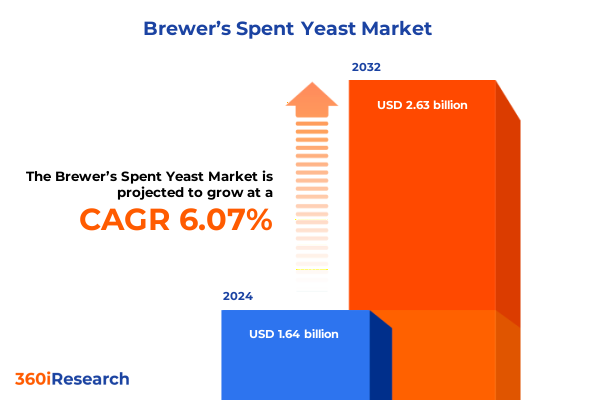

The Brewer’s Spent Yeast Market size was estimated at USD 1.73 billion in 2025 and expected to reach USD 1.83 billion in 2026, at a CAGR of 6.15% to reach USD 2.63 billion by 2032.

Unlocking the untapped potential of spent brewer’s yeast as a sustainable biomaterial for diverse industrial applications and circular economy initiatives

Brewer’s spent yeast, the residual biomass generated during the beer brewing process, has traditionally been perceived as a low-value by-product destined for basic animal feed or disposal. However, its rich composition of proteins, B vitamins, beta-glucans, and yeast cell wall components positions it as a versatile ingredient for a spectrum of industrial applications. Over recent years, stakeholders across brewing, food processing, and biotechnology sectors have begun to recognize its potential as a sustainable resource that can contribute to circular economy objectives.

Amid growing global emphasis on resource efficiency and waste valorization, business leaders and technical experts are reevaluating brewer’s spent yeast not as waste, but as a feedstock for high-value ingredients. Its functional proteins offer opportunities in nutrition-focused food and feed formulations, while its bioactive compounds have found traction in cosmetics and pharmaceutical markets. These developments reflect a paradigm shift in how industries approach co-products, elevating brewer’s spent yeast from a disposal challenge to an innovation platform.

This executive summary offers an overview of the key drivers, emerging trends, and market dynamics influencing the utilization of brewer’s spent yeast. It establishes the groundwork for deeper analysis of transformative changes, trade policy impacts, segmentation nuances, regional variations, competitive landscapes, and strategic recommendations. By providing a structured introduction, this section sets the tone for understanding the multifaceted opportunities and challenges within this evolving marketplace.

Exploring the groundbreaking transformation in brewer’s spent yeast value chain driven by technological innovations and shifting sustainability paradigms

The landscape of brewer’s spent yeast utilization has undergone a fundamental transformation driven by rapid advancements in processing technologies and evolving stakeholder priorities. Innovations in drying methods, such as low-temperature belt drying and freeze-drying techniques, have dramatically improved preservation of yeast’s nutritional and functional qualities. Concurrently, advances in controlled fermentation technologies are enabling the conversion of spent yeast into specialized bioactive extracts, opening doors to premium ingredients for skin care formulations and digestive health supplements.

In parallel, consumer and regulatory pressures have spurred companies to adopt sustainability frameworks that integrate waste valorization into core operations. This shift has encouraged brewing firms to forge partnerships with industrial biotechnology players, creating closed-loop systems where spent yeast is repurposed into animal feed, cosmetic actives, or even bioplastics. As a result, the traditional linear value chain is giving way to circulatory models that prioritize resource efficiency and environmental stewardship.

Equally important, the digital transformation of the broader supply chain-facilitated by real-time tracking, quality assurance sensors, and data analytics-has enhanced transparency and traceability. These technological shifts not only streamline logistics but also enable end users to verify the provenance and quality of brewer’s spent yeast-derived ingredients. Taken together, these transformative factors are redefining how industry participants perceive, process, and position brewer’s spent yeast in global markets.

