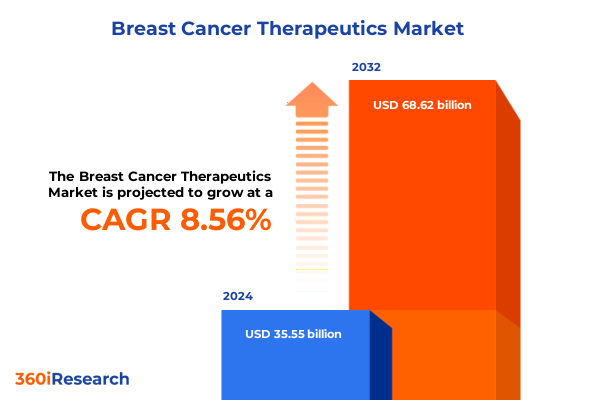

The Breast Cancer Therapeutics Market size was estimated at USD 38.61 billion in 2025 and expected to reach USD 41.93 billion in 2026, at a CAGR of 9.00% to reach USD 70.62 billion by 2032.

Foundations and Future Directions of Global Breast Cancer Therapeutics Amidst a Shifting Clinical and Commercial Ecosystem

The evolution of breast cancer therapeutics over recent decades underscores a dynamic interplay of scientific breakthroughs, regulatory shifts, and emerging clinical evidence. From the advent of early cytotoxic agents to today’s precision-targeted interventions, treatment paradigms have continually expanded to offer improved survival and quality of life for patients. These developments reflect a collaborative ecosystem involving academic research, industry-led innovation, and healthcare policy frameworks that collectively propel the field forward.

Amidst this backdrop, stakeholder priorities have diversified, with payers demanding value-based evidence, regulators emphasizing expedited pathways for high-unmet-need therapies, and clinicians seeking tools to personalize treatment decisions. Concurrently, patient advocacy has brought greater attention to survivorship, equity in access, and long-term safety outcomes. As a result, the contemporary breast cancer therapeutics environment is characterized by multidimensional pressures and opportunities that set the stage for both incremental enhancements and paradigm-shifting innovations.

Revolutionary Advances Reshaping Breast Cancer Treatment Paradigms Through Precision Medicine and Novel Therapeutic Approaches

Breast cancer treatment is undergoing a revolution driven by the integration of immunotherapy, targeted therapies, and combination regimens. Immune checkpoint inhibitors have demonstrated meaningful responses in subsets of triple-negative and hormone receptor–positive disease, building on initial successes in melanoma and lung cancer. Emerging adoptive cell therapies, including tumor-infiltrating lymphocyte approaches and engineered T-cell modalities, show promise in early-phase breast cancer trials, offering avenues to overcome immune resistance mechanisms through enhanced antigen specificity and persistence.

Targeted modalities have also accelerated, with antibody-drug conjugates refining cytotoxic delivery. The recent FDA approval of datopotamab deruxtecan (Datroway) for hormone receptor–positive, HER2-negative metastatic breast cancer underscores the impact of ADCs in improving progression-free outcomes while minimizing off-target toxicity. Oral targeted inhibitors continue to expand, exemplified by the first-in-class AKT inhibitor capivasertib receiving U.S. approval in late 2023 for HR-positive advanced disease, establishing a new standard for interventions in PI3K-AKT pathway–driven tumors. Moreover, long-term data from the OlympiA trial confirm that adjuvant PARP inhibition with olaparib yields sustained reductions in invasive disease recurrence, reinforcing the role of DNA damage-response targeting in BRCA-mutant cohorts.

These advances highlight the shift toward precision medicine frameworks that stratify patients by molecular, immunologic, and genomic markers. As biomarkers proliferate and companion diagnostics mature, the emphasis on multiparametric profiling will shape next-generation clinical trial designs and real-world evidence generation, ensuring that therapeutic selection aligns with individual tumor biology.

Evaluating the Far-Reaching Consequences of 2025 U.S. Import Tariffs on Breast Cancer Drug Supply Chains and Cost Structures

With the implementation of a 10% global tariff on goods entering the United States as of April 2025, critical components of breast cancer treatment, including active pharmaceutical ingredients and specialty chemicals, now face heightened import costs. This measure, intended to bolster domestic manufacturing, has introduced significant cost pressures for drug developers and healthcare providers alike, leading companies to reevaluate sourcing strategies and consider onshoring of key synthesis processes. The impact is most pronounced for generics and biosimilars, where profit margins are narrow and reliance on overseas APIs remains substantial.

China’s predominance in API production-accounting for an estimated 80% of key ingredients for generics-exacerbates supply vulnerability under tariff constraints. Analyses suggest that even modest duty escalations could intensify existing shortages and strain patient access to essential cancer therapies, particularly in low-income communities that depend heavily on lower-cost generic regimens. In response, industry groups such as the American Hospital Association have petitioned for targeted exemptions and phased implementation timetables to safeguard critical drug supply chains and protect patient outcomes.

