancer diagnoses, the imperative for innovative and effective therapeutic options remains critical. Over the past three decades, mortality rates have declined by 44 percent due to earlier detection, enhanced screening protocols, and incremental improvements in treatment protocols. Yet, incidence rates are rising by nearly 1 percent annually, driven in part by shifting demographic factors and lifestyle influences such as reproductive trends and obesity.

In parallel, the treatment landscape has evolved far beyond traditional cytotoxic chemotherapy. The approval of novel antibody–drug conjugates like Datroway, specifically targeting unresectable or metastatic hormone receptor–positive, HER2–negative breast cancer, exemplifies this evolution by delivering cytotoxins directly to malignant cells and reducing systemic toxicity. Concurrently, the introduction of oral selective estrogen receptor degraders such as Elacestrant provides a critical option for ESR1–mutated metastatic disease, further illustrating the shift toward precision oncology. These advances mark the transition from one-size-fits-all regimens to highly targeted therapies that address molecular drivers and resistance mechanisms, setting the stage for transformative growth in the sector.

Revolutionary Breakthroughs in Antibody Drug Conjugates CDK4/6 Inhibitors and Personalized Medicine Reworking the Breast Cancer Treatment Paradigm

Emerging therapeutic modalities are rapidly redefining the standards of care in breast cancer treatment. Antibody–drug conjugates (ADCs) such as Enhertu and Trodelvy epitomize this shift by linking potent cytotoxins to tumor-specific antibodies, minimizing collateral damage to healthy tissue while maximizing antitumor efficacy. The growing body of clinical data supporting ADCs underscores their potential to address unmet needs, particularly in subtypes with limited treatment options such as triple–negative disease.

At the molecular level, cell cycle regulators have become pivotal therapeutic targets. The U.S. approval of capivasertib (Truqap) in combination with fulvestrant exemplifies how AKT pathway inhibition can overcome endocrine resistance in hormone receptor–positive, HER2–negative breast cancer. Similarly, CDK4/6 inhibitors continue to demonstrate durable progression-free survival benefits, reinforcing the centrality of cell cycle modulation in current treatment paradigms.

Beyond targeted small molecules, immuno-oncology approaches are gaining traction. Checkpoint inhibitors, monoclonal antibodies, and bispecific constructs are under investigation to harness antitumor immune responses. Concurrently, advances in biomarker testing and liquid biopsies facilitate real-time monitoring of tumor evolution, enabling adaptive treatment strategies. Collectively, these breakthroughs are not only expanding therapeutic options but also encouraging earlier intervention and combination strategies that promise to elevate patient outcomes to unprecedented levels.

Assessing the Cumulative Impact of United States 2025 Trade Tariffs on Pharmaceutical Supply Chains and Drug Availability Dynamics

The United States’ evolving trade policy environment in 2025 is exerting significant pressure on the pharmaceutical supply chain and cost structures. Since April, a 10 percent global tariff has been applied to nearly all imported goods, including active pharmaceutical ingredients (APIs) and finished drug products, as part of broader measures to incentivize domestic manufacturing and bolster national security. Concurrently, U.S. authorities have imposed reciprocal tariffs of up to 245 percent on Chinese APIs, raising the cost of generics and critical drug precursors. These measures have sparked concerns over increased production expenses, potential supply shortages, and delayed market entry for new therapies in oncology and other high–need areas.

Adding to this complexity are high–profile proposals for tariffs reaching 200 percent on pharmaceutical imports, intended to encourage onshoring and reduce foreign dependency. However, the proposal includes a grace period extending up to 18 months, offering the industry time to adapt supply chains or expand domestic capacity. Pharmaceutical companies are responding by accelerating plans to reshore API production, enter partnerships with contract development and manufacturing organizations (CDMOs), and strategically stockpile inventory. While these adjustments aim to mitigate near–term disruptions, uncertainty surrounding the final scope and timing of tariff implementation continues to influence investment decisions, pricing strategies, and stakeholder collaboration throughout the industry.

Uncovering Critical Segmentation Insights Across Drug Classes Administration Routes Subtypes Channels and End Users in Breast Cancer Therapy

A comprehensive understanding of the breast cancer drug market requires segmentation across multiple dimensions to reveal nuanced growth pockets and competitive dynamics. When categorized by drug class, the market spans bone modifying agents, chemotherapy, hormonal therapies, and targeted therapies. Within bone modifying agents, bisphosphonates and RANK ligand inhibitors illustrate distinct mechanisms to reduce skeletal morbidity in metastatic settings. Chemotherapeutics break down into anthracyclines, antimetabolites, platinum agents, and taxanes, each contributing unique efficacy and safety profiles. Hormonal therapies are further refined into aromatase inhibitors, selective estrogen receptor downregulators, and modulators, tailoring endocrine intervention to diverse menopausal and receptor contexts. Targeted therapies encompass Cdk4/6 inhibitors, HER2 inhibitors, mTOR inhibitors, PARP inhibitors, and tyrosine kinase inhibitors, reflecting the precision needed to counter specific oncogenic pathways.

