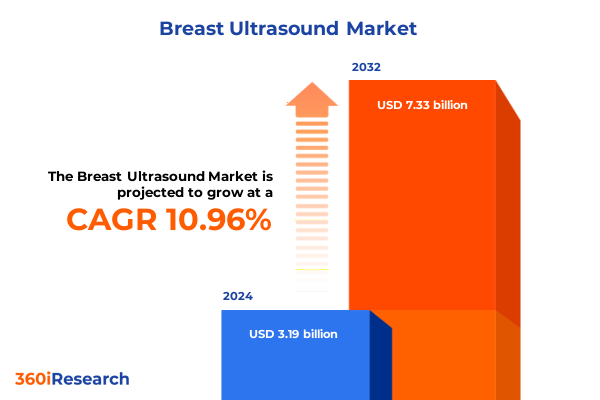

The Breast Ultrasound Market size was estimated at USD 3.54 billion in 2025 and expected to reach USD 3.94 billion in 2026, at a CAGR of 10.94% to reach USD 7.33 billion by 2032.

Discover the Vital Role of Breast Ultrasound in Early Detection and Diagnostic Excellence Driving Improved Patient Outcomes and Clinical Confidence

Breast ultrasound has emerged as a pivotal imaging modality that complements mammography and MRI by providing real-time visualization of soft tissue structures without ionizing radiation. As clinicians increasingly rely on ultrasound to differentiate between cystic and solid lesions, its capacity for guiding minimally invasive procedures has elevated its status within multidisciplinary diagnostic workflows. Major advances in transducer technology, image processing algorithms, and portable device form factors have collectively driven broader adoption across healthcare settings ranging from high-volume hospitals to point-of-care clinics. The evolving diagnostic guidelines and patient-centric care models have further underscored the strategic importance of ultrasound, positioning it as a front-line tool for early cancer detection and surveillance in high-risk populations.

Over the past decade, breast ultrasound has transcended its traditional role as a supplemental tool to become a primary imaging choice in certain clinical scenarios. Innovations such as handheld devices and elastography have enabled more nuanced tissue characterization, while advancements in Doppler imaging and contrast-enhanced techniques have opened new diagnostic frontiers. Concurrently, mounting emphasis on cost containment and value-based care has driven demand for scalable, efficient modalities that deliver high diagnostic yield with minimal patient discomfort. This intersection of technological innovation and evolving healthcare economics highlights the strategic imperative for stakeholders to understand both current capabilities and future trajectories of the breast ultrasound domain. This introduction thus establishes the clinical and commercial backdrop for an in-depth analysis of market drivers, challenges, and strategic imperatives that follow.

How Innovations in Technology and Clinical Practices Are Reshaping the Breast Ultrasound Market with Unprecedented Precision and Accessibility

The breast ultrasound landscape has undergone sweeping changes in recent years, fueled by converging technological breakthroughs, shifting clinical paradigms, and evolving regulatory frameworks. Artificial intelligence-powered image analytics now augment sonographers’ interpretations by highlighting suspicious regions and standardizing lesion measurements, thereby reducing interobserver variability. Concurrently, elastography techniques that quantify tissue stiffness are enhancing lesion characterization and enabling earlier differentiation between benign and malignant masses. Handheld ultrasound devices, once constrained by limited processing power and resolution, now rival cart-based systems in image quality while delivering unprecedented portability for point-of-care use.

Clinical practices are also adapting to these innovations by integrating multimodal protocols that combine ultrasound with contrast-enhanced mammography or MRI when additional tissue characterization is required. These complementary workflows optimize diagnostic accuracy and streamline care pathways, minimizing unnecessary biopsies and enhancing patient comfort. On the regulatory front, expedited pathways for AI-augmented medical devices and evolving reimbursement policies are encouraging greater investment in research and development. As a result, industry participants are rapidly iterating on product designs, forging partnerships with software companies, and aligning with clinical societies to ensure guideline adoption. These transformative shifts are fundamentally reshaping market expectations, underscoring the need for stakeholders to stay ahead of technological advances and regulatory changes to maintain competitive advantage.