Analyzing the comprehensive effects of the 2025 United States tariff revisions on brewer’s spent yeast trade dynamics supply chains and pricing structures

In 2025, United States trade policy introduced revised tariff structures affecting microbial biomass imports, including dried brewer’s spent yeast. By raising duties on certain categories of imported yeast derivatives, the policy has altered the economics of sourcing raw materials, compelling companies to reassess supply chain configurations and cost management strategies. Domestic processors, once reliant on competitively priced imports, now face higher input costs that have ripple effects on contract negotiations with end users.

As a response, many downstream users have accelerated investments in local fermentation and drying capacities to mitigate exposure to tariff fluctuations. This drive toward regional self-reliance has reshaped sourcing patterns, with an increasing share of brewer’s spent yeast now remaining within North American processing networks rather than being exported or re-imported. Over time, this realignment is expected to reduce overall logistics complexity and enhance supply security.

Furthermore, the tariff-induced cost pressures have spurred innovation in utilization pathways. Producers are exploring higher-value applications-such as purified beta-glucan isolates or peptide-rich extracts-to justify premium pricing and offset elevated raw material expenses. Meanwhile, collaborative ventures between brewing companies and technology partners are gaining traction, aimed at optimizing processing efficiencies and unlocking new revenue streams. Together, these strategic adaptations underscore the extensive cumulative impact of the 2025 United States tariff revisions on the global brewer’s spent yeast ecosystem.

Unveiling critical segmentation insights shaping brewer’s spent yeast market performance across forms processes distribution methods and application verticals

Segmentation analysis reveals critical insights into how form, processing, distribution, and application shape market behaviors in brewer’s spent yeast. When comparing dry and liquid forms, the dried variant commands a commanding presence due to its extended shelf life and versatility in transport, while liquid preparations continue to facilitate on-site enzymatic processes in fermentation and agriculture.

Processing technology further delineates the competitive landscape, with drying operations emphasizing energy-efficient belt and rotary drying systems to preserve protein integrity, and fermentation-based techniques focusing on bioconversion pathways that enhance the concentration of bioactives. These differing process modalities steer producers toward either volume-oriented feed ingredients or niche, high-margin extracts for personal care and pharmaceutical applications.

Distribution channels exhibit a clear division between offline and online routes. Traditional offline networks benefit from direct, bulk transactions with feed and food manufacturers, while digital marketplaces are emerging as vital conduits for specialty formulations that serve cosmetics brands and health supplement distributors. This dual-channel dynamic has encouraged producers to develop hybrid approaches that combine the reliability of established sales teams with the reach of e-commerce platforms.

Application segmentation underscores the broad utility of brewer’s spent yeast. In animal feed, subsegments such as aquaculture, poultry, and swine demonstrate differentiated nutrient demands and regulatory considerations. Cosmetics and personal care applications range from hair care products to skin care formulations where yeast-derived peptides and glucans command premium positioning. In the food and beverage sphere, spent yeast enhances bread, bakery products, improvised gravies, and sauces and spices, contributing both functional and flavor-enhancing properties. Finally, pharmaceutical applications leverage brewer’s spent yeast as a source for digestive health supplements and probiotic formulations, reflecting its rich micronutrient profile.

This comprehensive research report categorizes the Brewer’s Spent Yeast market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Processing Technology

- Distribution Channel

- Application

Mapping regional dynamics to reveal how Americas Europe Middle East Africa and Asia Pacific markets are driving brewer’s spent yeast adoption patterns

Regional examination highlights distinctive drivers and adoption patterns across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, the United States and Canada lead utilization of brewer’s spent yeast in animal feed and nutritional ingredients, supported by advanced regulatory frameworks for novel feed additives and robust co-processing partnerships between brewers and agricultural firms.

In Europe Middle East Africa, stringent environmental directives and circular economy mandates have galvanized investments in repurposing spent yeast as a bioresource. European Union member states are pioneering incentives to integrate food grade yeast derivatives into sustainable food systems, while Middle Eastern and African nations are exploring cost-effective approaches to leverage local brewing by-products for feed and agriculture.

