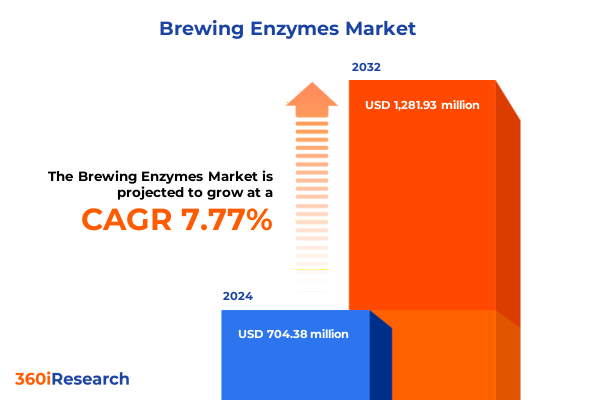

The Brewing Enzymes Market size was estimated at USD 750.33 million in 2025 and expected to reach USD 804.64 million in 2026, at a CAGR of 7.95% to reach USD 1,281.92 million by 2032.

Exploring pivotal enzyme innovations reshaping operational efficiency, product quality, and consistency in modern beer production

Brewing enzymes have emerged as transformative agents in the beer manufacturing process, fundamentally redefining how brewers extract flavors, optimize yields, and streamline production workflows. By facilitating targeted breakdown of complex carbohydrates and proteins, these biological catalysts enable the conversion of raw materials into fermentable sugars, significantly improving mash efficiency and consistency. Over the past decade, advances in enzyme engineering have expanded functional performance under diverse pH and temperature regimes, catalyzing the adoption of specialized enzyme blends tailored to specific beer styles and process requirements.

This introduction seeks to illuminate the critical role that enzyme innovations play in driving operational excellence, cost efficiencies, and product differentiation across the global brewing industry. From microbreweries to large-scale maltsters, stakeholders are leveraging tailored amylases, proteases, cellulases, and xylanases to fine-tune mouthfeel, clarity, and foam stability while reducing process variability. The integration of these catalysts aligns with broader quality assurance initiatives, ensuring consistent sensory attributes and regulatory compliance.

Looking ahead, ongoing research in enzyme discovery and synthetic biology promises to unlock next-generation functionalities. This executive summary synthesizes the current state of enzymatic applications in brewing, highlights recent industry shifts, and establishes a strategic framework for brewers, ingredient suppliers, and investors aiming to harness the full potential of enzyme-driven brewing innovation.

Mapping the revolutionary shifts in brewing processes driven by enzymatic advancements and data-driven sustainability innovations

The brewing landscape is undergoing profound structural changes driven by technological breakthroughs, shifting consumer preferences, and heightened sustainability imperatives. Enzyme developers are pioneering novel formulations that enable lower-temperature saccharification, reduce energy consumption in mashing, and minimize reliance on harsh chemical clarifiers. These advancements dovetail with emerging craft and specialty segments, where unique flavor profiles and artisanal production methods demand precise enzymatic control.

Simultaneously, collaborative partnerships between brewing operations and biotechnology firms are proliferating, fostering open innovation platforms for co-development of customized enzyme blends. This cross-sector synergy accelerates time to market for novel catalysts capable of enhancing fermentation kinetics and mitigating off-flavor formation. As a result, process intensification has become a central focus, with many breweries redesigning facilities to incorporate continuous flow reactors and immobilized enzyme systems.

Another transformative shift arises from digital process monitoring coupled with enzyme analytics. Real-time tracking of viscosity, turbidity, and sugar profiles empowers brewers to dynamically adjust enzyme dosages, ensuring optimal mash performance and consistent end products. These digital-biocatalysis integrations underpin predictive maintenance models and enable proactive interventions, reducing downtime and maximizing throughput.

Together, these trends underscore a strategic pivot from traditional brewing paradigms to an adaptive, data-driven, and sustainability-anchored future-one where enzymes play an indispensable role in cost containment, quality assurance, and environmental stewardship.