Evaluating the Comprehensive Effects of United States Tariffs Implemented in 2025 on Breast Ultrasound Supply Chains and Cost Structures

In 2025, the United States government implemented targeted tariffs on imported medical imaging components, directly impacting the breast ultrasound ecosystem. Key components such as piezoelectric crystals, semiconductor processing chips, and specialized polymers used in transducer housings now incur additional duties, increasing procurement costs for global manufacturers. These cost pressures have been partially absorbed through streamlined supply chains and localized assembly, yet downstream pricing adjustments remain unavoidable. Healthcare providers are encountering higher per-scan equipment expenses, translating into tighter capital budgets for equipment upgrades and service contracts.

The cumulative effect of these tariffs extends beyond direct equipment pricing. Service providers are recalibrating maintenance agreements to account for elevated spare part costs, leading to renegotiated contracts with longer service intervals and modified warranty terms. Training programs for new device installations have also been affected, as travel-intensive onsite sessions are increasingly replaced by virtual modules to mitigate costs. While some large healthcare networks have leveraged purchasing power to negotiate bulk import deals and secure tariff waivers under specific trade provisions, smaller clinics and ambulatory surgical centers face greater financial strain. Looking ahead, stakeholders must weigh the benefits of localized manufacturing partnerships against the complexities of onshore production, while monitoring potential tariff adjustments tied to broader trade negotiations and supply chain resiliency initiatives.

Deep Dive into Product Service and Technology Segmentation Offering Multidimensional Perspectives on the Breast Ultrasound Market Landscape

A nuanced understanding of market segments reveals how product categories, modalities, technologies, transducer offerings, clinical applications, and end users each contribute to the overall breast ultrasound ecosystem. Within product categories, accessories and consumables such as coupling gel and sterile covers have seen steady demand driven by high procedural volumes, while core equipment segments-comprising probes and systems-reflect investment cycles tied to technological refreshes. Support services, encompassing installation, maintenance, and training, play a pivotal role in sustaining device uptime and clinical proficiency, particularly as systems become more sophisticated.

Modalities span portable cart-based platforms that cater to high-throughput imaging centers and trolley-mounted configurations that balance mobility with performance, alongside handheld devices that deliver battery-powered flexibility or tethered reliability for varying clinical environments. Technological diversity-from traditional 2D grayscale imaging to real-time 3D/4D volumetric visualization, Doppler flow analysis, and advanced elastography-ensures practitioners can select the most appropriate tool for specific diagnostic challenges. Transducer innovations, including 3D-optimized heads, curved array footprints for enhanced field of view, linear arrays for high-resolution superficial imaging, and phased arrays for improved beam steering, further refine clinical workflows.

Applications of breast ultrasound bifurcate into diagnostic use cases-such as lesion characterization, screening adjuncts, and staging assessments-and interventional procedures, including fluid aspiration, biopsy guidance, and drainage interventions. End users ranging from ambulatory surgical centers and specialized clinics to high-capacity diagnostic imaging centers and full-service hospitals exhibit distinct purchasing behaviors driven by procedural mix, throughput objectives, and budgetary constraints. This multifaceted segmentation framework underscores the importance of tailoring product development and marketing strategies to the unique needs of each stakeholder group.

This comprehensive research report categorizes the Breast Ultrasound market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Modality

- Technology

- Transducer Type

- Application

- End User

Unraveling Regional Dynamics Illuminating Distinct Growth Drivers and Adoption Trends Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the breast ultrasound market reveal diverse growth trajectories shaped by economic conditions, healthcare infrastructure maturity, and regulatory environments. In the Americas, strong emphasis on early breast cancer detection programs and the presence of well-established private imaging chains have driven demand for advanced 2D and Doppler systems. The United States remains a global innovation hub, with ongoing investment in AI-driven imaging solutions and robust reimbursement policies that support expanded ultrasound use. Meanwhile, Latin American markets are demonstrating gradual uptake of portable and handheld devices, fueled by growing government screening initiatives and partnerships aimed at improving access in underserved areas.

Across Europe, the Middle East, and Africa, regional disparities influence adoption patterns. Western European countries benefit from universal healthcare coverage and centralized purchasing mechanisms, which accelerate the rollout of 3D/4D and elastography systems. In contrast, markets in Eastern Europe and parts of the Middle East prioritize cost-effective 2D platforms, although demand for specialized interventional probes is rising in advanced oncology centers. African nations, while still in nascent stages of ultrasound adoption, are witnessing pilot programs that leverage battery-powered handheld units for remote screening. Government and nonprofit partnerships are critical here, as they underpin both equipment procurement and training initiatives.