Examining administration routes offers additional insight. Intravenous delivery remains indispensable for many high–potency biologics and ADCs, yet the proliferation of oral options has improved patient convenience and adherence. Oral formulations bifurcate into capsules and tablets, presenting formulation challenges and compliance considerations. Subcutaneous delivery is emerging as an attractive alternative in select antibody-based therapies, balancing bioavailability with reduced infusion burden.

Cancer subtype segmentation-HER2-positive, hormone receptor-positive (HR+), and triple-negative breast cancer-further delineates clinical priorities and unmet needs. HER2-positive disease benefits from an expanding arsenal of monoclonal antibodies and ADCs, HR+ patients increasingly rely on endocrine agents combined with targeted small molecules, and triple-negative subtypes drive demand for novel immunotherapies and ADC constructs. Distribution channels, including hospital pharmacies, online pharmacies, and retail pharmacies, dictate access pathways, reimbursement frameworks, and inventory models. Finally, end users such as homecare settings, hospitals, and specialty clinics illustrate the continuum of care environments where therapeutic strategies are delivered.

This comprehensive research report categorizes the Breast Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Distribution Channel

- End User

Mapping Key Regional Dynamics in Breast Cancer Treatment Adoption and Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in breast cancer drug adoption and market drivers reveal divergent opportunities and challenges across geographies. In the Americas, the United States remains the global epicenter for oncology innovation, propelled by a robust R&D ecosystem and favorable reimbursement policies for breakthrough therapies. Leading U.S. introductions include targeted ADCs like Datroway and Enhertu alongside CDK4/6 inhibitors and emerging AKT inhibitors, fostering rapid uptake among academic centers and community oncology practices. Canada mirrors these trends, supported by streamlined regulatory pathways and public healthcare investment in biomarker-driven regimens.

Moving to Europe, the market is characterized by a heterogeneous mosaic of regulatory frameworks and health technology assessment processes. The European Medicines Agency’s endorsement of Enhertu for post-endocrine therapy patients reflects a growing acceptance of ADC platforms, though national bodies such as NICE in the U.K. and HAS in France maintain stringent cost-effectiveness thresholds. Germany’s early adopter status and Italy’s regional centers of excellence underscore the role of public-private partnerships in driving oncology clinical trial throughput and enabling earlier patient access.

In the Asia-Pacific region, rapid expansion stems from increasing cancer incidence, infrastructure investments, and growing awareness of precision medicine. According to market analysis, the Asia-Pacific breast cancer therapeutics market reached nearly US$7.0 billion in 2022 and is forecast to exceed US$15.8 billion by 2030, driven by targeted drug therapies, immunotherapies, and combination regimens. China’s scaling of HER2-targeted ADCs and India’s uptake of biosimilars exemplify localized strategies to enhance affordability and expand patient reach, while Japan’s mature market shows continued innovation through next-generation biologics and oral SERDs.

This comprehensive research report examines key regions that drive the evolution of the Breast Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Corporate Initiatives R&D Pipelines and Collaborations Among Leading Biopharma Entities Driving Breast Cancer Drug Innovation

Leading biopharmaceutical companies are driving breast cancer drug innovation through strategic collaborations, pipeline diversification, and investment in next-generation modalities. Roche’s recent FDA approval of the PIK3CA-targeted Itovebi-based regimen, underpinned by the pivotal INAVO120 trial, exemplifies how precision targeting of oncogenic drivers can yield significant progression-free survival benefits over standard combinations. Beyond Roche, AstraZeneca continues to bolster its oncology portfolio with Enhertu across multiple lines of HER2-positive disease while advancing camizestrant and other novel agents through late-stage trials, positioning itself for sustained growth through 2030.

Gilead Sciences’ Trop-2-directed ADC Trodelvy has carved out a leading role in metastatic triple-negative breast cancer, underscoring the impact of antibody–drug conjugate technology on historically hard-to-treat subtypes. Macrogenics, in partnership with Merck, is advancing margetuximab in combination with pembrolizumab, targeting metastatic HER2–positive patients with prior anti-HER2 regimens and exploring synergistic immuno-oncology combinations. These strategic moves highlight the trend toward collaborative alliances that leverage complementary expertise in antibody engineering, payload selection, and immune modulation.

In addition, companies such as Novartis and Pfizer are expanding their targeted small-molecule portfolios with CDK4/6 inhibitors, PARP inhibitors, and emerging kinase inhibitors. Continuous engagement with regulatory agencies and sustained investment in companion diagnostics ensure these pipelines align with evolving precision medicine paradigms, enabling differentiated positioning across multiple breast cancer subtypes and reinforcing a competitive landscape defined by innovation and agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AstraZeneca PLC

- Biogen Inc.

