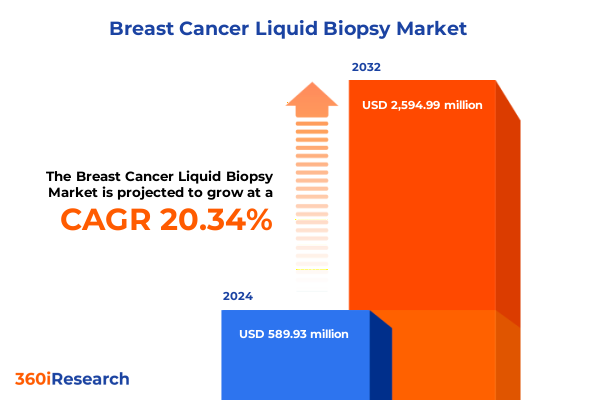

The Breast Cancer Liquid Biopsy Market size was estimated at USD 702.85 million in 2025 and expected to reach USD 841.84 million in 2026, at a CAGR of 20.51% to reach USD 2,594.99 million by 2032.

Exploring the Pivotal Role of Liquid Biopsy Innovations in Transforming Breast Cancer Diagnostics and Patient Outcomes Worldwide

The landscape of breast cancer diagnostics has undergone a profound evolution driven by the pursuit of less invasive, more sensitive methods for detecting and monitoring disease progression. Traditional tissue biopsies, while considered the gold standard, often present challenges including patient discomfort, procedural risks, and difficulties in capturing tumor heterogeneity. In response, liquid biopsy has emerged as a powerful alternative, offering real-time insights into tumor dynamics through analysis of circulating biomarkers in body fluids. This shift toward minimally invasive diagnostics not only enhances patient experience but also provides a transformative avenue for precision medicine.

Advances in molecular biology and bioinformatics have sharpened the ability to identify circulating tumor DNA, cell-free DNA fragments, exosomal cargo, and circulating tumor cells with unprecedented sensitivity and specificity. As technological innovations coalesce with expanding clinical evidence, liquid biopsy is poised to redefine early detection, guide treatment selection, and track minimal residual disease. By integrating emerging platforms and refining analytical workflows, stakeholders across diagnostics, research, and care delivery can harness these capabilities to improve clinical outcomes and streamline patient pathways.

Unveiling the Transformative Shifts Redefining the Liquid Biopsy Landscape through Technological, Regulatory, and Clinical Advances

Over the past several years, the liquid biopsy arena has experienced transformative shifts fueled by breakthroughs in digital PCR, next generation sequencing, and advanced bioinformatics algorithms. The transition from single-analyte assays to multiplexed NGS panels has enabled comprehensive genomic profiling, facilitating more nuanced treatment decisions and personalized therapeutic regimens. Coupled with AI-driven data interpretation, these platforms are rapidly moving beyond proof-of-concept toward routine clinical application.

Regulatory momentum has mirrored technological progress, with leading agencies providing clearer pathways for test validation and clinical adoption. Concurrently, payers across key markets have begun to recognize the value of noninvasive diagnostics, expanding reimbursement frameworks for selected liquid biopsy tests. These policy developments are complemented by an expanding body of clinical guidelines endorsing liquid biopsy in monitoring minimal residual disease and informing treatment selection. As a result, the industry is witnessing a convergence of supportive regulatory, reimbursement, and clinical infrastructures that are redefining market dynamics and accelerating innovation in breast cancer care.

Assessing the Far-Reaching Implications of United States Tariff Policies Enacted in 2025 on the Breast Cancer Liquid Biopsy Market Dynamics

New tariff measures enacted by the United States in 2025 have introduced complex cost pressures across the supply chain for liquid biopsy reagents and instrumentation. By imposing higher duties on imported components and consumables, these policies have elevated manufacturing expenses, thereby influencing pricing strategies and procurement practices. In response, many diagnostic companies have reevaluated supplier contracts and explored opportunities for localizing production to mitigate exposure to fluctuating tariff rates.

These shifts have reverberated through strategic partnerships and distribution channels, prompting diagnostic laboratories to negotiate volume discounts or adopt alternative sourcing models. On the clinical front, increased test costs can alter adoption curves among hospitals and research institutes, underscoring the importance of value-based discussions with payers. Looking ahead, industry participants are prioritizing supply chain resilience, exploring vertical integration strategies, and advocating for tariff exemptions for essential in vitro diagnostic materials to preserve long-term access and affordability.