The Asia Pacific region exhibits the highest pace of market expansion driven by surging demand in aquaculture feed, with Southeast Asian and Chinese aquafeed producers increasingly incorporating brewer’s spent yeast to meet protein and immunostimulant requirements. Simultaneously, South Korea and Japan are at the forefront of extracting cosmetic actives from yeast biomass, capitalizing on consumer appetite for clean label and biotech-derived beauty ingredients.

Although each region presents unique regulatory, infrastructural, and demand-side characteristics, a unifying theme is the transition towards integrated valorization models that maximize resource efficiency while capturing incremental value across end-use sectors.

This comprehensive research report examines key regions that drive the evolution of the Brewer’s Spent Yeast market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading enterprises pioneering innovation strategic partnerships and competitive advantages in the brewer’s spent yeast industry ecosystem

Leading enterprises in the brewer’s spent yeast domain are distinguishing themselves through strategic capacity expansions, technology licensing agreements, and collaborative research initiatives. One prominent yeast producer has recently enhanced its drying infrastructure to double throughput, thereby securing a reliable supply of high-quality dried yeast for global feed and food customers. Concurrently, an established fermentation specialist has entered into co-development partnerships with nutraceutical companies to isolate novel beta-glucan fractions, targeting high-end dietary supplement markets.

Another market stakeholder is forging alliances with cosmetic formulators to create standardized yeast peptide lines that deliver consistent performance in skin care applications. This move underscores a shift from commodity sales to value-added ingredient supply, enabling premium pricing. Meanwhile, biotechnology innovators are investing in enzyme-assisted extraction platforms that increase yield of bioactive compounds such as mannan oligosaccharides, presenting new opportunities for targeted gut health products in both human and animal nutrition segments.

Collectively, these strategic maneuvers reflect an industry landscape where competitive advantage is increasingly defined by technological prowess, intellectual property portfolios, and cross-sector collaborations. Companies that excel in optimizing process efficiencies while developing differentiated product offerings are well positioned to capture emerging opportunities and to navigate the evolving regulatory and trade environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brewer’s Spent Yeast market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB InBev

- Alltech, Inc.

- AngelYeast Co., Ltd.

- Archer-Daniels-Midland Company

- Asahi Group Holdings, Ltd.

- Associated British Foods PLC

- Avantor, Inc.

- BDI biotech

- Chr. Hansen Holding A/S by Novozymes A/S

- Furst-McNess Company

- Imperial Yeast

- Kerry Group PLC

- Lallemand Inc.

- Leiber GmbH

- Lesaffre

- Merck KGaA

- Mitsubishi Corporation

- Nisshin Seifun Group

- O. Salm & Co GmbH

- Omega Yeast Labs, LLC

- Prosol S.p.A.

- Revyve

- Solgar Inc. by Nestlé Health Science

- Tangshan Top Bio_Technology Co., Ltd.

- Thermo Fisher Scientific Inc.

- Urban Platter

- VetterTec GmbH

- White Labs

- Wilbur-Ellis Holdings, Inc.

- Yeastup AG

- Ziemann Holvrieka GmbH

- Zytex Biotech Pvt. Ltd.

Proposing actionable strategies for industry stakeholders to capitalize on opportunities mitigate risks and foster sustainable growth in brewer’s spent yeast markets

Industry stakeholders can accelerate growth by implementing targeted strategies that align technical capabilities with evolving market needs. Investing in advanced drying systems capable of preserving functional proteins and bioactive compounds should be prioritized to maintain product quality across transport and storage. Complementing these efforts with scalable fermentation platforms will enable the production of specialized extracts that command higher margins.

To bolster market access, companies are advised to adopt hybrid distribution models that integrate traditional offline sales channels with an enhanced digital presence. This dual-channel approach facilitates engagement with both large volume feed manufacturers and specialty ingredient buyers in cosmetics and health supplements. Additionally, forming strategic alliances with end-use customers can foster co-innovation, ensuring that brewer’s spent yeast derivatives meet specific formulation requirements and regulatory standards.