The Asia-Pacific region stands out for rapid adoption of mobile ultrasound solutions, driven by high population density, expanding private healthcare networks, and government-led cancer awareness campaigns. Markets like China and India are experiencing fierce competition among domestic and international players, with a focus on low-cost, locally manufactured systems. Meanwhile, established markets such as Japan, South Korea, and Australia continue to upgrade to AI-augmented and elastography-capable platforms, supported by strong research collaborations and progressive reimbursement frameworks. These regional insights highlight the need for market participants to customize strategies in alignment with local dynamics and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Breast Ultrasound market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Competitive Positioning of Leading Players Influencing the Breast Ultrasound Market Globally

Leading players in the breast ultrasound space are executing strategic initiatives to consolidate market share, drive innovation, and enhance global reach. Major medical device conglomerates have intensified R&D investment in AI-enabled imaging platforms, fostering collaborations with technology firms and academic institutions. These alliances aim to accelerate algorithm validation for lesion detection and improve workflow efficiencies through automated reporting modules. Simultaneously, key competitors are expanding their service footprints by establishing regional training academies and virtual support centers to reduce downtime and ensure clinical proficiency among end users.

To mitigate supply chain disruptions and tariff impacts, companies are forging partnerships with local contract manufacturers and setting up regional assembly plants. Such moves not only optimize cost structures but also confer regulatory advantages in markets with local content requirements. Product portfolios are being refined with modular architectures that allow customers to upgrade specific components-such as transducer heads or processing units-without replacing entire systems. This approach enhances lifecycle management and aligns with the growing preference for scalable, future-proof solutions.

Marketing strategies are equally multifaceted, encompassing targeted educational campaigns for radiologists and sonographers, digital engagement via virtual demonstrations, and participation in key scientific conferences. Some market leaders have introduced bundled service packages combining installation, preventive maintenance, and extended warranty options to deepen customer relationships and create recurring revenue streams. Collectively, these competitive maneuvers reflect a strategic emphasis on value-added services, localized operations, and technology differentiation as pillars for long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Ultrasound market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurora Healthcare US Corp.

- Braster S.A.

- Canon Medical Systems Corporation

- CapeRay Medical (Pty) Ltd.

- Carestream Health, Inc. by Onex Corporation

- Delphinus Medical Technologies, Inc.

- Fujifilm Holdings Corporation

- Fukuda Denshi Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Hologic, Inc.

- Koninklijke Philips N.V.

- QT Imaging, Inc.

- QView Medical, Inc.

- Samsung Electronics Co., Ltd.

- Seno Medical Instruments, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens AG

- SmartBreast Corporation

- SonoCiné, Inc.

- Trivitron Healthcare

- Volpara Health Technologies Ltd.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Market Risks

Industry leaders must adopt a proactive stance to capitalize on emerging trends and safeguard against market headwinds. First, accelerating investment in artificial intelligence and machine learning capabilities is critical for enhancing diagnostic accuracy and workflow efficiency; companies should pursue strategic partnerships with clinical research institutions to validate algorithms and secure regulatory clearances. Second, embracing a hybrid manufacturing strategy that combines global R&D with localized assembly can mitigate tariff impacts and bolster supply chain resilience. Firms should evaluate onshore production opportunities in key regions to optimize cost structures and meet local content mandates.

Third, expanding service portfolios beyond traditional maintenance agreements by offering modular upgrades and subscription-based software enhancements will create scalable revenue streams and strengthen customer loyalty. Fourth, tailoring product designs to address specific regional requirements-such as battery-powered handheld units for remote screening in emerging markets or high-resolution elastography systems for advanced oncology centers-will unlock new growth corridors. Fifth, investing in comprehensive virtual training platforms that complement in-person sessions can enhance adoption rates while containing costs. Finally, establishing thought leadership through targeted educational initiatives, peer-reviewed publications, and presence at specialty conferences will elevate brand credibility and facilitate market penetration. By implementing these recommendations, stakeholders can position themselves at the forefront of the evolving breast ultrasound market and achieve sustainable competitive advantage.