Simultaneously, major multinational manufacturers have accelerated U.S. investments to mitigate tariff exposure. For example, AstraZeneca’s announcement of a $50 billion commitment to expand domestic manufacturing and research capacity by 2030 reflects a strategic pivot to align production footprints with evolving trade policies and national security imperatives. These cumulative tariff effects not only influence cost structures but also drive a broader realignment of global pharmaceutical operations, with lasting implications for patient access and market competitiveness.

Strategic Segmentation Insights Illuminating Patient Populations by Therapy Attributes and Treatment Pathways Across Diverse Modalities

Strategic analysis of breast cancer therapeutics reveals nuanced variations in market opportunities when viewed through the lens of therapy type segmentation, mechanism-of-action differentiation, receptor status categories, treatment line pathways, dosage form preferences, patient age cohorts, and end-user channels. Distinct clusters emerge by therapy type, capturing the full spectrum from broad-spectrum cytotoxic regimens divided into anthracyclines, platinum agents, and taxanes to specialized hormonal strategies leveraging aromatase inhibitors, estrogen receptor down-regulators, and selective estrogen receptor modulators. Concurrently, immuno-oncology approaches center on immune checkpoint inhibitors, while targeted modalities extend across CDK4/6 inhibitors, mTOR inhibitors, and PARP inhibitors.

Mechanism-based perspectives further refine these insights, spotlighting molecular inhibitors such as CDK4/6 antagonists, monoclonal antibodies targeting specific receptors, mTOR pathway blockers, PARP inhibitors for DNA repair deficiencies, and tyrosine kinase inhibitors with varied selectivity profiles. Stratification by receptor status delineates estrogen receptor-positive, HER2-positive, and triple-negative segments, each exhibiting distinct efficacy metrics and safety considerations.

Line-of-therapy segmentation frames the continuum from adjuvant and neoadjuvant settings to first-line, second-line, and maintenance phases. Dose formulation preferences trace the balance between intravenous infusions, oral regimens, and emerging subcutaneous delivery systems. Demographics segment into post-menopausal versus pre-menopausal age groups, underscoring variations in pharmacodynamics and tolerability, while end users range from hospital oncology units and specialty clinics to home care environments, reflecting shifts in treatment administration and patient support infrastructure.

This comprehensive research report categorizes the Breast Cancer Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Mechanism Of Action

- Receptor Status

- Line Of Therapy

- Dosage Form

- Patient Age Group

- End User

Navigating Regional Dynamics: How Breast Cancer Therapeutics Adoption and Access Vary Across the Americas, EMEA, and Asia-Pacific Landscapes

Regional dynamics continue to shape adoption patterns and access to breast cancer therapies across the Americas, EMEA, and Asia-Pacific markets. In the Americas, North America leads with robust R&D ecosystems, supportive reimbursement frameworks, and concerted efforts to integrate novel agents into standard care pathways. Substantial investments in domestic manufacturing and precision oncology programs reinforce U.S. market leadership, although payer-driven cost containment strategies and value-based contracting models exert downward pressure on launch pricing.

Within Europe, the Middle East, and Africa, heterogeneous regulatory landscapes and reimbursement policies influence the pace of product roll-outs. EU central approvals via the European Medicines Agency streamline market entry, yet national health technology assessments and budget impact analyses introduce variability in adoption rates. Emerging programs for accelerated access and risk-sharing agreements have begun to shorten time-to-patient for high-unmet-need therapies, while Gulf Cooperation Council nations demonstrate growing interest in public-private partnerships to expand oncology infrastructure.

The Asia-Pacific region exhibits rapid expansion, propelled by increasing healthcare expenditure, rising cancer incidence, and government initiatives to enhance local production. Regulatory agencies in countries such as China, Japan, and South Korea have implemented expedited review pathways for breakthrough therapies, thereby reducing traditional approval timelines. However, disparities in per-capita income and healthcare infrastructure necessitate tiered access strategies to ensure equitable treatment availability across diverse economies.

This comprehensive research report examines key regions that drive the evolution of the Breast Cancer Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence Revealing Leading Biopharma Players Driving Innovation and Strategic Collaborations in Breast Cancer Therapeutics

A review of key industry participants highlights a competitive landscape driven by strategic R&D investments, high-value collaborations, and geographic footprint optimization. AstraZeneca’s multi-billion-dollar commitment to expand U.S. manufacturing capacity underscores its determination to secure supply resilience and align with tariff mitigation strategies, reflecting a long-term vision for sustaining global market leadership. Pfizer’s headline agreement with 3SBio for a multi-billion-dollar cancer drug collaboration illustrates the growing reliance on licensing and co-development deals to accelerate pipeline diversification and regional access.

Roche continues to leverage its expertise in targeted oncology through robust phase III programs for PI3K and HER2-directed agents, while Novartis further consolidates its presence by expanding U.S.-based API production to mitigate tariff exposures. Johnson & Johnson and Merck & Co. maintain significant investments in immuno-oncology, pairing checkpoint inhibitors with novel modalities to address resistant disease phenotypes. Additionally, mid-sized biotechs and specialty firms remain agile in pioneering next-generation ADC constructs and biomarker-driven approaches, forming attractive acquisition targets for large cap players seeking to bolster late-stage pipelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Cancer Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca PLC

- Baxter International Inc.