Monitoring policy developments and engaging with trade associations remains crucial to anticipate and mitigate risks associated with tariff changes and regulatory shifts. Pursuing sustainability certifications and transparent sourcing verification can further differentiate offerings in environmentally conscious markets. Finally, exploring new application horizons-such as pharmaceutical excipients and bioplastic additives-can diversify revenue streams and strengthen resilience against sector-specific downturns.

Detailing the research methodology covering data collection validation expert insights and cross-validation approaches in this brewer’s spent yeast analysis

The research methodology underpinning this analysis integrates primary and secondary data sources to ensure rigor and reliability. Initial phases involved targeted interviews with brewing companies, feed formulators, cosmetics manufacturers, and technology providers to capture qualitative insights on processing challenges and market requirements. These expert inputs were complemented by an extensive review of industry trade publications, patent filings, regulatory reports, and corporate disclosures to map technology trends and strategic initiatives.

Quantitative data on production capacities, processing throughput, and supply chain footprints were compiled from publicly available statistical databases and industry consortium releases. To validate and refine these metrics, a cross-validation approach was employed, reconciling data points through triangulation of multiple independent sources. Peer review by subject matter experts ensured that interpretations of tariff impacts, segmentation dynamics, and regional variations aligned with observed industry developments.

Analytical frameworks, including value chain mapping and competitive landscape modeling, were applied to structure the findings and highlight interdependencies across processes and applications. This comprehensive methodology provides a robust foundation for the insights presented in the preceding sections, supporting informed decision-making for stakeholders seeking to navigate the brewer’s spent yeast ecosystem with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brewer’s Spent Yeast market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brewer’s Spent Yeast Market, by Form

- Brewer’s Spent Yeast Market, by Processing Technology

- Brewer’s Spent Yeast Market, by Distribution Channel

- Brewer’s Spent Yeast Market, by Application

- Brewer’s Spent Yeast Market, by Region

- Brewer’s Spent Yeast Market, by Group

- Brewer’s Spent Yeast Market, by Country

- United States Brewer’s Spent Yeast Market

- China Brewer’s Spent Yeast Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing the strategic findings and outlook highlighting the untapped potential challenges and future directions for brewer’s spent yeast applications

Brewer’s spent yeast is transitioning from an undervalued co-product to a strategic bioresource, driven by technological breakthroughs and heightened sustainability imperatives. The metamorphosis of processing capabilities, from innovative drying techniques to precision fermentation, has unlocked new application avenues spanning animal feed, cosmetics, food ingredients, and pharmaceutical formulations. These developments underscore the versatility and functional appeal of yeast derivatives.

The 2025 United States tariff adjustments have reshaped supply chain economics, prompting near-shoring of processing activities and fostering a pivot toward high-value purification methods. Simultaneously, segmentation analysis reveals diverse market behaviors across forms, process technologies, distribution channels, and end-use verticals, each demanding tailored approaches to extraction, quality assurance, and marketing.

Regionally, the Americas leverage regulatory support for feed innovations, EMEA prioritizes waste valorization within environmental mandates, and Asia Pacific leads in aquafeed applications and cosmetic actives. Leading companies are capitalizing on these dynamics by expanding capacity, securing technology partnerships, and venturing into niche product categories. To sustain momentum, industry players must adopt targeted strategies that encompass advanced processing investments, hybrid channel engagement, policy monitoring, and sustainability certification.

Overall, the brewer’s spent yeast market offers a compelling blend of operational challenges and growth opportunities. As stakeholders deepen collaboration, refine technical processes, and pursue differentiated applications, this co-product is poised to assume a central role in circular economy frameworks and innovation-driven business models.

Contact Ketan Rohom Associate Director Sales and Marketing to learn how to access the brewer’s spent yeast market report and unlock strategic insights

Contact Ketan Rohom, Associate Director Sales and Marketing, to learn how to access the brewer’s spent yeast market report and unlock strategic insights

- How big is the Brewer’s Spent Yeast Market?

- What is the Brewer’s Spent Yeast Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?