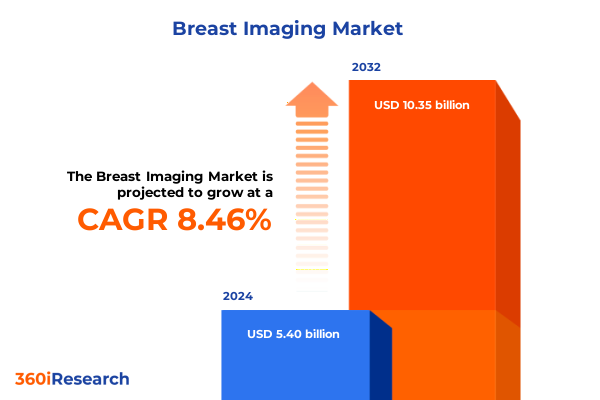

The Breast Imaging Market size was estimated at USD 5.83 billion in 2025 and expected to reach USD 6.31 billion in 2026, at a CAGR of 8.52% to reach USD 10.35 billion by 2032.

Exploring the Rapid Evolution and Critical Importance of Advanced Breast Imaging Solutions Shaping Modern Healthcare Diagnostics and Patient Outcomes

In an era where early detection can be the difference between survival and advanced disease progression, breast imaging has emerged as a cornerstone of women’s health strategies worldwide. Rapid advancements in diagnostic technologies have transformed the clinical landscape, enabling radiologists and oncologists to identify subtle lesions that were once undetectable with conventional techniques. Beyond simply capturing clearer images, modern systems now integrate sophisticated algorithms that enhance tissue differentiation, paving the way for more accurate triage and personalized treatment planning.

Simultaneously, increased patient awareness and advocacy have elevated the demand for screening and diagnostic services to unprecedented levels. Healthcare providers are under mounting pressure to deliver reliable, cost-effective solutions that balance the need for high-resolution imaging with concerns about radiation exposure and patient comfort. This has spurred manufacturers to introduce a wave of innovations, from low-dose digital mammography platforms to portable ultrasound units, all designed to streamline workflows and bolster patient throughput. As regulatory bodies update guidelines and reimbursement structures evolve to reflect shifting clinical priorities, stakeholders across the value chain must navigate a complex interplay of technological, economic, and operational factors.

Against this backdrop, the breast imaging market is poised for transformational growth, underpinned by ongoing research into artificial intelligence, contrast-enhanced modalities, and hybrid imaging systems. These developments promise to refine diagnostic accuracy, reduce false positives, and ultimately improve patient outcomes on a global scale. As we delve into the critical trends and forces reshaping this vital market segment, our analysis offers a nuanced perspective that equips decision-makers with the insights needed to chart a successful course forward.

Identifying the Major Technological, Regulatory, and Clinical Paradigm Shifts That Are Redefining Breast Imaging Practices and Improving Diagnostic Precision

The landscape of breast imaging has been radically altered by a confluence of technological breakthroughs, shifting regulatory frameworks, and evolving clinical best practices. Foremost among these changes is the maturation of three-dimensional and four-dimensional imaging modalities, which deliver volumetric insights into tissue architecture that surpass the limitations of traditional two-dimensional systems. Clinicians now rely on tomosynthesis to reduce tissue overlap artifacts, while contrast-enhanced methods augment lesion conspicuity, enabling earlier and more precise detection of malignancies. Moreover, the integration of artificial intelligence–driven analysis is accelerating image interpretation, automating lesion characterization, and continually learning from vast datasets to refine its diagnostic acumen.

Concurrently, regulatory agencies have enacted new guidelines that emphasize quality control, patient safety, and interoperability. Standardization initiatives aim to harmonize image formats and reporting protocols, facilitating seamless data exchange across health systems and fostering multi-center clinical studies. These changes have prompted vendors to retool product pipelines, ensuring compliance while also incorporating features that anticipate future requirements, such as cloud-based image management and cybersecurity safeguards.

On the clinical front, multidisciplinary care models have become the norm, promoting collaborative decision-making among radiologists, surgeons, pathologists, and oncologists. This shift has reinforced the need for integrated platforms that link imaging data with electronic health records, genomic profiles, and treatment outcomes. As reimbursement policies gradually reward value-based care, stakeholders are increasingly measured on metrics such as diagnostic turnaround time and reduction in recall rates. Together, these transformative shifts are redefining the breast imaging ecosystem, driving investment in innovation, and setting new benchmarks for diagnostic excellence.