- Bristol-Myers Squibb Company

- Cipla Limited

- Daiichi Sankyo Company, Limited

- Eli Lilly and Company

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Puma Biotechnology, Inc.

- Roche Holding AG

- Sanofi S.A.

- Seagen Inc. (A Pfizer Company)

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience Innovate Portfolios and Navigate Complex Regulatory and Trade Environments

To capitalize on the wave of innovation in breast cancer therapeutics, industry leaders must embrace a multi-faceted strategic approach. First, diversifying supply chains through partnerships with contract development and manufacturing organizations and nearshoring critical API production can mitigate the risk of tariff-related disruptions while supporting resilience in global operations. Aligning procurement strategies to leverage “China+1” sourcing models and domestic capacity expansions will reduce cost volatility and ensure continuity of supply.

Second, accelerating investments in biomarker-driven development and companion diagnostics will solidify the value proposition of precision therapies. Early engagement with payers and health technology assessment bodies to define clear evidence generation frameworks can facilitate favorable reimbursement outcomes and optimize time to market. Additionally, forming cross-sector alliances with diagnostic developers and academic research centers will enhance translational research capabilities and streamline patient identification for targeted regimens.

Lastly, tapping into emerging markets requires localized commercialization strategies that address affordability and access. Implementing tiered pricing, partnering with government-led screening programs, and deploying digital health platforms to support teleoncology can expand patient reach in high-growth regions. By combining operational agility with scientific rigor and a patient-centric ethos, companies can unlock sustainable growth and deliver on the promise of personalized breast cancer care.

Comprehensive Research Methodology Incorporating MultiSource Data Collection Stakeholder Interviews and Rigorous Quality Assurance Protocols

This market analysis was developed through a rigorous research methodology combining primary and secondary data sources. Primary research included structured interviews with key stakeholders across the pharmaceutical value chain, including regulatory experts, oncologists, supply chain leaders, and payers. These interactions provided qualitative insights into emerging trends, competitive strategies, and anticipated policy shifts.

Secondary research involved a comprehensive review of peer-reviewed literature, regulatory approvals, industry reports, company filings, and trade publications. Data points such as clinical trial outcomes, approval timelines, and supply chain developments were triangulated to ensure accuracy and completeness. Regulatory databases such as the FDA’s Drugs@FDA and the European Medicines Agency’s EPAR repository were consulted for up-to-date approval statuses.

Analysts employed advanced data-analytics tools to normalize and compare heterogeneous data sets, allowing for meaningful segmentation and regional analysis. All findings underwent multiple rounds of quality assurance, including cross-validation with subject-matter experts and statistical validation checks. This robust methodological framework ensures that the conclusions and recommendations presented are grounded in reliable evidence and reflect the current state of the breast cancer drug landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Cancer Drugs Market, by Drug Class

- Breast Cancer Drugs Market, by Route Of Administration

- Breast Cancer Drugs Market, by Distribution Channel

- Breast Cancer Drugs Market, by End User

- Breast Cancer Drugs Market, by Region

- Breast Cancer Drugs Market, by Group

- Breast Cancer Drugs Market, by Country

- United States Breast Cancer Drugs Market

- China Breast Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Synthesis of Breast Cancer Therapeutic Advancements Strategic Implications and Emerging Opportunities for Stakeholders

Breast cancer drug development is undergoing a period of unprecedented innovation, characterized by the proliferation of targeted therapies, ADCs, and precision diagnostics. Advances in molecular biology and immune modulation have expanded treatment options and enabled more nuanced strategies to overcome resistance. Yet, this dynamic environment also presents challenges related to supply chain volatility, regulatory complexity, and global access disparities.

The cumulative impact of 2025 tariff policies underscores the need for resilient manufacturing networks and proactive engagement with trade and policy stakeholders. Simultaneously, segmentation analysis highlights high-growth opportunities within specific drug classes, administration routes, and end-user settings, guiding resource allocation and commercial focus. Regional insights emphasize the importance of tailoring strategies to local regulatory and healthcare ecosystem nuances, from reimbursement frameworks in Europe to expanding market access initiatives in Asia-Pacific.

As leading companies continue to refine their R&D pipelines through strategic alliances and data-driven approaches, industry stakeholders are poised to deliver more effective, personalized treatments to patients worldwide. By synthesizing the insights presented here, decision-makers can craft informed strategies that balance innovation with operational resilience, ultimately shaping a future where breast cancer is managed more effectively and equitably than ever before.

Immediate Next Steps to Secure InDepth Market Intelligence Engage with Ketan Rohom and Harness Insights for Informed Strategic Decision Making

Ready to delve deeper into the comprehensive analysis of breast cancer drug trends, driver dynamics, and strategic insights? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to access the full market research report. Elevate your strategic planning with tailored data, expert interpretation, and actionable intelligence designed for decision-makers. Secure your copy today and position your organization at the forefront of therapeutic innovation and market opportunities

- How big is the Breast Cancer Drugs Market?

- What is the Breast Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?