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Hikma Pharmaceuticals plc

- Macrogenics, Inc.

- Merck & Co., Inc.

- NanoString Technologies, Inc.

- Novartis AG

- PerkinElmer, Inc.

- Pfizer Inc.

- Puma Biotechnology, Inc.

- Roche Holding AG

- Sanofi S.A.

- Viatris Inc.

Proactive Strategic Initiatives and Operational Roadmaps for Industry Leaders to Enhance Access and Outcomes in Breast Cancer Treatment

Leaders seeking to maintain competitive differentiation and drive patient impact should prioritize proactive supply chain diversification and strategic onshoring initiatives to fortify against tariff-induced disruptions. Establishing dual-source API agreements and investing in modular manufacturing platforms will not only mitigate cost volatility but also enhance agility in responding to regulatory changes and public health emergencies.

Equally critical is the integration of advanced diagnostics into clinical pathways to refine patient selection and demonstrate real-world value. By collaborating with diagnostic developers to co-validate companion tests, organizations can substantiate the clinical and economic benefits of targeted therapies, thereby accelerating payer coverage decisions and optimizing formulary placement. Finally, fostering cross-sector alliances-spanning academic consortia, patient advocacy groups, and technology partners-will catalyze the generation of comprehensive evidence packages, enabling more compelling value propositions and supporting adaptive regulatory strategies.

Rigorous Multi-Source Research Methodology Combining Quantitative and Qualitative Approaches to Ensure Data Integrity and Insights Validity

The research underpinning this report combines rigorous secondary and primary methodologies to ensure robust data integrity and comprehensive market perspectives. Secondary research encompassed analysis of peer-reviewed journals, regulatory filings, and public financial disclosures, providing a foundational understanding of therapeutic approvals, clinical trial outcomes, and corporate strategies.

Primary research involved in-depth interviews with key opinion leaders across oncology, supply chain experts, payers, and patient advocacy representatives, yielding qualitative insights on emerging trends and unmet needs. Additionally, a targeted survey among pharmaceutical executives and healthcare providers informed quantitative validation of strategic priorities and adoption barriers.

Data triangulation was employed to reconcile discrepancies between diverse sources, while scenario modeling techniques assessed the implications of macroeconomic factors such as tariff policies and regional reimbursement shifts. This multi-source framework delivers actionable intelligence rooted in methodological rigor and real-world relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Cancer Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Cancer Therapeutics Market, by Therapy Type

- Breast Cancer Therapeutics Market, by Mechanism Of Action

- Breast Cancer Therapeutics Market, by Receptor Status

- Breast Cancer Therapeutics Market, by Line Of Therapy

- Breast Cancer Therapeutics Market, by Dosage Form

- Breast Cancer Therapeutics Market, by Patient Age Group

- Breast Cancer Therapeutics Market, by End User

- Breast Cancer Therapeutics Market, by Region

- Breast Cancer Therapeutics Market, by Group

- Breast Cancer Therapeutics Market, by Country

- United States Breast Cancer Therapeutics Market

- China Breast Cancer Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Forward-Looking Perspectives to Illuminate the Path for Future Breakthroughs in Breast Cancer Therapeutics

This executive summary synthesizes critical insights across clinical innovation, market dynamics, and strategic imperatives within the breast cancer therapeutics landscape. From the advent of precision-targeted agents and immuno-modulatory approaches to the operational realignments prompted by trade policies, the sector is poised at an inflection point where scientific potential intersects with commercial realities.

Forward-looking perspectives emphasize the importance of integrating biomarker-driven development, resilient supply chains, and value-based evidence frameworks to navigate evolving stakeholder expectations. As reimbursement environments become more discerning and regulatory pathways continue to adapt, organizations that align clinical differentiation with compelling health economic arguments will be best positioned to drive sustainable growth and patient benefit.

Ultimately, the path to future breakthroughs will be paved by collaborative ecosystems that unite scientific innovation with pragmatic execution strategies. Stakeholders that leverage this intelligence to inform R&D prioritization, market entry planning, and adaptive commercialization models will shape the next era of breast cancer treatment excellence.

Empower Your Strategic Decisions in Breast Cancer Therapeutics Research by Partnering with Ketan Rohom for an In-Depth Market Report

To elevate your strategic decision-making and gain unparalleled insights into breast cancer therapeutics, connect with Ketan Rohom, Associate Director, Sales & Marketing, for a personalized consultation that will align research findings with your organizational objectives. Ketan’s expertise in navigating complex pharmaceutical landscapes and delivering targeted intelligence ensures that your teams can swiftly translate in-depth market intelligence into actionable plans. Engage directly with him to explore how a tailored market research report can refine your commercial strategies, optimize development pipelines, and strengthen competitive positioning. Reach out today to secure your copy and catalyze transformative growth in breast cancer therapeutic initiatives.

- How big is the Breast Cancer Therapeutics Market?

- What is the Breast Cancer Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?