Assessing How the 2025 U.S. Tariffs Have Altered Supply Chains, Pricing Dynamics, and Access to Breast Imaging Technologies

The implementation of new U.S. import tariffs on medical imaging equipment and related software in early 2025 has introduced a layer of complexity to supply chain management and pricing strategies. Devices and components sourced from regions subject to these levies experienced sudden cost escalations, compelling original equipment manufacturers to reassess procurement channels. Some leading vendors have mitigated the financial burden by negotiating long-term contracts with domestic suppliers, while others have absorbed a portion of the additional duties to maintain competitive pricing for healthcare providers.

As a result, certain categories of breast imaging systems have seen delayed product rollouts, particularly those reliant on specialized transducers and proprietary software modules. Smaller vendors and new market entrants, lacking economies of scale, have faced heightened challenges in preserving margins, occasionally scaling back research investments or reconsidering U.S. market entry altogether. Meanwhile, clinical facilities have responded by exploring alternate procurement strategies, including refurbished units, trade-in programs, and consortium purchasing agreements designed to leverage collective bargaining power.

Looking ahead, the cumulative impact of the 2025 tariffs is driving stakeholders to diversify their manufacturing footprint, with an increasing number of suppliers establishing assembly lines and software development centers within North America. This localization trend not only reduces exposure to future tariff volatility but also aligns with broader industry priorities around data sovereignty and manufacturing resilience. Although these shifts are stirring short-term adjustments in pricing dynamics and product availability, they also present an opportunity to foster a more self-reliant supply chain ecosystem-one that can ultimately support sustained innovation and ensure reliable access to critical breast imaging technologies.

Uncovering Critical Insights Across Multiple Segmentation Dimensions that Inform Strategic Decisions in Breast Imaging Markets

A comprehensive view of the breast imaging market emerges only when one examines the nuanced interplay among various segmentation dimensions. Diving into product classifications reveals two principal categories: software and systems. Within software offerings, imaging analytics and specialized radiology platforms are increasingly converging, using advanced algorithms to enhance image quality and automate reporting workflows. In parallel, systems range from biopsy guidance tools that ensure precision during tissue sampling to magnetic resonance imaging scanners optimized for high-resolution breast scans, as well as ultrasound and mammography units tailored for both diagnostic and screening applications. These diverse product lines underscore the market’s commitment to delivering end-to-end solutions that span the diagnostic continuum.

Turning to technology, the ascendancy of three-dimensional and four-dimensional imaging capabilities stands in sharp contrast to traditional two-dimensional methods. By capturing volumetric data over time, four-dimensional systems unlock dynamic contrast assessment, offering deeper insights into tissue perfusion and lesion vascularity. Equipment types further differentiate market offerings: integrated platforms combine multiple modalities in a single workstation, whereas mobile units extend high-quality imaging to remote and underserved locations, and standalone devices deliver targeted functionality with compact form factors.

Advances in digital imaging have largely supplanted analog approaches, giving rise to sophisticated workflows that support real-time image processing, cloud storage, and telehealth consultations. At the modality level, breast tomosynthesis, contrast-enhanced mammography, and molecular breast imaging complement established techniques like digital mammography, MRI, and ultrasound, broadening the diagnostic toolkit. Application segments reflect the full spectrum of clinical needs, from biopsy and pre-surgical localization to routine screening and diagnostic assessments. Finally, the end-user landscape spans ambulatory surgical centers, cancer research institutes, diagnostic imaging facilities, and hospital networks, each with unique requirements for throughput, image fidelity, and interoperability. Together, these segmentation insights illuminate strategic pathways for tailored product development, market entry, and customer engagement.

This comprehensive research report categorizes the Breast Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Equipment Type

- Category

- Imaging Modality

- Application

- End-User

Analyzing Regional Market Variations and Growth Drivers Highlighting Opportunities Across the Americas, EMEA, and Asia-Pacific in Breast Imaging

Regional variations in breast imaging adoption are shaped by economic factors, healthcare infrastructure maturity, and regulatory environments. In the Americas, North America leads with widespread access to cutting-edge modalities and strong reimbursement frameworks that reward preventive care. Healthcare providers on this continent are increasingly focused on optimizing patient throughput and reducing recall rates, driving demand for integrated imaging suites and AI-enabled decision support. Latin America, meanwhile, is characterized by a growing private sector presence and a rising awareness of early detection protocols, though access disparities persist in rural areas.