Rigorous Research Methodology Combining Primary Expert Interviews and Secondary Data Triangulation for Market Intelligence Integrity

This report’s insights derive from a rigorous research methodology that integrates both primary and secondary data sources under a structured, multi-stage approach. Primary research involved in-depth interviews with over two dozen key opinion leaders, including radiologists, sonographers, biomedical engineers, and procurement executives across leading hospitals, imaging centers, and specialty clinics. These conversations provided nuanced perspectives on clinical workflows, technology adoption barriers, and evolving reimbursement policies. Secondary research encompassed an extensive review of publicly available regulatory filings, scientific publications, patent databases, conference proceedings, and industry white papers to contextualize market trends and validate hypotheses.

Data triangulation was achieved by cross-referencing interview insights with quantitative indicators such as shipment volumes, regional trade statistics, and pricing indices. A bespoke database capturing historical equipment launches, software approvals, and service contract structures facilitated trend analysis over multiple years. The bottom-up market sizing approach aggregated segment-level data across product categories, modalities, and regions, while a top-down analysis leveraged total healthcare spending and diagnostic imaging utilization rates to ensure consistency. Quality checks included peer reviews by independent market analysts and scenario testing to model sensitivity around key growth drivers such as tariff fluctuations and regulatory changes. This comprehensive methodology undergirds the credibility of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Ultrasound market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Ultrasound Market, by Product

- Breast Ultrasound Market, by Modality

- Breast Ultrasound Market, by Technology

- Breast Ultrasound Market, by Transducer Type

- Breast Ultrasound Market, by Application

- Breast Ultrasound Market, by End User

- Breast Ultrasound Market, by Region

- Breast Ultrasound Market, by Group

- Breast Ultrasound Market, by Country

- United States Breast Ultrasound Market

- China Breast Ultrasound Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Guide Stakeholders Toward Informed Decisions in a Rapidly Evolving Breast Ultrasound Market

The breast ultrasound market stands at a crossroads, driven by technological innovation, shifting clinical protocols, and geopolitical factors that are redefining supply chain dynamics. Advancements in AI-enabled diagnostics, portable device miniaturization, and elastography techniques are fueling widespread adoption, while regulatory pathways and reimbursement models are evolving to accommodate these breakthroughs. Tariffs introduced in 2025 have reshaped cost structures, prompting manufacturers and service providers to explore local manufacturing, modular upgrades, and diversified supply networks. Comprehensive segmentation analysis illuminates how product types, modalities, technologies, transducer variants, applications, and end users each present unique growth narratives and strategic imperatives.

Regional insights reveal that the Americas, EMEA, and Asia-Pacific markets each exhibit distinct demand drivers-from established reimbursement frameworks and private imaging chains to government screening programs and cost-sensitive emerging markets. Leading players are responding with differentiated strategies, including targeted R&D collaborations, regional assembly operations, and hybrid service offerings designed to enhance customer engagement and secure recurring revenue. Stakeholders that adopt an integrated approach-leveraging advanced analytics, localized operations, and comprehensive training platforms-will be best positioned to navigate evolving market dynamics. This conclusion underscores the critical need for agility, collaboration, and foresight in harnessing the full potential of the breast ultrasound landscape.

Take the Next Step Connect with Ketan Rohom to Secure Comprehensive Breast Ultrasound Market Insights and Drive Strategic Growth

Engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to unlock a tailored walkthrough of the comprehensive breast ultrasound market report. Ketan brings deep expertise in imaging market dynamics and can illuminate how the report’s insights align with your strategic objectives. By scheduling a brief consultation, you will gain clarity on key findings, understand how to leverage growth opportunities, and explore customized data packages that address your specific needs. This conversation will provide you with actionable takeaways to refine your go-to-market strategies, optimize capital allocation, and strengthen competitive positioning. Don’t miss the chance to transform high-level market intelligence into concrete business outcomes-connect with Ketan today to secure your copy of the report and catalyze your organization’s growth in the evolving breast ultrasound landscape

- How big is the Breast Ultrasound Market?

- What is the Breast Ultrasound Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?