Analyzing the multifaceted repercussions of 2025 U.S. trade tariffs on brewing enzyme supply chains and industry procurement strategies

In 2025, United States trade policies introduced sweeping tariffs that reverberated throughout enzyme supply chains, particularly affecting catalysts sourced from China. Under Section 301 measures, the U.S. Trade Representative imposed an additional 25 percent levy on a broad range of imported goods, including certain brewing machinery and processing aids-categories that encompass specialized enzymes critical to beer production. This policy shift disrupted longstanding procurement strategies and compelled brewing ingredient distributors to reassess cost structures and contractual terms.

Imogene Ingredients, a case study emblematic of this upheaval, has historically sourced key enzyme blends from Chinese manufacturers for nearly two decades. Following the implementation of new tariffs, these enzyme imports experienced marked price increases, illustrating the vulnerability of domestic brewers to geopolitical trade dynamics. Despite the company’s exploration of alternative suppliers, the capital-intensive nature of enzyme production-requiring large-scale fermenters and stringent environmental compliance-hindered rapid repatriation of supply chains.

The resulting cost pressures have rippled through craft and industrial breweries alike. Smaller operations, which operate on razor-thin margins and lack bulk purchasing power, face disproportionate impacts and potential margin erosion. Larger brewers are mitigating these effects by renegotiating long-term supply agreements, adjusting formula cost models, and exploring in-house enzyme development partnerships with biotech startups.

Looking forward, stakeholders are evaluating risk-mitigation strategies such as diversifying raw material origins, leveraging tariff-exempt formulation adjustments, and expanding domestic enzyme production capacity through strategic investments. While these adjustments require upfront capital and logistical reconfiguration, they represent critical steps toward supply chain resilience and sustained operational stability.

Delving into comprehensive segmentation insights revealing enzyme types, sources, applications, and formulation trends shaping industry value streams

Understanding the brewing enzymes market necessitates a nuanced segmentation across enzyme type, source, application, and form that reveals underlying value drivers and consumption behaviors. Amylases, which catalyze starch breakdown, dominate enzyme portfolios and comprise alpha- and beta-subtypes tailored for liquefaction and saccharification processes, respectively. Beta-glucanases-encompassing beta-glucosidase and endo-1,4-beta-glucanase-address cell wall degradation to improve wort filtration rates and extract yields. Meanwhile, cellulases break down cellulose fibers via endo- and exo-modes of action to enhance turbidity control, while proteases manage protein composition for clarity and foam stability through endo- and exo-proteolytic activity. Xylanases, available as beta-xylosidase and endo-xylanase variants, facilitate hemicellulose breakdown to optimize mash viscosity.

The source segmentation differentiates between animal-derived, plant-derived, and microbial enzymes, with microbial variants-sourced from bacterial and fungal strains-offering superior specificity, yield consistency, and scalability. Application segmentation underscores the diverse functional roles of enzymes in cleaning operations (including bottle washing and CIP), primary and secondary fermentation enhancement, sediment removal and wort clarification during filtration, and both liquefaction and saccharification in mashing. Finally, form segmentation distinguishes between liquid concentrates that enable rapid dosing and powder formats prized for extended shelf life and ease of transport.

This integrated segmentation framework informs targeted go-to-market strategies and product development roadmaps, enabling enzyme suppliers and brewers to align performance characteristics with process requirements, regulatory considerations, and cost constraints.

This comprehensive research report categorizes the Brewing Enzymes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Application

- Form

Dissecting diverse regional growth pathways and compliance drivers that define enzyme market performance across key global territories

Regional dynamics in the brewing enzymes market reflect distinct industry maturities, regulatory landscapes, and consumption patterns across the Americas, Europe-Middle East-Africa, and Asia-Pacific. In the Americas, well-established production facilities and a robust craft beer movement drive demand for high-performance enzyme blends that enable differentiation and operational scalability. Regulatory clarity and strong logistics infrastructure further support domestic enzyme manufacturing innovations, while emerging sustainability mandates encourage adoption of low-energy and high-yield catalysts.