Delving into Precise Segmentation Insights Illuminating Technology Platforms Biomarker Categories and Clinical Applications Driving Targeted Growth

The technology dimension of the breast cancer liquid biopsy domain encompasses methodologies such as BEAMing and digital PCR, which have matured to deliver highly sensitive quantitation of circulating tumor DNA. Within the digital PCR segment, chip-based and droplet-based approaches enable precise detection of low-frequency variants, while next generation sequencing platforms offer broad genomic coverage through targeted, whole exome, or whole genome workflows. Complementing these are quantitative PCR modalities, including multiplex and real-time formats that provide rapid turnaround for actionable mutation analyses.

Biomarker segmentation highlights the diverse analytes leveraged for disease insights. Circulating free DNA remains a cornerstone analyte, complemented by circulating tumor cells and circulating tumor DNA assays that elucidate tumor burden and clonal evolution. Exosomes carrying protein and RNA payloads further expand the repertoire of detectable biomarkers, offering a window into tumor biology and microenvironment interactions. The clinical application spectrum spans early detection-ranging from high-risk to population screening-to monitoring minimal residual disease post treatment surveillance, as well as tracking recurrence and informing treatment selection decisions.

Sample type analysis underscores the predominance of plasma, with serum, saliva, and urine presenting emerging noninvasive matrices for biomarker recovery. End users include diagnostic laboratories equipped for high-throughput workflows, hospital pathology departments integrating testing into clinical care, and academic or commercial research institutes driving assay development. Moreover, cancer stage differentiation between early and advanced stages, with metastatic disease focus within the latter, informs assay design, sensitivity requirements, and intended use in therapeutic monitoring.

This comprehensive research report categorizes the Breast Cancer Liquid Biopsy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Biomarker Type

- Sample Type

- Cancer Stage

- Application

- End User

Uncovering Key Regional Nuances Influencing Adoption Variances and Strategic Imperatives across the Americas Europe Middle East and Africa and Asia Pacific

Within the Americas, robust reimbursement frameworks and established clinical practice guidelines have facilitated early adoption of liquid biopsy assays in breast cancer management. The presence of key industry players and leading academic centers further supports a collaborative environment for pilot studies and real-world evidence generation. In contrast, Europe, Middle East, and Africa present a heterogeneous landscape, with varying regulatory procedures across European Union member states and evolving reimbursement mechanisms in Middle Eastern and African markets. Stakeholders in these regions must navigate divergent policies and leverage regional hubs to streamline market entry.

Meanwhile, the Asia-Pacific region is characterized by rising breast cancer incidence, growing healthcare infrastructure investments, and government initiatives to bolster precision medicine. Local diagnostic firms are increasingly partnering with global technology providers to co-develop assays that align with regional patient profiles. As a result, Asia-Pacific markets are emerging as dynamic growth centers, driven by a blend of public health priorities, expanding private sector capabilities, and an appetite for innovative diagnostics to address growing patient needs.

This comprehensive research report examines key regions that drive the evolution of the Breast Cancer Liquid Biopsy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players and Their Strategic Collaborations Innovations Reshaping the Breast Cancer Liquid Biopsy Competitive Landscape

Leading players in the breast cancer liquid biopsy sphere are distinguished by their strategic alliances, diversified product pipelines, and commitment to clinical validation. Global life sciences companies have fortified their NGS and PCR portfolios through acquisitions and research collaborations, delivering comprehensive assay offerings. Innovative startups focused on specialized biomarker analytics have attracted significant venture funding, enabling rapid assay development and early clinical deployment.

Collaborative frameworks between diagnostics pioneers and pharmaceutical firms have been instrumental in aligning companion diagnostics with targeted therapies, accelerating co-development timelines. At the same time, partnerships between technology vendors and contract research organizations are facilitating large-scale real-world studies that validate clinical utility. Collectively, these inter-industry synergies are reshaping the competitive dynamics, driving differentiation through enhanced assay performance, expanded indication breadth, and integrated data reporting solutions that streamline clinical decision-making.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Cancer Liquid Biopsy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adaptive Biotechnologies

- Bio-Rad Laboratories, Inc.

- Biocept, Inc.

- Biodesix, Inc.

- Epic Sciences Inc.

- Exact Sciences Corporation

- Fluxion Biosciences, Inc.

- Grail, LLC

- Guardant Health, Inc.

- Illumina, Inc.

- Menarini Silicon Biosystems

- Myriad Genetics, Inc.

- Natera, Inc.

- NeoGenomics Laboratories

- Qiagen N.V.

- Roche Diagnostics International AG

- Sysmex Inostics GmbH

- Thermo Fisher Scientific Inc.