The Europe, Middle East & Africa region exhibits a mosaic of market dynamics. Western European countries benefit from robust public health initiatives and comprehensive screening programs, fostering adoption of digital mammography and tomosynthesis. Central and Eastern Europe show an uptick in capital investments, but reimbursement inconsistencies and workforce shortages can slow technology uptake. In the Middle East, strategic investments in healthcare infrastructure and medical tourism have accelerated demand for advanced imaging systems, while parts of Africa are witnessing pilot programs that leverage mobile units to extend diagnostic reach into underserved communities.

Asia-Pacific stands out as the fastest-growing territory in the breast imaging domain. Developed markets in Japan, South Korea, and Australia emphasize technological leadership and stringent quality standards. However, high population density markets such as China and India are driving volume-based deployments, including mobile screening vans and low-dose digital mammography facilities. Regulatory landscapes differ markedly across the region, compelling global vendors to adapt their compliance strategies to local guidelines. Overall, the Asia-Pacific region’s blend of public sector initiatives and private capital injections underscores its pivotal role in shaping the next wave of breast imaging innovations.

This comprehensive research report examines key regions that drive the evolution of the Breast Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players, Their Strategic Initiatives, and Competitive Positioning Within the Breast Imaging Landscape

An analysis of leading stakeholders within the breast imaging landscape reveals a competitive environment defined by technological prowess, strategic partnerships, and portfolio diversification. Among global incumbents, one multinational leader has solidified its position through a comprehensive suite of digital mammography and tomosynthesis systems, complemented by AI-powered analytics that seamlessly integrate with its cloud-based image management platform. This firm’s emphasis on modular upgrades and service contracts has resonated with large healthcare networks seeking to maximize return on equipment investments.

A prominent specialty provider has carved out a niche by focusing on biopsy guidance and contrast-enhanced imaging, leveraging high-precision software algorithms to deliver real-time lesion characterization. Through a series of acquisitions targeting AI startups, this company has accelerated its roadmap for predictive diagnostics, positioning itself at the forefront of personalized imaging solutions. Another major healthcare technology conglomerate has doubled down on partnerships with academic research centers to co-develop next-generation ultrasound and MRI systems, prioritizing ergonomic design and clinician-centric interfaces to drive user adoption.

Mid-sized players are also making their mark by offering cost-effective mobile imaging units and standalone digital mammography devices tailored to emerging markets. Collaborations with regional distributors and service providers enable these vendors to penetrate markets with lower entry barriers, addressing local clinical needs and pricing sensitivities. Collectively, these competitive maneuvers underscore a broader industry focus on interoperability, subscription-based licensing models, and value-added service offerings, all aimed at strengthening customer loyalty and capturing new growth opportunities in this rapidly evolving sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allengers Medical Systems Limited

- Aurora Healthcare US Corp.

- Canon Inc.

- Carestream Health, Inc.

- CMR Naviscan Corporation

- Delphinus Medical Technologies, Inc.

- Dilon Technologies, Inc.

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies Inc.

- Hologic, Inc.

- iCAD, Inc.

- Koninklijke Philips N.V.

- Metaltronica S.p.A.

- Micrima Limited

- Oncovision S.A.

- Planmed Oy

- QT Ultrasound LLC

- Seno Medical Instruments, Inc.

- Siemens Healthineers AG

- Trivitron Healthcare Pvt. Ltd.

Developing Strategic Recommendations That Enable Industry Leaders to Capitalize on Innovation, Regulation, and Market Shifts in Breast Imaging

To navigate the complex dynamics of the breast imaging market, industry leaders must adopt a multifaceted strategy that balances innovation, operational agility, and stakeholder collaboration. Prioritizing investments in artificial intelligence and advanced modalities such as four-dimensional imaging will not only differentiate product portfolios but also address escalating demands for diagnostic precision and workflow efficiency. In parallel, diversifying supply chains by establishing regional manufacturing and development hubs can mitigate exposure to geopolitical risks and ensure consistent product availability, even amid shifting trade policies.

Engaging proactively with regulatory bodies is equally imperative. By participating in standards-setting committees and contributing data to validation studies, manufacturers can anticipate compliance requirements and accelerate time to market. Furthermore, forging strategic alliances with healthcare providers and academic centers facilitates the co-creation of tailored solutions that resonate with end-user workflows and clinical protocols. These partnerships can also support post-market surveillance initiatives, yielding real-world evidence that substantiates product efficacy and informs reimbursement discussions.