Europe-Middle East-Africa presents a heterogeneous panorama, where stringent food safety regulations and multi-jurisdictional compliance requirements influence enzyme selection. Western European brewers prioritize eco-friendly enzyme solutions that minimize effluent treatment costs, whereas rapidly growing craft segments in Eastern Europe and parts of the Middle East pursue specialized enzymes to develop novel beer styles. Africa, although nascent in commercial brewing enzyme deployment, reveals untapped growth potential tied to local grain variations and mash profile optimization.

Asia-Pacific leads in enzyme R&D, driven by large-scale malting industries in China, India, and Australia. Enzyme suppliers in the region leverage advanced fermentation platforms to introduce recombinant and genetically optimized variants, serving both domestic consumption and global export markets. Dynamic demographic shifts and rising disposable incomes further amplify demand for premium, custom-brewed offerings that rely on tailored enzymatic processes.

Collectively, these regional insights inform strategic site investments, cross-border partnership models, and localized product development strategies geared toward capturing differentiated growth pockets in the global brewing enzymes landscape.

This comprehensive research report examines key regions that drive the evolution of the Brewing Enzymes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing competitive positioning and strategic alliances driving innovation, service integration, and growth in the brewing enzyme industry

Competitive dynamics in the brewing enzymes sector are shaped by established biotechnology firms and agile specialized producers, all vying to deliver superior performance, cost efficiency, and customized solutions. Leading players possess deep R&D pipelines, extensive patent portfolios, and global manufacturing footprints that enable rapid scale-up and consistent quality control. At the same time, nimble niche providers differentiate through targeted enzyme blends tailored for emerging craft and specialty brewing segments.

Strategic alliances between enzyme manufacturers and major brewery groups have emerged, facilitating co-creation of proprietary catalysts optimized for specific process parameters and beer styles. These partnerships yield exclusive supply agreements and accelerate technology transfer, while enabling brewers to maintain competitive product attributes. Meanwhile, acquisitions of biotech startups by global life sciences corporations enhance innovation pathways, introducing advanced protein engineering techniques and high-throughput screening methodologies into commercial enzyme production.

Market leaders are also investing in integrated service platforms that combine technical support, on-site process audits, and digital monitoring tools. This service-oriented approach fosters deeper client engagement and drives incremental revenue through performance-based contracts and subscription-style enzyme supply models. Collectively, these strategic imperatives underscore a shift toward value-added offerings that transcend commoditized enzyme sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brewing Enzymes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amano Enzyme Inc.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Aumgene Biosciences Pvt. Ltd.

- Biocatalysts Ltd

- Biocatalysts Ltd

- Biolaxi Corporation

- Caldic B.V.

- CBSBREW (India) Pvt. Ltd.

- Chr. Hansen Holding A/S

- Creative Enzymes LLC

- DuPont de Nemours, Inc.

- Jiangsu Boli Bioproducts Co., Ltd.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lallemand Inc.

- Lesaffre Groupe

- Leveking (Jiangsu) Bio‑Engineering Co., Ltd.

- Megazyme Ltd

- Nagase America LLC

- Nature BioScience Pvt. L.T.D.,

- Novozymes A/S

- RahrBSG

- SternEnzym GmbH & Co. KG

- WeissBioTech GmbH

Strategic playbook for industry leaders to optimize enzyme innovation, enhance supply chain resilience, and secure long-term operational excellence

Industry leaders must adopt a multifaceted strategy to capitalize on enzymatic advancements while mitigating geopolitical and operational risks. First, implementing a comprehensive supplier diversification plan will reduce dependency on any single geographic source and enhance supply chain resilience. By qualifying alternative microbial enzyme strains from geographically dispersed biomanufacturing sites, companies can stabilize procurement costs and mitigate exposure to future tariff escalations.

Second, fostering collaborative R&D ecosystems with academic institutions and biotech startups will accelerate the development of next-generation enzymes. Joint innovation initiatives that leverage advanced protein engineering, machine learning-driven enzyme screening, and robust scale-up protocols will deliver performance breakthroughs in process efficiency and sustainability.