Delivering Tactical Recommendations Empowering Industry Leaders to Leverage Emerging Technologies Regulatory Insights and Collaborative Opportunities for Growth

Industry leaders should prioritize investment in next generation sequencing and digital PCR innovations that balance sensitivity requirements with cost-effectiveness. Establishing strategic collaborations with reagent manufacturers can secure preferential pricing and supply certainty amid tariff-driven volatility. Simultaneously, engaging early with regulatory authorities and payers will foster constructive dialogues around evidence requirements, paving the way for optimized reimbursement pathways.

Building real-world evidence through partnerships with leading oncology centers will demonstrate clinical utility across diverse patient populations and support value-based discussions. Furthermore, adopting modular assay architectures with scalable bioinformatics pipelines can accommodate expanding biomarker panels without extensive revalidation efforts. By cultivating cross-sector alliances, leveraging patient advocacy groups for trial recruitment, and maintaining agile supply chains, industry stakeholders can position themselves to capitalize on evolving clinical guidelines and sustain long-term growth.

Detailing the Comprehensive Research Methodology Integrating Quantitative Analytics Qualitative Interviews and Validation Processes Ensuring Data Integrity

This analysis is grounded in a rigorous research framework combining in-depth secondary research and primary data collection. Secondary inputs were sourced from peer-reviewed publications, regulatory filings, clinical trial registries, and patent databases. Complementing this, semi-structured interviews were conducted with oncologists, molecular pathologists, laboratory directors, technology providers, and reimbursement experts to capture nuanced perspectives on adoption drivers and barriers.

Quantitative analytics involved systematic data triangulation to validate trends and align them with industry developments. Key opinion leader feedback was integrated to refine segmentation logic and ensure methodological robustness. Data integrity was further reinforced through cross-validation exercises across multiple databases and stakeholder reviews, culminating in a comprehensive dataset that underpins the insights and strategic implications presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Cancer Liquid Biopsy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Cancer Liquid Biopsy Market, by Technology

- Breast Cancer Liquid Biopsy Market, by Biomarker Type

- Breast Cancer Liquid Biopsy Market, by Sample Type

- Breast Cancer Liquid Biopsy Market, by Cancer Stage

- Breast Cancer Liquid Biopsy Market, by Application

- Breast Cancer Liquid Biopsy Market, by End User

- Breast Cancer Liquid Biopsy Market, by Region

- Breast Cancer Liquid Biopsy Market, by Group

- Breast Cancer Liquid Biopsy Market, by Country

- United States Breast Cancer Liquid Biopsy Market

- China Breast Cancer Liquid Biopsy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Core Insights and Strategic Imperatives to Navigate the Evolving Breast Cancer Liquid Biopsy Ecosystem with Confidence and Foresight

Culminating this examination of breast cancer liquid biopsy, it is evident that the convergence of advanced molecular platforms, evolving regulatory frameworks, and shifting reimbursement landscapes is catalyzing a new era of precision diagnostics. Stakeholders who embrace technology diversification, foster strategic alliances, and proactively address supply chain challenges will distinguish themselves in a competitive environment. Moreover, the integration of liquid biopsy into clinical workflows promises to enhance patient stratification, optimize treatment efficacy, and reduce healthcare costs associated with late-stage interventions.

As the field continues to mature, sustained collaboration across diagnostics providers, clinical institutions, and regulatory bodies will be paramount. By synthesizing real-world evidence with clinical trial data, the industry can validate the long-term benefits of noninvasive testing and advocate for broader access. In this dynamic ecosystem, organizations that maintain agility, prioritize innovation, and align their strategies with patient-centered outcomes will lead the transformation of breast cancer care.

Unlock Market Intelligence and Propel Strategic Decisions by Reaching Out to Ketan Rohom Associate Director of Sales for Full Breast Cancer Liquid Biopsy Report

To explore the full breadth of insights and capitalize on emerging opportunities within the breast cancer liquid biopsy landscape, we invite you to engage directly with Ketan Rohom, Associate Director of Sales. By discussing your specific strategic priorities and diagnostic aspirations, you can unlock tailored guidance that aligns with your organizational goals. This personalized conversation will illuminate pathways for integrating the latest technologies, optimizing stakeholder collaboration, and accelerating time to clinical adoption. Connect today to secure your full report and gain the clarity needed to shape market-leading initiatives and drive patient-centered innovation.

- How big is the Breast Cancer Liquid Biopsy Market?

- What is the Breast Cancer Liquid Biopsy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?