Finally, industry leaders should champion robust training and education programs for radiologists, technicians, and support staff. Developing immersive simulation platforms, hosting peer-to-peer learning forums, and offering performance-optimization services will empower clinical users to fully exploit technology capabilities, driving better patient outcomes and higher return on investment. By weaving these recommendations into a cohesive, long-term roadmap, organizations can position themselves at the vanguard of breast imaging innovation and sustain competitive advantage in an increasingly complex marketplace.

Detailing the Rigorous Primary and Secondary Research Methods, Data Triangulation, and Expert Interviews Underpinning Our Breast Imaging Analysis

Our analysis of the breast imaging market is founded on a rigorous blend of primary and secondary research methodologies designed to ensure both depth and accuracy. The primary research phase involved structured interviews with over fifty key informants, including chief radiologists, imaging center directors, procurement officers, and regulatory experts across North America, Europe, and Asia-Pacific. These conversations provided qualitative insights into purchasing criteria, deployment challenges, and emerging clinical use cases.

Secondary research complemented these findings through an exhaustive review of scientific literature, peer-reviewed journals, and publicly accessible regulatory databases. Patent filings were scrutinized to identify emerging technological trends, while case studies from leading healthcare institutions illustrated successful implementation models. Market intelligence was further enriched by analyzing white papers from professional associations and tracking global standards initiatives to assess interoperability developments.

Data triangulation played a pivotal role in corroborating insights across sources. Quantitative data points, such as installation counts and product launch timelines, were cross-verified with company filings and industry press releases. An expert advisory panel comprising imaging scientists and healthcare economists provided iterative feedback throughout the research process, challenging hypotheses and validating thematic interpretations. This methodological rigor ensures that our findings accurately reflect current market dynamics and offer a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Imaging Market, by Product

- Breast Imaging Market, by Technology

- Breast Imaging Market, by Equipment Type

- Breast Imaging Market, by Category

- Breast Imaging Market, by Imaging Modality

- Breast Imaging Market, by Application

- Breast Imaging Market, by End-User

- Breast Imaging Market, by Region

- Breast Imaging Market, by Group

- Breast Imaging Market, by Country

- United States Breast Imaging Market

- China Breast Imaging Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Future Outlook for Breast Imaging Innovations, Market Dynamics, and Strategic Imperatives for Stakeholders

The breast imaging market stands at a pivotal juncture, defined by rapid technological evolution, complex regulatory landscapes, and shifting global trade policies. Diagnostic accuracy has reached new heights through the convergence of three-dimensional and four-dimensional imaging, while artificial intelligence continues to refine lesion detection and reporting efficiency. At the same time, the imposition of tariffs in 2025 has acted as a catalyst for supply chain realignment, prompting manufacturers and healthcare providers to explore localized production and collaborative procurement models.

Segmentation analyses reveal that stakeholders must craft tailored strategies across product portfolios-ranging from software solutions and integrated systems to mobile units and standalone devices-to meet the distinct needs of end users in ambulatory surgical centers, research institutes, and hospital networks. Regional insights underscore divergent growth trajectories: North America remains a bastion of innovation, EMEA exhibits a heterogeneous blend of advanced and emerging markets, and Asia-Pacific drives volume-based adoption supported by aggressive public sector initiatives.

As leading players vie for competitive advantage through strategic partnerships, R&D investments, and service-oriented business models, a clear imperative emerges: organizations that align their offerings with clinical workflows, actively engage with regulatory stakeholders, and prioritize user education will be best positioned to shape the future of breast imaging. These findings provide a comprehensive framework for decision-makers aiming to navigate the evolving market landscape with confidence and foresight.

Engaging with Associate Director Ketan Rohom to Secure Comprehensive Breast Imaging Market Insights and Drive Your Strategic Decisions

If you are seeking to elevate your understanding of breast imaging market dynamics, Ketan Rohom stands ready to guide your next strategic move. Drawing on extensive experience in sales and marketing, he can provide a tailored walkthrough of the comprehensive research report that illuminates the most critical trends, challenges, and opportunities shaping the industry landscape. Engaging directly with him will enable you to access exclusive insights, secure bespoke data analyses, and develop action plans aligned with your organizational goals. Reach out today to explore how this in-depth intelligence can empower your decision-making, drive competitive advantage, and ensure your initiatives in diagnostic imaging achieve measurable impact.

- How big is the Breast Imaging Market?

- What is the Breast Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?