Third, advancing digital integration across brewing operations-including real-time enzymatic activity monitoring and predictive maintenance analytics-will enable dynamic process optimization. This approach ensures that enzyme dosages are precisely calibrated to mash composition and fermenter conditions, maximizing yield and minimizing waste.

Finally, negotiating value-based supply agreements that align pricing with performance outcomes can protect brewers against cost volatility and incentivize continuous improvement. These outcome-focused contracts, combined with proactive tariff management and compliance planning, will empower industry participants to sustain competitive margins and innovate with confidence.

Robust research methodology synthesizing primary expert interviews, proprietary quantitative modeling, and systematic peer validation

This research integrates a rigorous multi-methodology framework to ensure robust, actionable insights. Primary data sources include in-depth interviews with brewing executives, enzyme formulators, and supply chain experts, capturing firsthand perspectives on operational challenges, innovation priorities, and market drivers. Secondary research encompasses comprehensive analysis of industry publications, regulatory filings, patent databases, and financial disclosures from key market participants.

Quantitative modeling leverages proprietary data sets on raw material consumption, enzyme formulation costs, and process efficiencies to triangulate market trends and identify high-growth segments. Advanced statistical techniques and sensitivity analyses validate segmentation logic and forecast potential adoption curves without disclosing specific market sizing metrics. Additionally, a triangulation approach cross-verifies qualitative insights with quantitative data, ensuring consistency and credibility in key findings.

All research outputs undergo systematic peer review by subject matter experts in brewing science, biochemical engineering, and global trade policy. This validation process endorses methodological integrity, reinforces accuracy, and refines strategic recommendations presented in this report. The resultant insights deliver a comprehensive view of brewing enzyme dynamics, optimized for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brewing Enzymes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brewing Enzymes Market, by Type

- Brewing Enzymes Market, by Source

- Brewing Enzymes Market, by Application

- Brewing Enzymes Market, by Form

- Brewing Enzymes Market, by Region

- Brewing Enzymes Market, by Group

- Brewing Enzymes Market, by Country

- United States Brewing Enzymes Market

- China Brewing Enzymes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing critical findings and forward-looking perspectives to guide stakeholders toward sustainable growth and competitive advantage in brewing enzymes

The brewing enzymes market stands at the confluence of scientific innovation, evolving regulatory frameworks, and shifting consumer expectations. Recent years have witnessed a surge in customized enzyme formulations that enhance critical process metrics-yield, clarity, flavor consistency-while reducing environmental footprints through lower energy and water consumption. Concurrently, geopolitical trade policies and tariff measures have surfaced as key variables influencing supply chain configurations and cost structures.

Segmentation analysis reveals that amylases and beta-glucanases will remain cornerstone catalysts, whereas proteases, cellulases, and xylanases will gain traction in specialty applications. Regional dynamics underscore the Americas’ robust craft beer movement, EMEA’s regulatory sophistication, and Asia-Pacific’s R&D leadership. Competitive landscapes are evolving, with major biotechnology firms leveraging partnerships and acquisitions to deepen market penetration and service offerings.

Actionable recommendations emphasize supply chain diversification, digital process integration, collaborative R&D models, and performance-based contracting to navigate uncertainties and seize growth opportunities. As enzyme technologies continue to advance, stakeholders equipped with rigorous market intelligence and strategic foresight will be best positioned to drive sustainable innovation, secure competitive advantage, and deliver next-generation brewing experiences.

Connect with an Associate Director to access the definitive brewing enzymes market research report and enhance your strategic decision-making

Unlock the full breadth of strategic, operational, and market insights by securing the comprehensive brewing enzymes market research report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to discuss your specific information requirements, explore custom data packages, or learn about priority access to regular advisory briefings. Partnering with Ketan ensures that you will receive detailed guidance on driving innovation through enzymatic solutions, navigating tariff complexities, and capitalizing on emerging growth trends. Contact him today to elevate your competitive positioning and secure the authoritative analysis that empowers decisive, informed decision-making in an increasingly dynamic brewing landscape.

- How big is the Brewing Enzymes Market?

- What is the Brewing Enzymes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?